- Binance plans to delist six altcoins prompted speedy double-digit drops of their worth.

- Binance’s native cryptocurrency BNB rises by 0.835%, however the bearish sentiment lingers.

In a transfer harking back to its previous actions, Binance, one of many world’s largest cryptocurrency exchanges, has introduced the delisting of six altcoins.

Binance’s delisting plans

Beginning twenty sixth August 2024, at 03:00 UTC, Binance will delist all spot buying and selling pairs related to Ellipsis [EPX], PowerPool [CVP], ForTube [FOR], Reef [REEF], Loom Community [LOOM], and VGX Token [VGX].

This choice would have an effect on pairs equivalent to CVP/USDT, EPX/USDT, FOR/BTC, FOR/USDT, LOOM/BTC, LOOM/TRY, LOOM/USDT, REEF/TRY, REEF/USDT, and VGX/USDT.

Following the elimination, all lively commerce orders involving these pairs can be routinely canceled by the change.

Evidently, this announcement triggered sharp declines within the worth of those altcoins, with every experiencing double-digit drops instantly following the information.

Remarking on the identical, X (previously Twitter) consumer underneath the identify Brill stated,

“REEF is going lol, never fall in love with your bag guys.”

This choice comes shortly after Binance revealed its plans to checklist Toncoin, signaling a strategic shift on the platform.

The announcement famous,

“At Binance, we periodically review each digital asset we list to ensure that it continues to meet a high level of standard and industry requirements. When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it.”

It additional added,

“Our priority is to ensure the best services and protections for our users while continuing to adapt to evolving market dynamics.”

Components thought of whereas delisting tokens

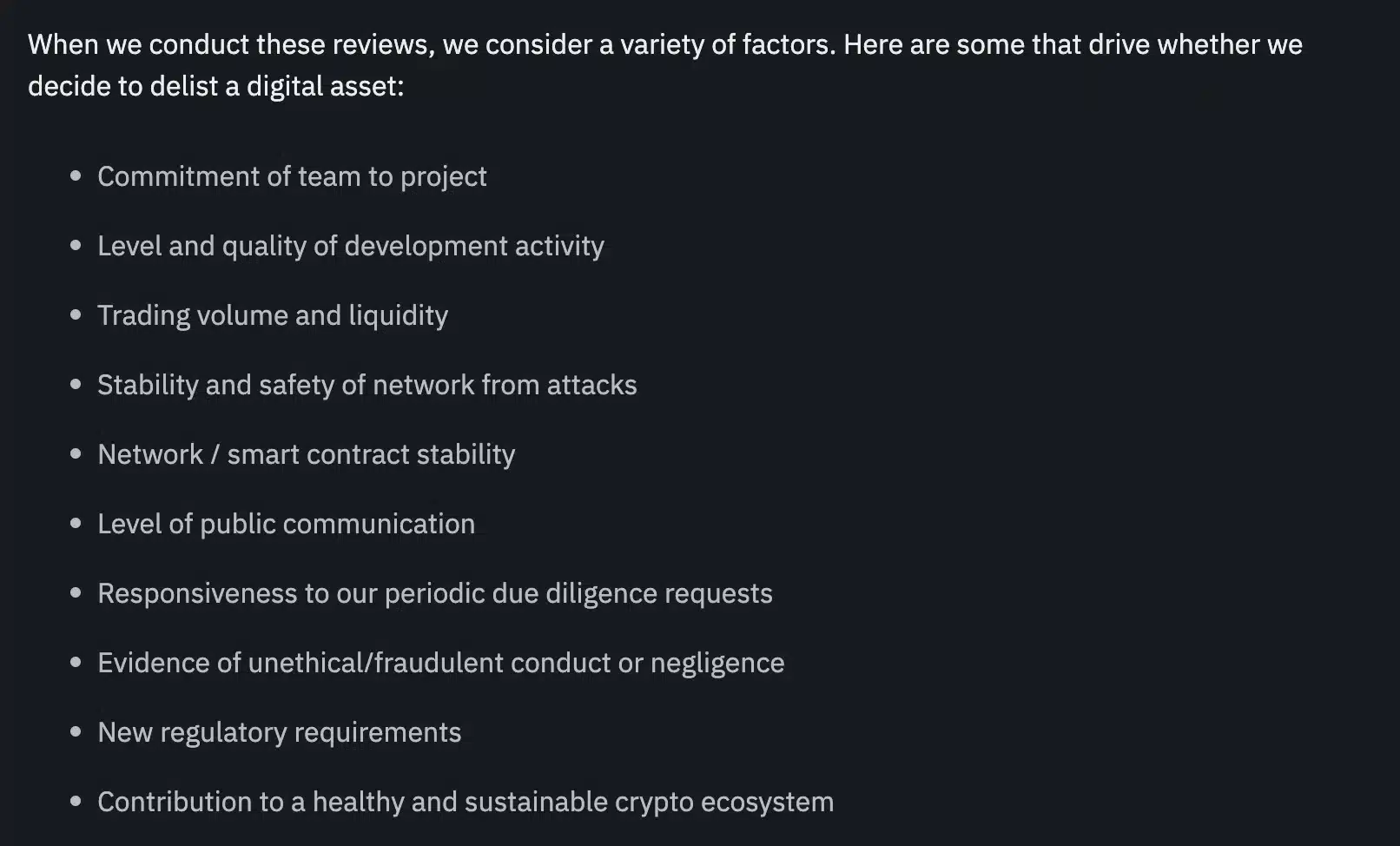

Binance considers a number of key elements when deciding whether or not to delist a digital asset, together with the challenge’s workforce’s dedication, the extent and high quality of improvement exercise, buying and selling quantity, liquidity, and the steadiness and security of the community.

Moreover, the platform evaluates public communication, the challenge’s responsiveness to due diligence requests, and any indicators of unethical conduct or negligence.

New regulatory necessities and the asset’s total contribution to a wholesome and sustainable crypto ecosystem additionally play an important function within the decision-making course of.

BNB market pattern

In the meantime, Binance’s native cryptocurrency BNB has risen by 0.835%, buying and selling at $520.37 and exhibiting constructive motion on the each day chart.

Regardless of this uptick, the RSI stays under the impartial degree at 46, indicating that bearish sentiment persists even because the coin developments upward.