- Miners offered over 110,000 BTC in per week; will it stall value rally?

- There was little room for development earlier than euphoria hit BTC markets per cycle tops indicators.

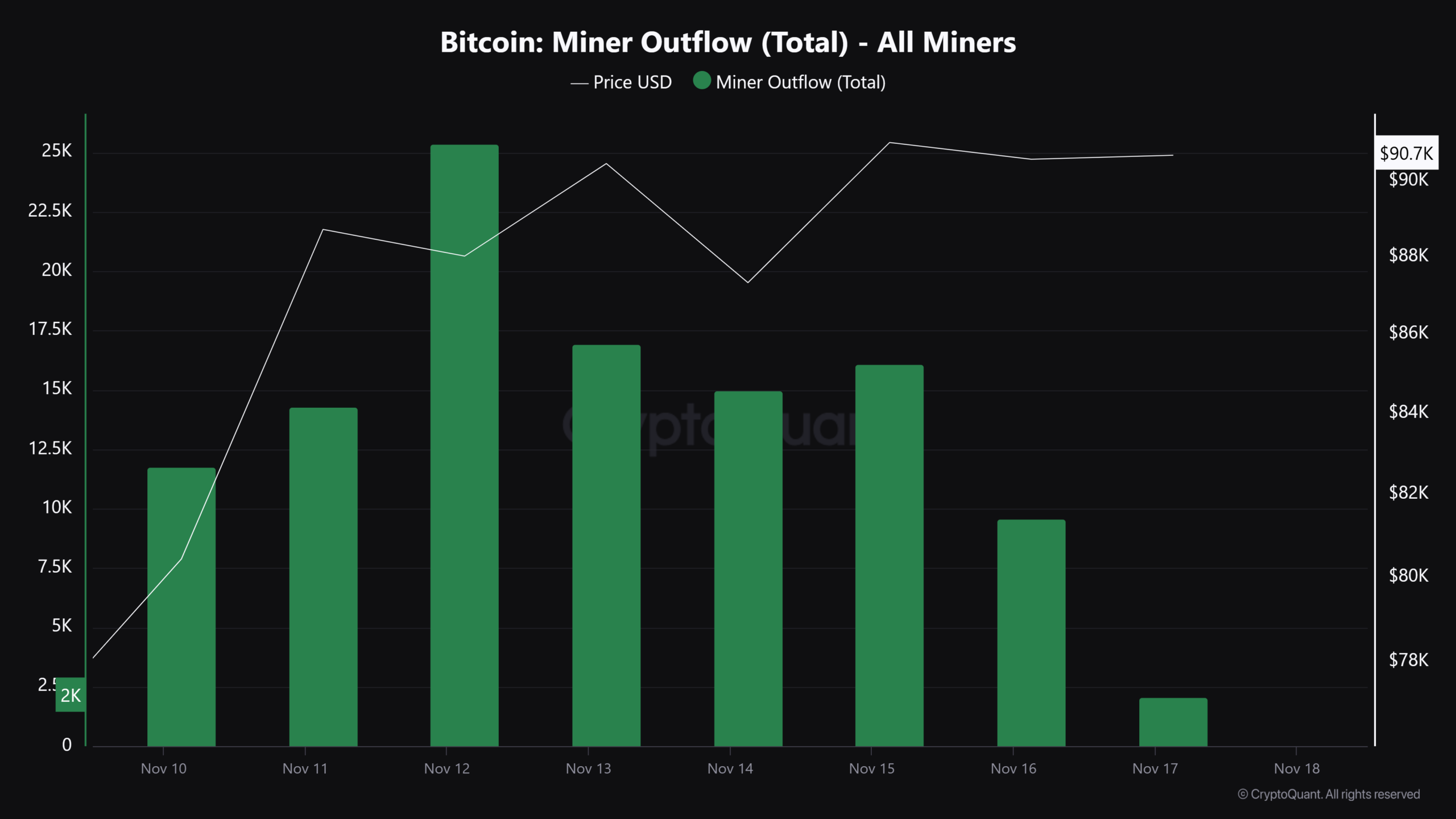

Bitcoin [BTC] miners’ promoting strain has intensified as the value of BTC crossed $90K. Between the tenth to the seventeenth of November, miners offered over 110K BTC, valued at almost $10 billion, in per week.

The best day by day sell-off, 25 367 BTC (price $2.2B), occurred on the twelfth of November because the miners’ dump intensified.

Since October, miner sell-off has been rising amid total broader market restoration.

Nevertheless, this week’s intensified sell-pressure has raised doubts about whether or not it might derail BTC from crossing the $100K psychological goal.

Previously, elevated miner sell-offs and income marked native and cycle tops. If the present development and studying leaned on the latter (cycle high), that would additionally set off different holders to promote.

So, what’s the present cycle standing as BTC flirts with $90K and eyes $100K?

Decoding BTC’s cycle high

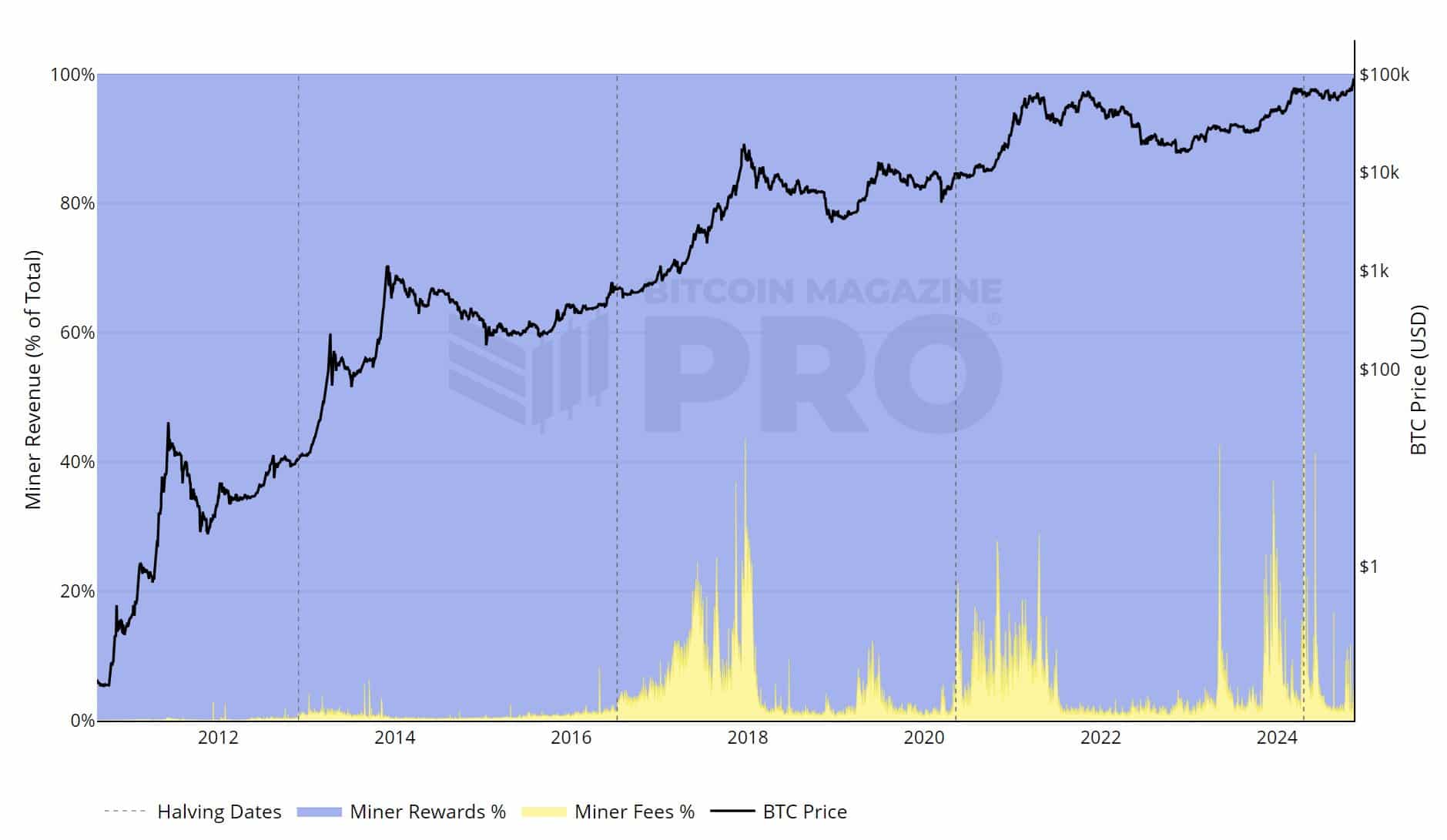

From a miner’s perspective, a spike in miner charges (yellow) above 30% of whole income has usually been correlated with previous BTC cycle tops.

A excessive studying means elevated euphoria in BTC markets, which drives transaction charges to report excessive towards rewards. That’s an overheated market sign.

In November, the miner charges hovered round 10% of whole income, which means the market was not nonetheless overheated.

One other indicator, the Pi Cycle High, confirmed little room for a rally for BTC earlier than the market grew to become overheated.

In previous tendencies, BTC’s transfer above the transferring common (350DMA x2, inexperienced line) marked the cycle high and a sign for holders to dump.

The inexperienced line studying confirmed $120K, so the BTC surge previous the extent could possibly be deemed a promote sign.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

Curiously, the $100K-$120K targets had been wildly anticipated by giant gamers throughout the choices market, as famous QCP Capital, one of many world’s largest crypto choices buying and selling desks. The agency not too long ago famous,

“In view of Bitcoin’s impressive rally since the US election, our view is that $100,000 – $120,000 may not be too far off.”

In that case, a powerful transfer above $120K might set off the Pi Cycle High and, by extension, improve revenue reserving throughout all cohorts of BTC holders. That might indicate a 30% transfer from the $90K degree at press time.