- Bitcoin’s change reserve dropped to the extent that was seen in 2018.

- Lengthy-term traders have been assured in BTC, however a couple of indicators have been bearish.

Bitcoin [BTC] has as soon as once more gained bullish momentum because it was quick approaching the $60k goal. This simply may be the tip of the iceberg, because the coin has the potential to achieve new highs quickly. Let’s take a look at why that was the case with BTC.

Is a giant transfer doubtless?

As per CoinMarketCap’s knowledge, BTC’s worth elevated by over 6% up to now seven days. Within the final 24 hours additionally, the bullish pattern continued because the king of crypto’s worth rose by greater than 1%.

On the time of writing, BTC was buying and selling at $59,256.11 with a market capitalization of over $1.17 trillion.

In the meantime, Titan of Crypto, a well-liked crypto analyst, posted a tweet highlighting that BTC was following a previous pattern. As per the tweet, in previous cycles, BTC has all the time reached new highs after starting its third parabolic advance stage.

To be exact, such episodes occurred again in 2013, 2017, and 2021. On the time of writing, BTC had reached the help degree from which it might start its third advance.

Therefore, there have been possibilities of this bull rally pushing BTC to an all-time excessive within the coming months.

Odds of Bitcoin reaching an ATH in 2024

Since there have been possibilities of an enormous bull rally, AMBCrypto deliberate to have a better have a look at the king of cryptos’ state.

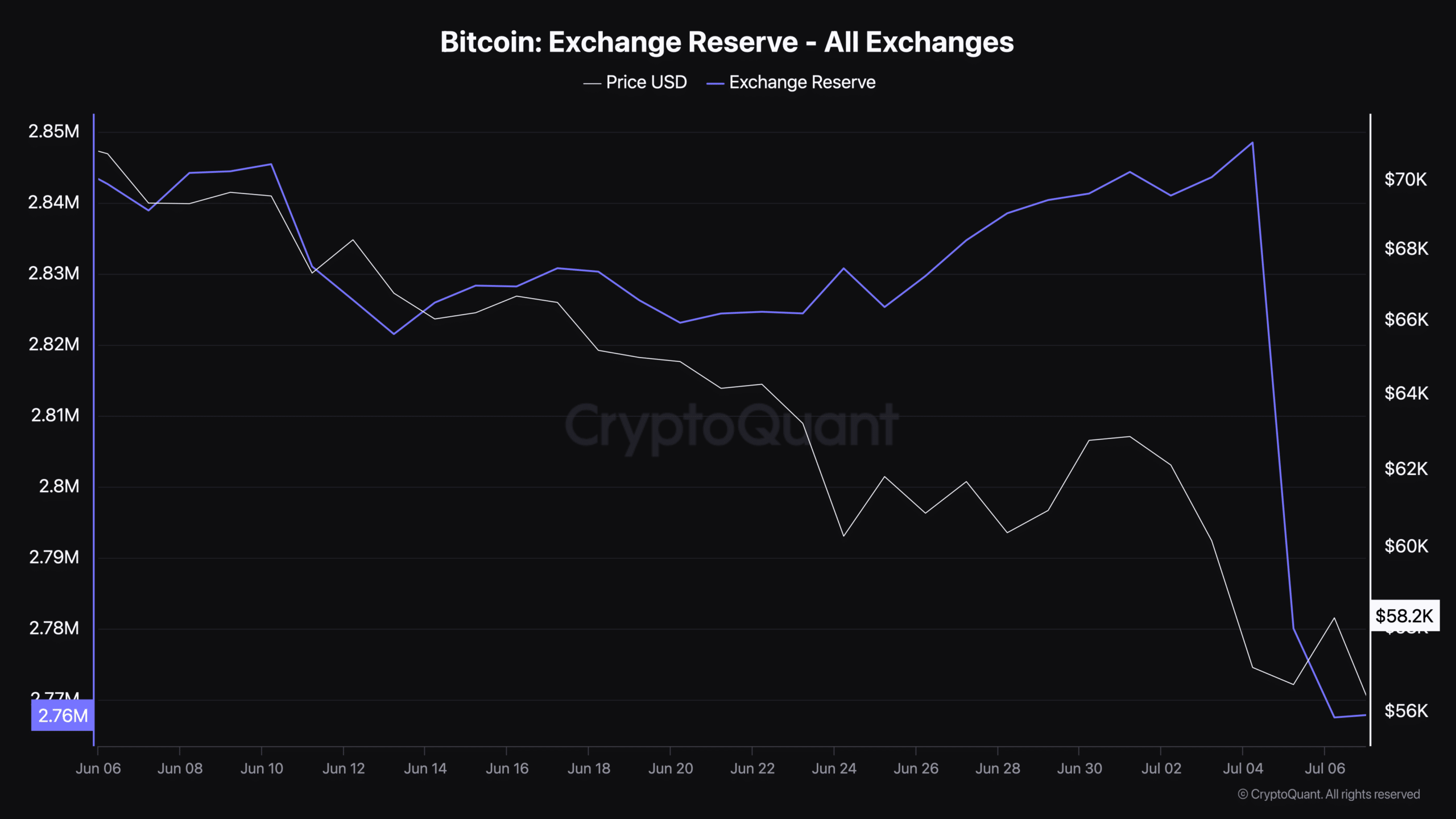

As per our evaluation of CryptoQuant’s knowledge, Bitcoin’s change reserve reached as little as it was seen again in 2018. This clearly indicated that purchasing stress on the coin was growing, which is taken into account a bullish sign.

Other than that, BTC’s Binary CDD was inexperienced, which means that long-term holders’ motion within the final seven days was decrease than the common. They’ve a motive to carry their cash.

Nevertheless, the aSORP seemed troublesome because it was purple. This urged that extra traders have been promoting at a revenue. In the course of a bull market, it might probably point out a market prime.

Subsequently, AMBCrypto deliberate to take a look on the day by day chart of Bitcoin to raised perceive whether or not it might maintain this upward trajectory.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

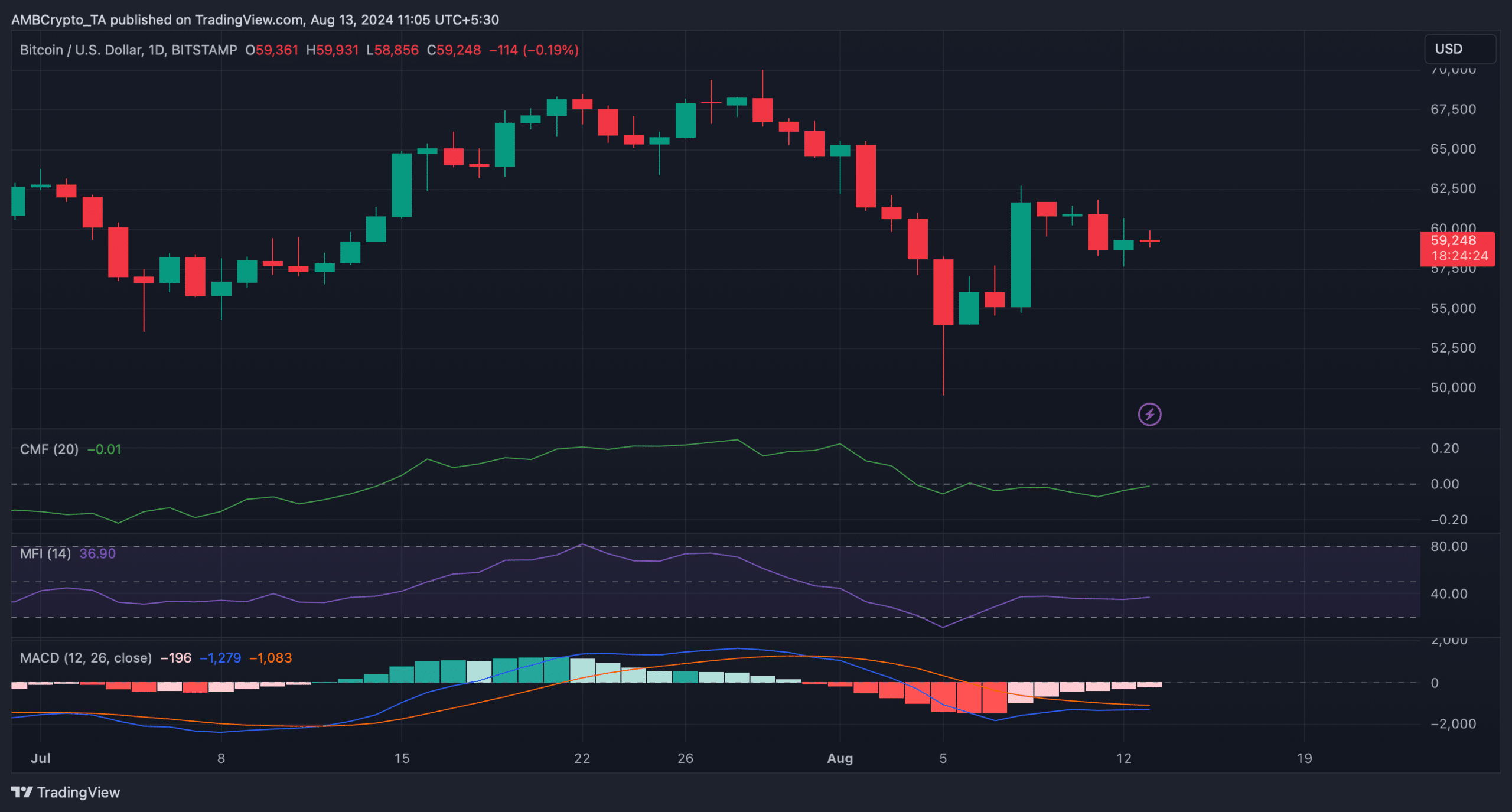

The technical indicator MACD displayed that the bulls have been attempting to meet up with the bears.

BTC’s Chaikin Cash Move (CMF) gave hope of a bullish takeover because it went northward. Nonetheless, the Cash Move Index (MFI) moved sideways, indicating a couple of slow-moving days forward.