- Analysts predicted that Bitcoin might repeat its 2017 and 2021 bull run sample, hinting at an upcoming surge.

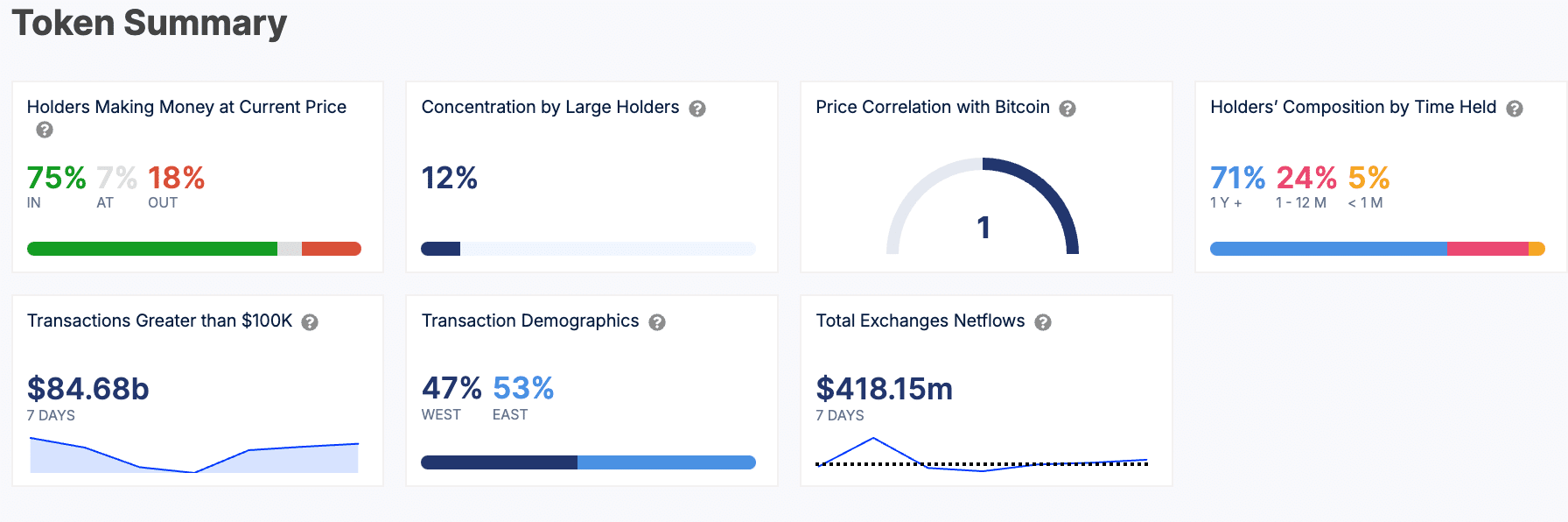

- Regardless of latest dips, 75% of BTC holders remained worthwhile, with whales controlling 12% of the provision.

Bitcoin [BTC] has skilled a notable decline in worth over the previous 24 hours. Beginning at round $60,890, Bitcoin confirmed temporary indicators of resilience, with some upward momentum early on.

Nonetheless, it quickly confronted a pointy drop, falling beneath the $59,000 threshold.

As of press time, Bitcoin traded at $58,315.93, reflecting a 4.21% lower during the last 24 hours. Regardless of this, Bitcoin has seen a 1.96% value improve previously week.

With a circulating provide of 20 million BTC, Bitcoin’s market capitalization stood at $1.15 trillion.

Bitcoin’s latest efficiency has drawn comparisons to earlier bull markets, significantly these of 2017 and 2021.

Based on analyst Moustache on X (previously), Bitcoin’s present trajectory is much like these previous cycles, albeit at a quicker tempo.

Moustache famous,

“If you think the bull market is over, open the charts. BTC is doing the same as in 2017 and 2021, it’s just happening faster in terms of timing. The last time the ROC & SROC indicator changed from red to green was in 2016. A massive wave is coming imo.”

The historic sample in Bitcoin’s value exhibits recurring bullish cup-and-handle formations which have preceded main rallies in 2017 and 2020, with one other potential rally anticipated in 2024.

These patterns included a “retest” section, the place the value consolidates earlier than breaking out to new highs.

Actually, this historic pattern recommended that Bitcoin could be making ready for one more vital upward motion because it approached the following retest in 2024.

Market sentiment and value assist

Regardless of the latest decline, market sentiment round Bitcoin remained largely optimistic. Moustache added,

“It’s always funny to see the bears coming out and posting horror scenarios even though BTC is down just 5%. They probably haven’t realized that Bitcoin has already been above the 2021 ATH for 7 months. That’s called support. Very, very strong support.”

Present technical indicators offered blended alerts. The Bollinger Bands recommended lowering volatility, as the value remained near the center band.

The MACD histogram was within the adverse zone at press time, indicating bearish momentum, however this momentum seemed to be weakening.

Nonetheless, the MACD line was approaching a possible bullish crossover, which might sign a reversal within the present pattern.

General, Bitcoin was consolidating inside a variety, and a breakout might outline the following main transfer.

Bitcoin abstract and market alerts

Based on IntoTheBlock information, Bitcoin’s token abstract revealed that 75% of holders had been profiting at its present value. 18% had been at a loss, whereas 7% broke even. Whales managed 12% of the whole provide.

Concerning holders’ composition, 71% have held Bitcoin for over a yr, 24% for 1–12 months, and 5% for lower than a month.

Over the previous seven days, transactions exceeding $100,000 totaled $84.68 billion, with 53% of those transactions originating from the East and 47% from the West.

Moreover, whole change netflows amounted to $418.15 million throughout this era.

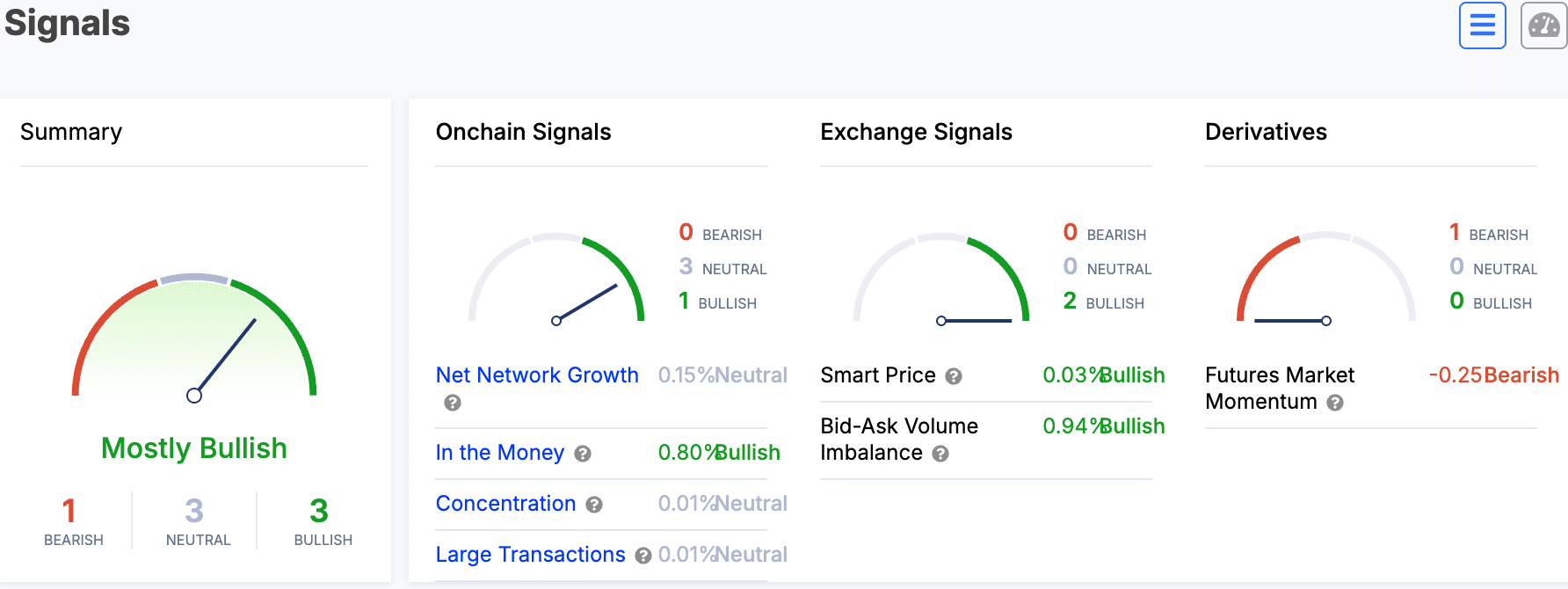

Market alerts indicated an general “mostly bullish” sentiment. On-chain alerts confirmed three impartial indicators and one bullish, with internet community progress at 0.15%, categorized as impartial.

In the meantime, 0.80% of holders had been “in the money,” a bullish indicator. Trade alerts had been completely bullish, with a 0.06% improve in good value and a 2.13% bid-ask quantity imbalance.

Nonetheless, the derivatives market mirrored some bearish sentiment, with Futures market momentum at -0.25%.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Based on AMBCrypto’s take a look at DefiLlama information, Bitcoin had a Whole Worth Locked of $620.01 million at press time, with a 24-hour quantity of $201,892 and 662,757 lively addresses.

This evaluation recommended that, regardless of short-term fluctuations, Bitcoin could also be gearing up for one more vital upward motion, harking back to earlier bull markets.