- BTC LTHs are torn between promoting and holding amidst value volatility.

- Bitcoin remained under $60,000 at press time.

The current improve in Bitcoin’s [BTC] volatility is obvious, as its value struggles to keep up the essential $60,000 vary.

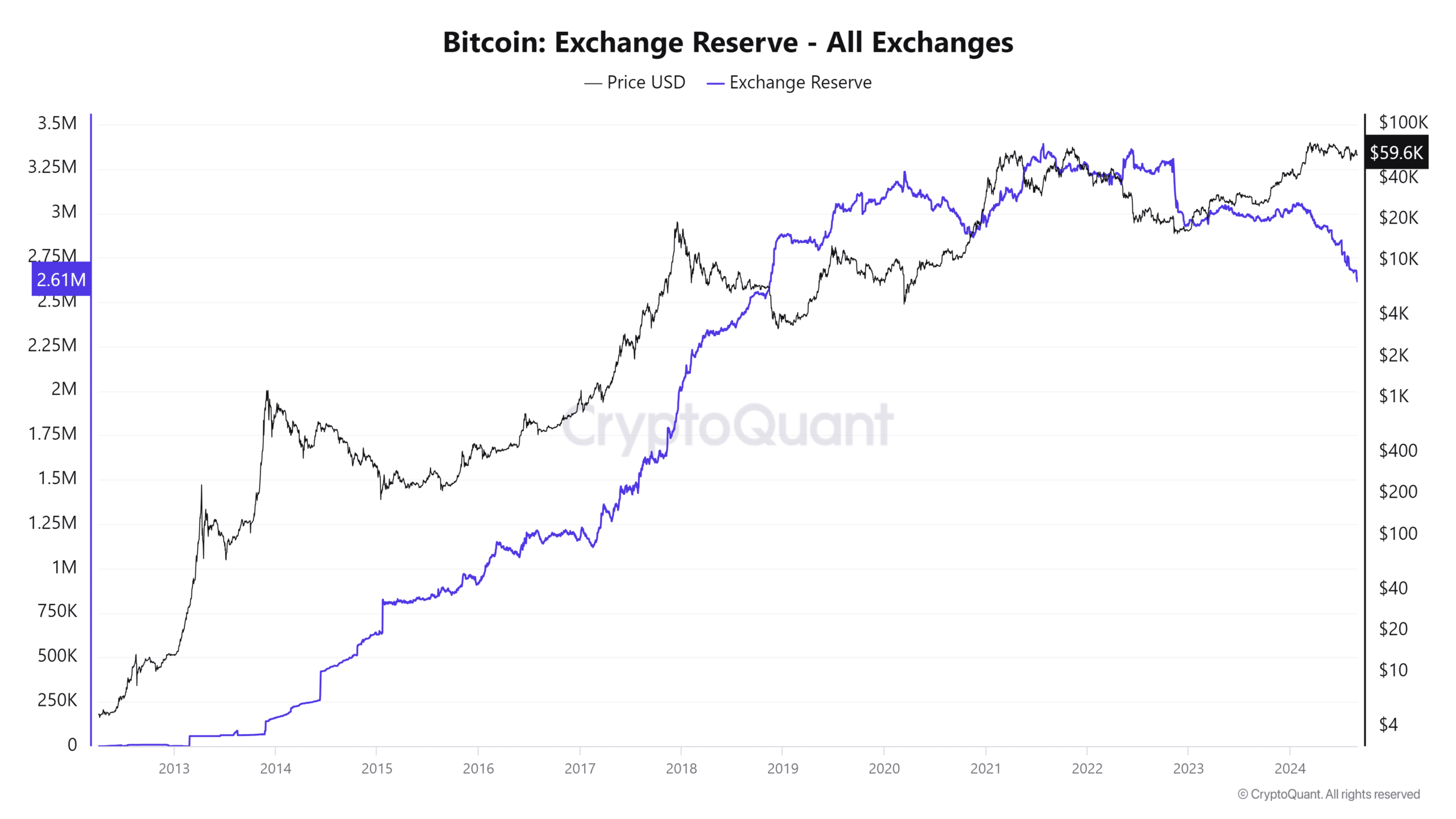

Regardless of these value fluctuations, a notable development has emerged: Bitcoin alternate reserves have declined. This lower in alternate reserves signifies that main holders, usually known as “whales,” are more and more unwilling to promote their Bitcoin.

Bitcoin alternate reserves hit one other low

AMBCrypto’s evaluation of Bitcoin’s alternate reserves revealed that they’ve hit one other low, persevering with a major downward development that started at first of the 12 months.

Based on the chart on CryptoQuant, the reserves have fallen to roughly 2.6 million BTC. This was down from over 3 million BTC reserves recorded in January.

Additionally, this decline in alternate reserves suggests a discount within the liquidity out there on exchanges.

This discount in liquidity could be a optimistic signal for Bitcoin’s value, because it signifies that fewer holders wish to promote their BTC. The transfer reduces the promoting stress available on the market.

Moreover, the continued decline in alternate reserves is probably going pushed by long-term holders (HODLers). This conduct displays a robust perception in Bitcoin’s future worth and a reluctance to interact in short-term buying and selling.

As long-term holders’ dominance will increase, the market might change into extra steady and fewer inclined to massive panic gross sales.

Evaluating CDD with Bitcoin alternate reserves

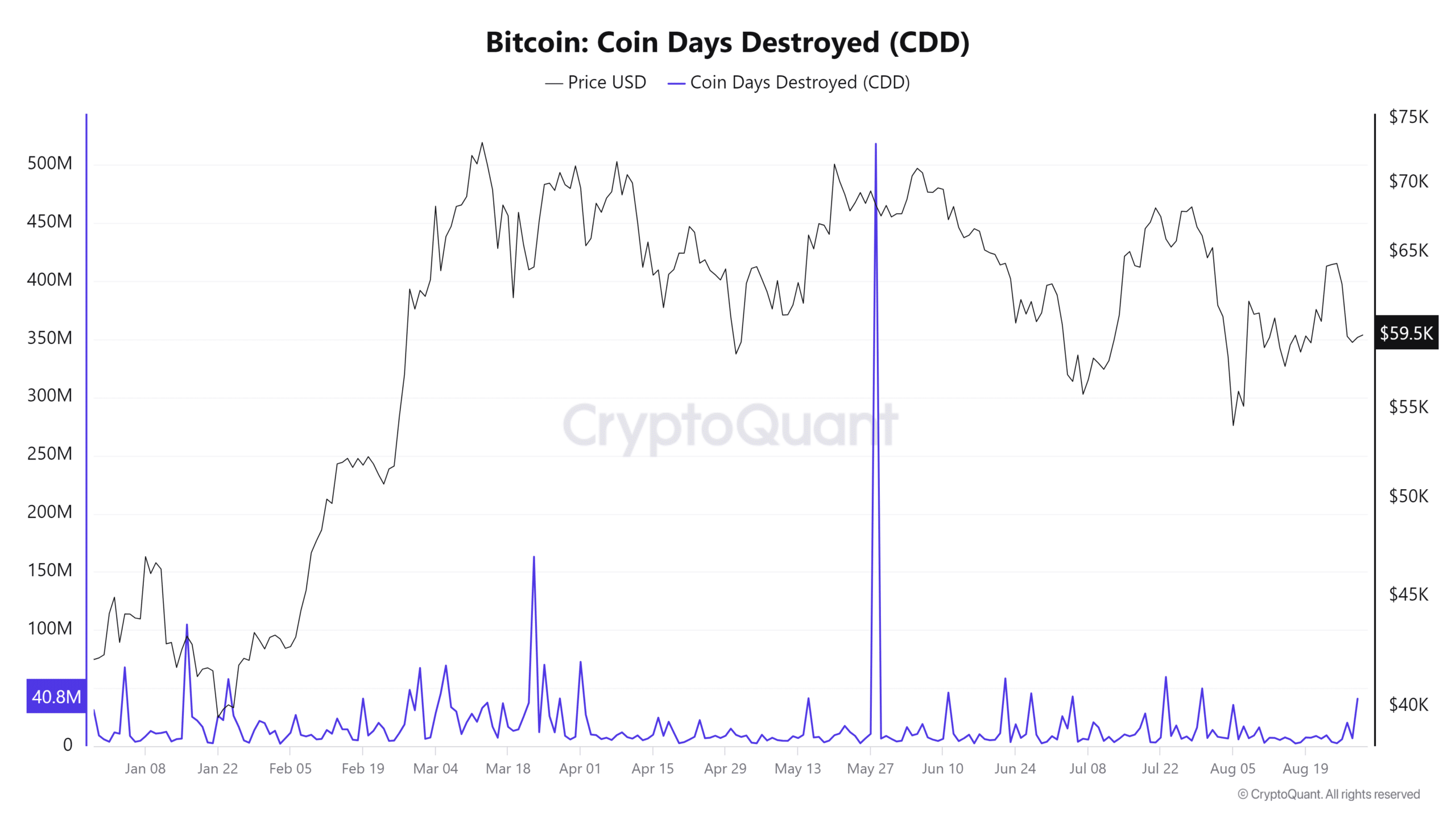

The current evaluation of Bitcoin’s Coin Day Destroyed (CDD) metric alongside Bitcoin alternate reserves suggests an fascinating divergence. The CDD metric has skilled a slight spike just lately.

This contrasted with the beforehand steady development that indicated long-term holders (LTHs) weren’t actively spending their cash.

The CDD metric tracks the motion of older Bitcoins which have accrued “coin days” whereas remaining unspent. Every Bitcoin earns a “coin day” for on a regular basis it’s held in a pockets with out being moved.

When these Bitcoins are ultimately spent, the accrued coin days are “destroyed,” therefore the time period “Coin Day Destroyed.”

The current improve in CDD means that the current volatility in Bitcoin’s value might have triggered some long-term holders to maneuver or promote their cash, breaking the earlier development of holding.

This shift may very well be a response to market uncertainty or a strategic resolution by some holders to capitalize on value actions.

BTC stays risky

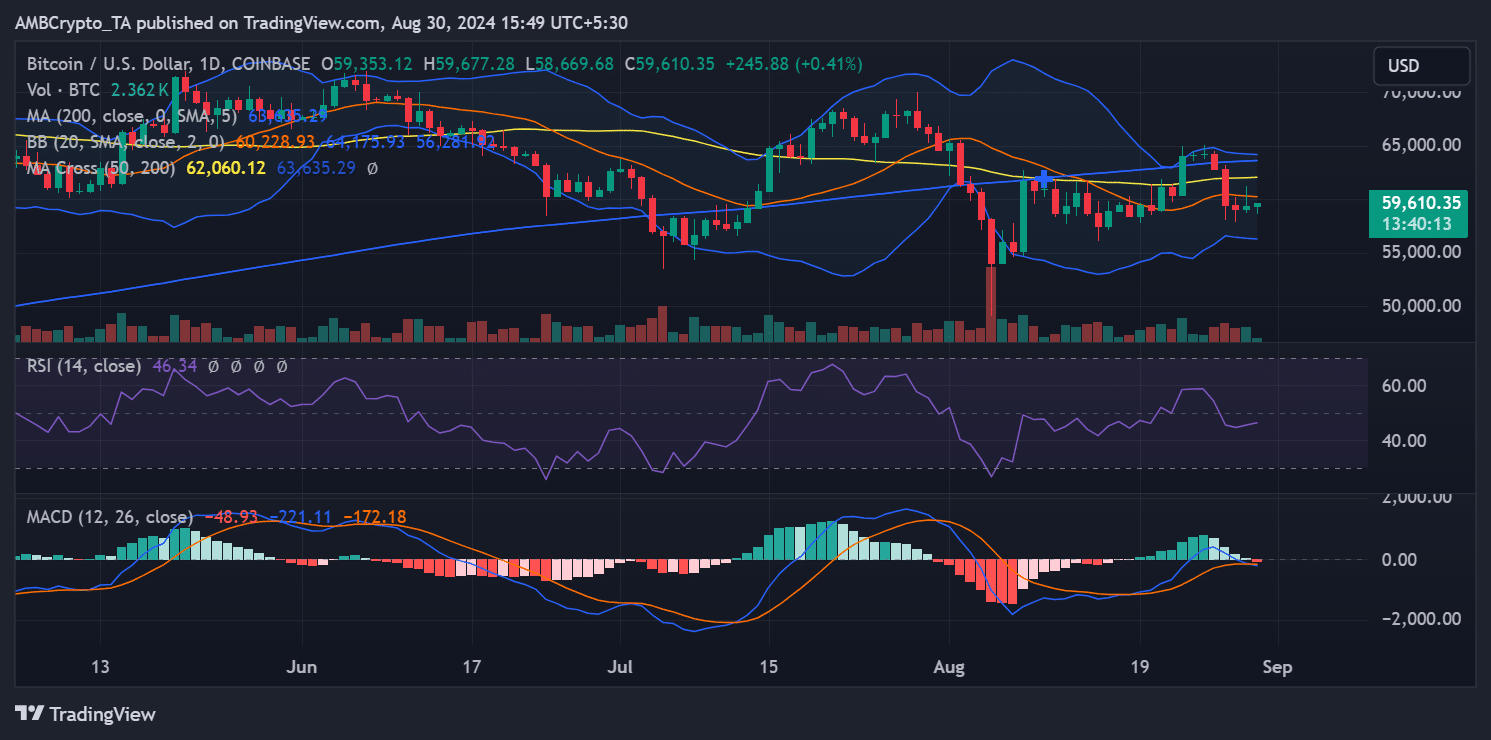

The current evaluation of Bitcoin’s day by day value development signifies that Bitcoin rose to roughly $61,000 within the earlier buying and selling session. Nevertheless, it couldn’t maintain this degree and ultimately closed the session at round $59,264.

This sample of briefly reaching increased costs earlier than retreating has been a constant development for Bitcoin over the previous couple of days, contributing to elevated market volatility.

The extent of this volatility is additional illustrated by the conduct of Bitcoin’s Bollinger Bands, a technical indicator that measures value volatility.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The “elasticity” of the Bollinger Bands refers to their widening in response to elevated value fluctuations. When the bands stretch wider, it signifies increased volatility as the worth strikes extra dramatically in both route.

As of this writing, Bitcoin is buying and selling at round $59,597, with a slight improve of lower than 1%. The continuing volatility, as proven by the Bollinger Bands, means that Bitcoin is experiencing vital short-term value swings.