- Institutional urge for food for Bitcoin mixed with robust whale demand underpin current BTC upside.

- Bitcoin hash charge’s current new ATH alerts the state of exercise across the cryptocurrency.

Bitcoin [BTC] has been exhibiting indicators of elevated exercise particularly within the whale and institutional lessons. These two classes arguably have the most important impression on BTC’s worth actions.

Bitcoin has maintained a robust upside within the final six weeks after beforehand struggling to remain above $60,000. This newest rally has been smoother than normal and that was possible as a result of robust institutional involvement.

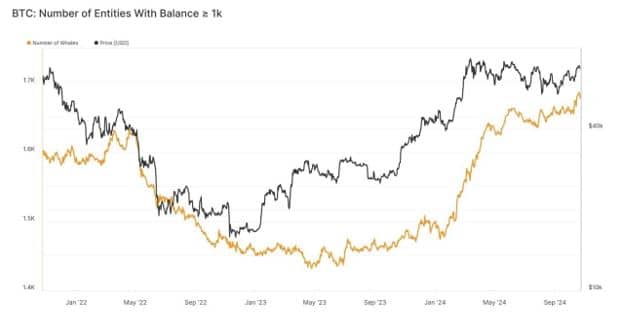

The shifting sentiment round BTC made it extra interesting as evident by the surge in establishments holding the cryptocurrency. Glassnode information not too long ago revealed that entities holding over 1,000 BTC not too long ago pushed above Could 2022 ranges.

The identical class of Bitcoin holders beforehand noticed vital decline which leveled out in Could final yr. This implies they’ve been aggressively accumulating, however momentum appears to have slowed down between Could and August.

Bitcoin whale holdings soar to new highs

The tempo of upside seems to have regained an upward trajectory since September. This additionally aligns with information on whale exercise which has additionally been hovering.

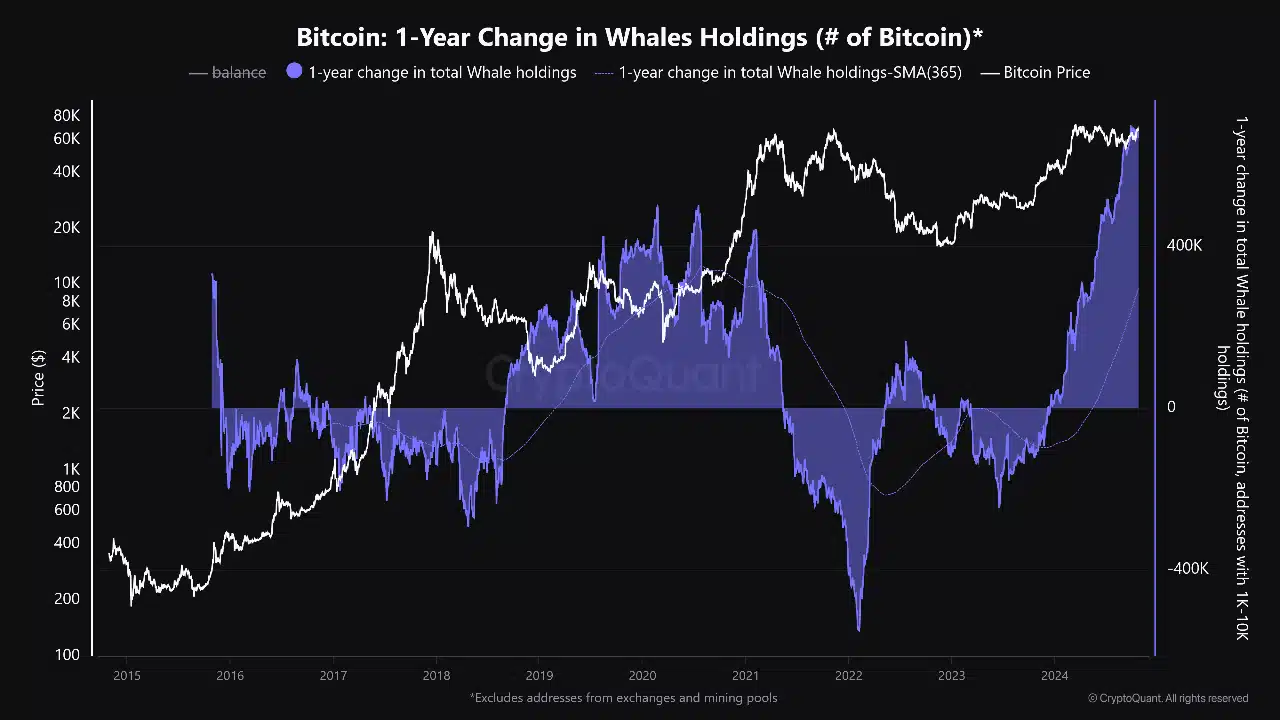

Bitcoin whales reportedly held over 670,000 BTC as per the most recent information, which is the very best quantity that the whale class has ever held. CryptoQuant analyst BaroVirtual described the remark as an indication of accumulation earlier than a serious transfer.

The Bitcoin whale holdings pivoted in 2023 and the continued accumulation not too long ago pushed above 2021 highs.

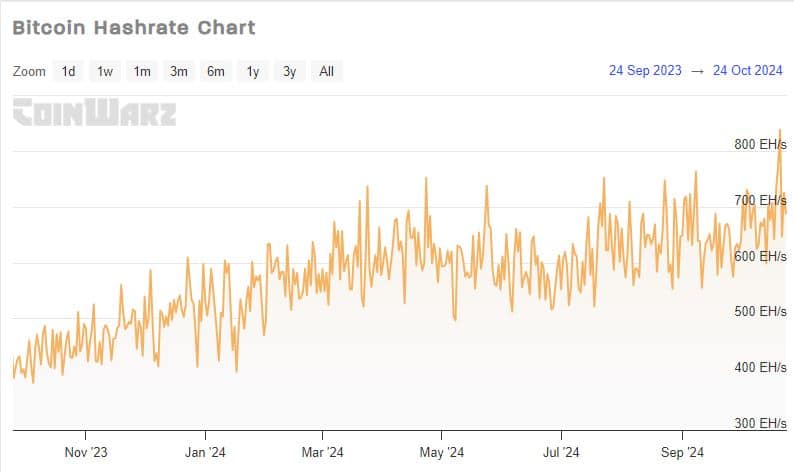

One of the vital widespread observations on each institutional and whale exercise is that it has been rising quickly within the final 2 months. Bitcoin-related transactions have thus been greater, necessitating extra community capability.

Bitcoin miners have responded to the surge in community exercise by boosting their operations. Consequently, the Bitcoin hash charge not too long ago pushed to its highest degree at 918.72 TH/s.

The community achieved this feat on Monday, twenty first October, this week. The hash charge ATH means that miner profitability has been fairly excessive.

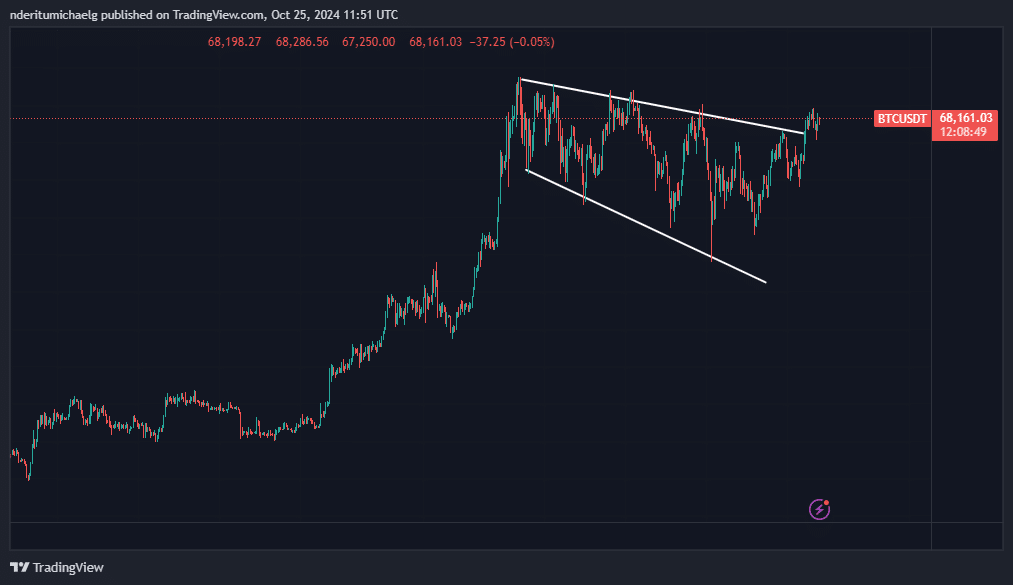

In the meantime, the impression of the most recent surge in demand for BTC was evident within the worth motion. Bitcoin has been transferring inside a bullish flag sample since March.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The most recent bullish momentum appeared to have pushed it above the resistance vary, suggesting that extra potential upside might happen within the coming months.

Supply: TradingView

Whale and institutional accumulation might recommend massive strikes on the best way. Nevertheless, these observations additionally implied the likelihood that Bitcoin might expertise extraordinarily risky strikes within the short-to-mid time period.