- Bitcoin ETF holdings declined throughout numerous monetary establishments declined.

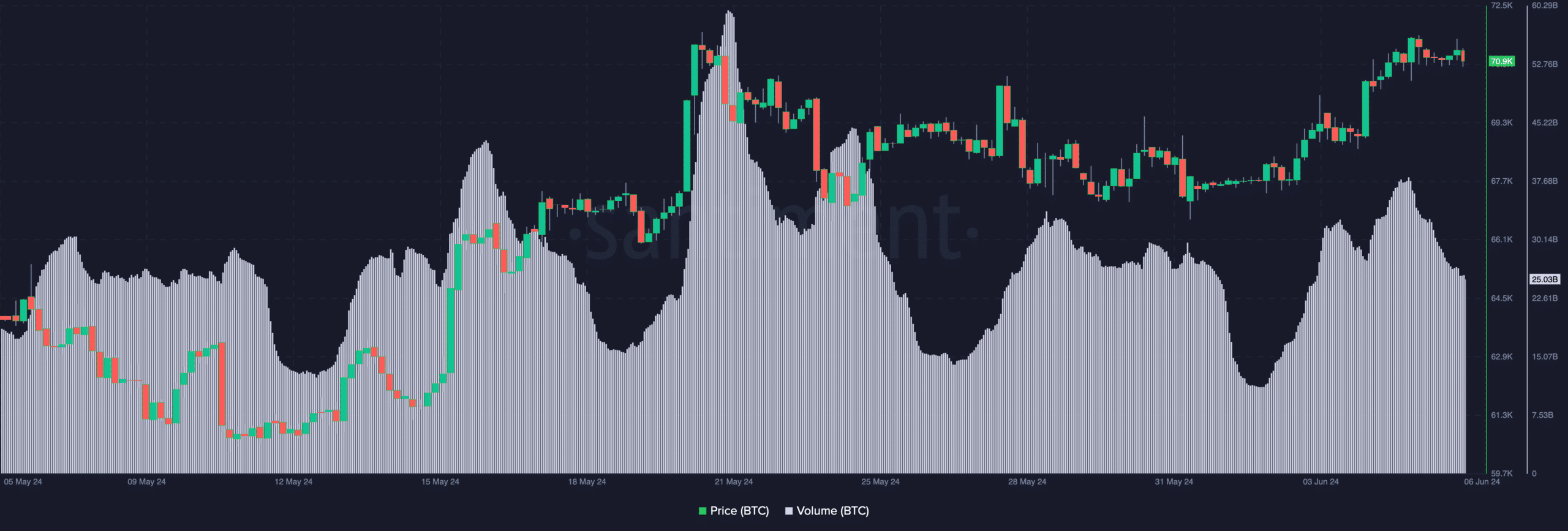

- The worth of Bitcoin remained stagnant, and volumes surged.

Bitcoin’s [BTC] latest correction in value prompted sentiment throughout markets to show unfavorable. Nevertheless it wasn’t simply the crypto merchants that had been affected, curiosity from Wall Avenue within the king coin diminished as properly.

Bitcoin ETFs see development

Throughout 9 Bitcoin exchange-traded funds ETFs, there was a collective lower in holdings of two,199 Bitcoin, which translated to roughly $153.4 million.

This decline could be attributed to 2 main gamers — ARK21Shares and Grayscale. ARK21Shares witnessed a lower of 840 BTC, which was roughly -$58.6 million.

On the twelfth of June, they held 48,199 BTC, valued at round $3.36 billion. Grayscale additionally noticed a lower in its holdings, by 580 BTC, round $40.5 million. On the twelfth of June, Grayscale held 283,966 BTC, valued at $19.81 billion.

If massive gamers are shedding religion and promoting their holdings, it would sign a insecurity within the long-term potential of BTC, resulting in a unfavorable sentiment ripple impact all through the market.

This might trigger a broader sell-off as much less risk-tolerant buyers panic and comply with go well with.

Knowledge from this week indicated a two-month excessive in transfers from mining swimming pools to exchanges, coinciding with BTC nearing its native peak of $70,000.

This recommended that miners had been capitalizing on the surge in value, probably by way of over-the-counter (OTC) desks.

This pattern was seemingly pushed by the latest Bitcoin halving, which lowered miner rewards and prompted these miners to promote a portion of their holdings to take care of profitability.

On the tenth of June, 1,200 BTC had been offered, representing the very best every day whole in two months, highlighting a possible rise in promoting stress from miners.

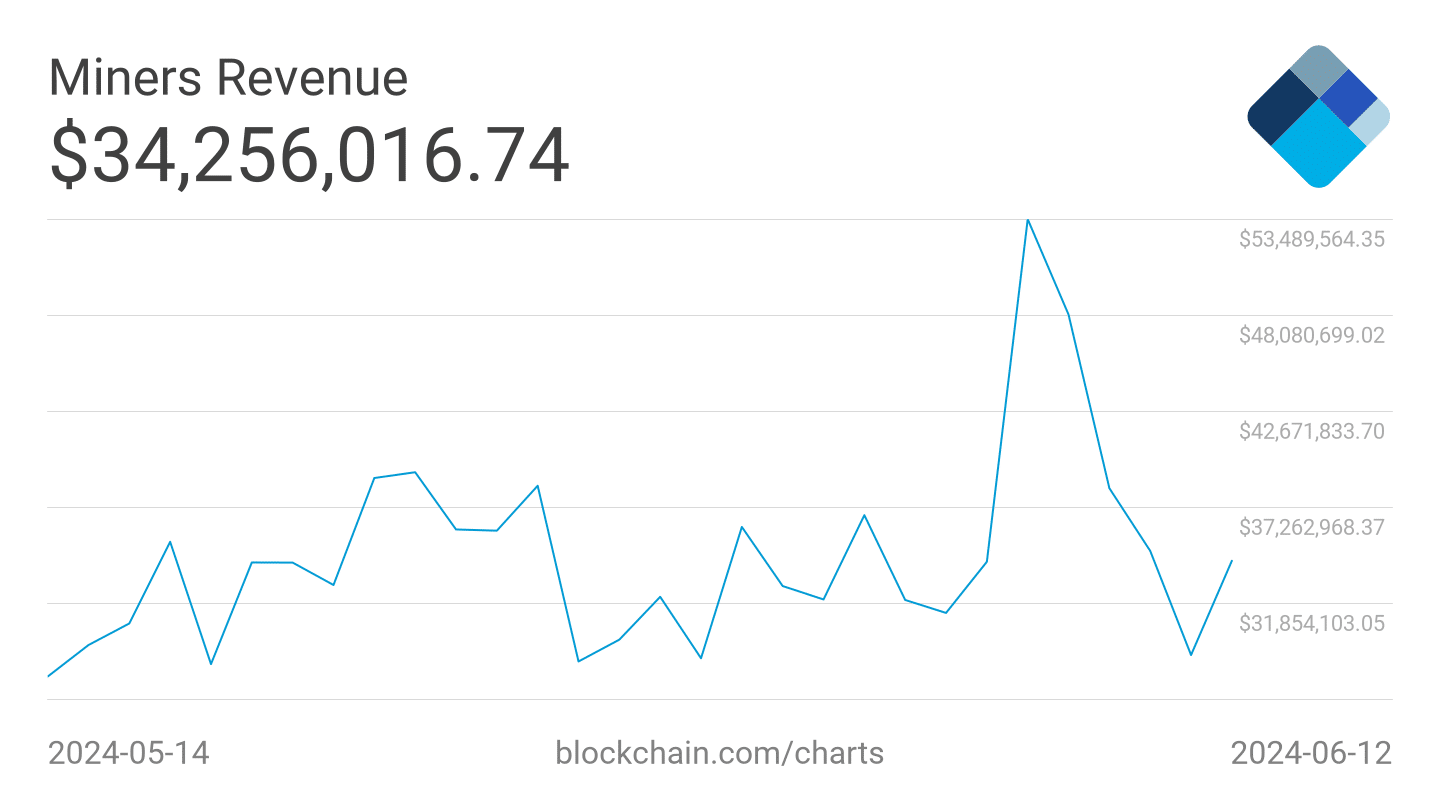

Furthermore, miner income declined. As miner income continues to plummet, the inducement for these miners to promote their holdings to stay worthwhile rises.

This decline in miner profitability can add additional promoting stress on BTC.

Learn Bitcoin (BTC) Value Prediction 2024-2025

How is BTC doing?

At press time, BTC was buying and selling at $67,268.41. Over the previous 24 hours, BTC’s value fell by 0.35%. Regardless of the decline in value, the amount at which BTC was buying and selling at surged by 25.26%.

The resurgence of buying and selling quantity for BTC may very well be an indicator of renewed curiosity within the coin. If the amount continues to develop, a constructive change may very well be mirrored within the value as properly.