- Bitcoin is at present buying and selling at round $87,000.

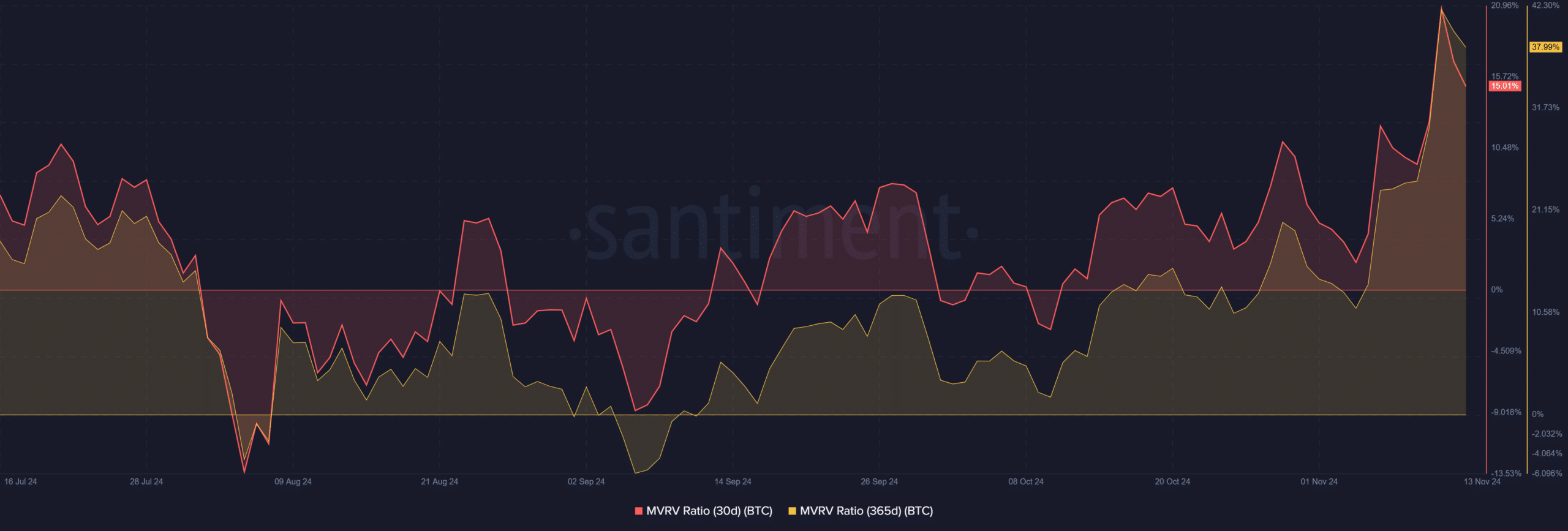

- The MVRV is at its highest in over a yr.

Bitcoin [BTC] has been on the heart of investor consideration, pushed by its latest all-time highs and important shifts in its on-chain metrics.

Amongst these indicators, the Market Worth to Realized Worth (MVRV) ratio gives insights into potential market conduct. On the similar time, the World In/Out of the Cash (GIOM) knowledge provides a view of holder profitability.

Collectively, these metrics reveal an fascinating image of Bitcoin’s present state.

Bitcoin MVRV ratios point out a heated market

The 30-day MVRV ratio for Bitcoin was at 15.01% at press time, whereas the 365-day ratio stood at 37.99%. These ranges point out that Bitcoin holders, on common, have accrued important unrealized earnings.

Traditionally, such elevated MVRV ratios have correlated with intervals of heightened market exercise, usually resulting in both profit-taking or continued bullish momentum.

The 365-day MVRV’s excessive stage means that long-term holders are seeing substantial positive aspects, a optimistic signal for market sentiment, and a possible set off for elevated promoting strain.

Majority of Bitcoin addresses are worthwhile

In keeping with knowledge from IntoTheBlock, 53.61 million Bitcoin addresses, representing 99.35% of all addresses, are at present in revenue. Across the present worth, 69.58% are within the cash, whereas 0.11% are on the cash, and 30.30% are out of the cash.

This breakdown highlights sturdy help ranges, because the excessive share of “in the money” addresses suggests a robust help base for Bitcoin.

Worthwhile holders are much less prone to promote at decrease costs, whereas the 30.30% out-of-the-money addresses may create resistance as Bitcoin approaches ranges the place these holders break even, significantly close to historic worth zones.

The information additional underpins Bitcoin’s bullish outlook, as most holders are in favorable positions, which may reinforce market confidence.

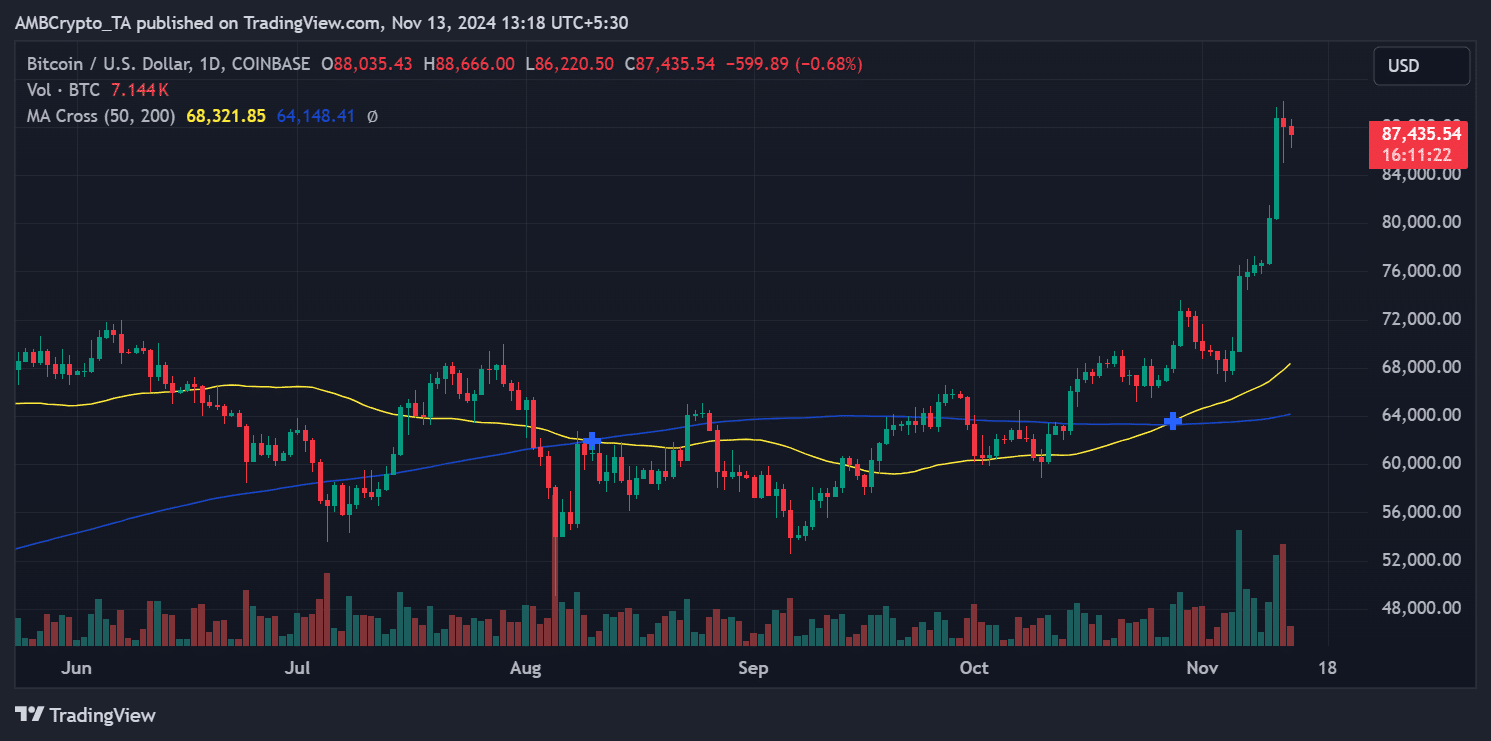

BTC worth motion displays rising volatility

Bitcoin’s worth just lately touched $88,666 earlier than retracing to $87,435 on the time of writing. This worth motion underscores the asset’s rising volatility because it continues to climb larger following the bullish breakout from its consolidation part round $68,000.

The each day chart highlights a robust upward pattern supported by the 50-day and 200-day transferring averages, at present at $68,321 and $64,148, respectively.

The latest rally has pushed Bitcoin into overbought territory, as evidenced by the Relative Energy Index (RSI) at 84.88. This means a possible cooldown part earlier than any additional upward motion, particularly if profit-taking intensifies.

Key help ranges to look at embody $85,000 and $80,000, whereas resistance is anticipated close to $90,000 and $95,000 as Bitcoin inches nearer to the psychological $100,000 mark.

Market outlook: Warning or continuation?

The mix of excessive MVRV ratios and overwhelmingly worthwhile addresses paints a bullish image for Bitcoin.

Learn Bitcoin (BTC) Worth Prediction 2023-24

Whereas some resistance might emerge from out-of-the-money addresses searching for to exit at breakeven, the underlying market sentiment stays optimistic.

Buyers will doubtless monitor these metrics carefully as Bitcoin navigates uncharted territory, with its subsequent main milestone doubtlessly crossing the $90,000 barrier.