- Bitcoin’s ETF choices spark bullish sentiment, however low-cost contracts skew the true market outlook.

- Methods like artificial longs and lined calls provide earnings potential however include dangers.

On the nineteenth of November, Bitcoin [BTC] choices for spot ETFs went reside, driving the cryptocurrency to a brand new all-time excessive of over $94,000.

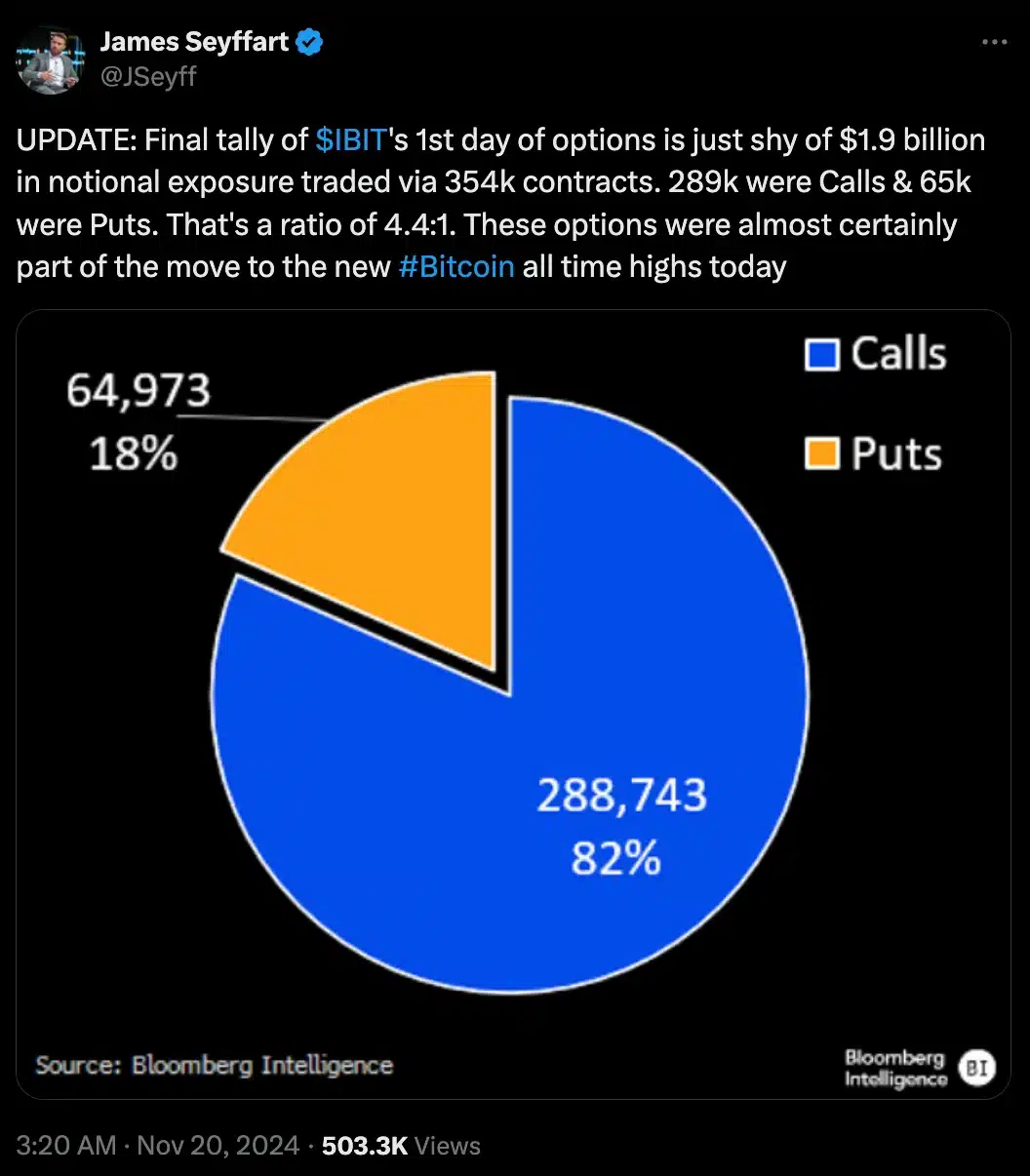

Analysts on X (previously Twitter) shortly marked the launch as successful, with a putting 4.4:1 call-to-put ratio.

A complete of 288,740 name choices far outpaced the 64,970 put choices, reflecting a surge in bullish sentiment and rising confidence in Bitcoin’s future.

Bloomberg ETF analyst James Seyffart remarked on the identical factor and famous,

Why it issues

The spike in Bitcoin name choices, notably the $100 calls expiring on the twentieth of December, initially steered a bullish outlook, with some contracts hinting at costs above $170,000.

Nonetheless, priced at simply $0.15 every—solely 0.3% of IBIT’s $53.40 worth—these choices pointed to a really slim likelihood of reaching $175,824.

Many view these low-cost choices as speculative “lottery tickets,” distorting true market sentiment and making a deceptive sense of optimism.

For a clearer instance, take into account the $65 IBIT name possibility expiring on the seventeenth of January, priced at $2.40–4.5% of IBIT’s $53.40.

It would grow to be worthwhile if Bitcoin hits $114,286, a 22% acquire in two months.

Different attainable methods

That being stated, superior merchants may also use methods like artificial longs.

As an illustration, an X person, “Ashton Cheekly,” shared a technique of promoting a $50 put and shopping for a $60 name for $2.15, replicating Bitcoin possession with out holding the asset straight.

One other in style technique is the lined name, the place an investor with IBIT sells a name possibility for fast earnings.

As an illustration, if IBIT is at $53.40, promoting a $55 name for $5.20 locks within the premium however limits the upside if IBIT rises above $55.

Now, if IBIT closes decrease, the investor retains the premium, decreasing losses or boosting returns.

Therefore, seeing the present tendencies, the $170,000 Bitcoin worth projection, pushed by speculative choices, is unlikely to materialize.

Thus, whereas choices provide leverage for important beneficial properties, they arrive with the danger of changing into nugatory.

Subsequently, for retail buyers, Bitcoin ETFs and choices current new revenue alternatives, however understanding the dangers and mechanics is crucial for fulfillment.