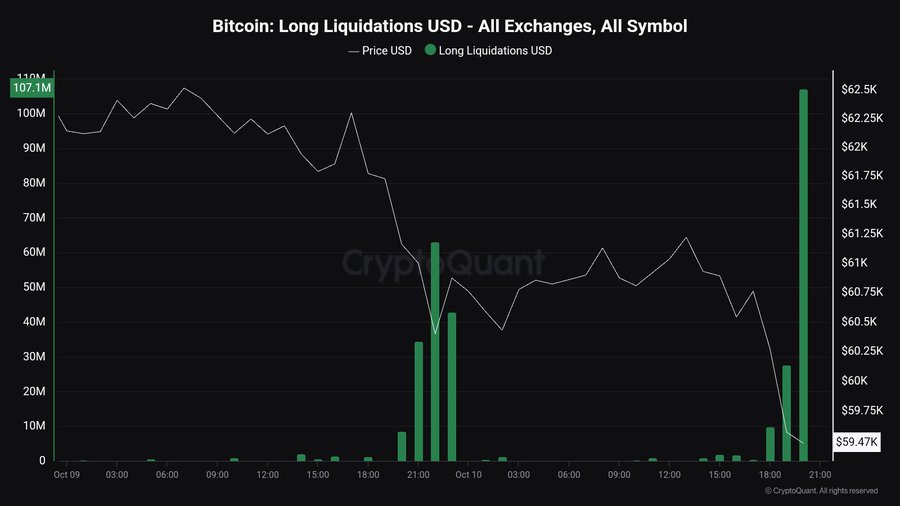

- BTC’s current volatility resulted in complete liquidations value $107 million

- Analyst sees $60,600 because the vital stage that may decide BTC’s trajectory

Because the begin of October, Bitcoin has seen heightened worth fluctuations. Over this era, BTC has hit a excessive of $66,500 and a low of $58,800, with the latter being a worth stage that was hit lower than 24 hours in the past.

This drop beneath $60k had an enormous affect on BTC holders, with many getting forcefully liquidated. In truth, over $107 million have been liquidated.

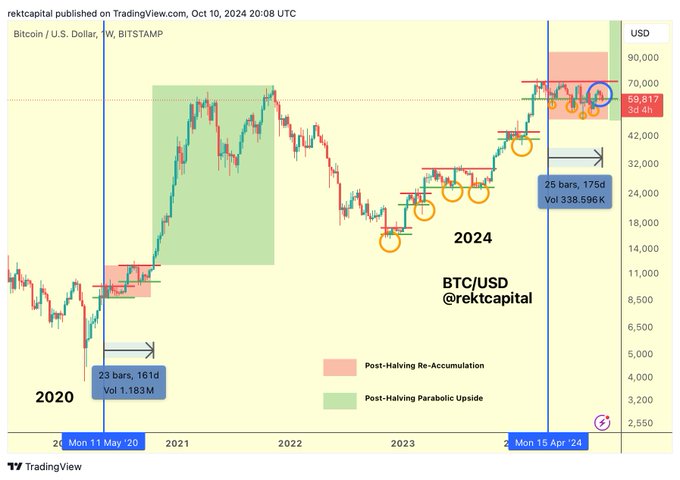

This rise in volatility, accompanied by present market market circumstances, raises questions on BTC’s future trajectory. That is why common crypto analysts resembling Rekt Capital have steered that BTC should stay above $60,600 for a possible upside.

What does market sentiment say?

In his evaluation, RektCapital posited that Bitcoin is retesting the weekly re-accumulation- vary of $60,600 as assist for the second consecutive week.

Based on this evaluation, BTC will report an uptrend if it closes above this stage on the weekly charts. Due to this fact, for any potential upside within the close to future, BTC should protect this vary which can place the value for additional hikes.

Nonetheless, the analyst additionally famous that if the crypto loses assist right here, it is going to notice one other draw back deviation interval.

What do the charts say?

On the time of writing, BTC was buying and selling at $60,573. This marked a 0.58% decline on the day by day charts with an extension to this bearish development by a 1.01% dip on the weekly charts.

Due to this fact, primarily based on the most recent worth motion, the aforementioned evaluation by RektCapital could also be regarding because it initiatives potential draw back.

Therefore, it’s important to find out what different market fundamentals recommend.

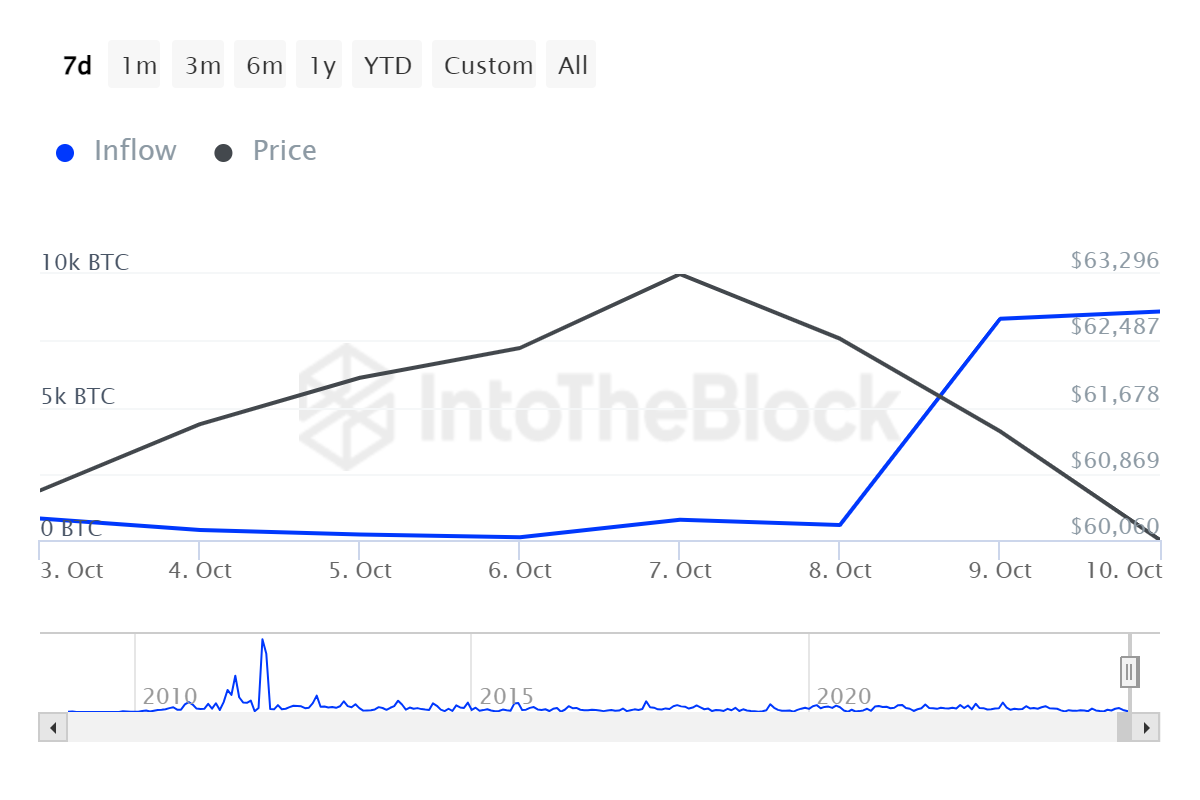

For starters, Bitcoin’s Giant holders influx spiked over the previous few days from 560.95 to eight.59k. A spike in massive holders signifies that buyers are shopping for the dip and taking lengthy positions.

Such market conduct can also be an indication that giant holders anticipate costs to rise within the close to future.

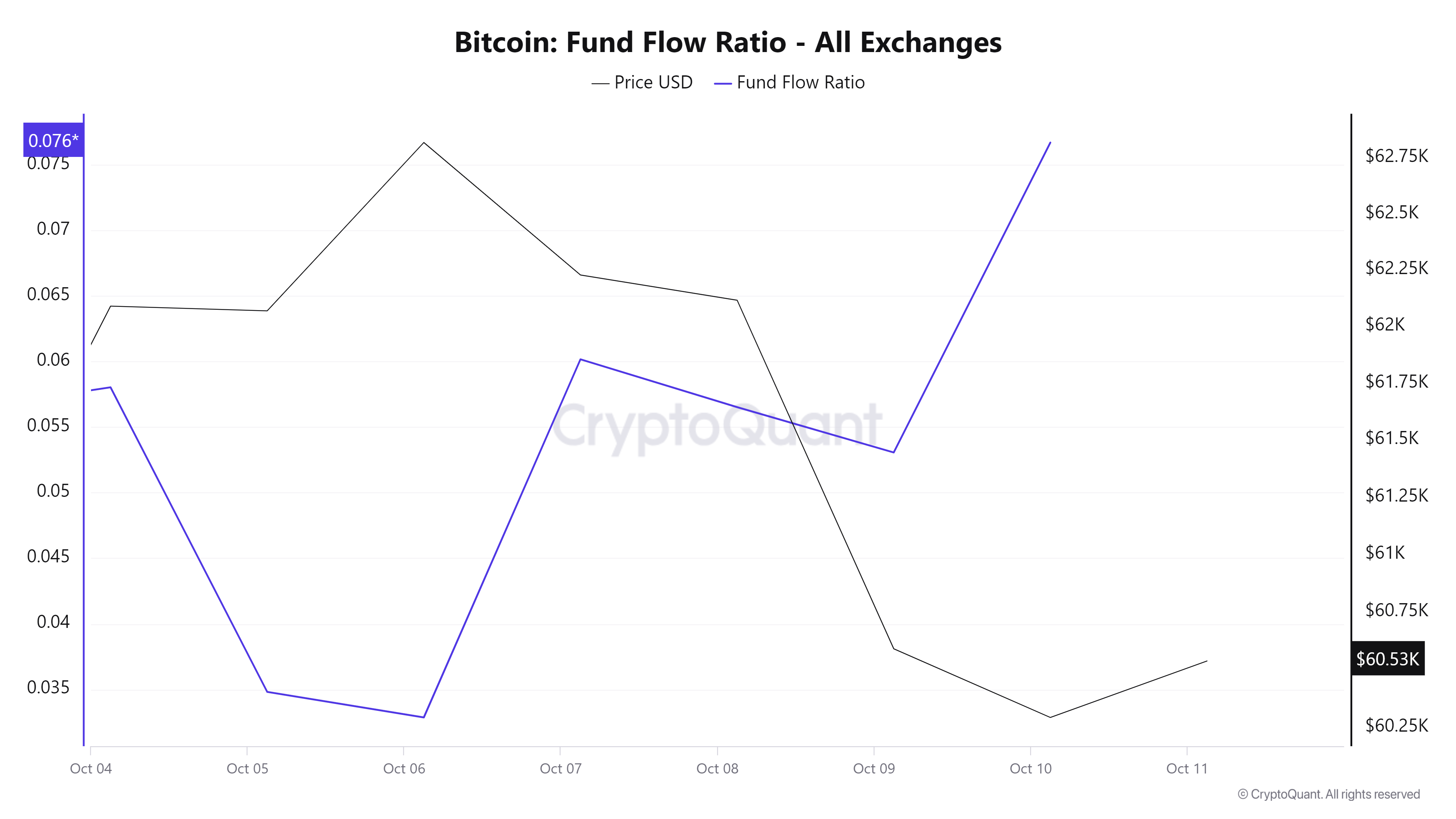

Moreover, Bitcoin’s fund circulation ratio spiked from a low of 0.032 to 0.077, indicating greater shopping for stress as buyers are depositing funds to purchase BTC.

Such conduct is normally related to bullish market sentiment.

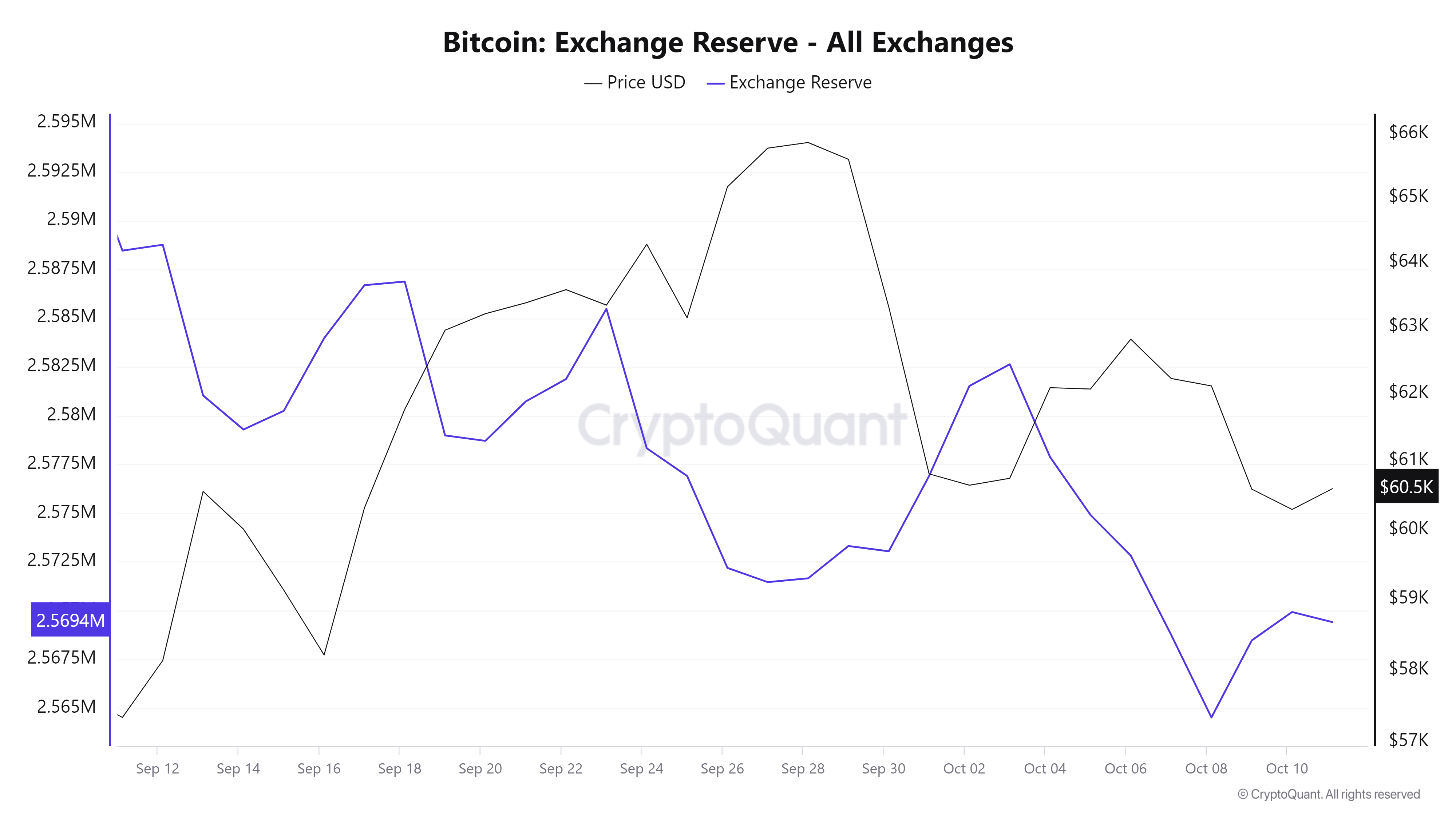

Lastly, Bitcoin’s Alternate reserve additionally registered a sustained decline over the previous month. This alludes to a long-term holding technique as buyers are much less more likely to promote their BTC within the brief time period. Principally, that is bullish sign because it reduces provide on exchanges, lowering the potential promoting stress.

Merely put, the current downtrend has been dropping momentum and, BTC could also be well-positioned for additional beneficial properties. If the constructive market sentiment holds, BTC will reclaim the $61,875 resistance stage. A failure to keep up this stage will see Bitcoin drop to $58,272.