- Bitcoin’s DeFi exercise has surged after the TVL hit an ATH and flipped that of BNB Chain.

- This rise co mes amid demand for restaking on the Babylon Bitcoin staking protocol.

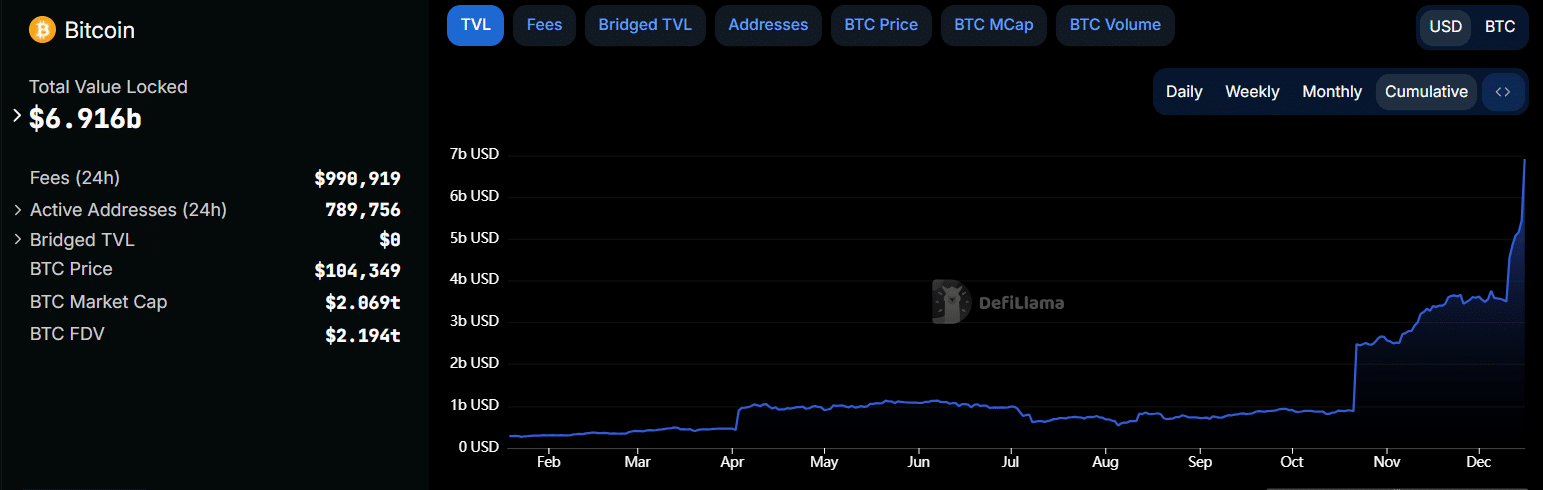

Bitcoin [BTC] has recorded a surge in decentralized finance (DeFi) exercise, with its Whole Worth Locked (TVL) surging to an all-time excessive of $6.9 billion per DeFiLlama. This progress has seen Bitcoin surpass BNB Chain to change into the fourth-largest blockchain by this metric.

Bitcoin’s DeFi exercise began to rise in late October as demand for BTC yield grew. DeFiLlama confirmed that on twenty first October, the TVL was beneath $1 billion, indicating that it has surged by greater than six instances in beneath two months.

The rising TVL isn’t solely due to BTC’s value appreciation but in addition a rise within the cash locked on the community. These belongings have elevated from 34,980 BTC to 66,040 BTC at press time.

So, what’s driving the growth in DeFi exercise on the blockchain?

Rising demand for restaking

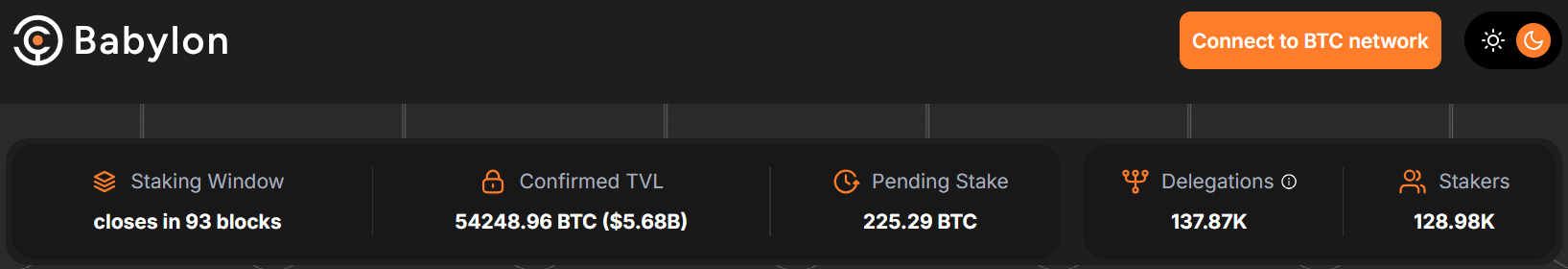

The primary issue behind the rising metric is the Babylon staking platform. This platform accounts for $5.6 billion of the overall TVL on Bitcoin.

In accordance with the Babylon staking dashboard, 128,000 stakers have locked greater than 54,000 BTC on the platform, displaying rising demand for Bitcoin yield.

Per DeFiLlama, the quantity of BTC staked on this platform has additionally elevated by 151% in seven days.

This surge has pushed Babylon to the highest of the leaderboard as the most important Bitcoin DeFi venture. Its progress has additionally outpaced the Lightning Community, which ranks a distant fifth with a $530 million TVL, highlighting a shift in BTC’s use case from funds to DeFi.

Regardless of this progress, Bitcoin’s TVL nonetheless pales compared to Ethereum’s $88 billion. The biggest staking protocol on Ethereum [ETH], Lido, additionally has $38 billion in TVL.

Nevertheless, after flipping BNB Chain, Bitcoin is now near flipping Tron [TRX], whose TVL stood at $8.08 billion.

Impression on Bitcoin value?

Bitcoin, at press time, traded at $104,240 after a 1.67% acquire in 24 hours. The king coin hit a recent all-time excessive of $106,488 on sixteenth December. This was amid rising demand from establishments after US-listed spot Bitcoin exchange-traded funds (ETFs) posted $2.17 billion inflows final week.

The rising DeFi exercise might drive recent demand for BTC, which might in flip push costs greater. Furthermore, staking might scale back promoting exercise on the coin as merchants search to generate yield.

DeFi exercise soars to 2022 highs

Bitcoin isn’t the one blockchain whose DeFi exercise is rising. The TVL throughout all protocols has surged to $154 billion, its highest degree since Might 2022.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Ethereum has added greater than $24 billion to its TVL in only one month, whereas Solana’s TVL has grown by over $1 billion. On the identical time, DeFi tokens reminiscent of AAVE [AAVE)] have outperformed most altcoins.

This rise might drive extra positive factors to Bitcoin’s TVL and ship a big rally for the king coin.