- Bitcoin whales have been accumulating for six weeks.

- BTC has continued to meander across the $60,000 value degree.

Bitcoin [BTC] has skilled a sturdy 48 hours, efficiently breaking by means of the essential $60,000 value degree at press time.

This degree, which has served as a big psychological barrier, noticed BTC oscillate round it because the market reacted to the renewed bullish momentum.

As Bitcoin’s value struggles to keep up its place above $60,000, some whale addresses seized the chance to build up extra BTC.

Weeks of whale accumulation

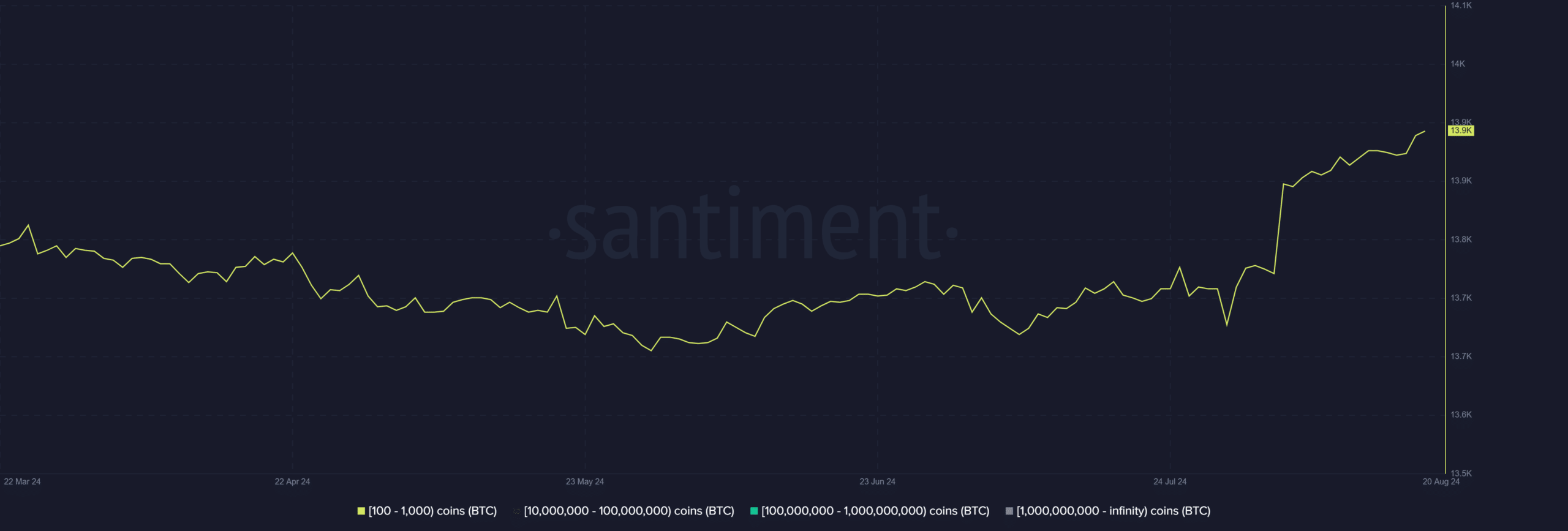

A current evaluation of Bitcoin whale addresses, particularly these holding between 100 and 1,000 BTC, revealed a big uptrend in accumulation.

Beforehand, there was a slight decline within the variety of these addresses, suggesting that some holders may need been promoting or redistributing their BTC holdings throughout that interval.

Nonetheless, the pattern has now reversed, with a transparent improve within the variety of addresses holding 100-1,000 BTC.

This means that mid-sized holders, typically thought of influential available in the market, have begun accumulating Bitcoin as soon as once more.

Over the previous six weeks, these addresses have collectively gathered roughly 94,700 extra BTC, representing a 2.44% improve of their holdings.

The rise in BTC held by these addresses might present underlying help for Bitcoin’s value, significantly because it makes an attempt to keep up and construct upon the current breakthrough of the $60,000 degree.

Doable implications of those accumulations

The current uptick in accumulation by mid-sized whale addresses holding 100-1,000 BTC signifies a rising confidence in Bitcoin’s value prospects.

These holders are probably anticipating additional beneficial properties and are positioning themselves strategically by accumulating extra BTC.

If the buildup pattern persists, it might result in diminished promoting strain available in the market. These mid-sized holders, having elevated their positions, are prone to maintain their BTC reasonably than promote within the quick time period.

This holding conduct might present a stabilizing impact on Bitcoin’s value, particularly if demand stays fixed or will increase.

Whereas the present pattern suggests accumulation is the dominant conduct, a big value surge might finally result in profit-taking.

Mid-sized whales, who’ve gathered at decrease ranges, could select to capitalize on greater costs, which might introduce some promoting strain into the market.

Nonetheless, that is prone to happen after the buildup part, and the present sentiment favors holding reasonably than instant promoting.

Bitcoin sees a slight restoration

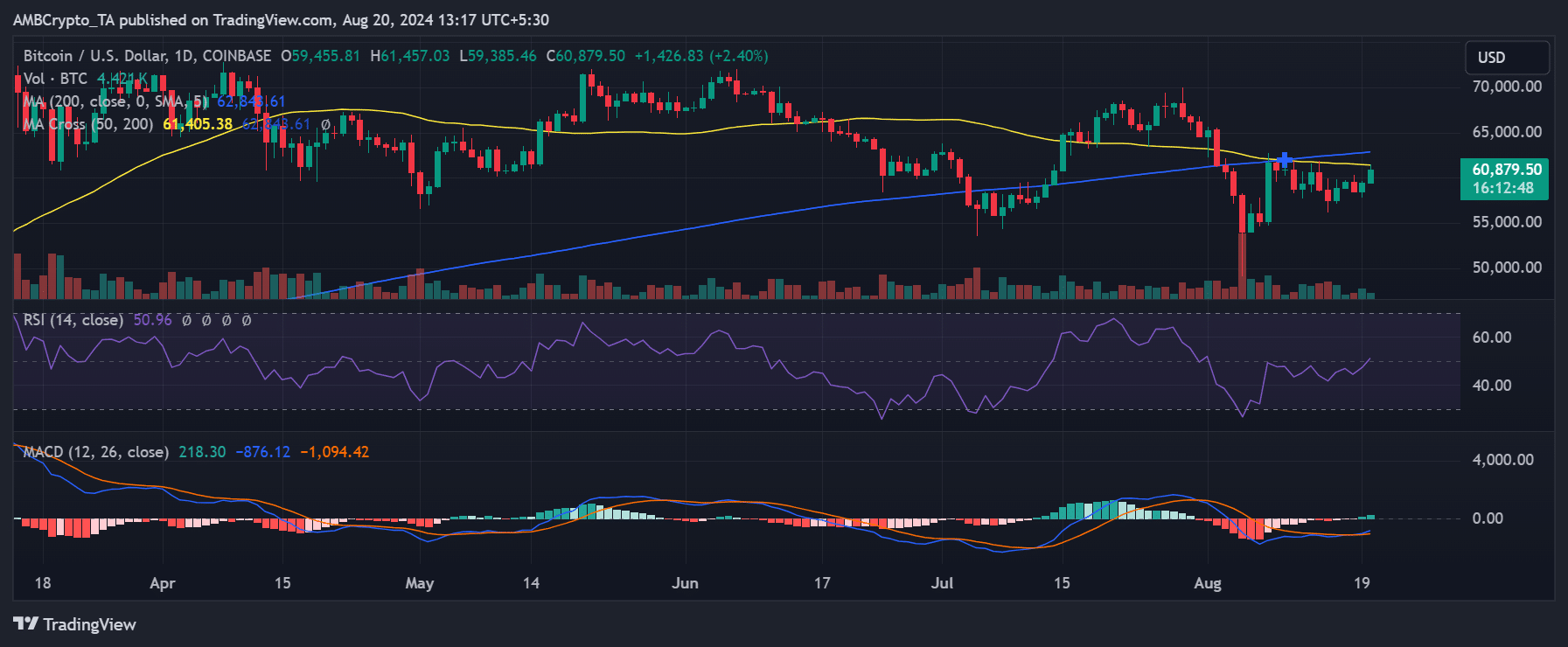

Bitcoin has skilled constructive value developments over the past 24 hours, reflecting rising market momentum.

Based on AMBCrypto’s evaluation, Bitcoin noticed a 1.74% improve within the earlier buying and selling session, bringing its value to round $59,400.

As of this writing, Bitcoin has continued its upward trajectory, reaching roughly $60,800 after an extra 2% improve.

This current value motion has pushed Bitcoin’s Relative Power Index (RSI) barely above the impartial line, signaling a shift towards a extra bullish sentiment.

The RSI crossing above the impartial degree advised that purchasing strain was starting to outweigh promoting strain, which might point out additional value appreciation if the pattern continues.

Whereas the value has proven constructive motion, mid-sized whale addresses holding 100-1,000 BTC haven’t but reacted considerably to this pattern.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

These addresses should still be in an statement part, ready to see how the market develops earlier than making any main strikes.

Their continued accumulation or potential promoting in response to additional value will increase will likely be key elements to observe within the coming days.