- Bitcoin ETFs noticed $1 billion in inflows, nearing Satoshi’s holdings and gold ETFs.

- Bitcoin’s 160% rise in 2024, now price $1.91 trillion, challenged gold’s market dominance.

Following the aftermath of the U.S. Presidential election, Bitcoin’s [BTC] market has skilled a big surge, with spot Bitcoin ETFs seeing an enormous inflow of capital.

In reality, as BTC’s value continues to inch nearer to the $100K mark, the momentum is mirrored within the ETF market.

Bitcoin ETFs replace

In line with Farside Buyers, Bitcoin ETFs noticed a powerful $490.3 million in inflows on the twenty second of November, marking a hanging continuation of the upward pattern.

Cumulatively, by the twenty first of November, BTC ETFs had attracted over $1 billion in new investments. This signaled a sturdy investor urge for food for publicity to the main cryptocurrency amid a wave of bullish sentiment.

In between the flood of Bitcoin ETF inflows, BlackRock’s IBIT has emerged because the front-runner, recording a powerful $513.2 million on the twenty second of November and $608.4 million on the twenty first of November.

Following intently behind is Constancy’s FBTc, solidifying its place available in the market. Nevertheless, not all Bitcoin ETFs are seeing progress, as Grayscale’s GBTC skilled outflows, dropping $67.1 million on the twenty second of November.

Will they surpass Satoshi Nakamoto’s holdings?

Regardless of this, the collective inflows into spot Bitcoin ETFs are making headlines, with discussions rising about these funds nearing a big milestone and turning into the biggest holders of Bitcoin globally.

Information prompt its potential of surpassing even the legendary Satoshi Nakamoto, whereas additionally closing in on gold ETFs in whole internet property.

Remarking on the identical, Bloomberg’s Senior ETF Analyst, Eric Balchunas famous,

“US spot ETFs now 98% of way there to passing Satoshi as world’s biggest holder. My over/under date of Thanksgiving looking good.”

He added,

“If next 3 days are like the past 3 days flow-wise it’s a done deal. Also at $107b aum they only lag gold ETFs by $23b, good shot to surpass by xmas.”

Journey up to now

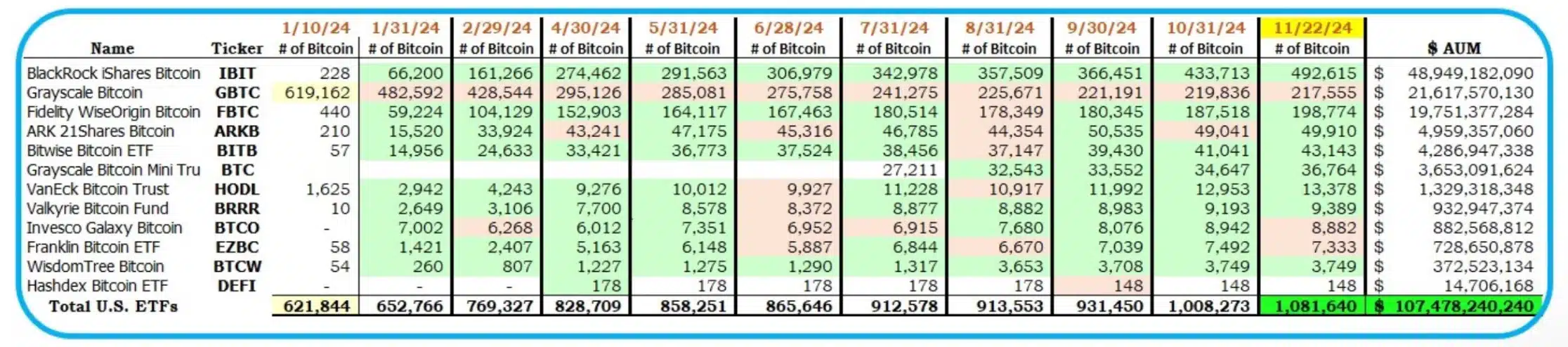

Nicely, since their debut in January, U.S. spot Bitcoin ETFs have skilled fast progress.

As of latest estimates from crypto analyst HODL15Capital, these funds collectively held round 1.081 million BTC, bringing them tantalizingly near Satoshi Nakamoto’s purported 1.1 million Bitcoin holdings.

Nakamoto, the elusive creator of Bitcoin, is assumed to personal about 5.68% of the whole Bitcoin provide, with their holdings valued at over $100 billion.

Subsequently, if Nakamoto have been a residing, single particular person, these huge holdings would place them among the many wealthiest individuals on the planet.

The 12 months 2024 and Bitcoin

For sure, Bitcoin’s outstanding efficiency in 2024 has solidified its place as a dominant pressure within the monetary panorama.

With a 160% surge since January, BTC is now approaching the $100,000 mark, whereas its market capitalization of $1.91 trillion surpasses that of silver and business giants like Saudi Aramco.

Regardless of this spectacular progress, Bitcoin nonetheless trails gold, the world’s largest asset, with a market cap exceeding $18 trillion.

These tendencies spotlight Bitcoin’s rising prominence but in addition underscore its ongoing journey to problem conventional property like gold for the highest spot.