- Evaluating the potential of an prolonged Bitcoin draw back as concern continues to grip the market.

- Bitcoin’s change flows recommend that there’s robust demand each time BTC drops under $50k.

Bitcoin [BTC] is on the threat of bearish capitulation as traders, particularly within the retail phase, lose confidence within the bulls.

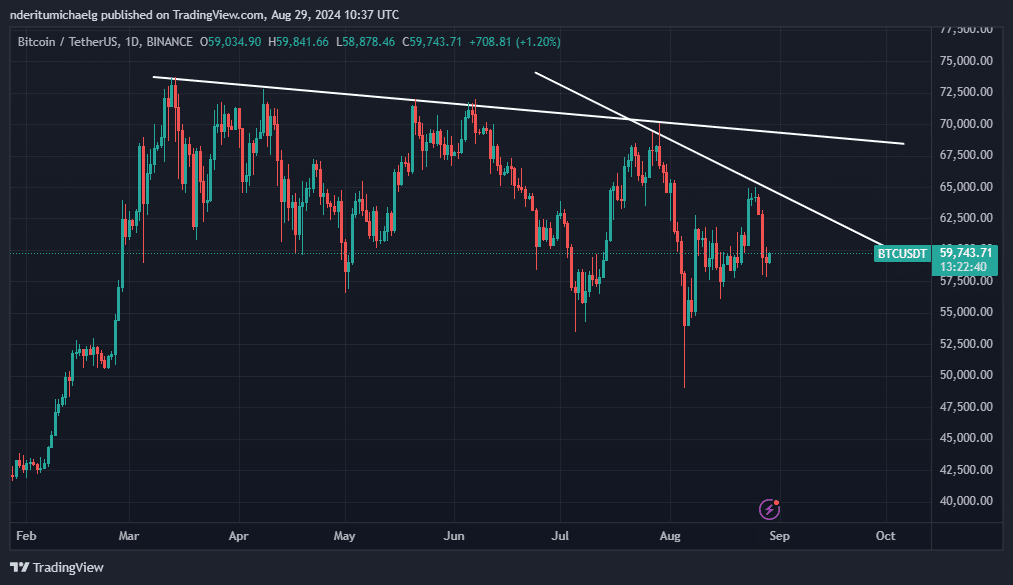

Its current bullish try shaped a decrease excessive, including to what we’ve noticed within the king coin since its peak in March.

Each bullish try since Bitcoin’s historic ATH in March has resulted in decrease highs, signaling weaker upside momentum.

This has been contributing an excellent deal to the erosion of confidence in BTC’s potential to soar into new highs.

The newest try at pushing above $60,000 resulted in a resurgence of promote stress. Consequently, the market sentiment dipped additional. The Bitcoin Worry and Greed Index fell from 39 per week in the past to 29 at press time.

The prevalence of concern additionally aligned with the escalating considerations in regards to the international financial situation, particularly as recession fears took maintain. These fears threatened to destabilize the worldwide funding panorama.

Buyers are usually risk-averse in such eventualities, that means risk-on belongings equivalent to Bitcoin could expertise liquidity outflows.

Bitcoin indicators flash completely different alerts

Then again, Bitcoin’s 2022 crash was largely fueled by liquidity drying up as governments raised rates of interest. Latest developments recommend that fee cuts could favor a bullish final result.

On-chain knowledge additionally supported these expectations.

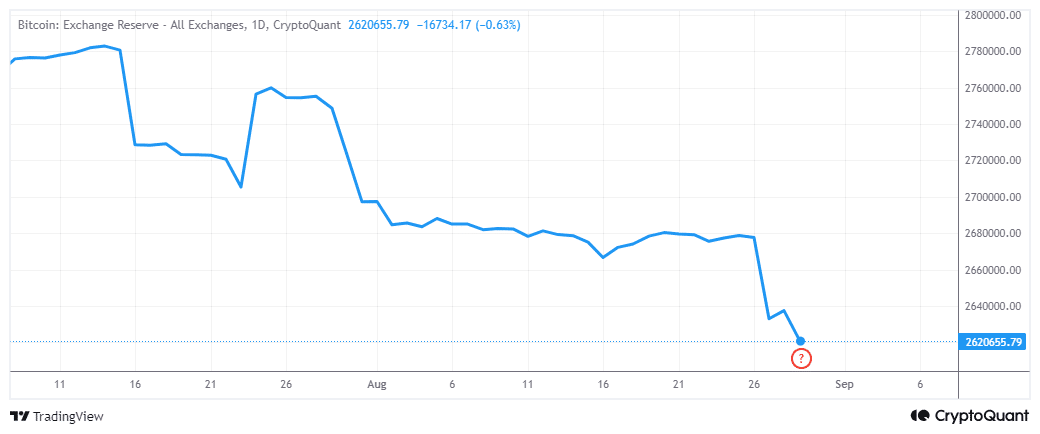

Bitcoin change reserves continued to drop regardless of the current bearish final result. This pointed to the truth that long-term demand was nonetheless excessive, and that current market efficiency is essentially a consequence of short-term volatility.

The declining change reserves have been moderately uncommon in a time when the market was changing into extra fearful. This urged that HODLers have been scooping BTC off exchanges and into non-public wallets.

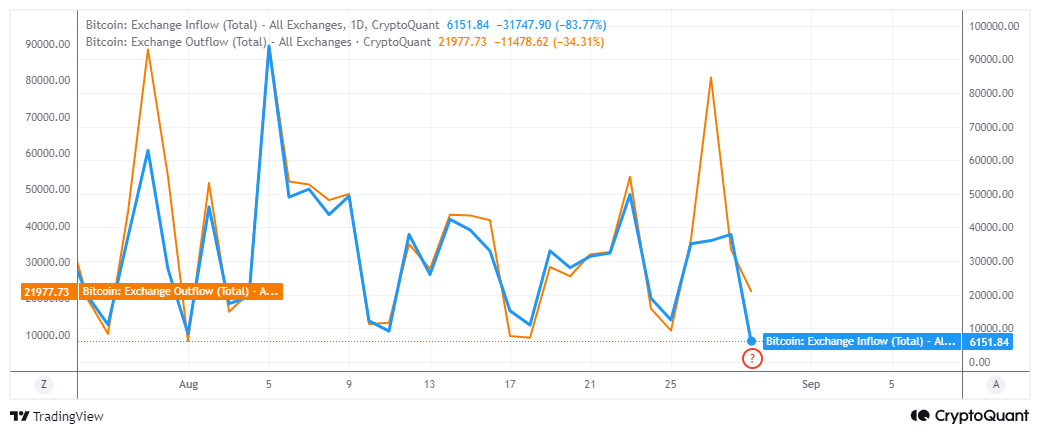

Trade move knowledge collaborated with the above level. The newest change outflows have far outweighed inflows.

For instance, the newest spike in change flows occurred on the twenty seventh of August, throughout which outflows peaked at 80,740 BTC. Inflows peaked at 36,071 BTC throughout the identical buying and selling session.

Bitcoin flows within the final 24 hours maintained an identical narrative. The change outflows have been larger at 21,977 BTC in comparison with 6151 BTC change inflows.

This signaled a robust demand for Bitcoin each time it dips under $60,000.

The prevailing demand doesn’t negate the truth that Bitcoin has been hitting decrease highs.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

There may be important threat that the macro-trend could weaken nearer to $50,000 vary and probably under, particularly if a robust capitulation occasion results in large inflows in change reserves.

Then again, the present knowledge suggests {that a} provide shock remains to be in play and will contribute to larger costs down the highway.