- Regardless of current worth troubles, the BTC market remained euphoric.

- Readings from the coin’s MVRV ratio and Realized Loss metrics instructed {that a} native backside could quickly be found.

Bitcoin’s [BTC] Web Unrealized Revenue & Loss (NUPL) metric has proven that the coin’s market stays throughout the euphoria section with vital unrealized positive aspects amongst buyers, Glassnode present in a brand new report.

The BTC market is claimed to be euphoric when there may be widespread optimism and perception that the coin’s worth will proceed to rise indefinitely.

Throughout this era, the market witnesses fast worth progress and elevated buying and selling exercise fueled by the joy.

Based on Glassnode, though this section has cooled off for the reason that market correction started, the worth of the coin’s NUPL above 0.5 confirmed that euphoric components remained throughout the BTC market.

Santiment stated,

“By this metric, the Euphoria phase (NUPL>0.5) of this bull market has been in effect for (the) last seven months. Even the mightiest up-trends experience corrections, however, and these events offer valuable information about investor positioning and sentiment.”

Is the native backside in?

Based on Glassnode, the current correction in BTC’s worth has brought on its short-term holders (STHs), notably those that have held their cash for durations between one week and one month, to accentuate distribution.

Their distribution exercise in periods of market correction corresponding to this turns into noteworthy as it could actually assist determine potential shopping for alternatives (native lows).

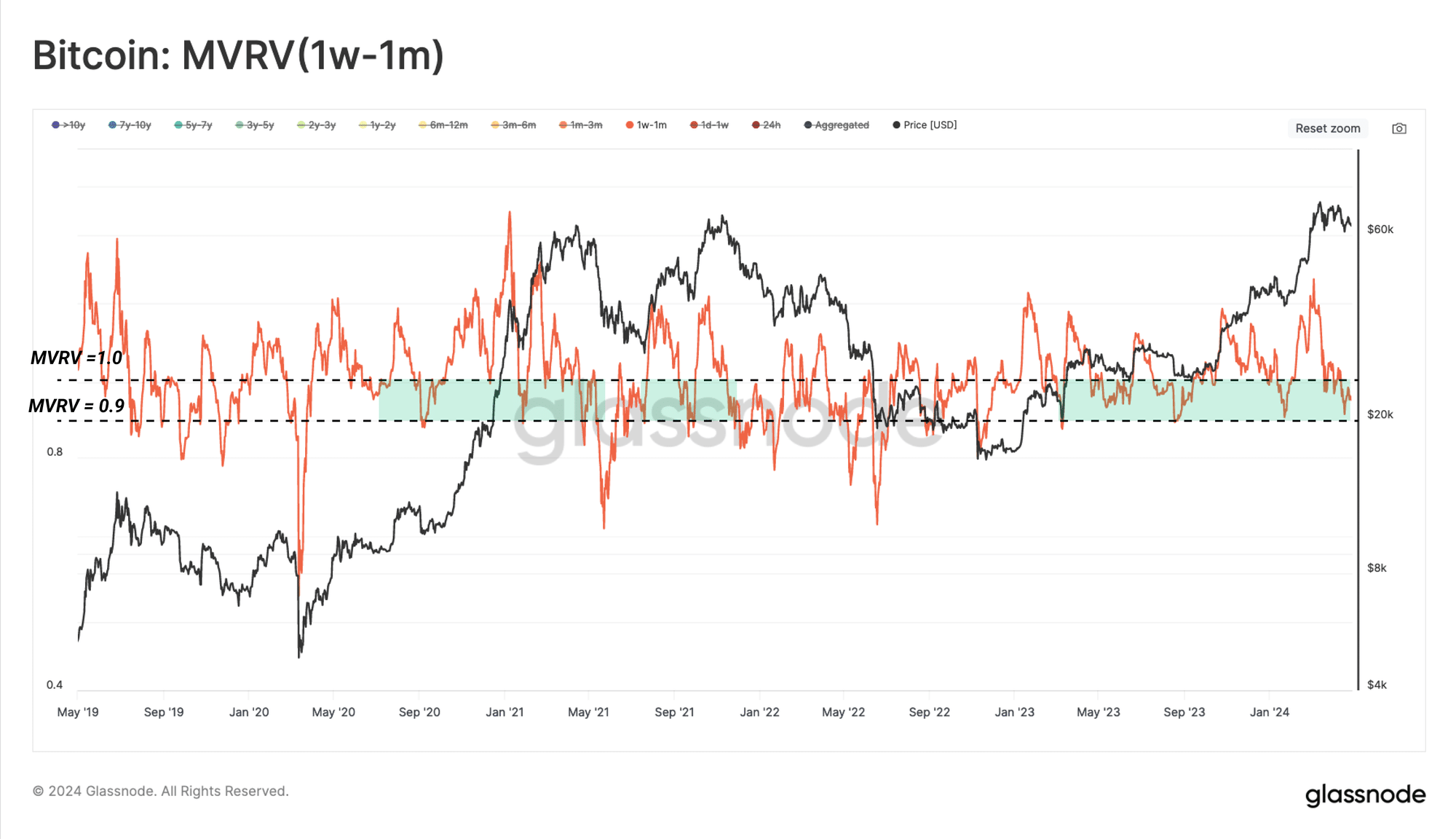

Glassnode assessed the historic sample of the MVRV ratio of cash held between one week and one month and located that in bull market corrections like this, the worth of the ratio “drops into the 0.9-1 range.”

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Which means that buyers who’ve held their cash for durations between one week and one month would often witness round 0% to 10% decline of their property, inflicting them to promote.

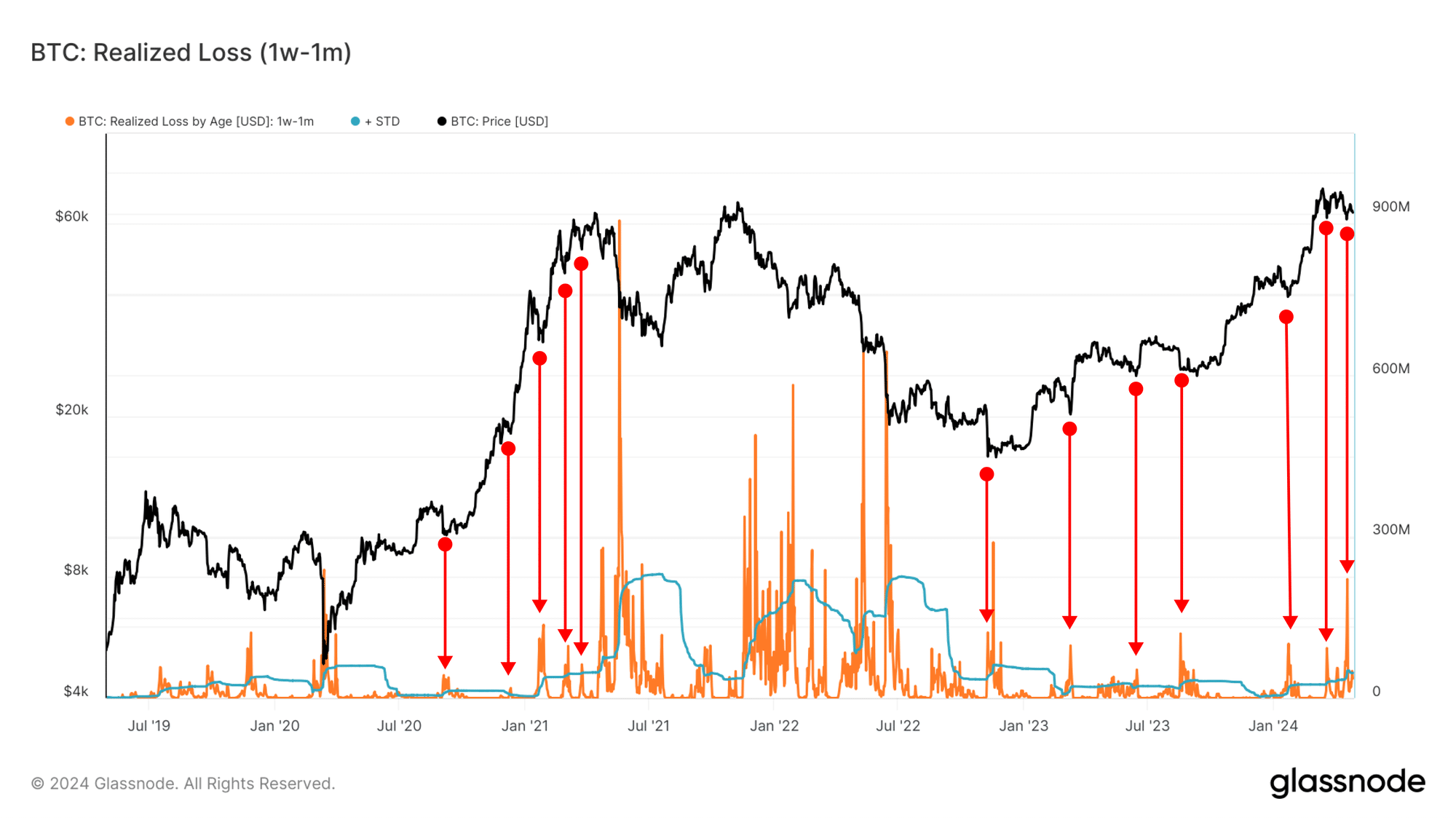

The on-chain information supplier additionally thought-about the Realized Loss by one-week to one-month-old entities.

Historic precedents present that when this metric goes above 1, it means that STHs are panic promoting at a loss.

Glassnode mixed its readings from each metrics and concluded:

“Since the price resides within the $60k to $66.7k range, the MVRV condition is met, and it could be argued that the market is hammering out a local bottom formation. That said, a sustained break below that MVRV level could create a cascade of panic and force a new equilibrium to be found and established.”