- Bitcoin’s bearish cross traditionally precedes vital value rallies.

- Present market indicators hinted at doable short-term volatility, adopted by a possible uptrend.

The cryptocurrency market seems to now be seeing Bitcoin [BTC] battle to ascertain a constant upward trajectory.

Regardless of reaching heights near $62,000 and lows round $56,000 within the final two weeks, Bitcoin’s value fluctuations have left buyers questioning its subsequent transfer.

At press time, the cryptocurrency was buying and selling at roughly $58,550, reflecting a minor 0.7% enhance over the previous day, with fluctuations between a 24-hour excessive of $59,833 and a low of $57,812.

Bitcoin: Indicators of a doable downturn

Amidst this unsure market conduct, a notable sample has emerged that would trace at future value actions.

Bitcoin has shaped what is called a “bearish cross” on its day by day chart, a technical indicator that may recommend a looming decline.

This time period refers back to the occasion when Bitcoin’s 50-day easy transferring common (SMA), presently at $61,749, drops under its 200-day SMA, which stands at $62,485.

This configuration, usually seen as a sign of short-term market weak point, was identified by the pseudonymous dealer Mags on the social media platform X (previously Twitter).

Whereas the formation of this sample on the chart could sound straightforwardly unfavourable, that may not essentially be the case now.

Mags identified that traditionally, the formation of this bearish cross sample on BTC’s chart has been adopted by vital rallies.

For instance, following a bearish cross in September 2023, Bitcoin’s value surged by roughly 50% inside 4 months. Equally, after a cross in July 2021, the worth elevated by 54% in the identical timeframe.

Mags means that if this sample holds true, Bitcoin could as soon as once more expertise a interval of fluctuating costs earlier than probably reclaiming its transferring averages and initiating a bullish cross, main to a different sturdy rally.

The underlying fundamentals

Regardless of the concentrate on chart patterns, it’s price contemplating Bitcoin’s basic metrics, which supply insights into the broader market stance and investor conduct.

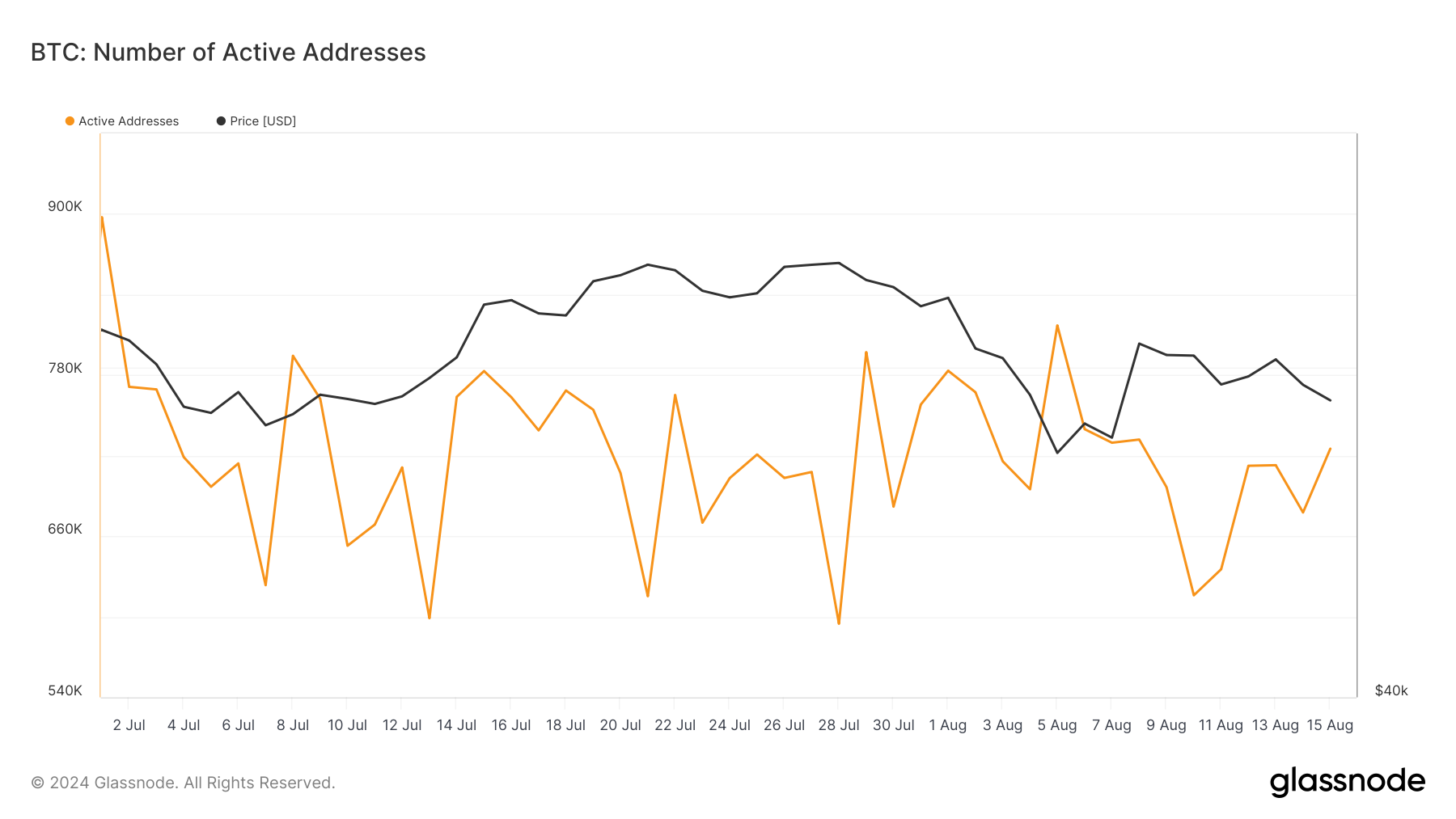

Latest information from Glassnode confirmed that the variety of energetic Bitcoin addresses noticed a major decline from 897,000 in early July to 615,000 by mid-August.

Nonetheless, there was a current uptick to over 725,000 addresses, marking an increase of roughly 17.89%.

This enhance in energetic addresses might recommend a rising engagement inside the Bitcoin community, probably signaling a constructive shift in market sentiment.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

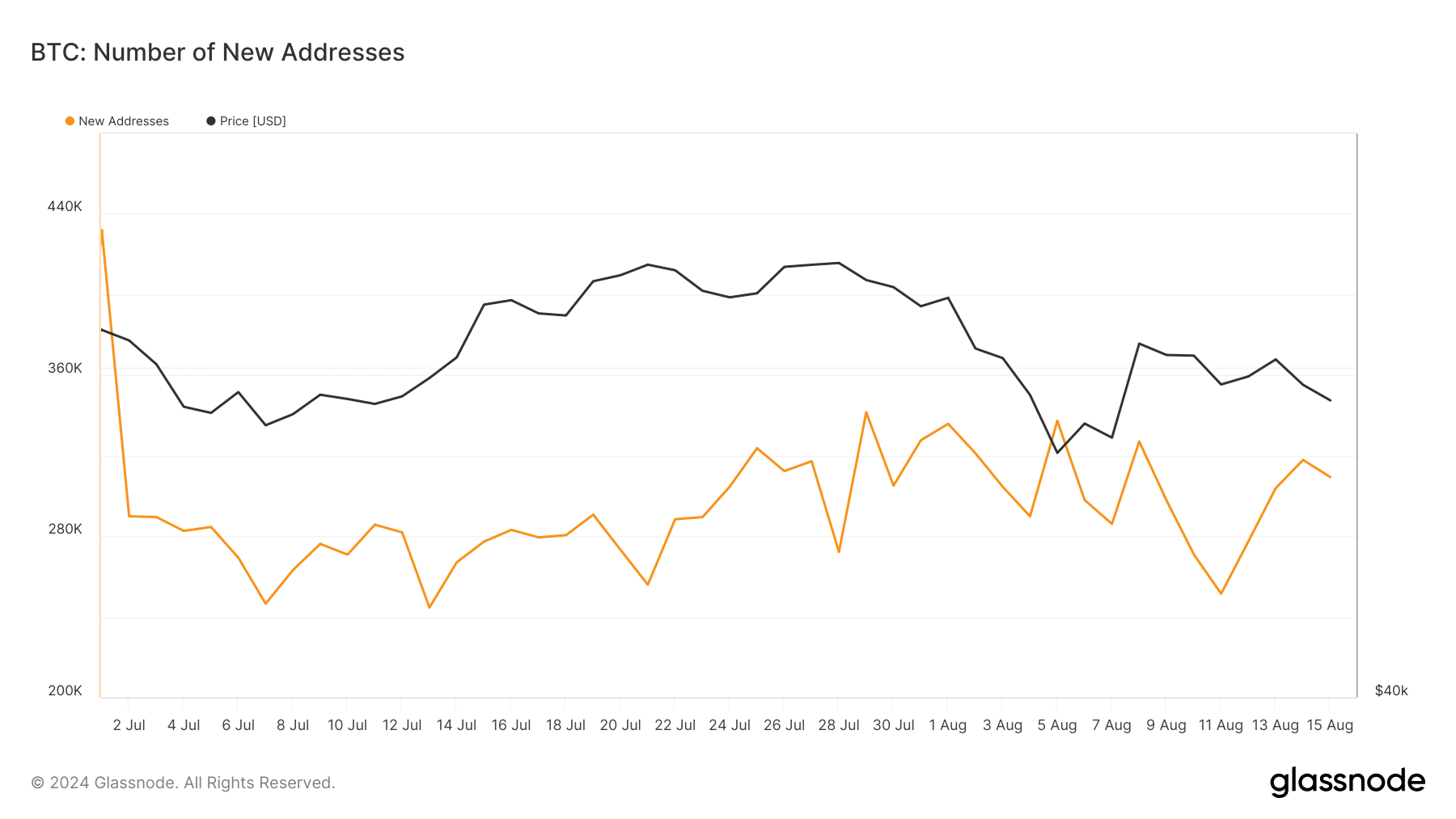

Moreover, the variety of new Bitcoin addresses, an indicator of contemporary investor curiosity, has additionally proven indicators of restoration.

After dropping to 251,000 in early August, there was a rise to over 300,000 new addresses, indicating renewed curiosity and probably extra capital influx into Bitcoin.