- Are stablecoin reserves holding again liquidity flows into Bitcoin?

- Bitcoin ETFs have grown considerably currently and may need influenced the crypto’s value too

Stablecoins play a significant function throughout Bitcoin’s bull and bear markets. They’re the medium by means of which liquidity flows into BTC they usually additionally present a buffer for holding worth throughout bearish occasions. Nevertheless, might stablecoin liquidity be holding again Bitcoin?

CryptoQuant founder Ki Younger Ju postulated in a latest evaluation that stablecoins aren’t able to driving bullish momentum. The assertion assumed essentially the most bullish situation, accounting for each Bitcoin and stablecoin reserves. He stated,

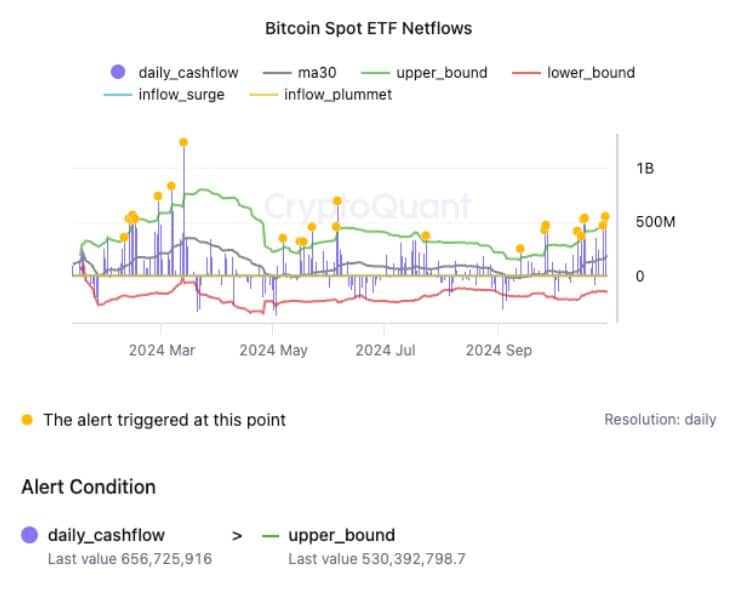

“Over the previous two weeks, we’ve noticed vital ETF inflows, led by BlackRock’s IBIT.

If spot ETF inflows would possibly decelerate sooner or later, the BTC/USD buy-side strain from brokerage companies like Coinbase Prime would possibly weaken, probably main the market again into stagnation.…”

In accordance with the exec’s evaluation, Bitcoin reserves outpaced stablecoin reserves by greater than 6-fold. Which means the present stablecoin reserves might not be sufficient to match peak Bitcoin demand.

Bitcoin had a $1.38 trillion market cap, on the time of writing. Quite the opposite, the collective stablecoin market cap, at press time, was $172.887 billion.

Right here, it’s value noting that the latter grew from as little as $123.74 billion in September 2024 – Its lowest degree within the final 3 years.

Bitcoin ETFs have been driving demand

The evaluation additionally explored the function of ETFs in Bitcoin’s value motion. It famous {that a} cooling down in Spot ETFs demand during the last 2 weeks was adopted by weak demand.

The evaluation additionally toyed with the concept Bitcoin’s value motion risked stagnation if Spot EFT demand slows right down to excessive lows.

This remark coincided with the most recent value motion and ETF flows. For instance, Bitcoin ETFs lately skilled a slowdown in demand on the final day of October after beforehand attaining per week of constructive flows.

The most recent ETF information revealed that Bitcoin ETFs have concluded the week with web outflows. For instance, ETFs recorded $54.9 million in outflows on Friday. In the meantime, BTC has been struggling to get better again above $70,000 – Confirming a slowdown in demand.

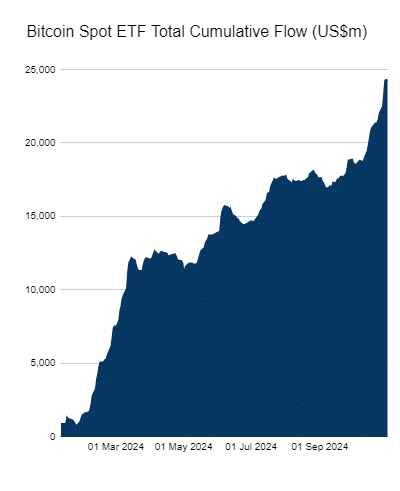

Nonetheless, Bitcoin ETFs had been up by 62% from their approval date earlier this yr. Right here’s a take a look at how the ETF flows have carried out to this point –

On the time of writing, Bitcoin ETFs held over $24.4 billion. This spectacular development is an indication of the rising demand from the institutional class.

In the meantime, the most recent outflows are probably related to the uncertainty across the election interval. It will likely be fascinating to see how issues play out after the elections.

Additionally, institutional buyers have been responding to the resurgence of worldwide liquidity, one thing that underscores probably good tidings for holder. It’s because decrease rates of interest have been paving the best way for a risk-on sentiment.