- Bitcoin’s value surged following Donald Trump’s presidential win, nearing the $90,000 milestone.

- BlackRock’s Bitcoin ETF and crypto shares reached document buying and selling volumes amid Bitcoin’s rally.

Bitcoin [BTC] has entered a bullish section following Donald Trump’s victory because the forty seventh President of the US.

Apparently, market hypothesis was already buzzing with predictions that Trump’s win might propel BTC to the much-anticipated $100,000 mark.

Now, with Bitcoin closing in on $90,000, that milestone appears inside attain—although market analysts stay cautious, emphasizing that future value actions stay unsure amid ongoing volatility.

Past BTC’s spectacular value surge, the broader crypto market can also be witnessing notable achievements.

Influence of Bitcoin nearing $90K

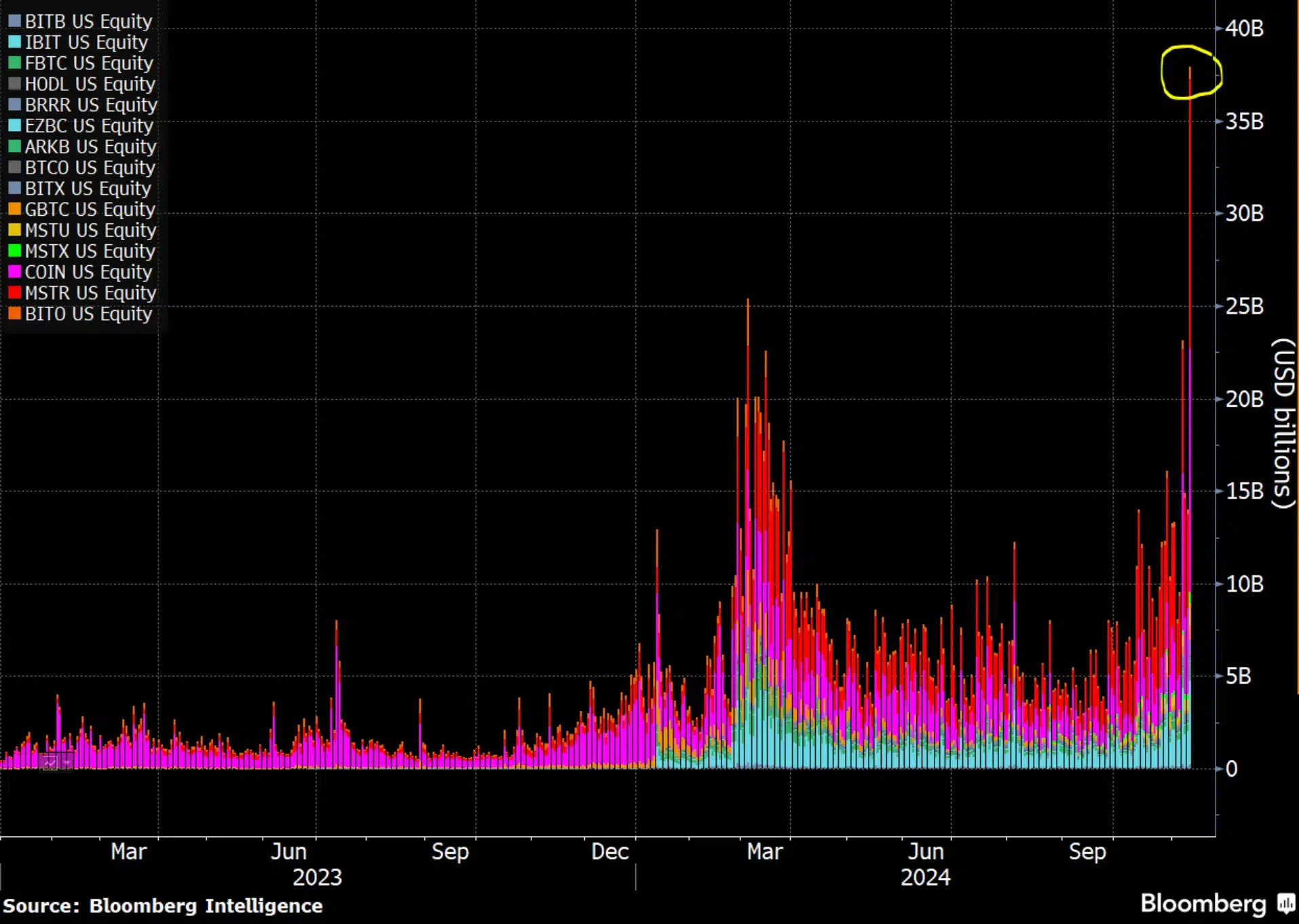

Bitcoin’s latest 11% rally in 24 hours, pushing it to $89,700 on the twelfth of November, has introduced a surge in buying and selling volumes for U.S. spot Bitcoin exchange-traded funds (ETFs), together with crypto companies like MicroStrategy Inc. (MSTR) and Coinbase International Inc. (COIN).

Mixed day by day buying and selling volumes for these property hit a document $38 billion, a big enhance over the earlier excessive of roughly $25 million recorded in March.

Remarking on the identical, Bloomberg Intelligence and ETF analyst Eric Balchunas stated,

“The Bitcoin Industrial Complex (ETFs + MSTR, COIN) saw $38b in trading volume today, lifetime records being set all over the place, incl $IBIT which did $4.5b, which points to a robust week of inflows. Just an insane day, it really deserves a name a la Volmageddon.”

Bitcoin ETF, too, sees a surge

Properly, it wasn’t simply the standard gamers like Bitcoin ETFs, MSTR, and COIN witnessing a surge—BlackRock’s spot BTC ETF additionally shattered earlier buying and selling quantity information.

Days after Trump’s win, BlackRock’s spot Bitcoin ETF recorded an inflow exceeding $1.1 billion in a single day, setting a brand new benchmark.

MicroStrategy emerged as one of many largest gainers on eleventh November, with its inventory hovering over 25% to $340. Coinbase additionally surged almost 20%, reaching $324.20—its first time over $300 since 2021.

Notably, MSTR and COIN had been among the many high 5 most-traded shares in early buying and selling, surpassing even giants like Apple and Microsoft, as famous by ETF analyst Eric Balchunas.

Group response and extra

Observing the outstanding affect following Trump’s victory, Sam MacDonald responded to Balchunas’ tweet, saying,

“@EricBalchunas just trying to gauge the vibe in Wall Street. Are these numbers turning heads? Seems (from afar) like the Trump effect is pushing everything higher.”

Thus, whereas the latest surge in BTC’s value has stirred pleasure, it’s unsure whether or not this rally is solely pushed by Trump’s victory or if different components are additionally at play.

Subsequently, because the market adjusts within the coming days, it is going to be intriguing to see if Bitcoin’s momentum will probably be sustained or if a pullback will probably be on the horizon.