- Implied volatility for Bitcoin choices round US elections has hiked by practically 50%.

- Choices merchants priced a 20% likelihood of BTC hitting $80K by end-November.

With solely two weeks to the US presidential elections, Bitcoin [BTC] choices merchants remained bullish and eyed a $80K goal by November.

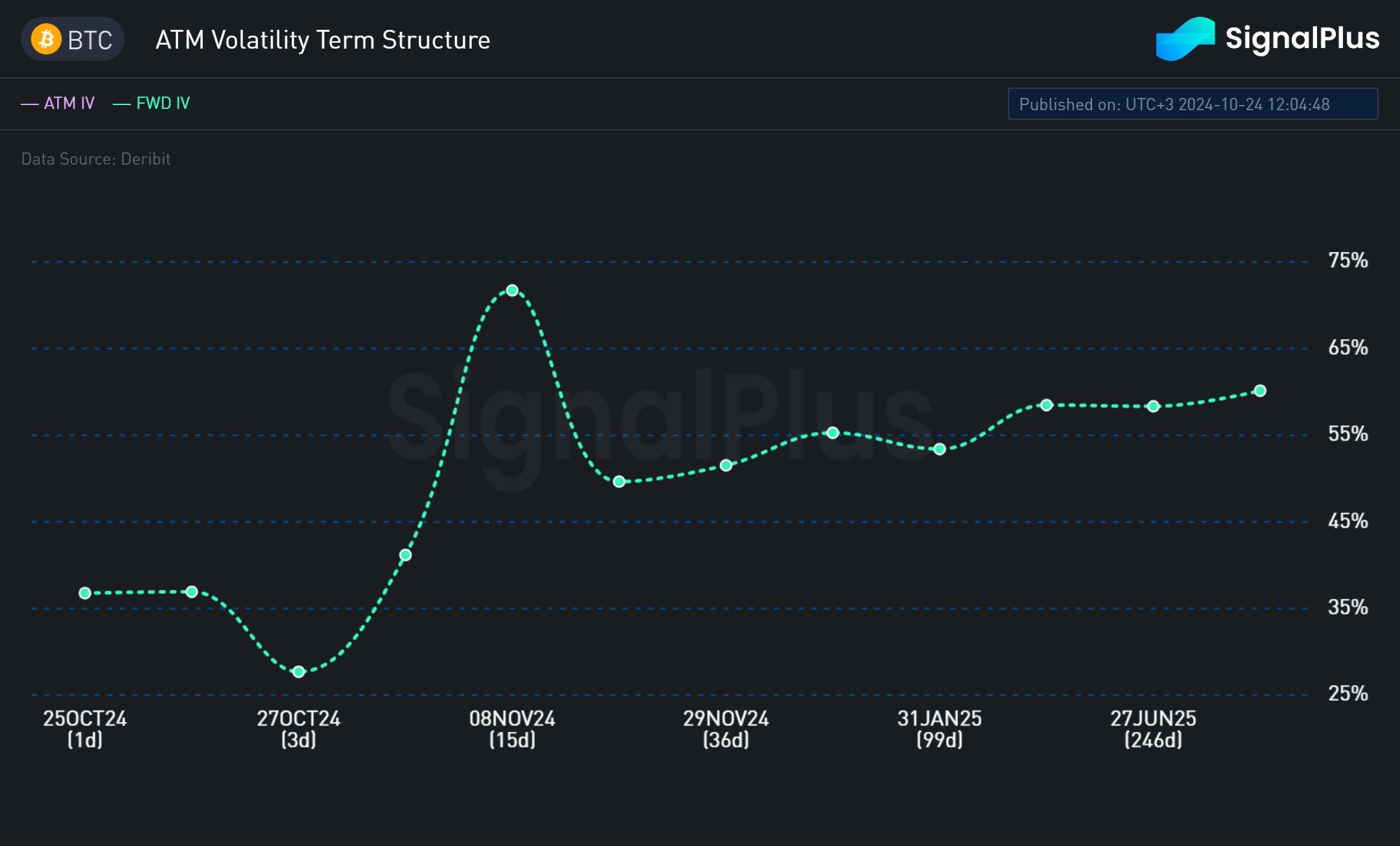

The election was a key market uncertainty, as famous by an almost 71% peak in FWD IV (ahead implied volatility) by November eighth.

This meant that the market anticipated wild worth swings across the US elections. Subsequently, the swings may very well be upside or draw back as institutional traders hedge their positions in opposition to the chance.

Market volatility was anticipated to taper off after two key occasions: the elections (fifth Nov.) and the Fed charge resolution (eighth Nov.). The FWD IV south-bound motion after November eighth illustrated this.

Choices bullish bets

Nevertheless, regardless of the election considerations, the BTC choices market has maintained a bullish outlook, as lately famous by crypto buying and selling agency QCP Capital. It acknowledged,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs.”

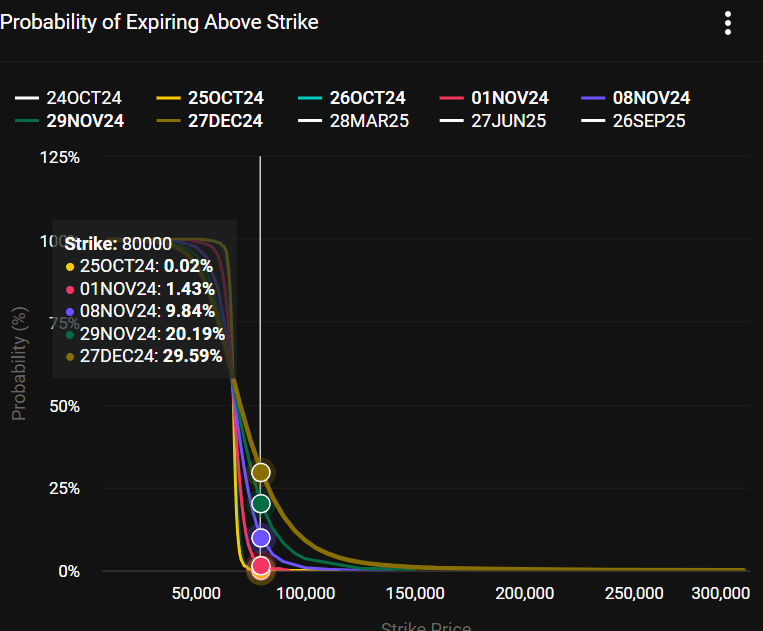

At press time, Deribit knowledge painted the same outlook, with name choices (bullish bets on BTC future worth rally) dominating put choices (bearish bets) for contracts expiring by 29 November.

The choices merchants have been pricing a 20% likelihood of BTC hitting $80K by the top of November.

Reacting to the positioning, Bitwise’s head of European analysis, André Dragosch, termed it as an expectation of a ‘bullish outcome.’

“This is supporting the hypothesis that bitcoin options traders are generally positioning for a bullish outcome.”

Properly, Donald Trump has been arguably essentially the most pro-crypto candidate. He has maintained a 20-point lead in opposition to Kamala Harris in polls and prediction web site Polymarket.

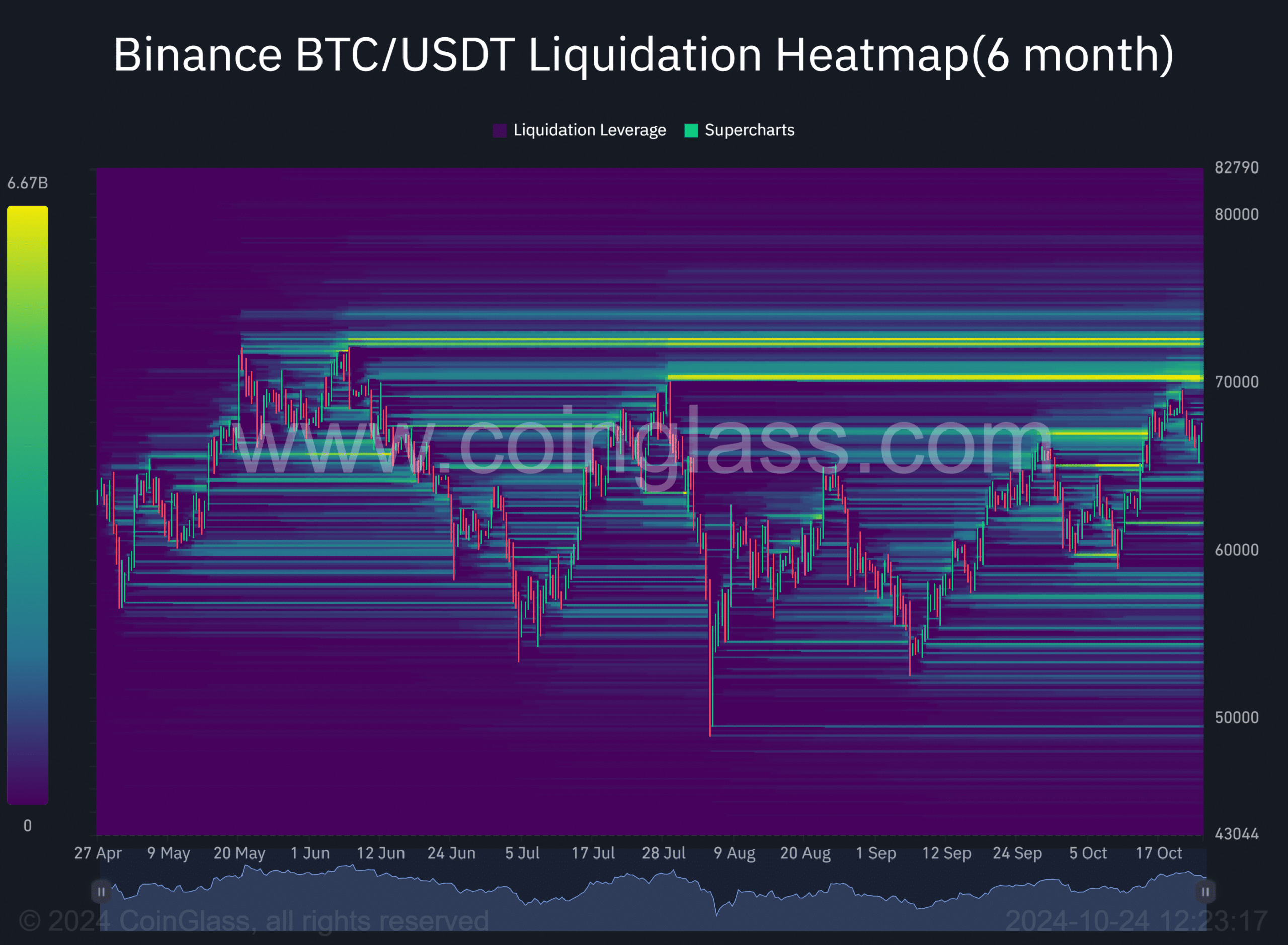

That mentioned, ought to BTC pump to $80K and clear the $70K psychological degree, practically $7 billion briefly positions can be squeezed.

Nevertheless, BTC has seen short-term weakening amid the continuing US earnings season. On the time of writing, BTC’s worth was $67K, about 10% away from its all-time excessive (ATH) of $73.7K.