- As ETH/BTC reaches its lowest level since 2021, traders, significantly from Korea and the U.S., start to build up.

- By-product merchants are additionally taking positions, putting lengthy bets on ETH.

Ethereum [ETH] has remained above the $3,000 mark for the previous month, with a 19.84% acquire. Nonetheless, over the previous week, ETH has seen a 2.15% drop.

Regardless of this, market sentiment seems to be shifting, as mirrored by a modest 0.19% uptick in latest buying and selling.

AMBCrypto examines why traders are viewing this worth motion as a compelling shopping for alternative.

What the ETH/BTC pair indicators for Ethereum

The ETH/BTC pair, which displays the worth of 1 ETH when it comes to BTC, just lately dropped to its lowest stage since 2021, dipping beneath 0.03221, as reported by Degen Information.

This implies that market members are receiving much less BTC for every ETH, as Bitcoin’s worth has surged to a lifetime excessive, now buying and selling above $97,000.

Two main interpretations will be drawn from this motion: First, Bitcoin’s rising dominance could result in liquidity flowing out of ETH and into BTC as investor confidence shifts.

Alternatively, some traders may view this as a possibility to build up extra ETH, believing it’s at the moment undervalued.

Evaluation by AMBCrypto indicated that the latter situation was extra doubtless, with metrics displaying an uptick in shopping for exercise as traders make the most of ETH’s perceived worth dip.

Buyers proceed to build up

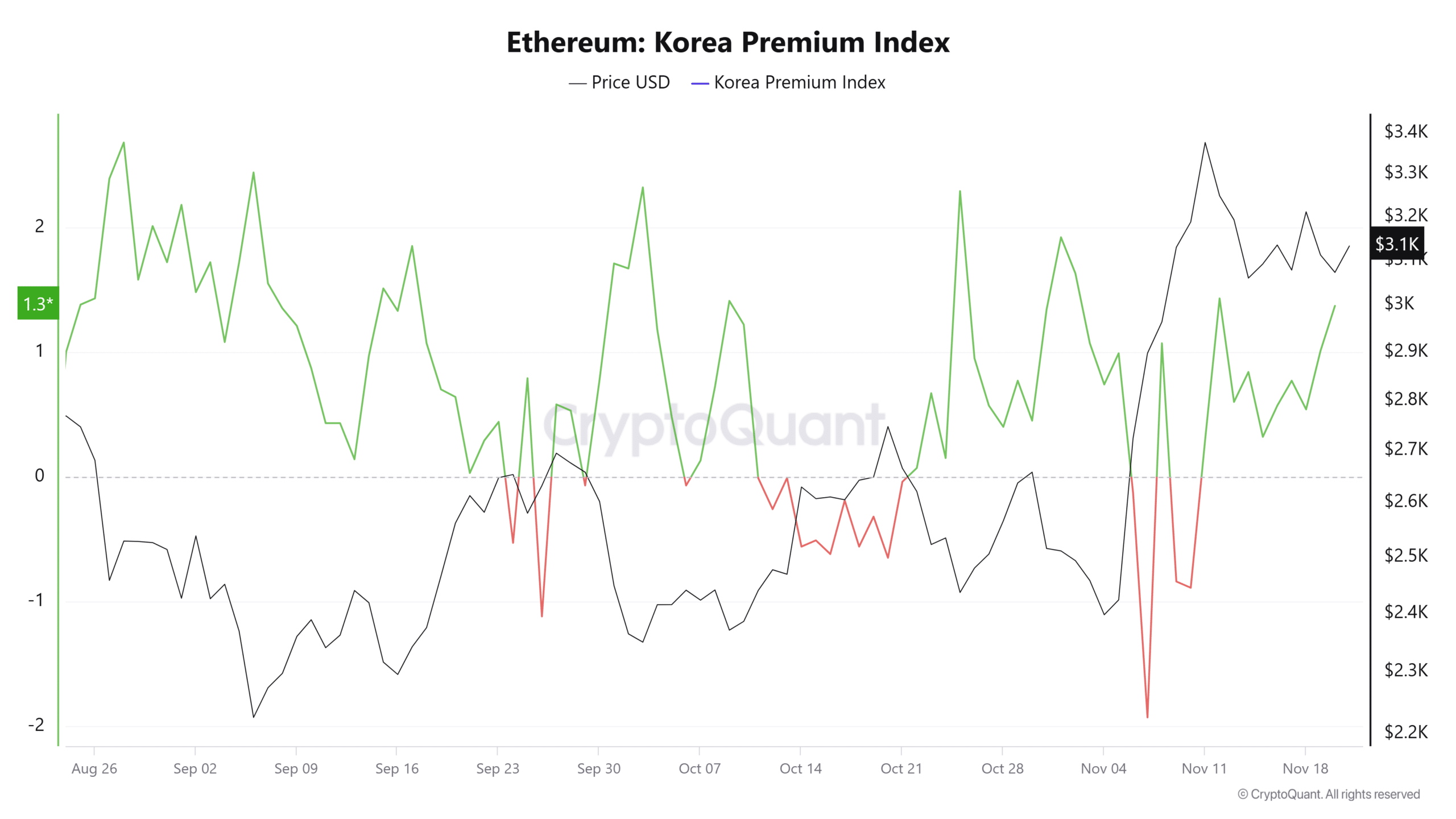

Regardless of the latest drop within the ETH/BTC pair, AMBCrypto discovered that traders from each Korea and the U.S. have been actively accumulating ETH.

The Korean Premium Index and Coinbase Premium Index, which observe the worth variations between Korean exchanges, Coinbase, and different platforms, present that each metrics are at the moment above 1 and 0, respectively.

This means sturdy shopping for strain from these investor teams.

As of writing, the Korean Premium Index is at 1.37, and the Coinbase Premium Index is at 0.0073, suggesting that these traders are rising their ETH holdings. If this development continues, it might drive the token to new highs.

Ought to the shopping for exercise persist amongst these cohorts, ETH’s modest features over the previous 24 hours might see a big enhance.

By-product merchants align with shopping for development

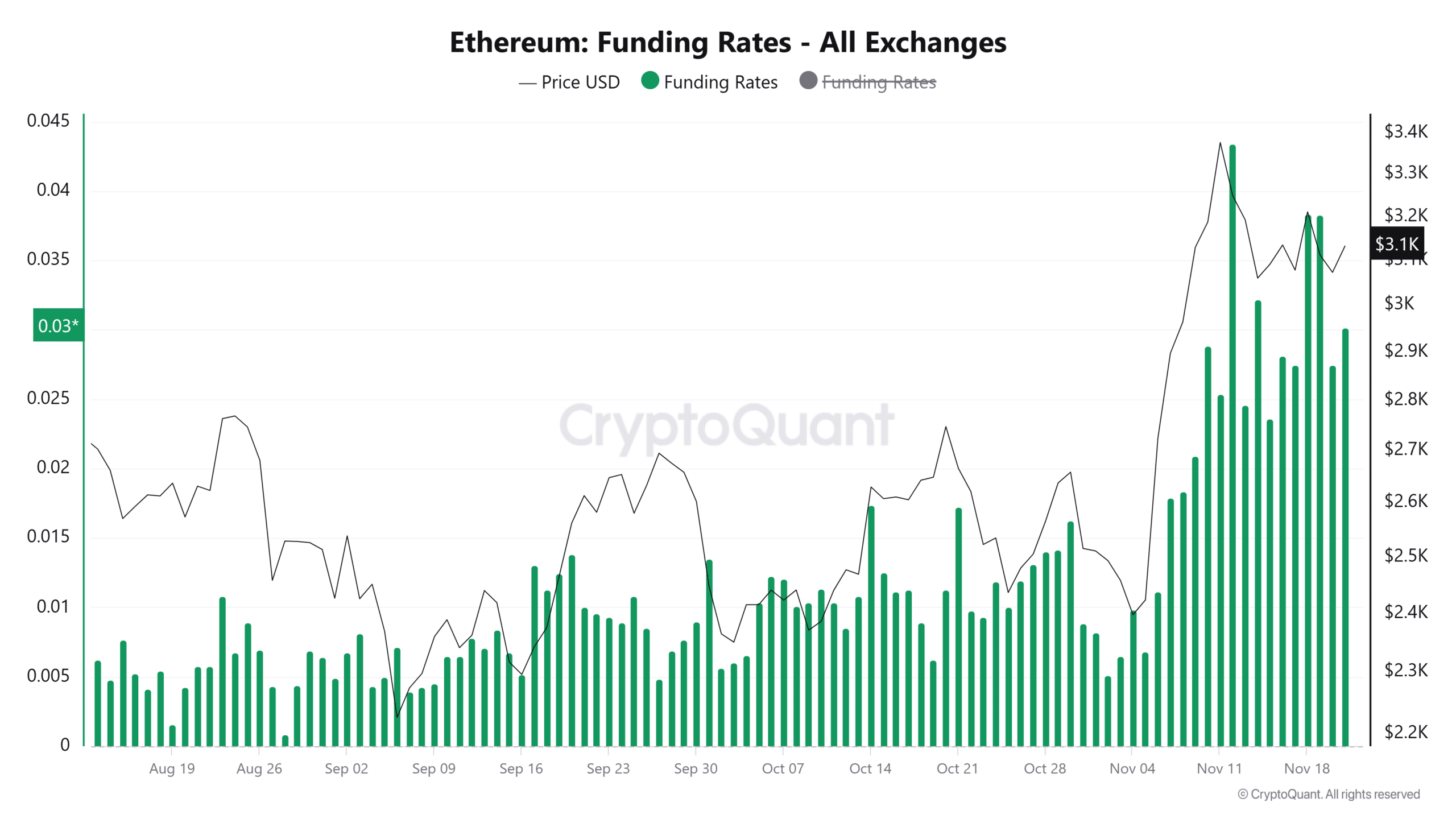

Current information by CryptoQuant on spinoff merchants within the ETH market revealed shopping for developments, significantly with the Funding Price and Taker Purchase/Promote Ratio.

The Funding Price, which displays the stability between lengthy and quick positions in Futures markets, favored lengthy positions at press time.

This instructed a bullish outlook, with merchants anticipating ETH to rise from its present worth stage.

As well as, the Taker Purchase/Promote Ratio—measuring the quantity of purchase orders versus promote orders amongst market takers—has surpassed 1 and reached its highest stage in November, exceeding the earlier peak of 1.0486.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

This indicated sturdy shopping for exercise and a market skewed towards upward momentum.

If these developments persist, they may drive ETH to greater ranges, additional reinforcing the bullish sentiment out there.