- Value outlook of Bitcoin is wanting good regardless of liquidity squeeze.

- Bitcoin’s key liquidity stage is at $65K.

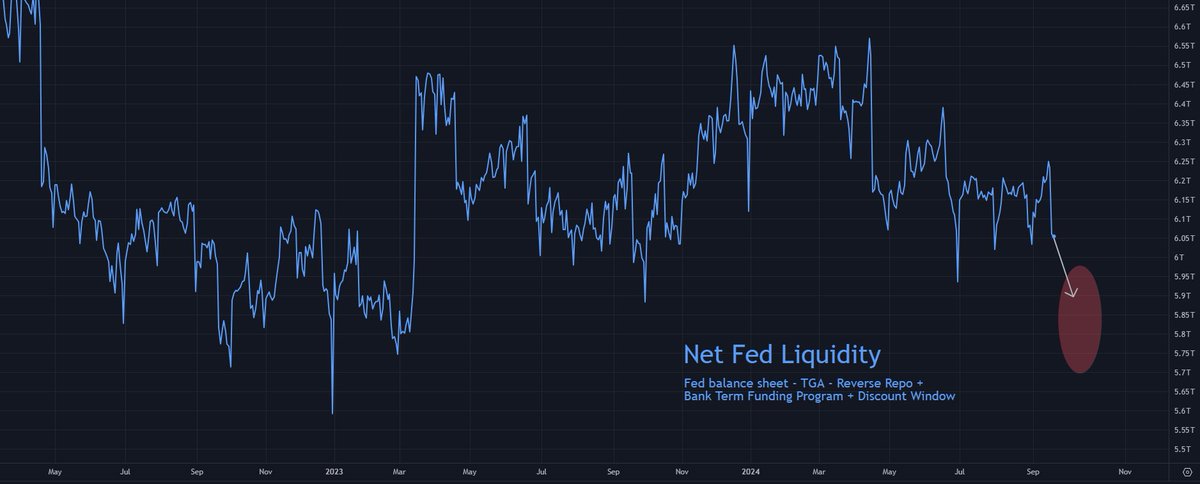

The Federal Reserve’s liquidity squeeze is effectively underway, with internet liquidity falling by round $200 billion since Monday.

This decline is because of company tax funds rising the Treasury Normal Account, adopted by a possible rise in Reverse Repo utilization in the direction of the tip of the month.

The market is now about midway by this liquidity squeeze, which is anticipated to proceed for one more seven buying and selling days.

One other $100 billion to $300 billion of liquidity might be drained earlier than October 1. Nonetheless, regardless of this tightening, main threat belongings reminiscent of US inventory indices, gold, and Bitcoin [BTC] have surged, boosted by the Fed’s current 50 foundation level fee reduce.

Bitcoin markets have largely shrugged off the short-term liquidity crunch, however warning remains to be suggested till this liquidity storm passes.

Can Bitcoin proceed its rally regardless of the Fed’s liquidity drop?

Over $2B in Bitcoin future contracts opened

Regardless of the drop in liquidity, a number of indicators counsel Bitcoin may proceed its upward trajectory. One such signal is the surge in open curiosity in futures contracts.

Over $2 billion in Bitcoin futures contracts had been opened inside simply 48 hours. Whereas this sharp improve may result in a possible long-squeeze, it additionally reveals that merchants are optimistic about Bitcoin’s future value.

The Federal Reserve’s fee reduce appears to have eased considerations about liquidity, encouraging merchants to guess on Bitcoin reaching increased ranges.

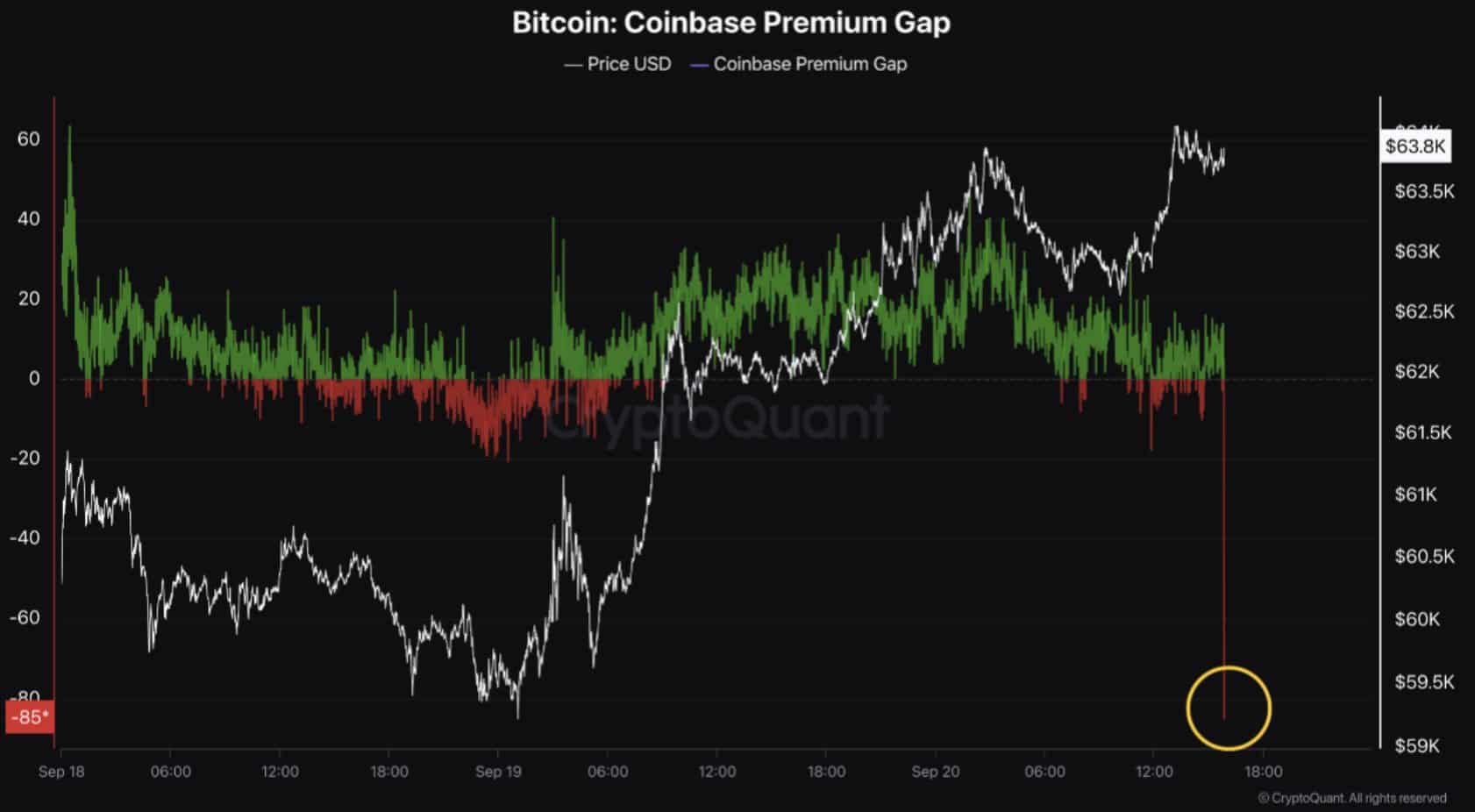

One other optimistic sign comes from the Coinbase Premium index, which measures the value distinction between Bitcoin on Coinbase and Binance.

Presently, the Coinbase Premium is adverse, that means Bitcoin is cheaper on Coinbase than on Binance. This sample, generally known as divergence, sometimes suggests robust shopping for strain, notably on Binance.

When two associated metrics transfer in reverse instructions, it usually indicators a reversal, suggesting that Bitcoin’s current downtrend could have discovered its backside.

Despite the fact that Bitcoin’s value hasn’t dropped, this shopping for strain signifies that Bitcoin might be set for a value improve.

Key ranges and liquidation zones for the subsequent transfer

Liquidation ranges are important for merchants, as they assist establish zones the place the value could transfer to choose up liquidity. Presently, Bitcoin’s key liquidity stage is at $65,000.

If Bitcoin breaks above this stage, it’s more likely to goal $75K, the place important liquidity awaits.

A break above $65K wouldn’t solely carry Bitcoin nearer to this subsequent goal but in addition verify a bullish market construction. It might sign a better excessive, following the current increased low seen after Bitcoin’s value dip in August.

Regardless of the continuing Fed liquidity squeeze, Bitcoin has proven resilience, with a number of indicators pointing in the direction of a continued rally.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The rise in open curiosity, robust shopping for strain on Binance, and key liquidity ranges all counsel that Bitcoin’s value may transfer increased within the coming weeks.

Merchants ought to look ahead to a break above the $65,000 stage, which may sign a major upward transfer to $75,000. Nonetheless, warning stays important till the liquidity storm totally passes.