- Bitcoin’s value surged by greater than 4% within the final seven days.

- Indicators instructed that BTC would possibly attain $87k quickly.

Bitcoin [BTC] bulls labored onerous this week because the king of cryptos’ value surpassed $70k. This sparked pleasure in the neighborhood, and a number of other anticipated the coin’s value to rise additional.

Nonetheless, a promote sign flashed on BTC’s chart, which may have impacted its value.

Bitcoin holds above $70k

CoinMarketCap’s information revealed that BTC gained bullish momentum on the third of June as its worth began to rise. The coin’s value spiked by greater than 4% within the final seven days.

On the time of writing, BTC was buying and selling at $71,091.06 with a market capitalization of over $1.4 trillion.

Within the meantime, Ali, a well-liked crypto analyst, posted a tweet highlighting a promote sign. This hinted at a value decline.

Nonetheless, the sign didn’t have a lot affect on Bitcoin’s value motion because the coin continued to commerce above $71k.

AMBCrypto’s evaluation of CryptoQuant’s information revealed that buyers didn’t promote BTC both. The coin’s change reserve was dropping, signaling excessive shopping for strain.

Moreover, shopping for sentiment remained dominant amongst US buyers as BTC’s Coinbase premium was inexperienced.

Will BTC proceed to rise?

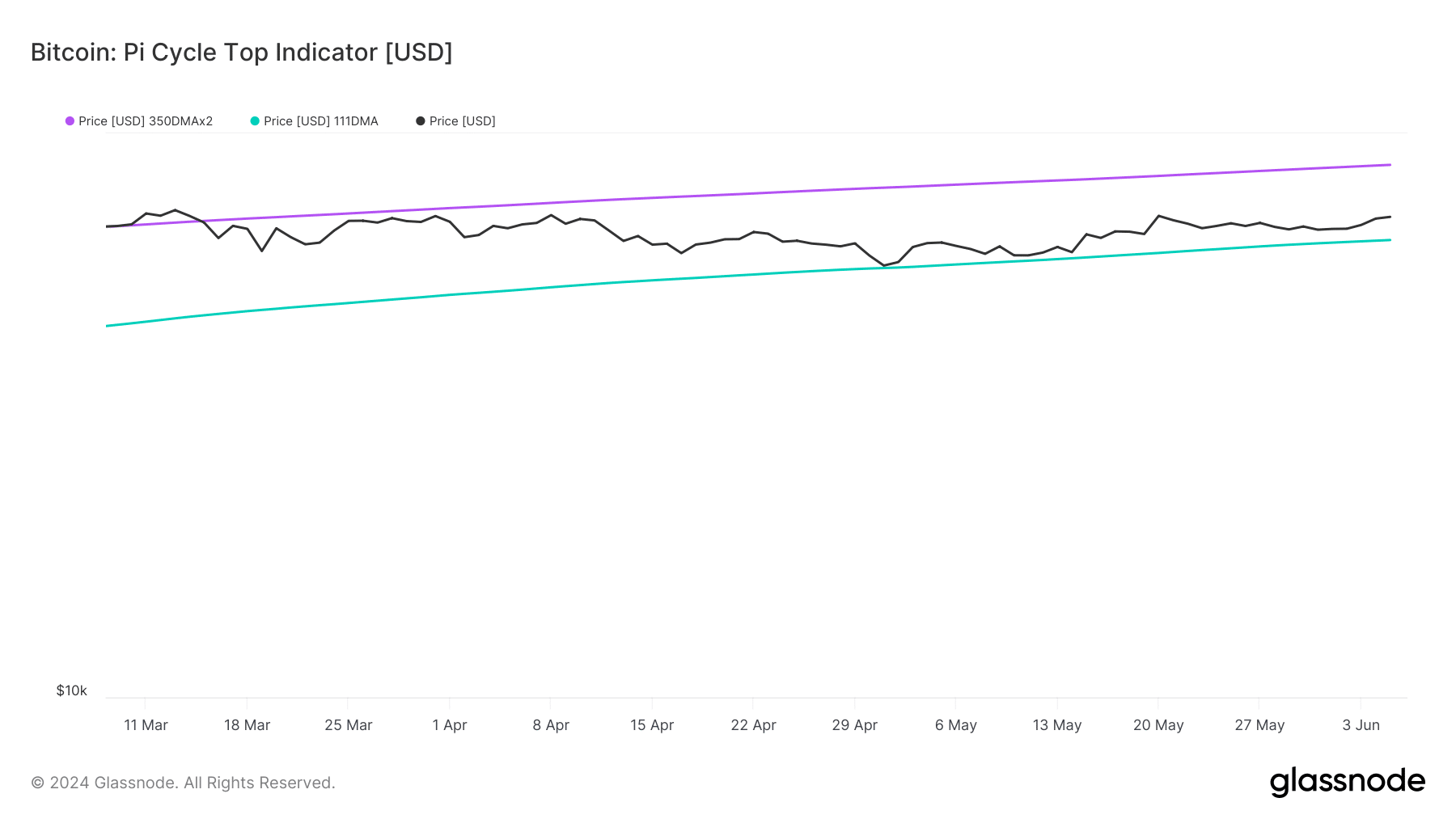

AMBCrypto’s evaluation of Glassnode’s information revealed that BTC would possibly proceed its bull rally. As per the coin’s Pi Cycle High indicator, BTC was but to achieve its market prime.

This meant that BTC’s value would possibly proceed to rise to $87k earlier than it witnesses any main value correction.

For starters, the Pi Cycle indicator consists of the 111-day transferring common and a 2x a number of of the 350-day transferring common of Bitcoin’s value.

BTC’s binary CDD was inexperienced, which means that long-term holders’ actions within the final 7 days had been decrease than common. They’ve a motive to carry their cash.

Moreover, its funding price additionally elevated. This meant that long-position merchants are dominant and are keen to pay short-position merchants. These metrics instructed that the probabilities of BTC persevering with to rise had been excessive.

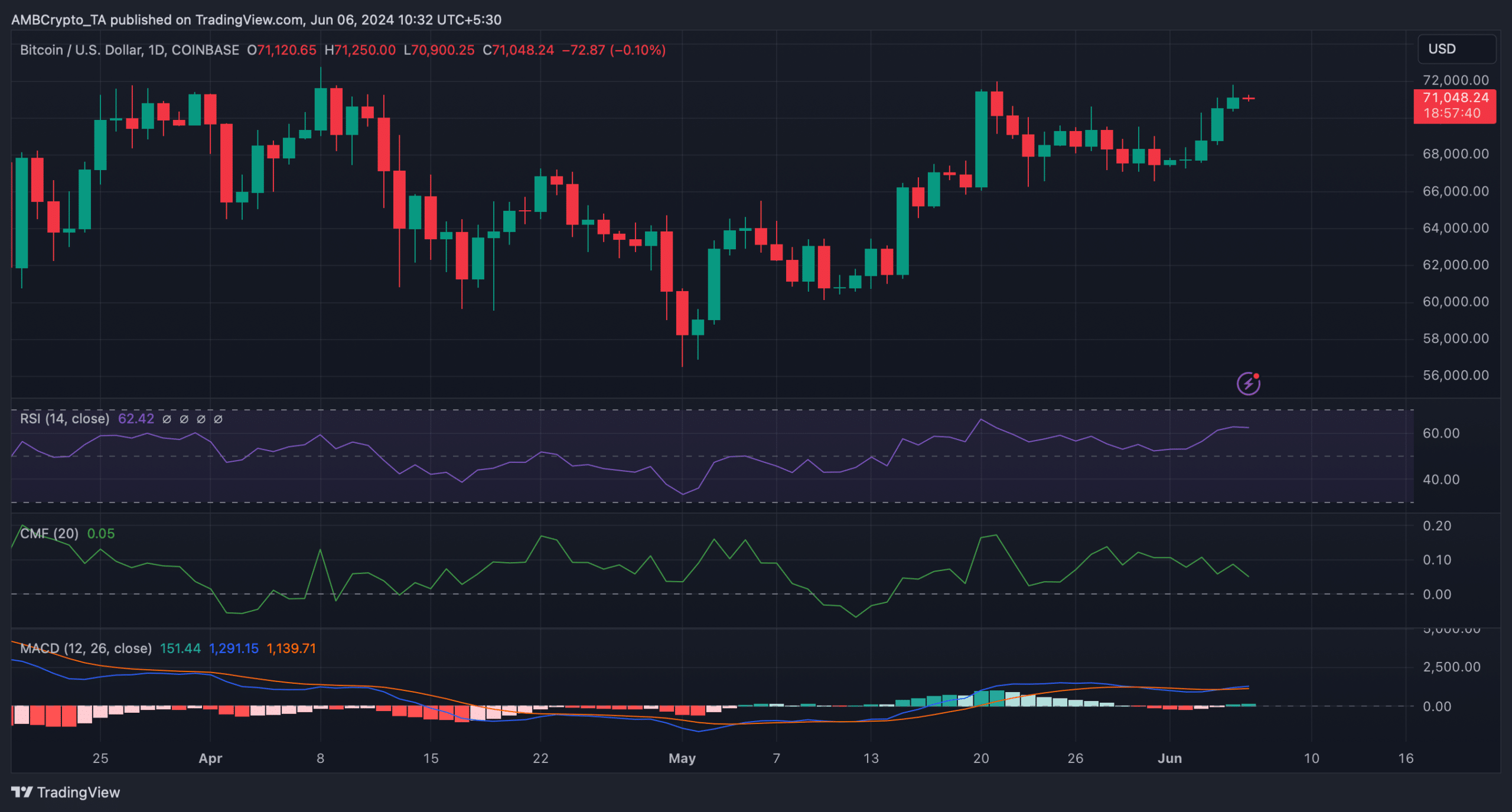

AMBCrypto then analyzed BTC’s each day chart to higher perceive which route its value was headed. The technical indicator MACD displayed a bullish crossover.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

On prime of that, BTC’s Relative Power Index (RSI) remained effectively above the impartial mark, suggesting an additional value hike within the coming days.

Nonetheless, whereas the aforementioned indicators supported the bulls, BTC’s Chaikin Cash Circulation (CMF) favored the bears. This appeared to be the case, because the indicator registered a downtick within the latest previous.