- The SEC lately permitted some BTC ETF Choices.

- Spot Bitcoin ETF noticed an elevated web circulation prior to now week.

Final week, the Securities and Trade Fee (SEC) permitted the itemizing and buying and selling of a number of Bitcoin [BTC] ETF Choices.

This marked a major step ahead in bridging conventional monetary markets with the quickly increasing digital asset house.

Main institutional gamers like Constancy and Grayscale have been taking the lea to ascertain ETF choices as an important element of a diversified funding portfolio.

The approval indicators regulatory readability

On the 18th of October, the SEC permitted the itemizing and buying and selling of choices for 11 spot Bitcoin ETFs, reinforcing the rising acceptance of Bitcoin ETF Choices by monetary regulators.

This regulatory endorsement is instrumental in fostering wider adoption.

As extra ETFs acquire approval for choices buying and selling, Wall Avenue’s curiosity in these monetary merchandise continues to rise.

Institutional merchants now have a clearer regulatory framework for participating with Bitcoin ETF Choices, rising their confidence out there.

The approval signifies a broader shift towards recognizing Bitcoin ETF Choices as professional monetary devices, with Wall Avenue more and more viewing them as precious instruments for portfolio diversification.

This regulatory readability and rising belief might sign a significant step towards the acceptance of digital property in mainstream finance.

Bitcoin ETFs expertise web circulation surge

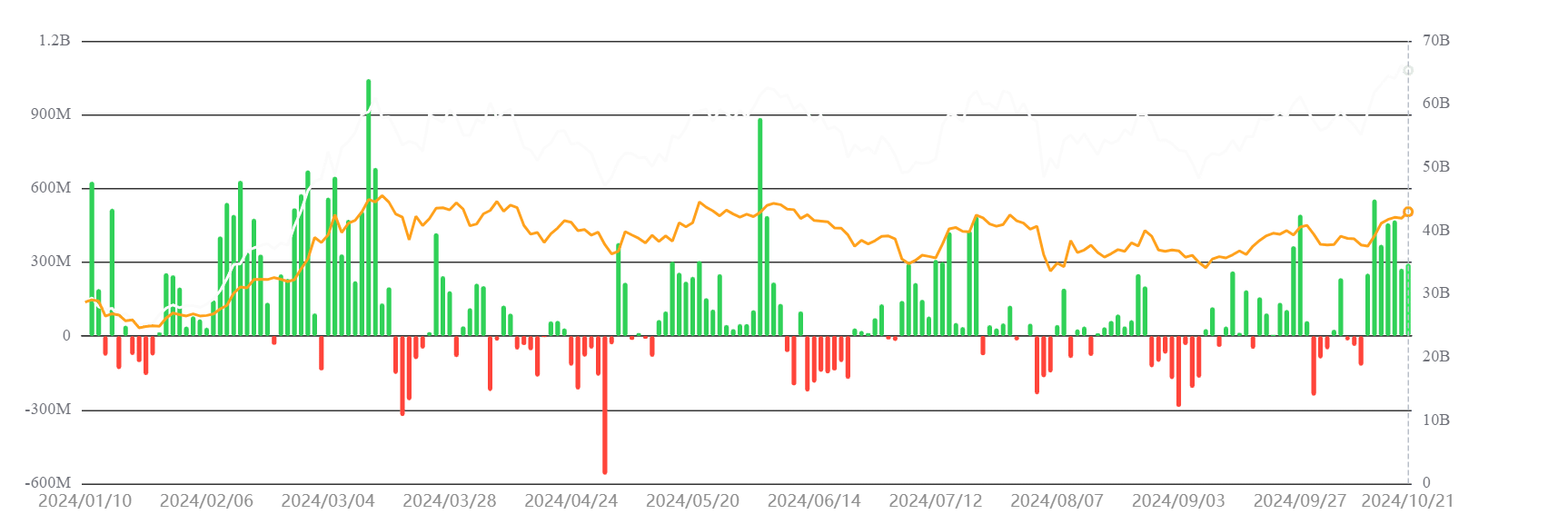

Current knowledge from SosoValue confirmed that Bitcoin ETFs have skilled optimistic inflows over the previous week. The evaluation revealed an influx of roughly $2.7 billion, bringing the entire web property to over $65 billion.

These inflows highlighted the heightened curiosity from institutional traders, with capital flowing out and in of the market.

With the introduction of Bitcoin ETF Choices, liquidity is predicted to rise. This can supply traders new methods to hedge their positions or speculate on future worth actions.

This might result in a extra secure worth motion for each Bitcoin and its related ETFs.

How Choices might form Wall Avenue portfolios

The rise of Bitcoin ETF Choices presents a major alternative for conventional monetary establishments and the broader crypto market.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Providing a regulated and versatile method to Bitcoin publicity, these choices open up new avenues for traders.

As regulatory frameworks proceed to evolve and extra monetary establishments embrace Bitcoin ETF Choices, these merchandise are poised to play a central position in future funding methods on Wall Avenue.