- Spot Bitcoin ETFs have collected over $22 billion in inflows, reflecting sturdy market demand.

- Retail traders now maintain 80% of whole belongings in Bitcoin ETFs, driving vital curiosity.

Since their introduction, spot Bitcoin [BTC] exchange-traded funds (ETFs) have skilled a exceptional surge in recognition, amassing cumulative inflows which have eclipsed $22 billion.

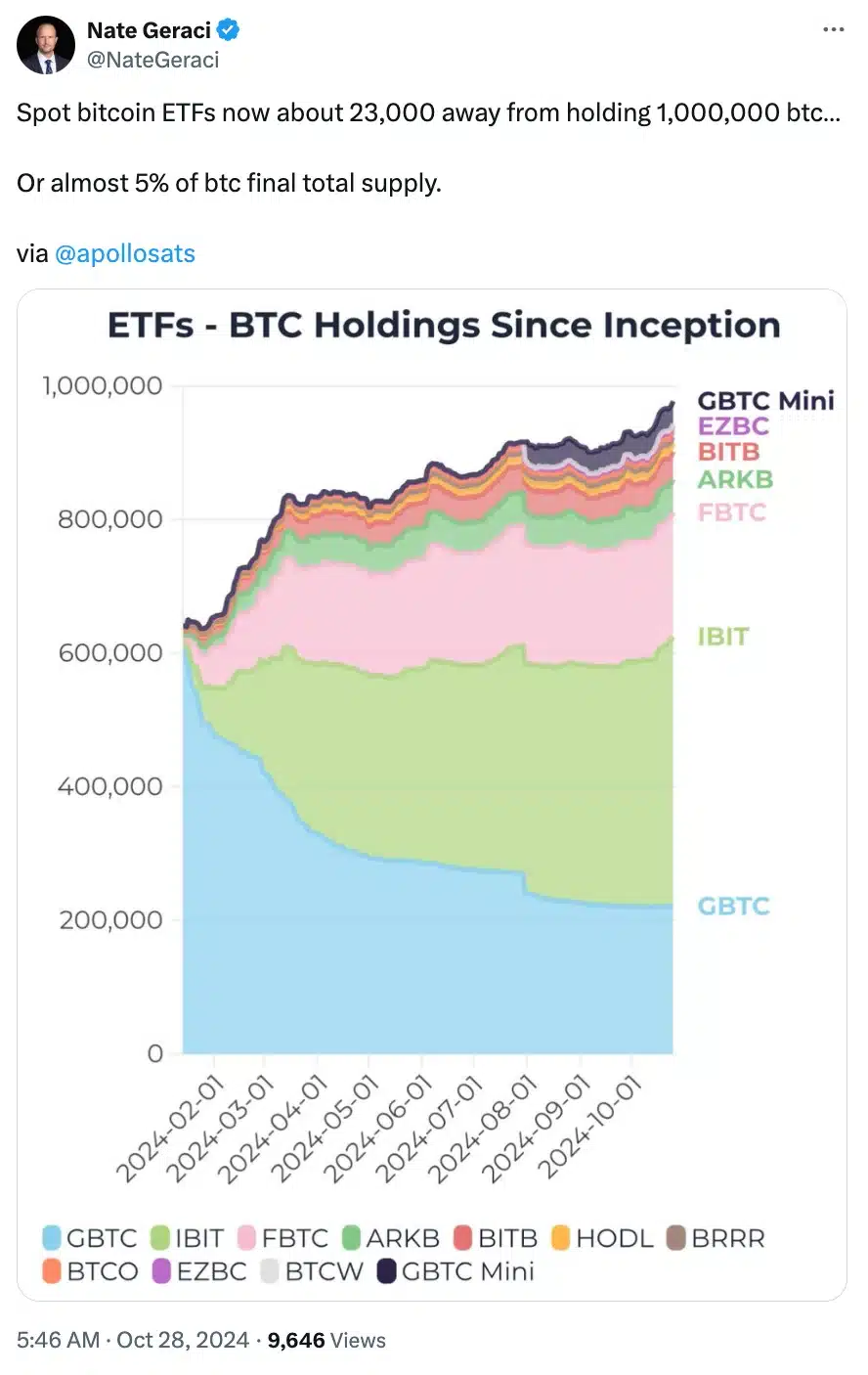

Among the many frontrunners, BlackRock’s IBIT stands out with a formidable $23 billion in inflows, whereas Grayscale’s GBTC has confronted notable outflows totaling $20 billion.

As anticipated, the latest momentum in BTC ETFs continued with almost $1 billion in web inflows recorded final week, marking the best demand seen up to now six months.

Execs weigh in…

In mild of the numerous success of spot Bitcoin ETFs, Nate Geraci, President of ETF Retailer, took to X to share his insights, and acknowledged,

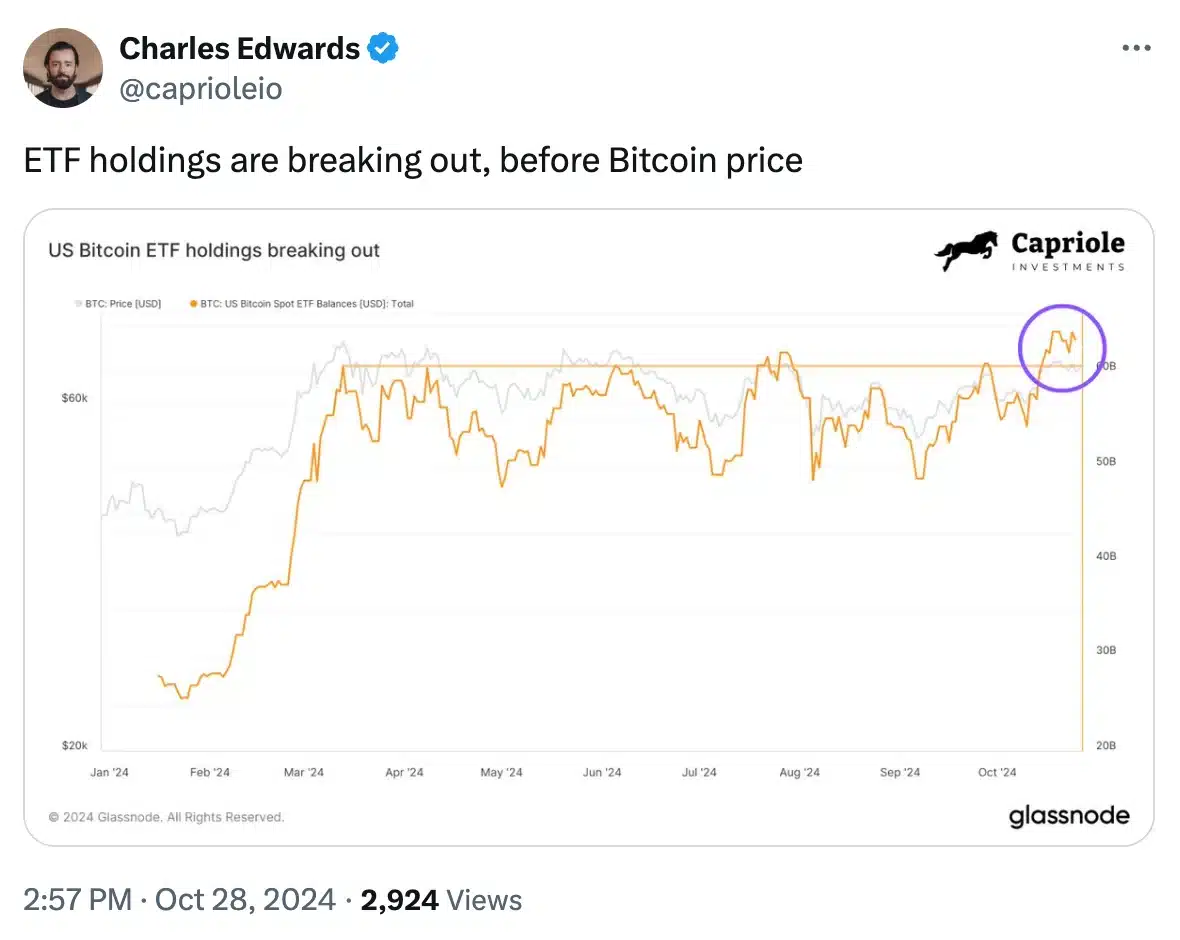

Becoming a member of the dialog, Charles Edwards, Founding father of Capriole Investments and The Ref, remarked,

Are retail traders driving the Bitcoin ETF market?

Regardless of spot BTC ETFs creating pathways for institutional traders, latest insights from crypto alternate Binance reveal that retail traders are considerably fueling the rising demand.

In line with their report, retail individuals now maintain a staggering 80% of the full belongings in these ETFs, underscoring their essential function available in the market’s upward momentum.

This pattern highlights a exceptional shift in funding dynamics, the place particular person traders are usually not solely energetic however are driving substantial curiosity in Bitcoin by means of these monetary devices.

The report famous,

“Spot Bitcoin (“BTC”) Change-traded funds (“ETFs”) have collected over 938.7K BTC (~US$63.3B), and when together with different comparable funds, this determine contains 5.2% of Bitcoin’s whole provide.”

What’s extra to it?

The report additional highlighted a major uptick in exercise inside crypto ETFs, with web inflows exceeding 312,500 BTC (roughly $18.9 billion) and optimistic inflows recorded in 24 of the final 40 weeks. On common, these ETFs are eradicating about 1,100 BTC every day from circulation, reflecting a proactive shopping for strategy.

This discount in provide, mixed with rising demand, may drive Bitcoin costs greater, indicating a rising acceptance of Bitcoin investments by means of ETFs and a notable shift in market dynamics.

Bitcoin ETFs vs Gold, Ethereum ETFs

That being stated, the report additionally reveals that spot BTC ETFs have considerably outperformed early Gold ETFs, recording web inflows of round $18.9 billion inside a 12 months, in comparison with simply $1.5 billion for Gold ETFs. This surge has drawn over 1,200 institutional traders to Bitcoin ETFs, a notable rise from the 95 establishments in Gold’s first 12 months.

In distinction, Ethereum [ETH] ETFs have struggled, experiencing outflows of roughly 43,700 ETH (round $103.1 million) and damaging flows in eight of the final eleven weeks.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Therefore, Bitcoin ETFs have a extra substantial influence on market dynamics when adjusted for spot buying and selling quantity, reflecting stronger demand from establishments.

These tendencies align with an increase in BTC’s value to $68,266.17, following a 1.87% enhance up to now 24 hours and a 4.38% month-to-month achieve, in response to CoinMarketCap.