- The big measurement of the Choices expiry on 16 August was preceded by a volatility spike in costs

- Worth tendencies may stabilize from right here on, however the bears nonetheless have the higher hand

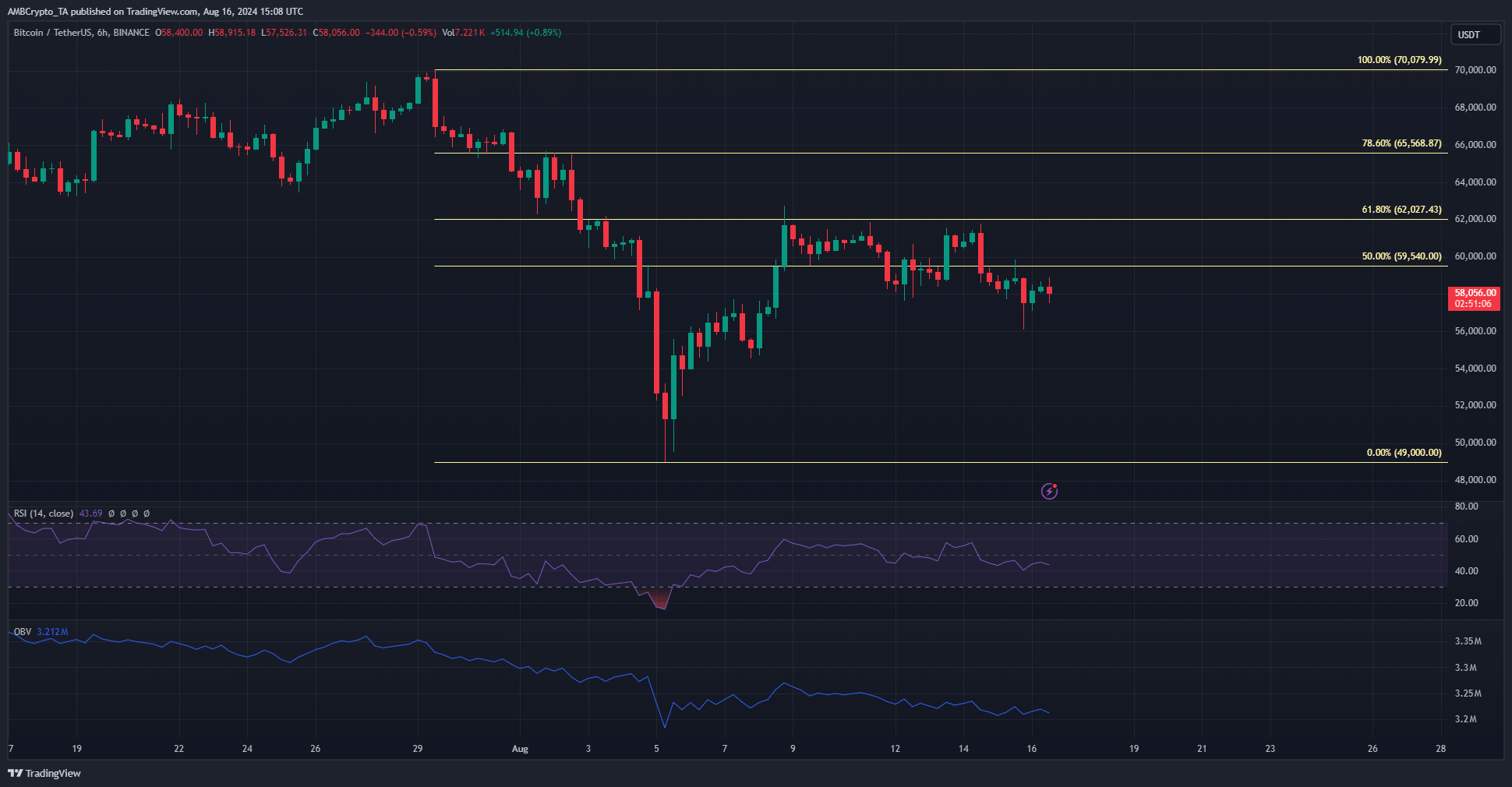

Knowledge on the Bitcoin [BTC] and Ethereum [ETH] Choices expiry on Friday, 16 August, is illuminating. On Wednesday, 14 August, BTC costs fell from $61.8k to $57.9k inside only a day.

Owing to the Choices expiry, one can see the market value tendencies stabilize considerably. Even so, the technical indicators and liquidity charts revealed {that a} transfer south is perhaps doubtless.

Market outlook from the Choices expiry knowledge

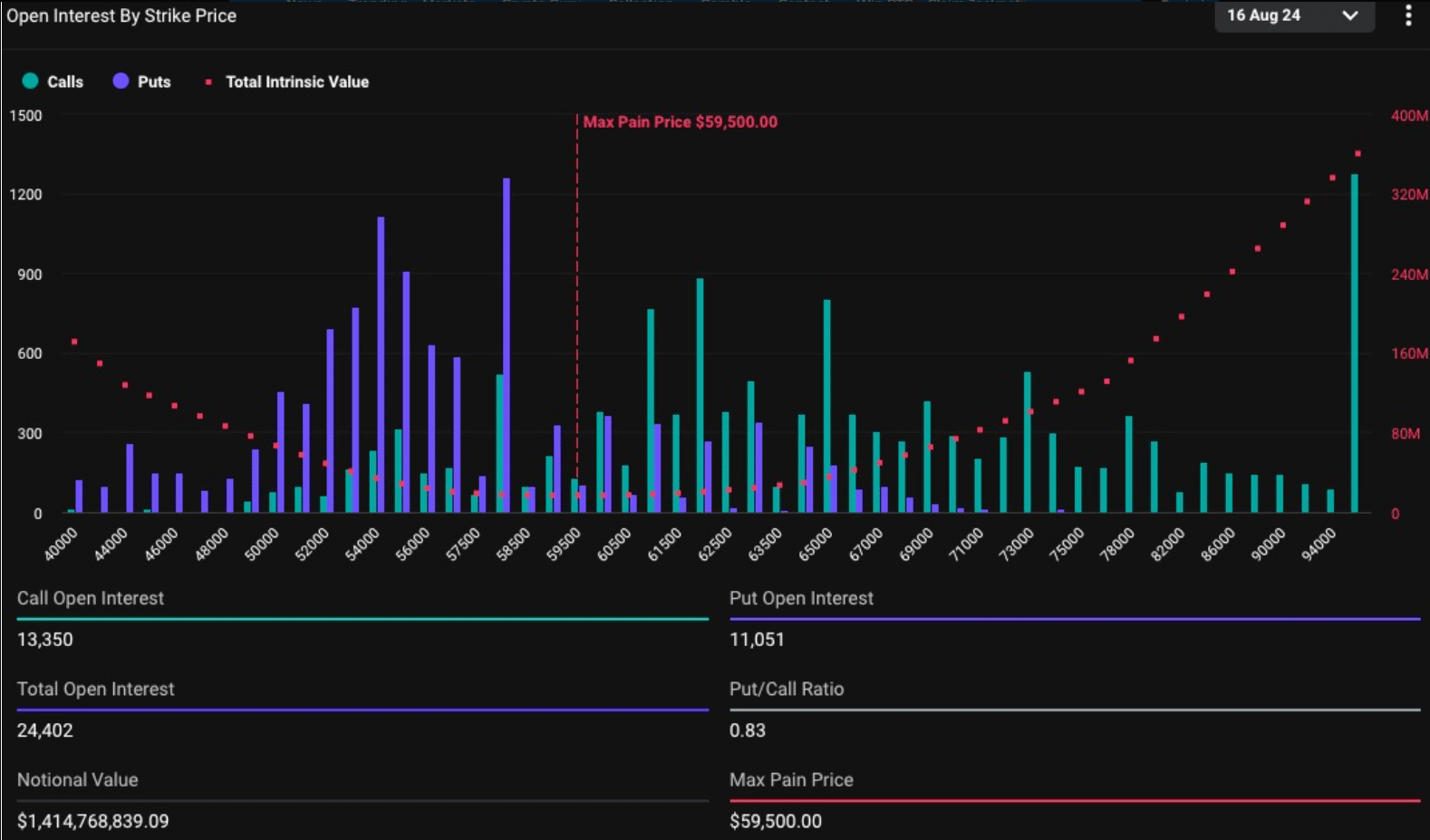

Supply: Deribit

Knowledge from Deribit (through Coingape) revealed that the market outlook for each Bitcoin and Ethereum favored the bearish aspect. For BTC, the notional worth of the entire Open Curiosity stood at $1.414 billion earlier than the expiry on Friday.

The 0.83 put/name ratio confirmed that the market sentiment was barely bullish, however leaned towards a balanced market sentiment. The max ache level was at $59.5k, underlining the place the place most Choices would expire nugatory.

The Thursday value dip beneath $58.5k was not reversed.

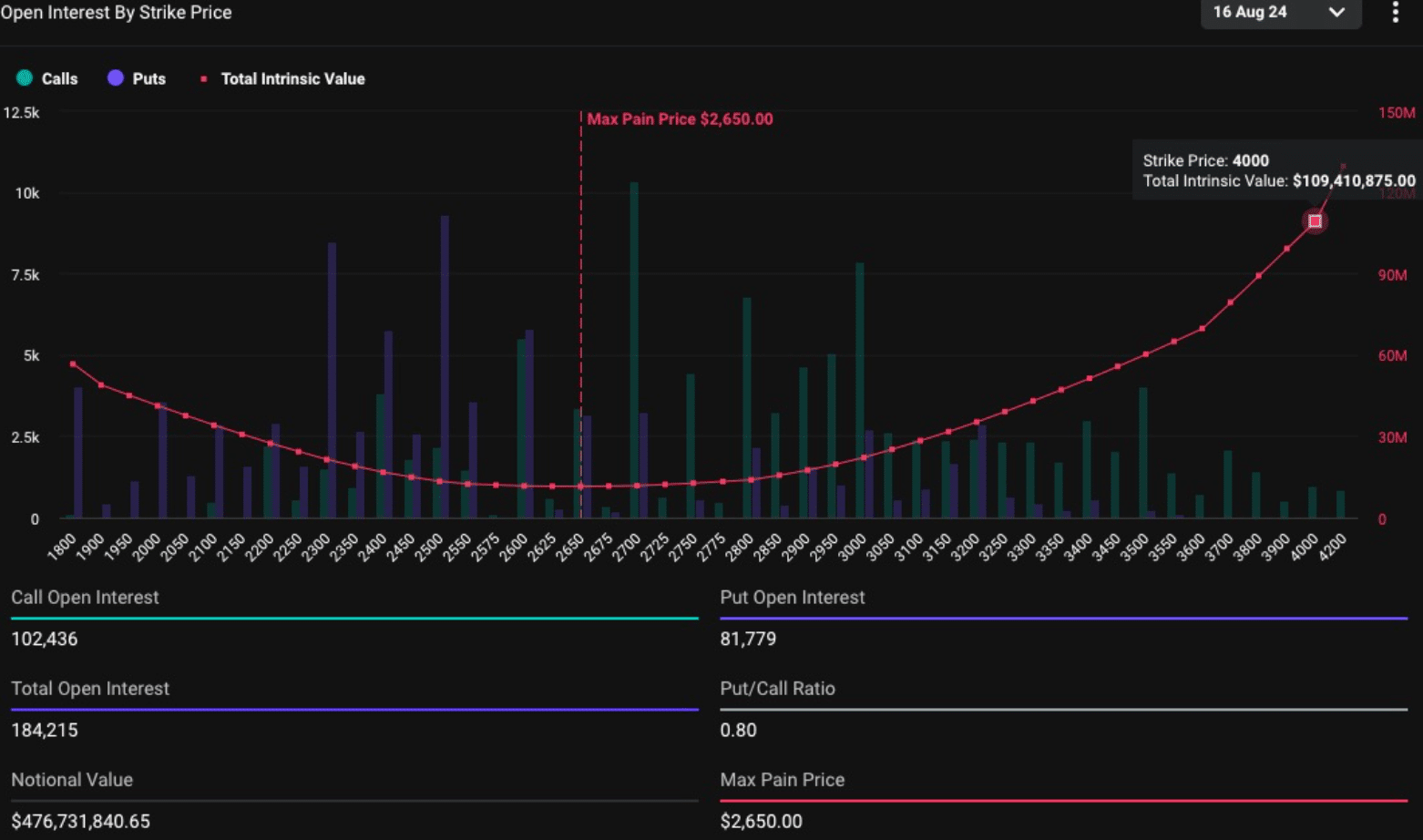

Supply: Deribit

The Ethereum Choices expiry amounted to $476.7 million, and the same put/name ratio to BTC’s meant the market was solely barely bullish. ETH remained beneath $2610, with the max ache level at $2650.

BTC and ETH had been up 0.8% and 0.4% on Friday, respectively, at press time after the huge Choices expiry, which launched volatility and a small value stoop within the late hours of Thursday.

What subsequent for the crypto markets?

The following expectation is that the volatility would ease, however the tendencies for each the leaders stay bearish. Bitcoin has a bearish market construction and the OBV confirmed persistent promoting stress on the 6-hour chart.

The dearth of upward momentum agreed with the construction and didn’t promise a reversal. Ethereum appeared to have an analogous bearish outlook too.

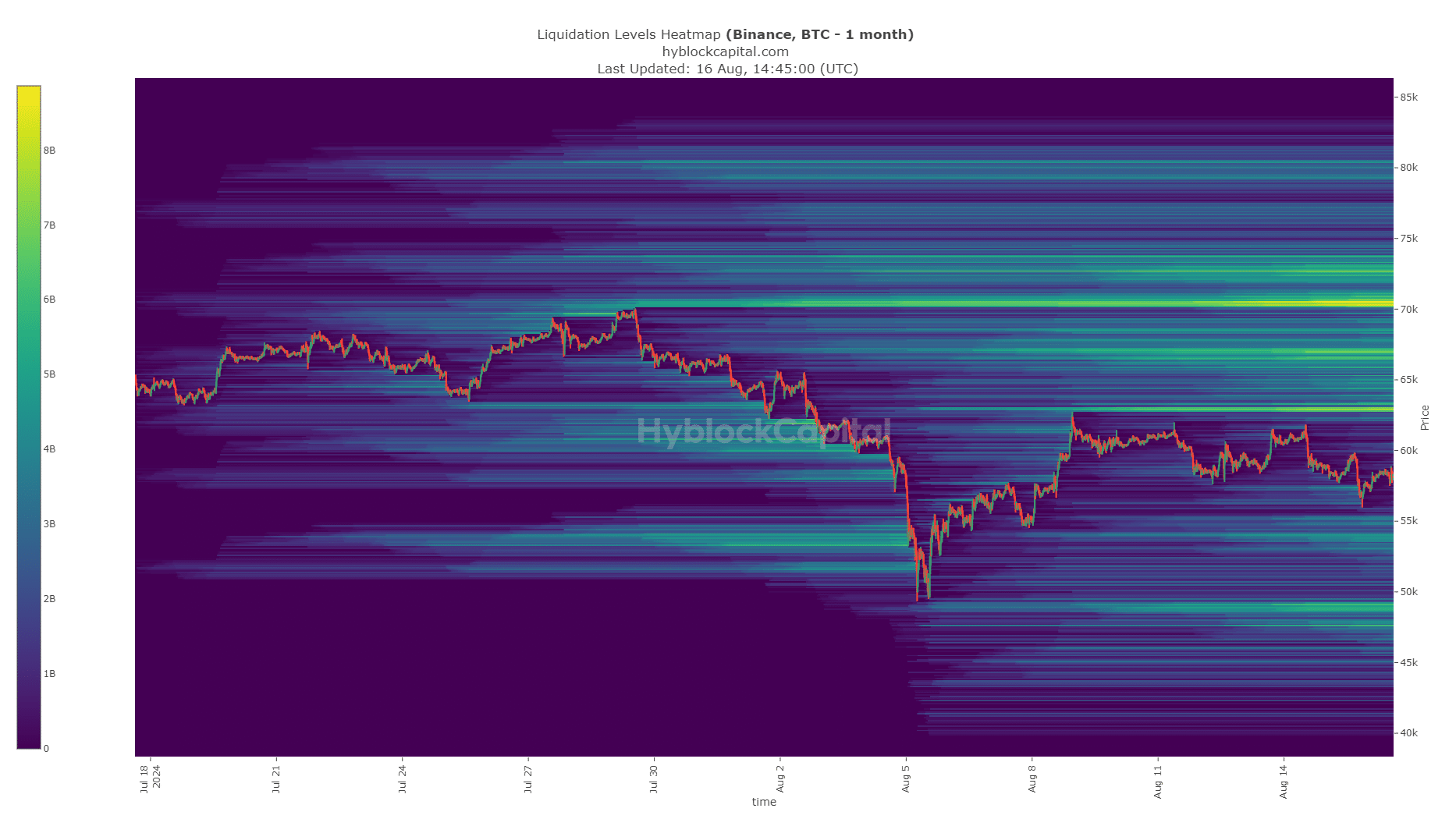

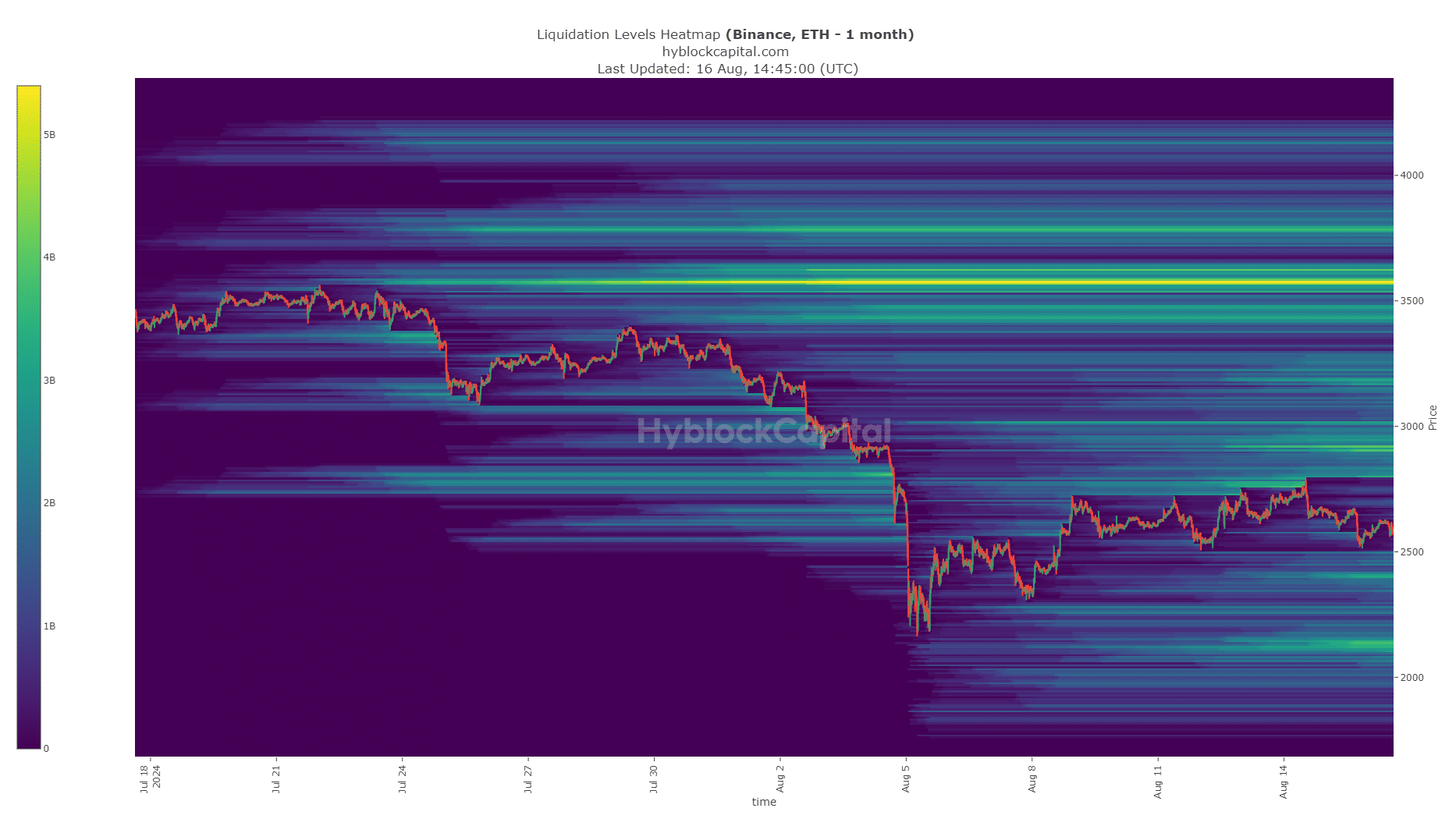

Supply: Hyblock

Actually, the liquidation heatmaps confirmed that downward targets had been nearer, and costs may gravitate towards them extra simply.

For Bitcoin, the closest liquidity pool was at $55.1k, with a similar-sized one at $53.9k as nicely. To the north, the $70k zone, although stuffed with liquidation ranges, may not be reached quickly.

Supply: Hyblock

For Ethereum, the closest pocket was at $2.4k at press time. The upside goal, although much less doubtless, was at $2.8k-$2.9k. The CPI knowledge confirmed a 0.2% month-on-month enhance in July, but it surely was on par with market expectations.

Is your portfolio inexperienced? Examine the Bitcoin [BTC] Worth Prediction 2024-25

With the chances of a giant Fed fee reduce lowered, the technical, liquidity, and macro circumstances all gave the impression to be in favor of the bears for the following month.