- Bitcoin whales began to maneuver their dormant BTC.

- Retail buyers confirmed curiosity, most holders remained unprofitable.

Bitcoin [BTC] has been buying and selling on the $64,000 stage for fairly a while and has stagnated at that place. Nonetheless, issues may quickly change for BTC as whales have been shedding curiosity in BTC.

Whales transfer their holdings

In keeping with Lookonchain’s knowledge, a pockets that remained inactive for 10.3 years just lately initiated a transaction, transferring all 687.33 BTC equal to $43.94 million.

The recipient of this transaction had initially obtained 687.33 BTC which was valued at $630,000 on the twelfth of January 2014, when the worth per BTC was $917.

This transfer could trigger FUD within the crypto markets and trigger a worth correction. Regardless of this whale’s habits, a big a part of the whale cohort remained impartial round BTC.

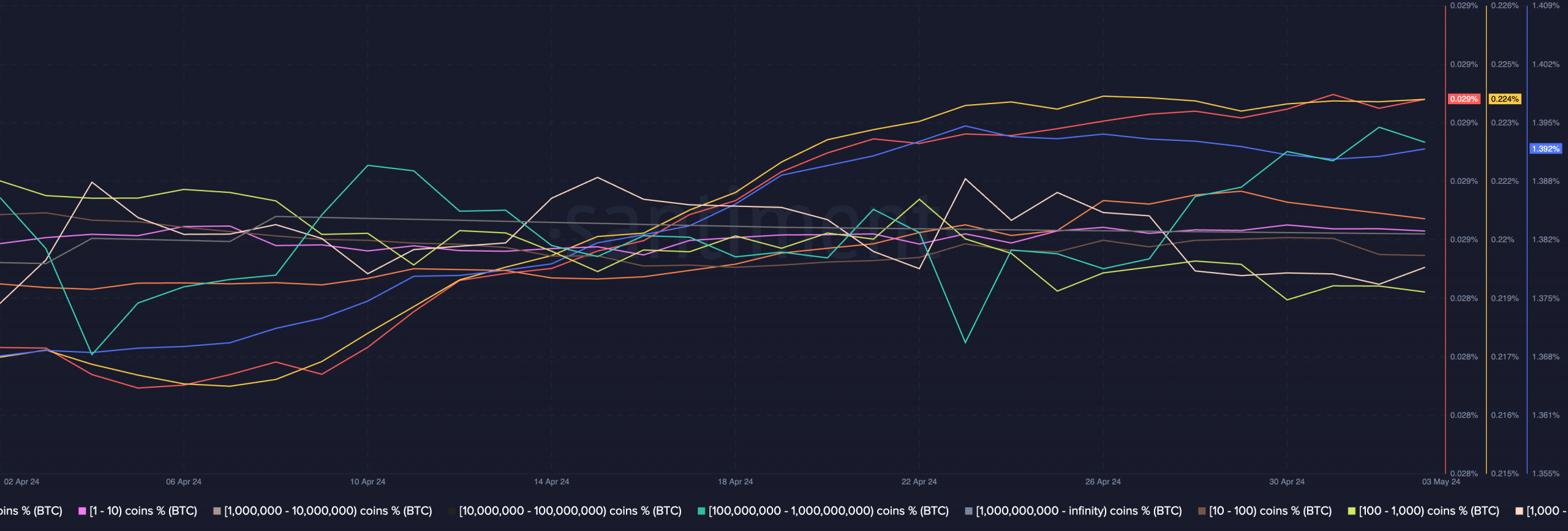

Santiment’s knowledge revealed that addresses holding anyplace between 1-10,000 cash weren’t seen to be accumulating or promoting their holdings.

Nonetheless, surprisingly, retail buyers had been seen to be accumulating en masse.

Although retail accumulation could not assist BTC see important surges in worth, it may assist enhance the sentiment across the king coin, which may result in optimistic worth motion going ahead.

Nonetheless, if extra whales start to promote their holdings and take pleasure in profit-taking, the retail buyers could undergo and may very well be impacted negatively.

What’s subsequent for BTC?

At press time, BTC was buying and selling at $64,293.03 and its worth had grown by 0.70% within the final 24 hours. The quantity at which BTC was buying and selling at had grown by 27.12% as effectively.

If the optimistic sentiment persists, the worth of BTC may declare the $65,000 stage and begin its journey in the direction of $70,000.

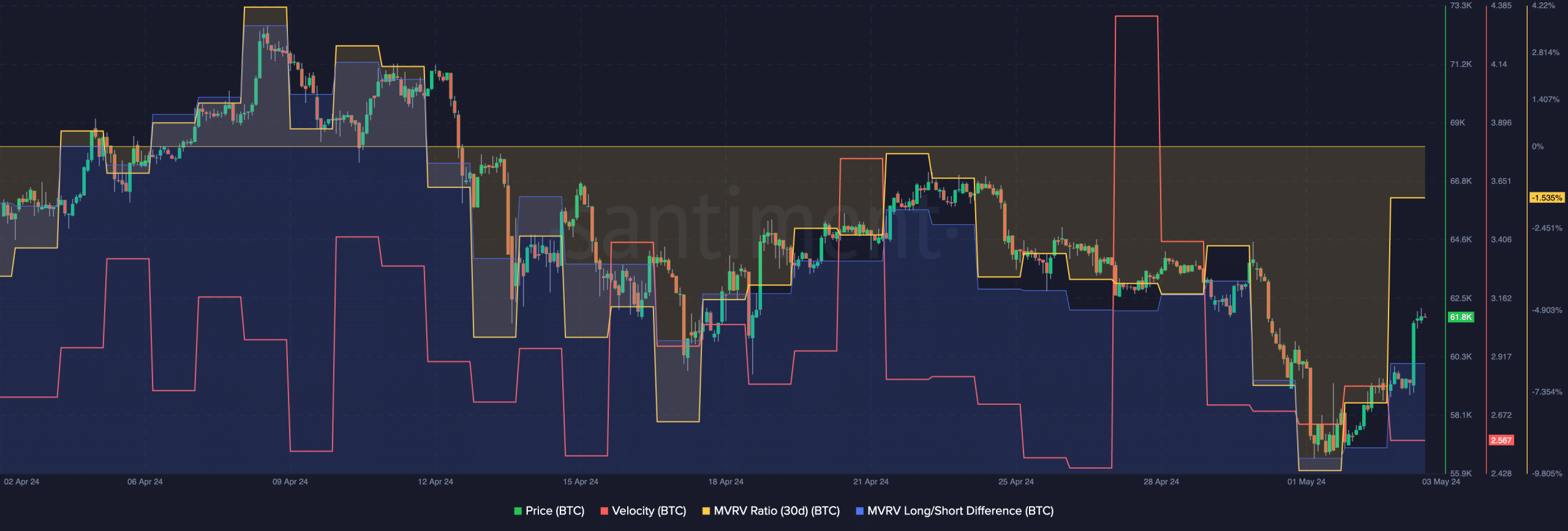

Nonetheless, there have been some issues that BTC may face on its solution to the highest. Considered one of them can be the declining velocity being seen for BTC.

Regardless of the surge in quantity, the speed round BTC in the previous few days had fallen, implying that the frequency with which BTC was being traded at had declined.

Although there are some challenges that BTC is going through, the promoting strain on a lot of the holders is comparatively low.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

One of many major causes for a similar can be the declining MVRV ratio for BTC, which indicated that almost all holders had been in losses on the time of writing.

This meant that BTC may proceed to rise to a sure stage until holders flip worthwhile. After this, revenue taking could happen and a slight correction could happen.