- Bitcoin HODLing has climbed to spectacular ranges, with holders now anticipating increased costs.

- Value assessing the potential danger in case of a serious sell-off

Bitcoin buyers have been eagerly ready for Bitcoin to reclaim the $70,000 value degree. This may be evidenced by the huge quantity of unrealized earnings – An indication that BTC holders have been opting to HODL, in anticipation of upper costs.

In truth, in accordance with a latest CryptoQuant evaluation, Bitcoin at the moment has over $7 billion value of unrealized earnings. This remark highlights the extent of HODLing occurring and the expectations of upper value ranges. Nevertheless, it additionally underscores the potential for an enormous retracement if or when revenue taking resumes.

If Bitcoin holders beginning taking earnings off the desk, the promote stress could result in an end result much like what occurred in the direction of the tip of July. On the time, the worth crashed exhausting in a matter of days. To date, the prevailing optimism has allowed BTC to carry on to its good points on the charts.

At press time, Bitcoin was buying and selling at $68,350, lower than 2.4% away from hitting $70,000. The cryptocurrency additionally appeared to shut in on the subsequent resistance vary between $69,400 and $71,500.

Bitcoin flows fall to the bottom ranges in 2024

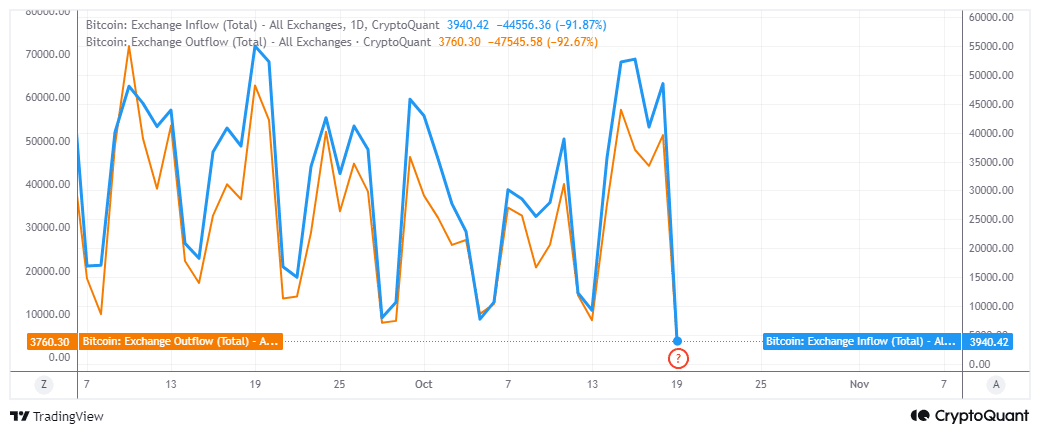

Bitcoin change flows would possibly provide us fascinating insights into the crypto’s newest bullish wave.

The most recent uptick in each change inflows and outflows occurred between 13 and 16 October. Nevertheless, change flows have since cooled all the way down to their lowest ranges this yr.

In truth, knowledge confirmed that 3,760 BTC moved out of exchanges within the final 24 hours. Roughly 3,940 BTC moved into exchanges, which implies change inflows have been barely increased than the outflows.

Trade circulate swings recommend that BTC is perhaps prepared for a volatility resurgence. Nevertheless, will one other swing up have bullish or bearish power? That is still to be seen, though tackle flows could provide us some insights.

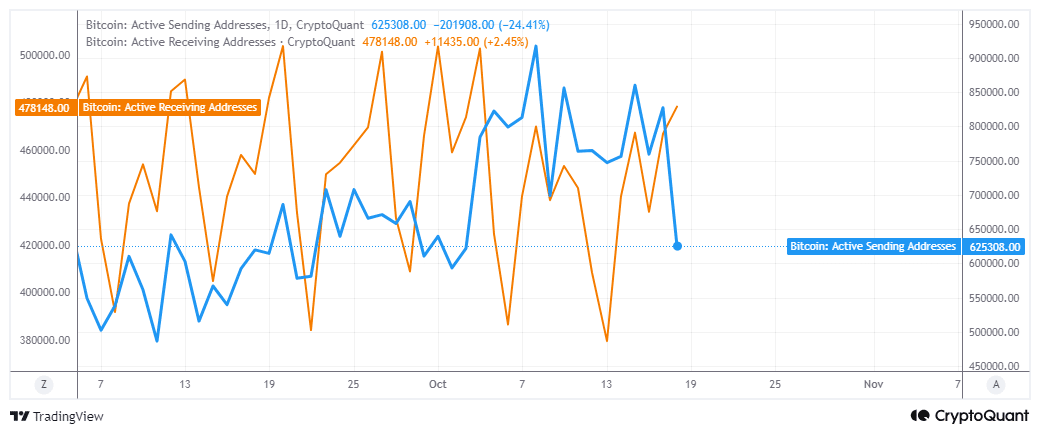

The variety of energetic sending addresses have been declining since mid-October. As an illustration – They fell from 860,161 addresses on 15 October to 478,148 addresses by 18 October.

Quite the opposite, receiving addresses grew from 379,545 addresses on 13 October to 625,308 addresses on 18 October. The info additionally revealed that addresses shopping for Bitcoin weren’t solely increased than these promoting it, however receiving addresses grew whereas sending addresses retreated.

Handle exercise confirmed a shift, one demonstrating declining promote stress regardless of the latest value hike. Whereas these outcomes recommend that Bitcoin could push increased, a shock wave of promote stress should be on the playing cards.