- Galaxy Digital’s web earnings jumped 40%, with the identical attributed to identify Bitcoin ETFs’ affect

- Galaxy Trading additionally noticed a hike in income and volumes

Galaxy Digital Holdings Ltd. has emerged as a major participant within the monetary realm after seeing a surge in web earnings by 40% to $422 million. Apparently, analysts are attributing this progress to the affect of spot Bitcoin [BTC] Trade Traded Funds (ETFs).

In actual fact, the upward trajectory coincided with a notable resurgence in web inflows noticed in spot Bitcoin ETFs on 14 Could, following 4 consecutive weeks of outflows. In line with stories, there have been whole inflows of $116.8 million final week, indicating renewed curiosity amongst buyers.

Good day for Bitcoin

These inflows might need had an affect on the value motion of Bitcoin too. After flashing all reds over the previous week, Bitcoin, at press time, was recovering on the charts following a 6% hike in 24 hours.

The identical was confirmed by the Relative Power Index climbing near the 50-level on the charts.

Offering additional insights into Galaxy Digital’s Q1 outcomes, analyst Joseph Vafi famous,

“Spot bitcoin ETF approvals have been a major catalyst for the increase in counterparty engagement as some of the more traditional asset managers and hedge funds are entering/reentering the space.”

In line with the agency’s first-quarter report,

“Trading reported counterparty trading revenue of $66 million in the first quarter, primarily driven by increased revenue from derivatives and favorable asset price movements.”

Galaxy Digital’s Q1 report

The report additional claimed that counterparty buying and selling volumes appreciated by 78%, in comparison with the prior quarter. This, whereas the typical mortgage guide dimension expanded to $664 million.

This underlines the rising significance of platforms like Galaxy Trading in facilitating digital asset trade and funding.

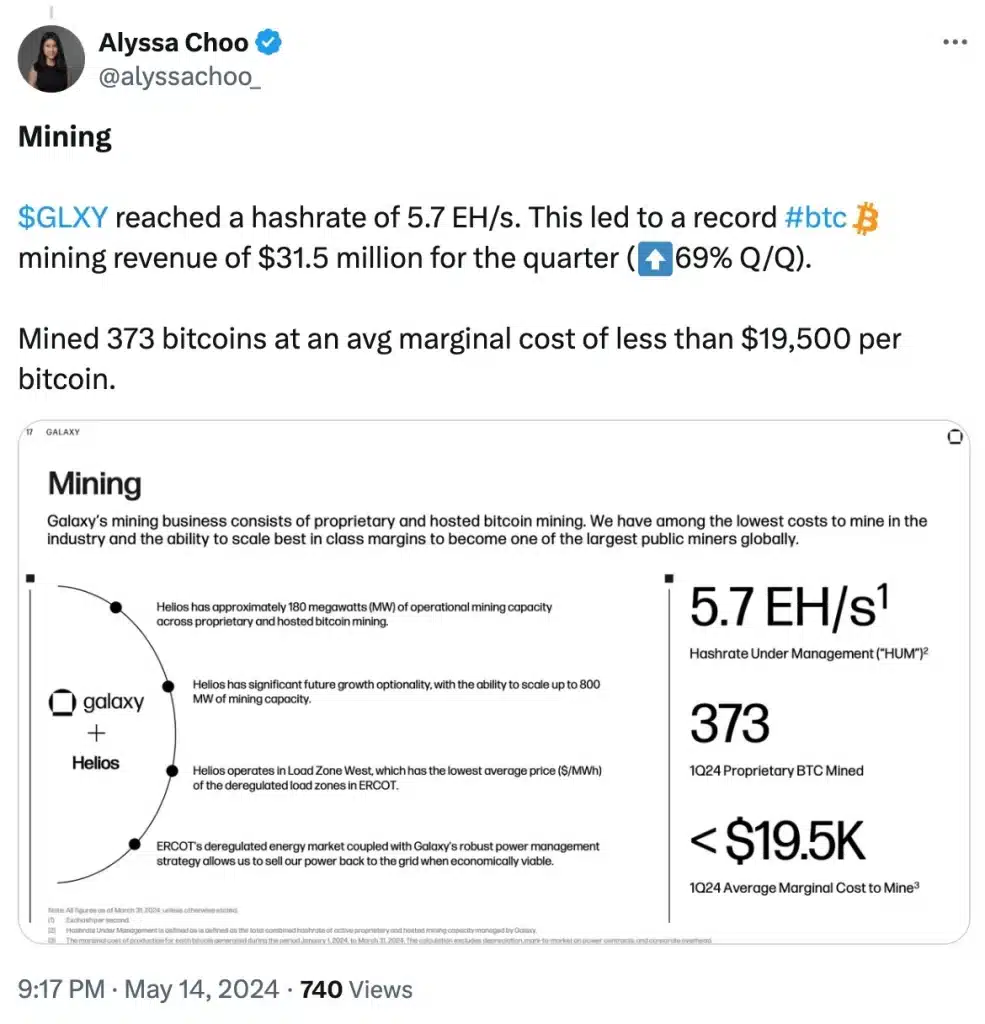

Moreover, Galaxy posted a file Bitcoin mining income of $31.5 million, a 69% hike from the earlier quarter.

Right here, it’s price noting that the corporate mined 373 bitcoins at a mean price of lower than $19,500 per Bitcoin, highlighting its effectivity in its mining processes.

Remarking on the identical, Mike Novogratz, CEO of Galaxy Digital Holdings Ltd, stated,

“Our first-quarter results underscore the strength and resilience of our business model.”

In conclusion, whereas optimism prevails, market uncertainties stay unpredictable. Nevertheless, the launch of the Invesco Galaxy Bitcoin ETF, together with two new XTrackers Trade Traded Commodities in partnership with DWS Group, paints a promising path ahead for the agency.