- With main establishments betting on its future, Bitcoin is more and more being seen as a retailer of worth

- Large quantities of USDT is flooding the market, indicating indicators of liquidity

Buyers moved from conventional equities to Bitcoin [BTC] as they view the latter as a lower-risk asset with sturdy potential.

The aforementioned development was highlighting by the ten% features on Bitcoin’s weekly charts, pushing it to a brand new all-time excessive of $77,000. This, on the again of rising uncertainty over Trump’s fiscal insurance policies – Significantly China tariffs and the rising nationwide debt.

With the brand new administration setting sights on positioning the US as a crypto capital, Bitcoin’s place as a secure haven is perhaps revised.

Large establishments are betting on Bitcoin’s future

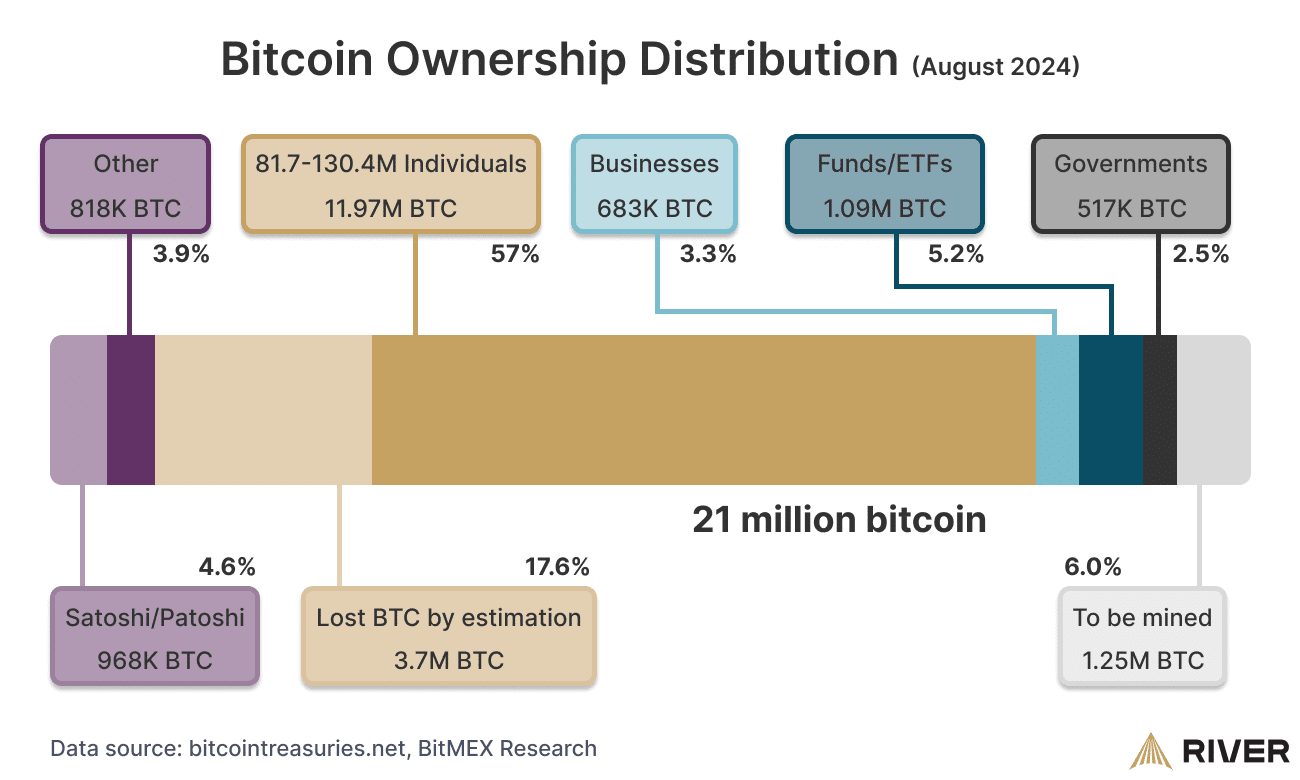

With Bitcoin’s fastened provide of 21 million cash, buyers are more and more stacking BTC as a real retailer of worth. In truth, a report by monetary intelligence agency River highlighted BTC’s possession throughout key stakeholders.

This backing was essential, particularly because the spinoff markets have developed because the final presidential election, with Open Curiosity (OI) hitting a document $45 billion.

Rising institutional curiosity provides long-term safety, serving to take in speculative swings. In consequence, during the last 24 hours, $36.28 million in liquidations occurred, with $25.20 million in brief positions being closed.

Moreover, BTC ETFs shattered information with large inflows, only a day after the election outcomes. This has given retail buyers a powerful foothold as they view the present worth as a high-risk, high-reward dip.

If this momentum holds, BTC might hit $80k by the top of November’s remaining buying and selling days. This may be confirmed a distinct set of bullish elements too.

Large liquidity is coming however…

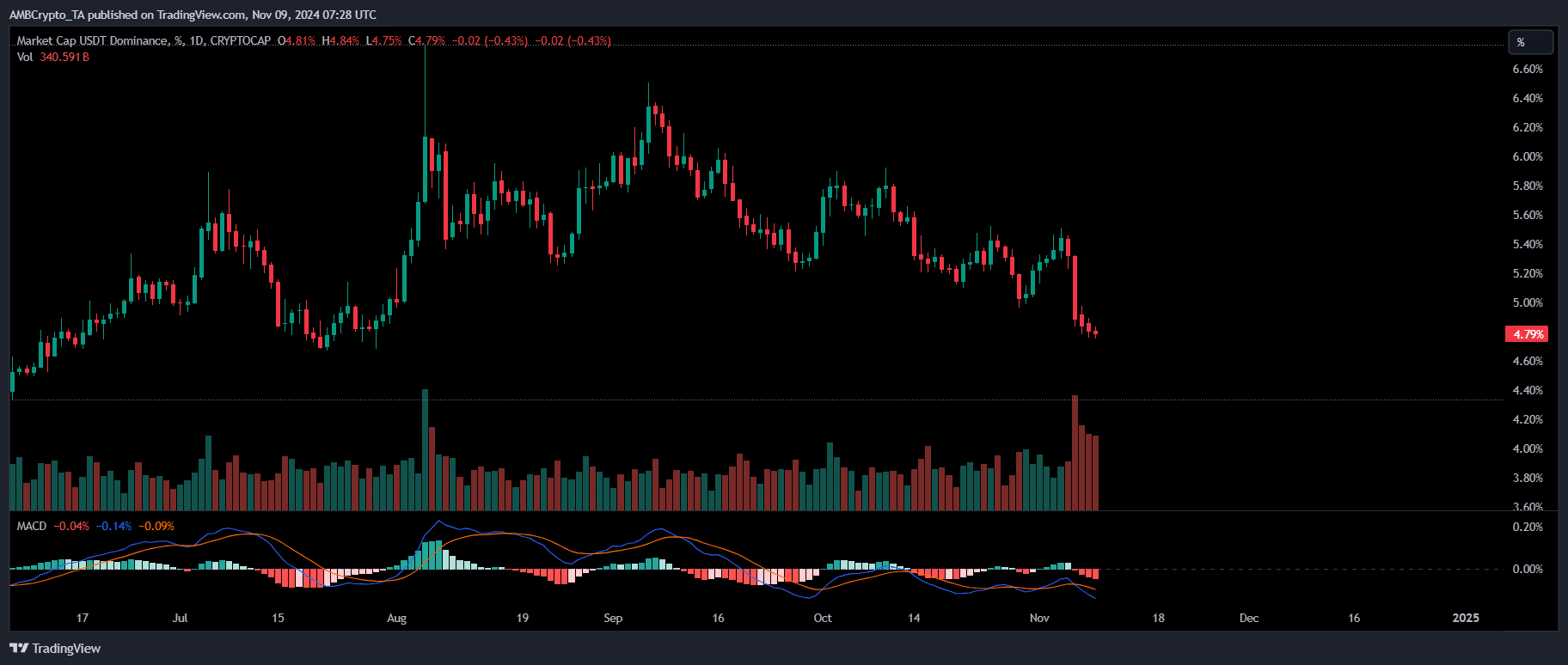

In contrast to earlier cycles, the place USDT market dominance slid however rebounded, this time, its dominance has steadily dropped. Regardless of BTC getting into a high-risk zone, the dominance confirmed constant pink bands, hitting a every day low of 6% on Election Day.

A low USDT market share usually indicators BTC nearing a market backside, as buyers transfer stablecoins again into the asset. They see the prevailing worth as a beautiful entry level.

Tether’s Treasury lately minted 1 billion USDT tokens, given the present market situations as Bitcoin emerged as a safer asset.

Regardless of bullish indicators, the market could also be overheating now. The RSI indicated an overbought situation, with 74% of worth motion upwards within the final two weeks.

Weak fingers would possibly money out, triggering a slight reversal. So, monitoring massive addresses is crucial, as their help will likely be essential in absorbing this stress. Thus, Bitcoin was at a crossroads at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Quick-Time period Holders (STHs) would possibly promote out on earnings, inflicting a minor pullback. Nonetheless, the general market sentiment nonetheless pointed to a rally to $80k earlier than the top of the month.

A key issue supporting this development is the rising uncertainty round ‘Trump trades.’ This makes Bitcoin a safer wager than equities, bolstering institutional curiosity.

Whereas a small dip did appear attainable, BTC’s bull rally appeared poised to proceed at press time.