- Bitcoin has edged greater above $63,000 as the brand new week unfolds a number of narratives that might affect costs.

- The Federal Reserve minutes, CPI knowledge, and Q3 earnings may drive additional value positive factors.

Bitcoin [BTC] has traded rangebound between $60,000 and $64,500 within the final seven days. The uneven value actions with no clear pattern present a state of market uncertainty.

Nonetheless, BTC might be headed for a unstable week forward as buying and selling volumes had jumped by 55% at press time per CoinMarketCap. Bitcoin has additionally gained by 2.5% in 24 hours to commerce at $63,435.

The rising volumes and value positive factors recommend that merchants might be shopping for into a number of narratives that might drive costs this week.

Federal Reserve minutes

The US Federal Reserve is ready to launch its minutes for the September financial coverage assembly on ninth October.

Final month, the Federal Reserve trimmed rates of interest for the primary time since 2020. The September minutes may make clear doable fee cuts throughout the November and December conferences.

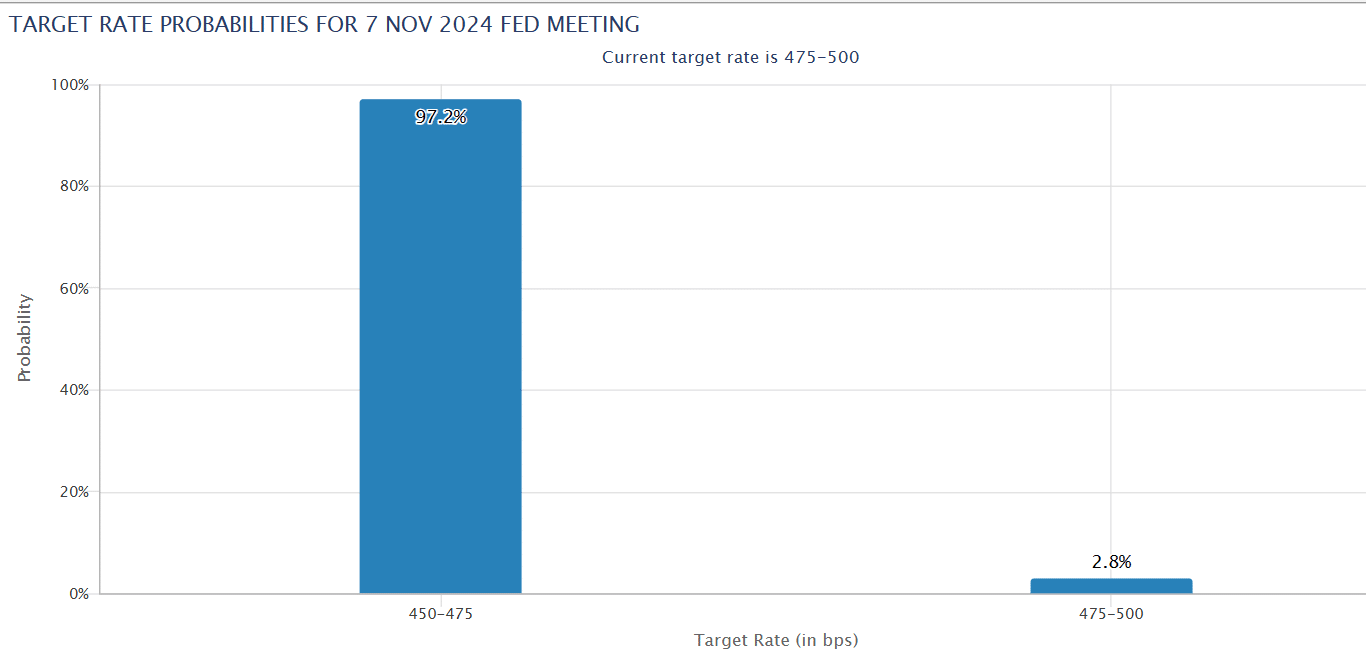

September’s 50-basis level discount performed a task in driving BTC costs final month. Information from the CME FedWatch Software exhibits that 97% of traders anticipate that the Fed will lower charges by 25 foundation factors in November.

An additional discount in rates of interest will stir curiosity in danger belongings like Bitcoin. Due to this fact, if the Fed minutes present a extra dovish stance, it may spur BTC positive factors.

CPI & PPI knowledge

The US inflation knowledge for September is ready for launch on tenth October. Markets anticipate that the annual inflation fee will are available at 2.3%, a drop from 2.5% reported in August.

Moreover, the Core Inflation Charge year-on-year is anticipated to chill down to three.1%, a drop from the three.2% reported in August.

The Producer Value Index (PPI), which can be used to foretell inflation will likely be launched on eleventh October. Economists forecast that the year-on-year PPI knowledge will drop from 1.7% to 1.3%.

If the inflation knowledge is available in as anticipated or falls under expectations, it may drive positive factors for Bitcoin. Alternatively, if this knowledge is available in hotter than anticipated, it may result in Bitcoin’s volatility and trigger a drop in costs.

BlackRock’s Q3 earnings

$10 trillion asset supervisor BlackRock, which is among the issuers of spot Bitcoin and Ethereum exchange-traded funds (ETFs), will launch its quarterly outcomes this week.

BlackRock’s iShares Bitcoin Belief (IBIT) holds 367,000 BTC valued at $22 billion. Due to this fact, the power of its Q3 earnings may affect costs.

JPMorgan will even launch its Q3 outcomes later this week, after which it can make 13-F filings with the US Securities and Trade Fee (SEC) revealing its publicity to Bitcoin ETFs.

In Q2, JPMorgan’s 13-F submitting revealed it held $760,000 price of Bitcoin ETF shares. Given that it’s the largest US financial institution, a change in its Bitcoin ETF holdings may drive volatility.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

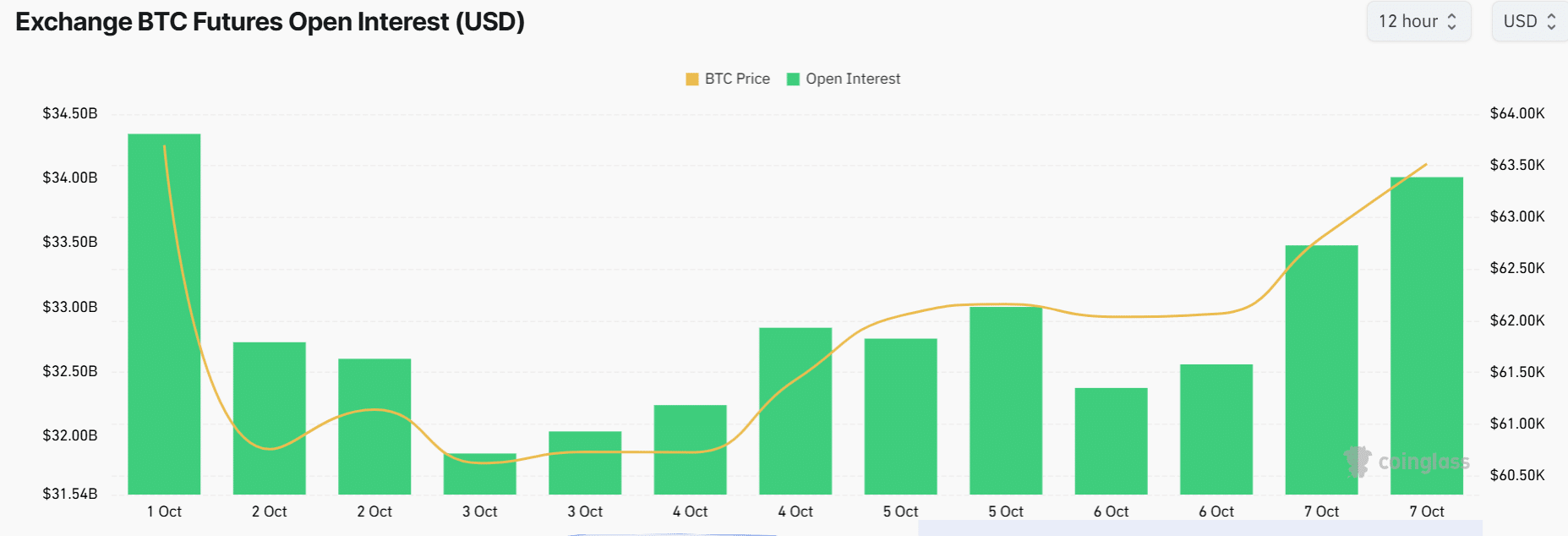

These three narratives are already driving exercise within the Bitcoin futures market. BTC’s open curiosity has elevated to the second-highest stage this month to $34 million at press time per Coinglass.

This improve exhibits there are extra merchants opening positions and collaborating available in the market.