- Trump’s Govt Order introduces a federal job drive to manage and promote innovation in cryptocurrency markets

- Bitcoin reacted with unstable value actions, reflecting optimism and uncertainty in regards to the order’s influence

President Donald Trump hit the bottom working by signing a number of government orders throughout his first three days in workplace. On 23 January, after a lot anticipation, President Trump lastly signed an Govt Order on cryptocurrency. For sure, this transfer has led to speculations about what could also be subsequent for the asset class.

Key highlights of the Govt Order on cryptocurrency

Trump’s government order on cryptocurrency, dubbed “Strengthening American Leadership in Digital Financial Technology”, is a landmark determination laying the groundwork for a extra structured strategy to digital asset adoption. Amongst its major goals, the order seeks,

- Set up a federal job drive to supervise cryptocurrency rules, guaranteeing shopper safety whereas encouraging innovation.

- Promote the event of U.S. dollar-backed stablecoins as a counterweight to different digital belongings, signaling the nation’s intent to take care of dominance in world monetary markets.

- Prohibit the introduction of a U.S. central financial institution digital foreign money (CBDC), citing dangers to financial sovereignty.

- Discover a reserve system for cryptocurrencies acquired by way of enforcement actions, signaling an openness to integrating digital belongings into governmental monetary programs.

These provisions spotlight a nuanced strategy, mixing help for innovation with a cautious eye on dangers reminiscent of fraud and market volatility.

How the market reacted to the chief order on cryptocurrency

The chief order on cryptocurrency generated a mixture of pleasure and warning throughout markets. Bitcoin (BTC), the most important cryptocurrency by market capitalization, noticed fast volatility following the announcement. Whereas some buyers noticed the transfer as a optimistic step in the direction of regulatory readability, others hesitated resulting from lingering uncertainties about implementation.

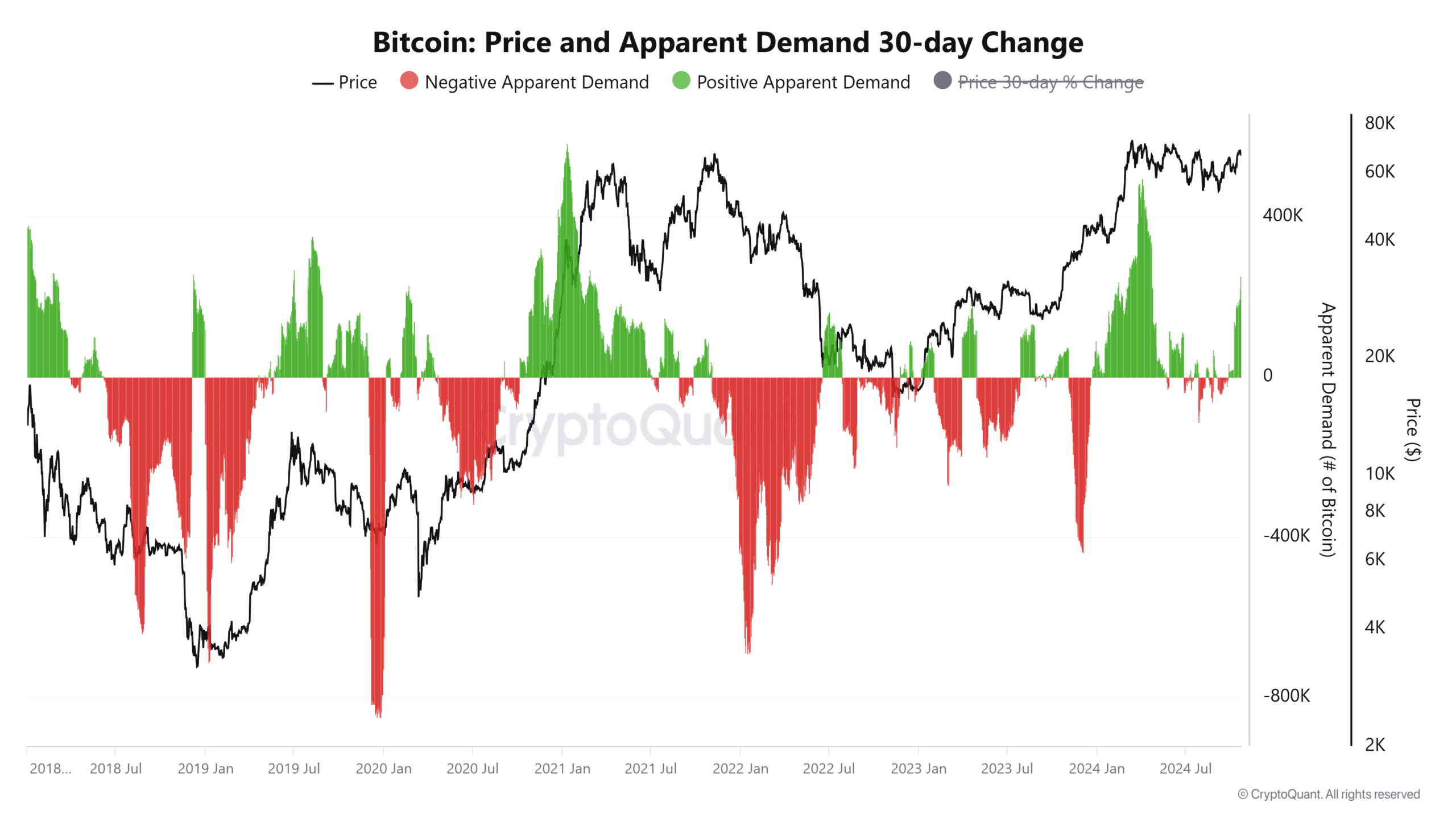

AMBCrypto analyzed Bitcoin’s value and obvious demand modifications to know the market’s response higher, as visualized within the accompanying chart.

Bitcoin’s value and obvious demand: An in depth look

The chart illustrated Bitcoin’s value trajectory alongside 30-day modifications in obvious demand. Throughout the days surrounding the Govt Order, Bitcoin’s value noticed heightened volatility.

The preliminary announcement spurred a slight uptick, reflecting market optimism. Nevertheless, the value retraced as merchants digested the long-term implications of potential regulatory oversight.

On the identical time, a pointy hike in optimistic obvious demand coincided with the order’s launch. This pattern hinted at heightened shopping for curiosity, doubtless pushed by renewed confidence amongst buyers that clearer rules may appeal to institutional capital.

Nevertheless, the chart additionally revealed intervals of destructive obvious demand, reflecting profit-taking and uncertainty amongst retail buyers. These fluctuations highlighted the fragile steadiness between optimism for regulatory readability and apprehension over tighter controls.

Implications for the cryptocurrency ecosystem

Trump’s Govt Order on cryptocurrency may mark a pivotal shift for the trade. By prioritizing stablecoin growth and opposing CBDCs, the order seeks to safeguard U.S. financial pursuits whereas enabling blockchain innovation. Nevertheless, the market’s combined response indicators the necessity for extra detailed implementation plans to deal with investor considerations.

For Bitcoin, the Govt Order reinforces its position as a barometer of market sentiment. Its value actions and demand dynamics underlined the cryptocurrency’s sensitivity to coverage modifications, underscoring the significance of regulatory predictability for fostering long-term development.