- Analyst projected a possible BTC breakout and rally in direction of $75K-$80K.

- Recovering investor demand supported the outlook, however rising leverage may very well be dangerous.

Bitcoin [BTC] value charts indicated a possible market construction shift, signaling a possible breakout from the $50K-$72K value vary that started in March.

In response to analyst Stockmoney Lizards, the vary breakout might occur in two weeks. In that case, the analyst predicted BTC might hit $75K-$80K if the current drop beneath $60K is defended as a ‘higher low.’

“If this higher low is confirmed, we will break this upper resistance within 2 weeks. $75-$80k next target.”

For context, BTC has been chalking larger lows since August, a value motion pattern that indicators a possible market construction shift, particularly if the next excessive is fronted.

Rising demand vs. threat

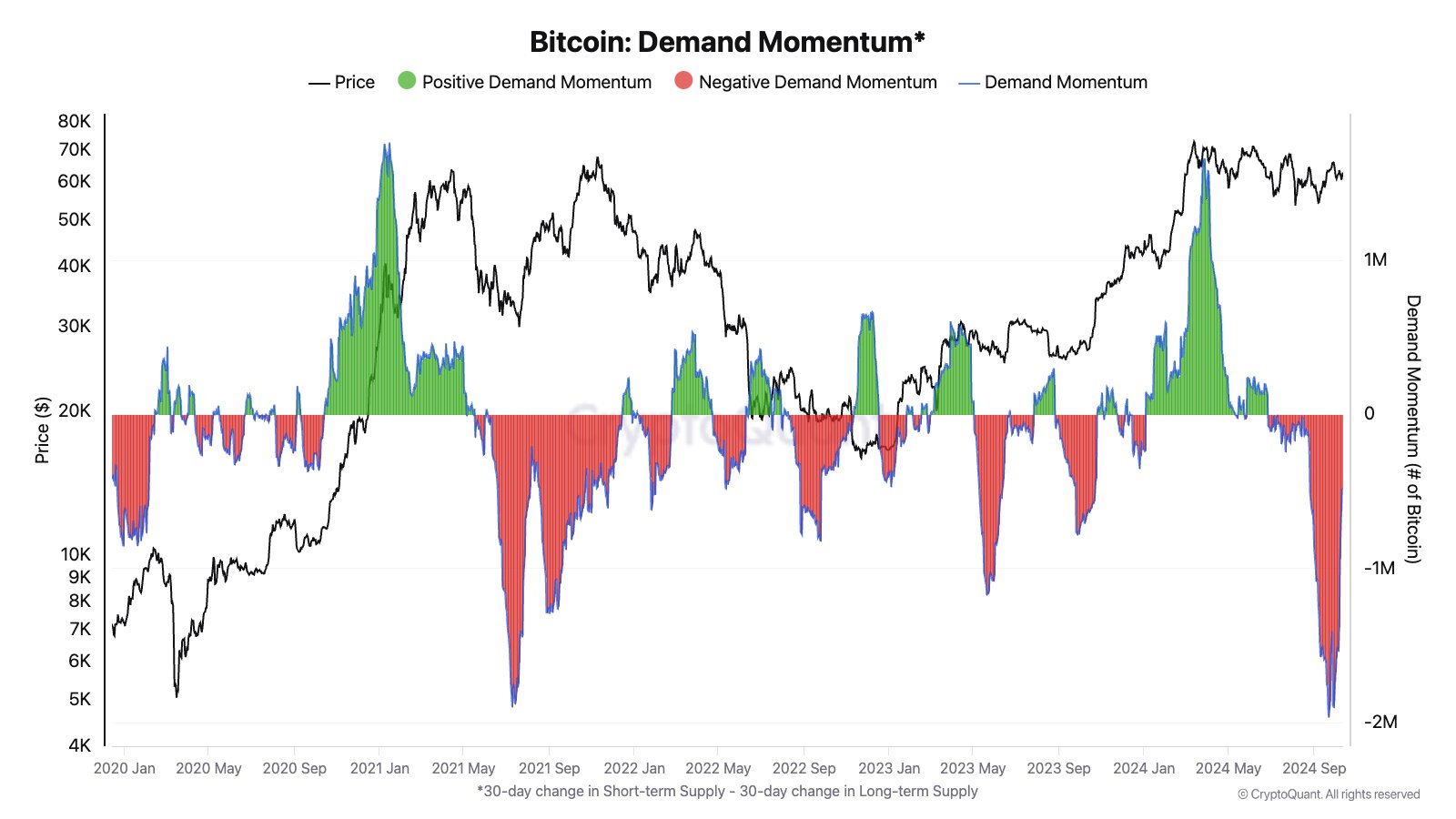

Buyers’ urge for food for the world’s largest digital asset additionally improved, suggesting a sluggish however regular demand restoration in This autumn in comparison with Q2/Q3.

For perspective, BTC demand has been destructive since Could, with promoting outpacing shopping for. Nevertheless, CryptoQuant famous that the tempo of the imbalance has eased.

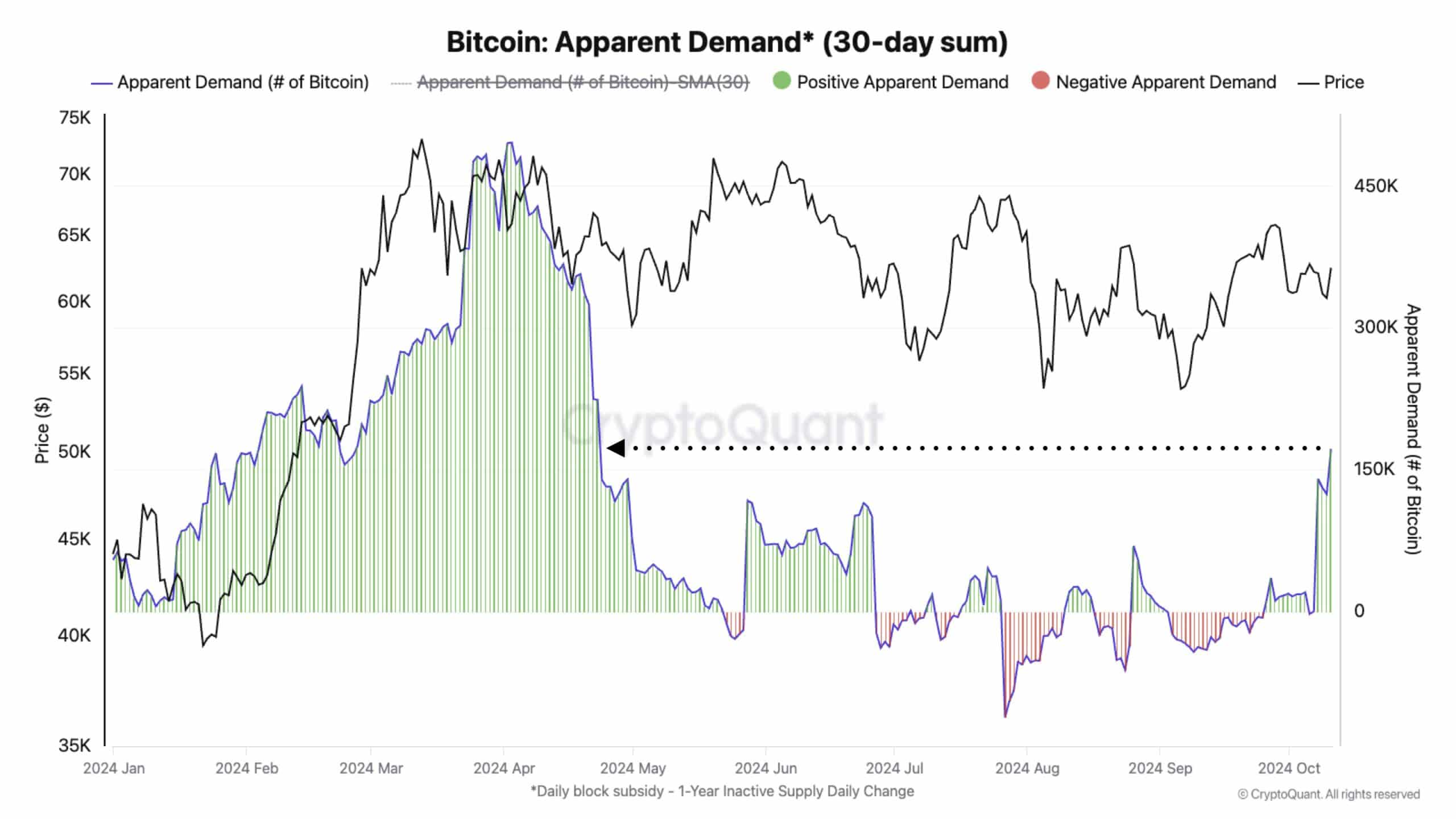

In actual fact, the obvious demand for BTC gauged over the previous 30 buying and selling days, indicated that investor demand hit ranges final seen in Could.

About 150K BTC, price roughly $9.4 billion, was snagged by buyers between late September and mid-October.

Due to this fact, if the sample prolonged within the subsequent two weeks, the rising demand might help Stockmoney Lizards’ breakout projection.

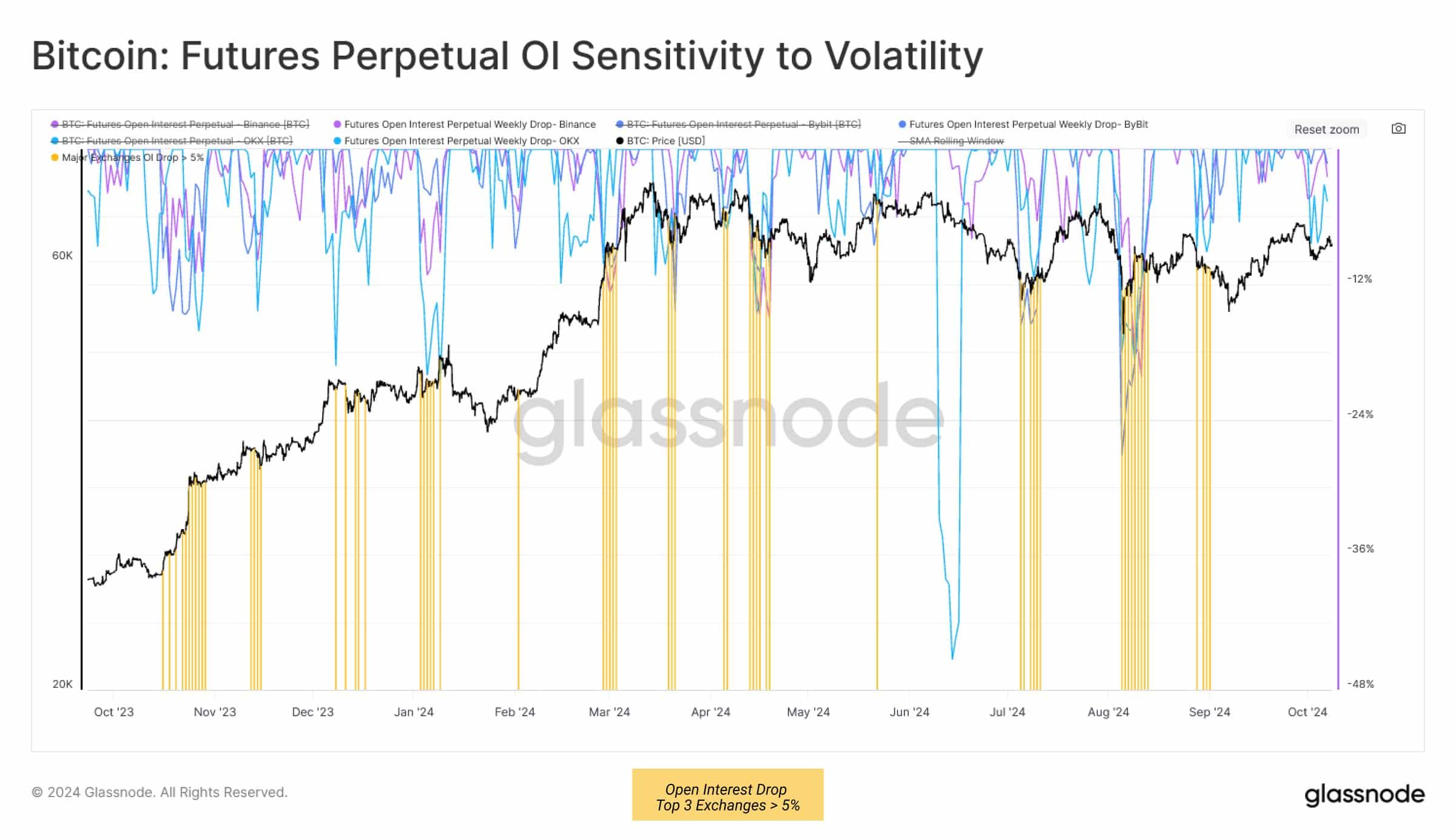

However rising leverage, as denoted by an uptick in Open Curiosity (OI), additionally posed an imminent pitfall to the breakout expectation.

For the unfamiliar, rising leverage meant speculators took extra threat by borrowing cash to open BTC positions within the Futures markets.

In response to Glassnode, the current weekend pump from $58.9K to $63.4K, flushed some short-sellers ($2.5B in OI).

Nevertheless, the analytic agency additionally famous that the drop in OI didn’t surpass 5%, a degree that traditionally at all times noticed an prolonged BTC rally if hit.

In brief, heightened volatility and liquidation dangers on both facet of the value route might derail the breakout expectation.

Within the meantime, BTC was valued at $62.8K and consolidated beneath the 200-day Transferring Common (MA) at press time.