- Saylor plans to make MicroStrategy a Bitcoin financial institution.

- MSTR rallied and hit an ATH after the revelation.

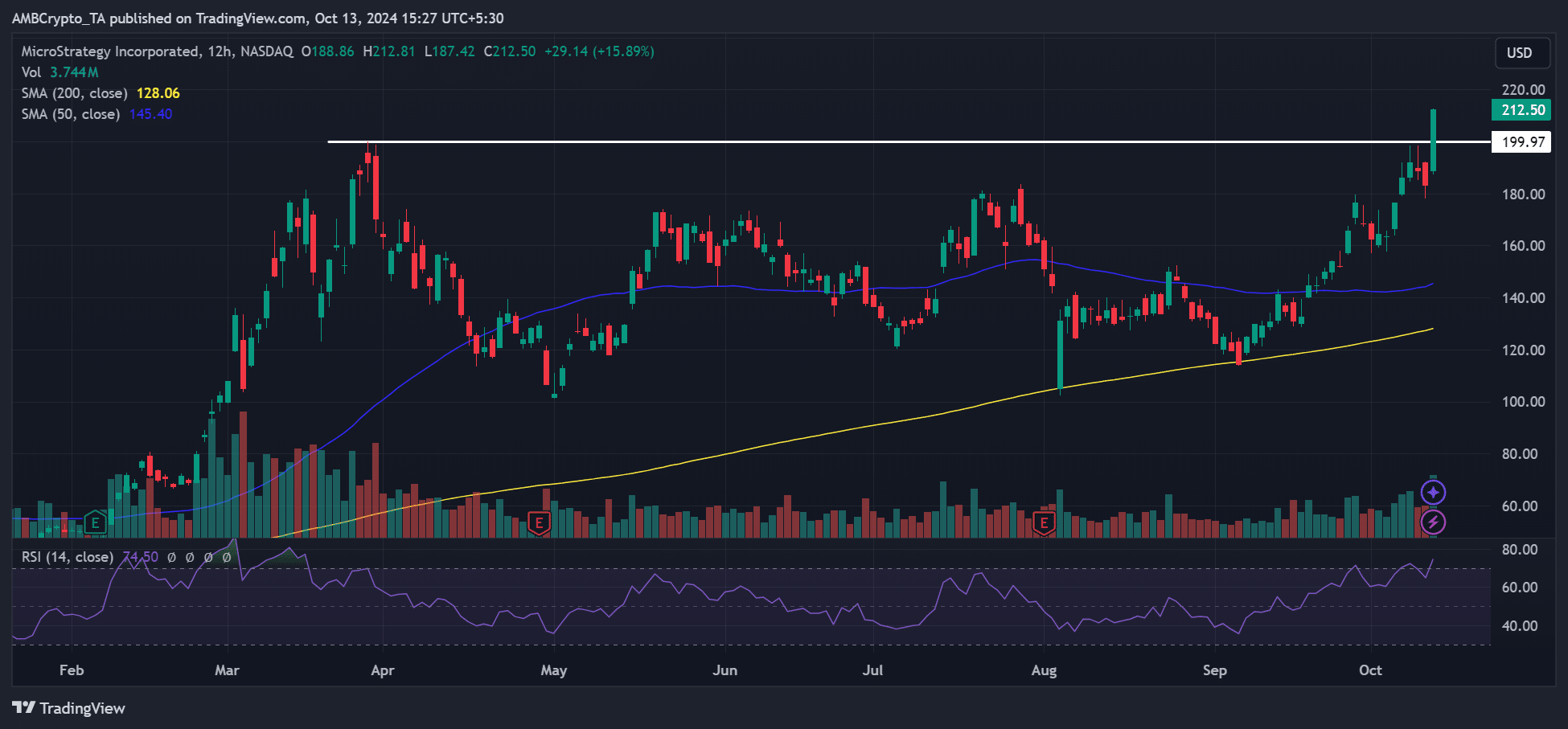

MicroStrategy’s MSTR inventory hit ATH (all-time excessive) after the revelation of its finish aim of changing into a trillion-dollar Bitcoin [BTC] financial institution.

MicroStrategy’s founder, Michael Saylor, informed Bernstein analysts his agency was eyeing a $1 trillion valuation as the most important BTC financial institution.

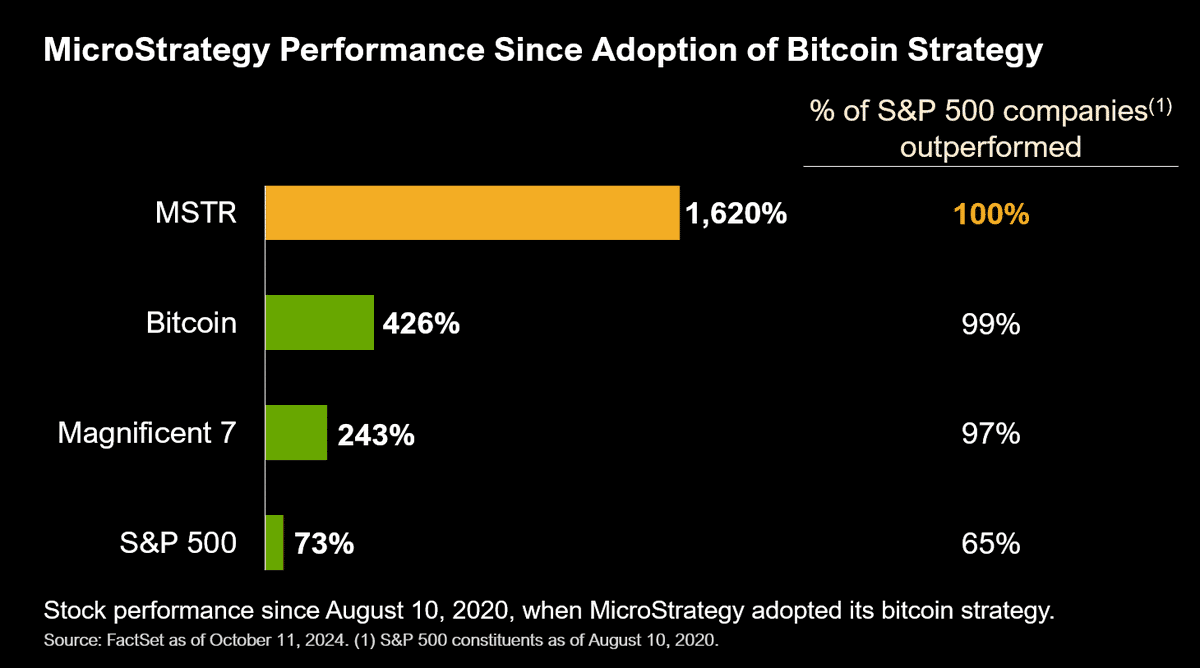

This could be partly aided by its aggressive accumulation of the world’s largest asset, because the analysts projected a value goal of $290 for the inventory.

Following the replace, MSTR soared to a report excessive of $212.50, a 15% improve in the course of the intra-day buying and selling session on October eleventh. It even smashed the $200 resistance.

Bitcoin financial institution end-game

Reacting to MSTR’s rally, Saylor famous that the one factor that performs higher than BTC was extra BTC.

“The only thing better than #Bitcoin is more Bitcoin.”

At press time, MicroStrategy held 252,220 BTC, value about $15.8 billion per information from Bitcoin Treasuries. In most interviews, Saylor has by no means acknowledged whether or not the agency will promote its BTC hoard or its finish aim.

However the end-game was made clear final week.

So, what’s a Bitcoin financial institution?

In accordance with Saylor, BTC financial institution would act like different asset courses and construct monetary entities constructed round them. A part of the Bernstein report acknowledged,

“Michael believes MSTR is in the core business of creating Bitcoin capital market instruments across equity, convertibles, fixed income, and preferred shares etc.”

Saylor had beforehand projected that BTC might hit $3M-$49M by 2045 because the asset expands as a part of international capital.

Thus, the manager projected that creating wealth from creating BTC-based monetary devices like bonds or shares can be simpler than lending out cash held by MicroStrategy.

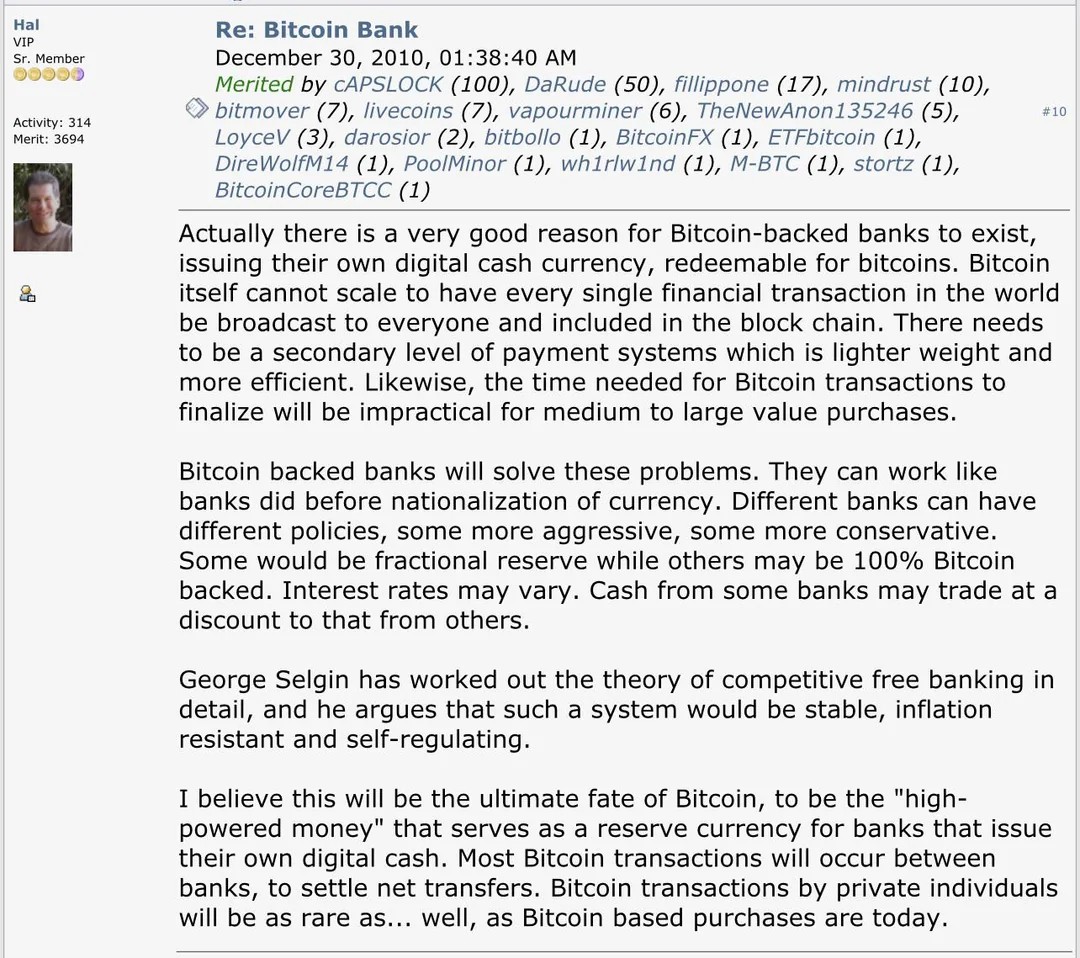

Apparently, Hal Finney, one of many early BTC community contributors, floated the same thought in 2010.

However some referred to as for superior self-custody expertise to make sure such a system stays sincere.

That mentioned, some market pundits foresaw a powerful BTC rally as a optimistic catalyst for MSTR’s worth.

In accordance with monetary marketing consultant Ben Franklin, primarily based on MicroStrategy’s monetary well being and BTC appreciation, MSTR’s worth might develop 6x-10x.