- BTC change reserves have dropped to the bottom degree this 12 months.

- Bitcoin, leaving exchanges’ reserves, stood at 2.6 million BTC.

Bitcoin [BTC] has as soon as once more damaged by way of a key resistance degree, rising above $65K, a degree it had struggled to surpass for over eight months.

This current surge has triggered bullish momentum, that means BTC is gaining energy.

A big signal of this optimistic outlook is the drop in Bitcoin change reserves, which have hit their lowest ranges of the 12 months.

The reserves stood at roughly 2.6 million BTC. This decline means that each short-term and long-term holders are more and more unwilling to promote. It has fueled expectations of additional value positive factors.

Traditionally, decrease change reserves are related to bullish market sentiment, as they point out a lowered chance of promoting stress within the close to time period.

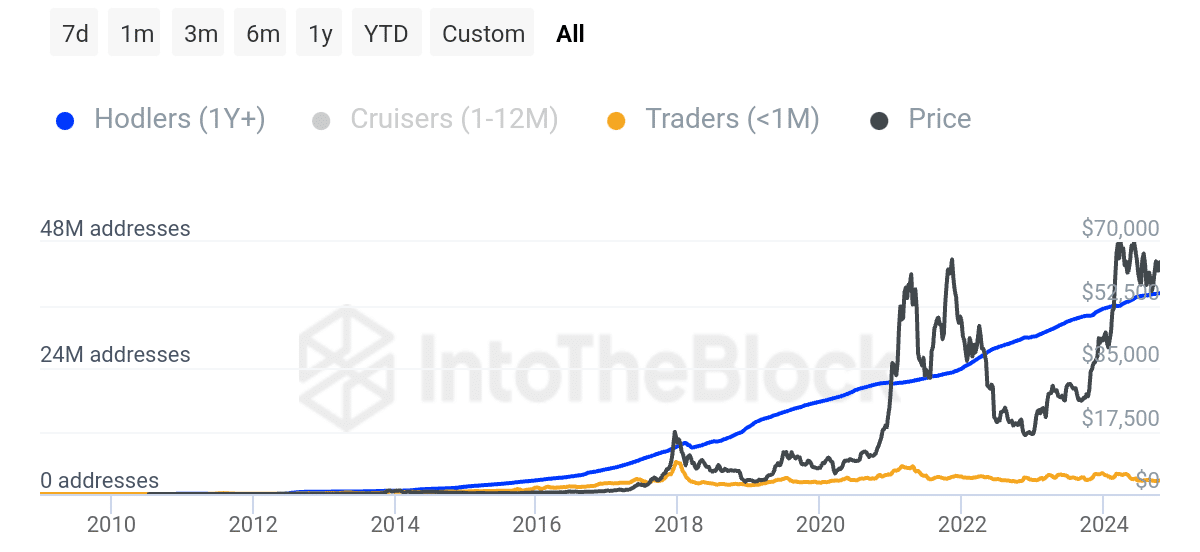

Bitcoin’s accumulation development amongst long-term holders has been steadily rising since 2014, and the variety of addresses holding BTC for over a 12 months is now at an all-time excessive.

This sturdy accumulation by long-term buyers helps the next value trajectory for Bitcoin.

In accordance with information from IntoTheBlock, the variety of addresses holding BTC for greater than a 12 months has elevated by 0.35% over the previous month.

At present, over 38 million addresses have retained Bitcoin for greater than a 12 months, whereas 13 million addresses have been held for one to 12 months.

Solely 2 million addresses have held BTC for lower than a month, underscoring the dominance of long-term holders.

This long-term accumulation development is a bullish sign. This indicated that extra buyers are assured in Bitcoin’s future development and are holding onto their positions for potential positive factors.

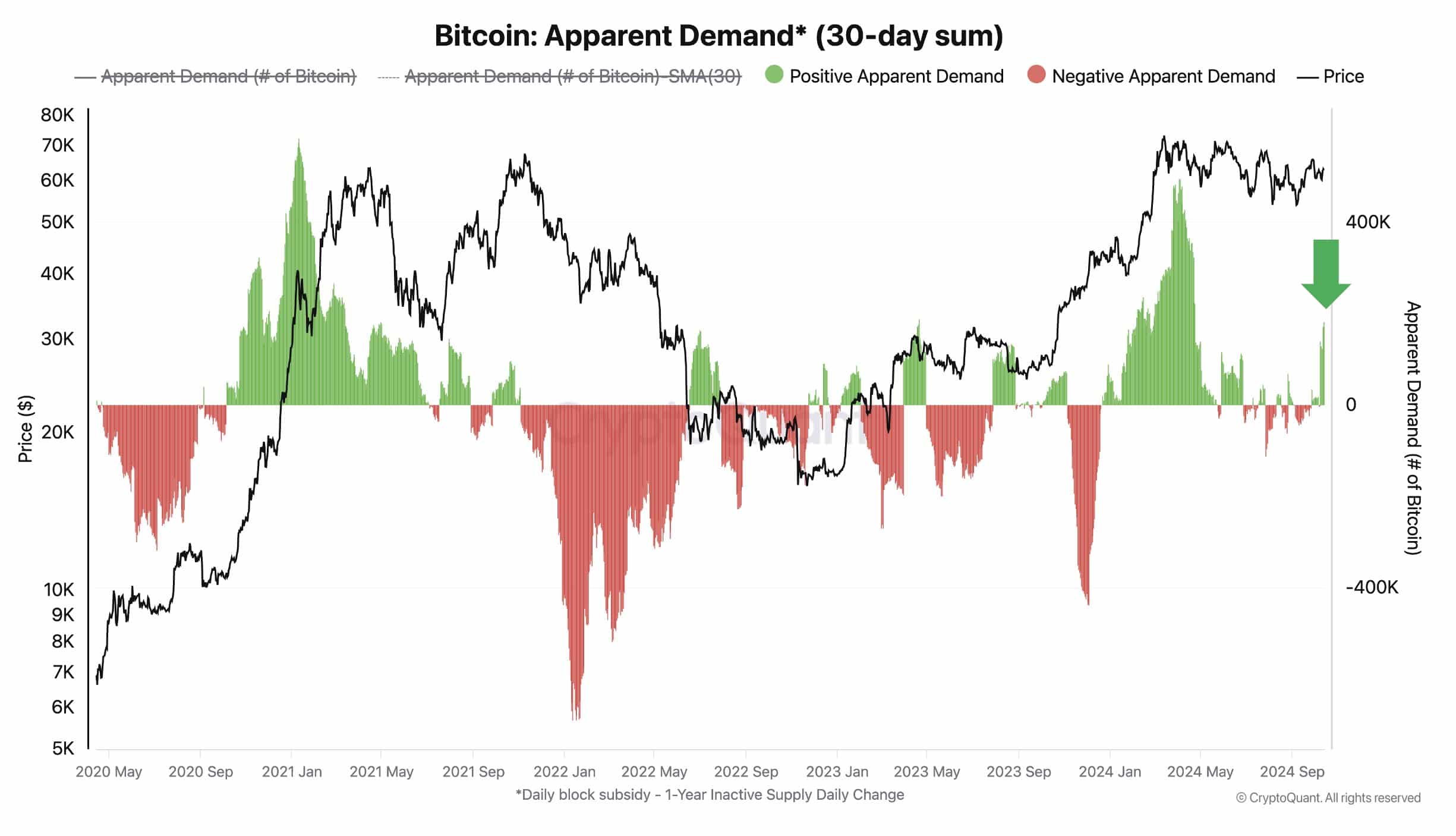

BTC’s obvious demand

One other optimistic indicator for Bitcoin’s value is the obvious demand, which measures the distinction between manufacturing and adjustments in stock.

Within the context of Bitcoin, manufacturing refers back to the issuance of latest BTC by way of mining, whereas stock refers back to the provide of Bitcoin that has been inactive for over a 12 months.

When the stock discount outpaces new manufacturing, it alerts growing demand for Bitcoin.

This elevated demand, mixed with a restricted provide, sometimes drives costs increased.

Given the current traits, the demand for Bitcoin seems to be on the rise, additional supporting the case for continued value will increase.

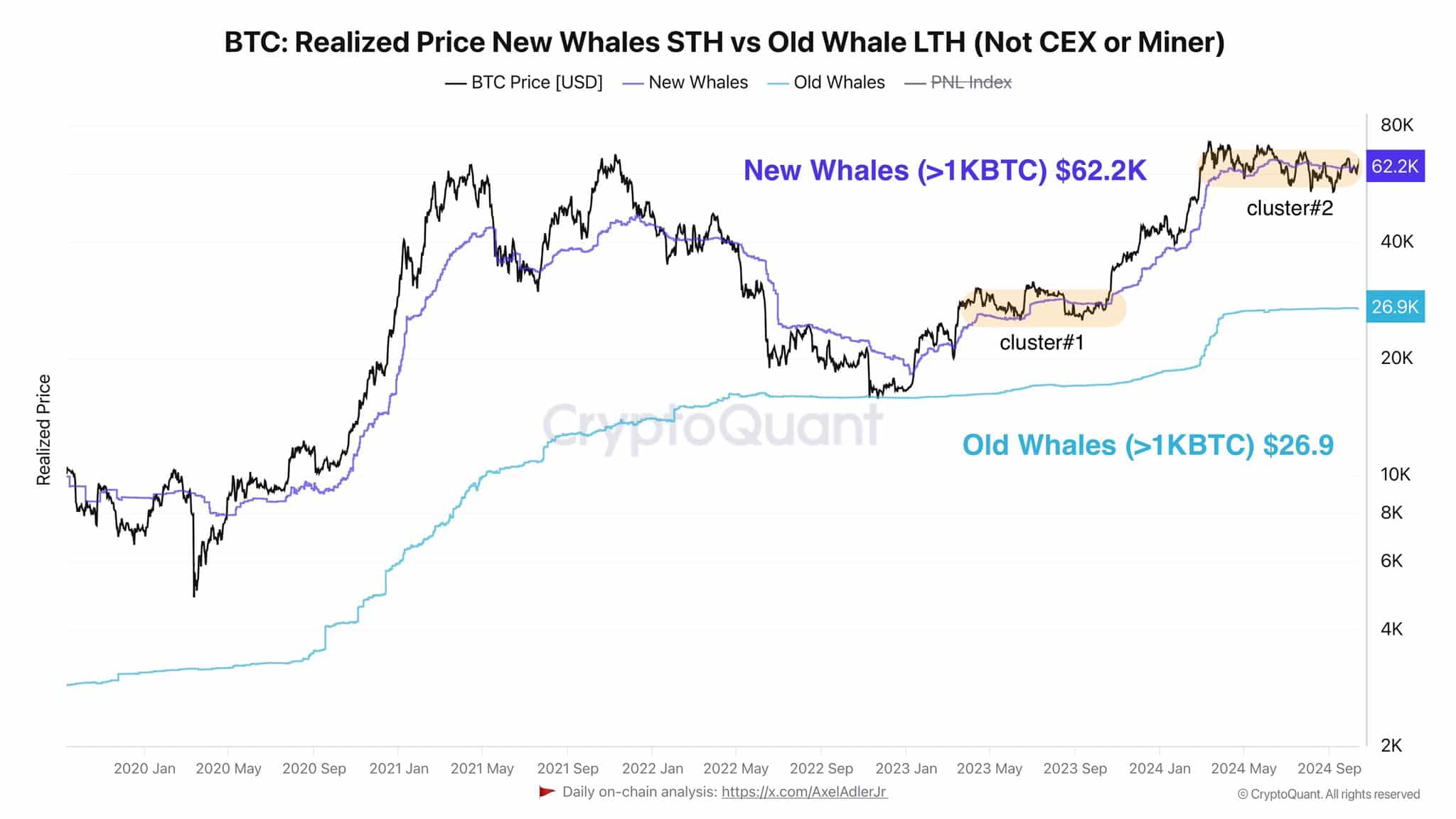

Realized value of latest vs. previous whales

The common buy value of latest whale buyers is at the moment round $62.2K, whereas extra skilled whales have a mean buy value of $26.9K.

With Bitcoin now buying and selling above these key value ranges, it turns into much less seemingly that whales will promote their holdings till the market cycle peaks.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This consolidation of whale purchases across the present ranges reinforces the assumption that Bitcoin’s value is poised to maneuver increased.

Giant buyers sometimes maintain onto their positions throughout an uptrend, including additional stability and confidence to the market.