- Bitcoin’s value stagnated at $95,000 as rising whale transfers signaled potential promoting stress.

- Growing MVRV ratio and energetic handle progress steered optimism regardless of uncertainty.

Bitcoin [BTC] has continued to hover across the $95,000 value degree, with its motion restrained over the previous few weeks.

Regardless of makes an attempt by bears to push the value under this psychological threshold, Bitcoin has maintained its place, displaying resilience however restricted upward momentum.

Over the previous week, BTC has recorded a modest improve of 1.1%, whereas within the final 24 hours, it has seen a slight dip of 0.4%, buying and selling at $95,463 on the time of writing.

The stagnation in Bitcoin’s value has prompted analysts to look at underlying market dynamics.

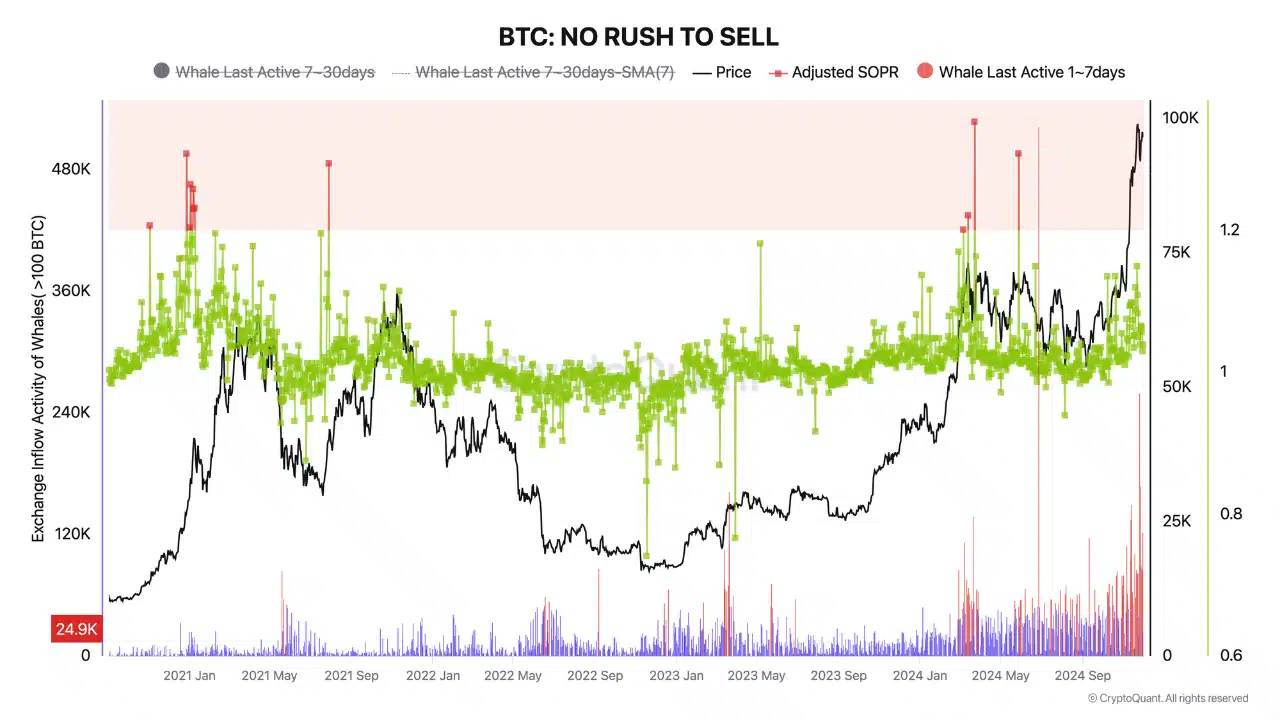

A CryptoQuant analyst, Onatt, highlighted a notable pattern in whale exercise put up the U.S. presidential election, the place Donald Trump secured a win.

Based on Onatt, there was an increase within the quantity of Bitcoin transferred to exchanges by energetic whale addresses for the reason that fifth of November.

Nonetheless, the Adjusted SOPR metric, which measures profit-taking exercise, doesn’t but point out important sell-offs.

Whereas the big influx of Bitcoin may sign potential short-term promoting stress, the truth that these belongings haven’t been bought suggests they could be allotted for different functions, similar to over-the-counter transactions or collateral.

This cautious method by whales displays a “wait-and-see” technique, highlighting the necessity for vigilance in monitoring these actions for any market impression.

Key indicators to look at

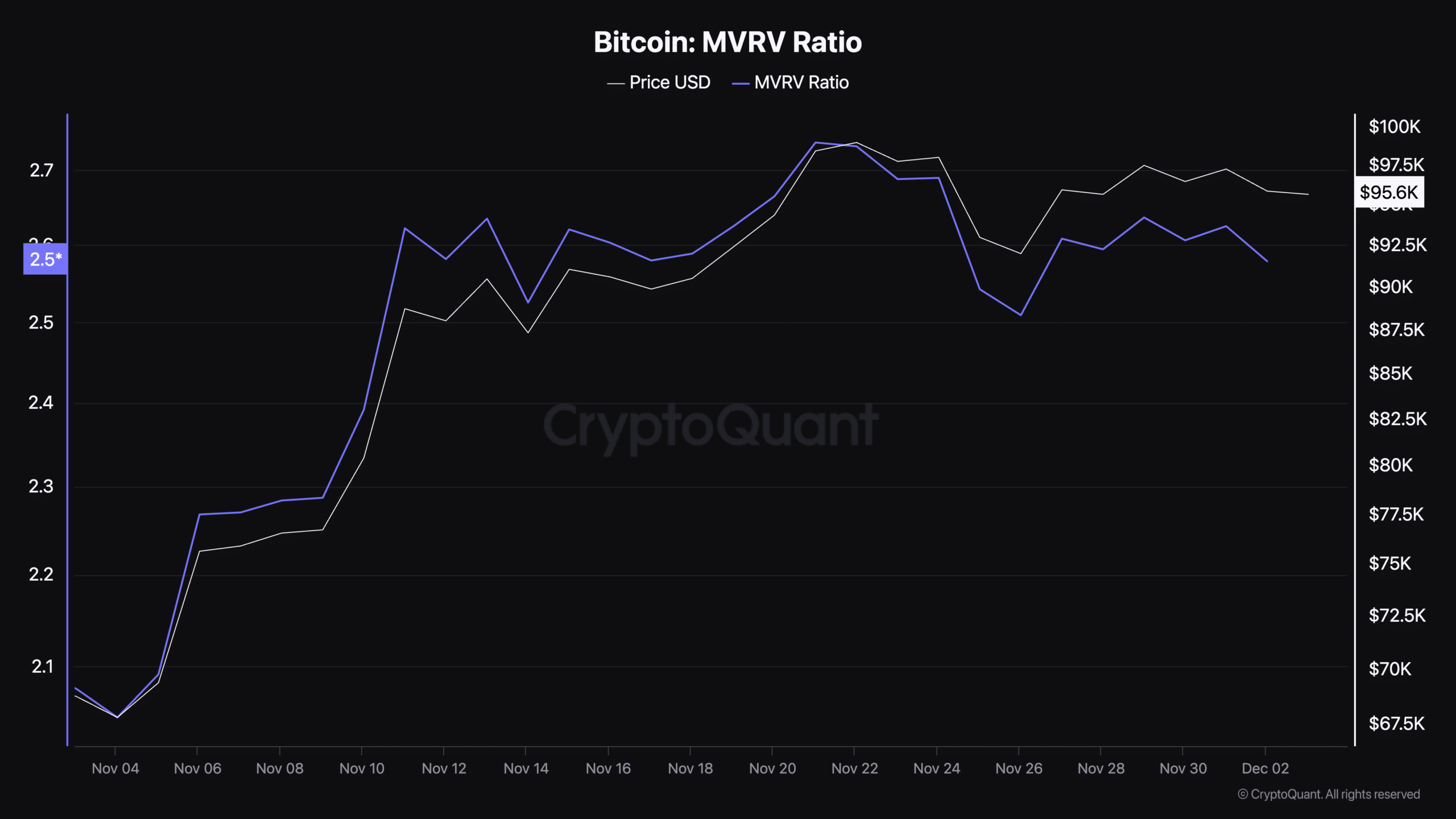

Bitcoin’s trajectory may be higher understood with its MVRV ratio and energetic addresses.

Notably, the MVRV ratio, a measure of market capitalization relative to realized capitalization, helps assess whether or not Bitcoin is overvalued or undervalued.

A ratio above 1 signifies profitability for many holders, whereas values of three.7 sign overvaluation. At press time, Bitcoin’s MVRV ratio sat at 2.57, signaling average profitability.

Whereas this degree means that Bitcoin was not in an overbought zone, it highlighted the necessity to monitor the ratio for potential indicators of market overheating or correction.

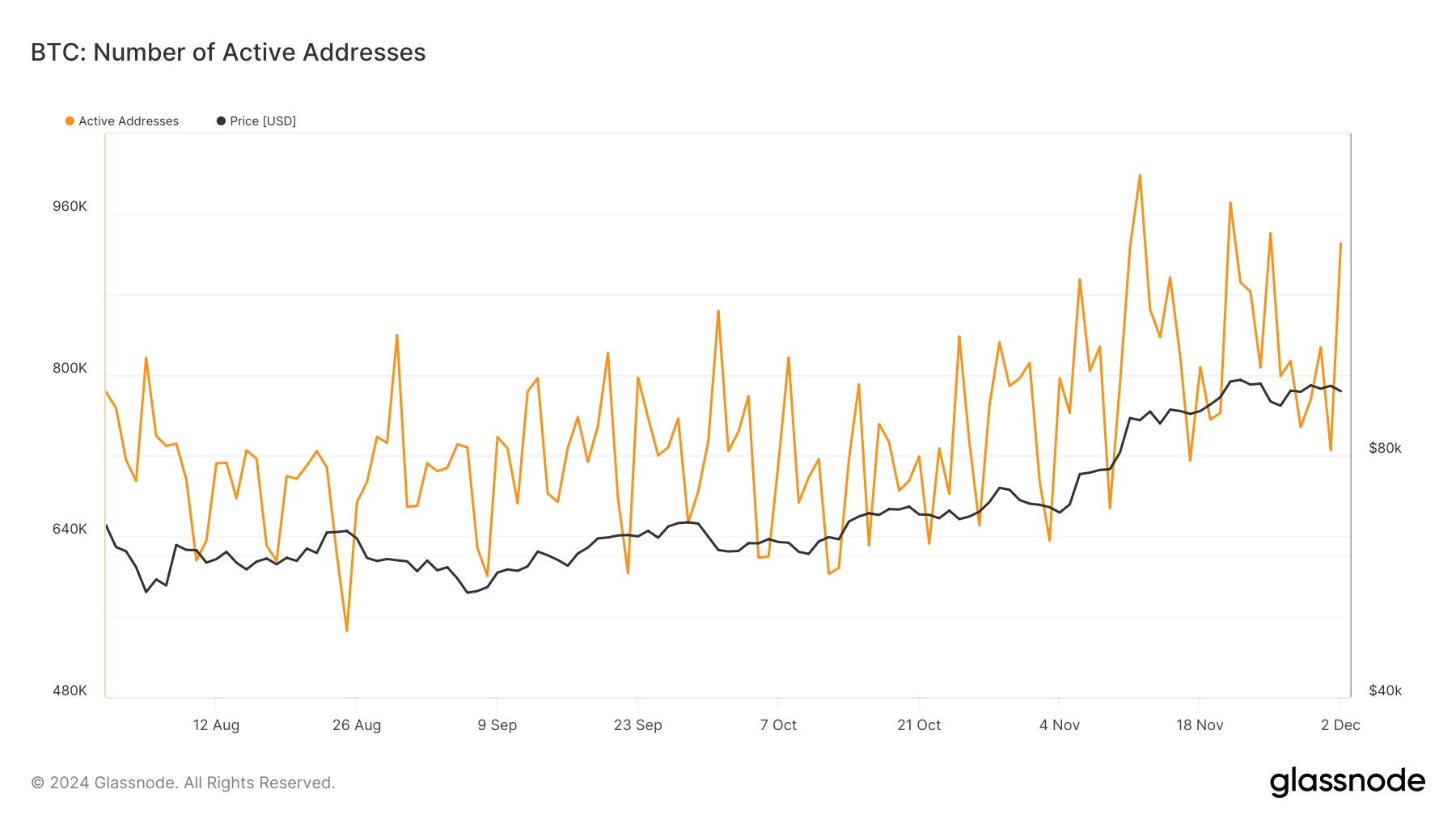

Additionally, Bitcoin’s energetic addresses, which function a proxy for community exercise and retail curiosity, confirmed a gentle improve in energetic addresses since August 2024, per information from Glassnode.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Though energetic addresses briefly declined to under 750,000 on the first of December, they’ve rebounded to over 900,000 as of press time.

This resurgence in energetic addresses indicated rising participation within the community, which may help value stability and doubtlessly sign bullish momentum, if sustained.