- The Pi Cycle High indicator predicted ETH’s market backside to be $3,285.

- Metrics revealed that purchasing strain on the token was rising.

Newest information revealed that Ethereum [ETH] had underperformed for the reason that starting of this bull market. Nevertheless, the development has modified during the last week because the king of altcoin has showcased promising efficiency.

Ethereum’s volatility shot up

Matrixport, an all-in-one crypto monetary providers supplier, not too long ago posted a tweet highlighting an fascinating improvement. As per the tweet, the 30-day realized volatility unfold between Ethereum and Bitcoin [BTC] has stayed inside a 1.0 to 1.5 ratio.

This indicated that at its peak, Ethereum had been 50% extra unstable than Bitcoin. Ethereum has underperformed for the reason that starting of this bull market. That’s why its elevated volatility has made it a much less fascinating asset to purchase.

The tweet additionally talked about,

“However, as long as the volatility ratio stays within this range, buying Ethereum volatility at the lower end could present an attractive opportunity.”

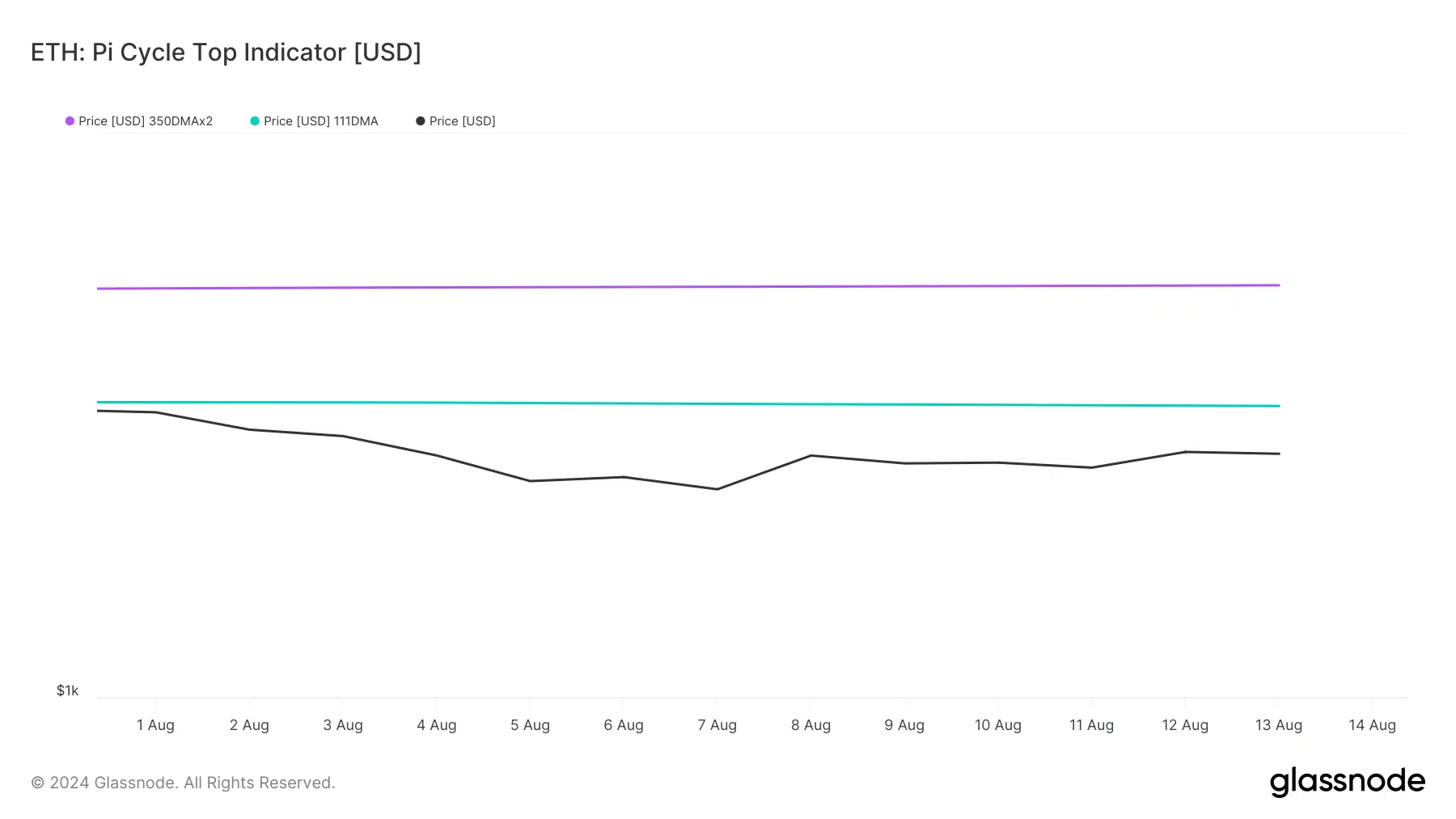

Due to this fact, AMBCrypto checked Glassnode’s information to seek out out whether or not metrics additionally advised that this was the correct time to build up ETH. The Pi Cycle high indicator revealed that ETH was buying and selling beneath its potential market backside of $3,285.

This advised that the token’s worth may quickly acquire bullish momentum, permitting it to succeed in that mark in any case. Notably, the metric additionally revealed that ETH’s potential market high was $5,378.

Is shopping for strain rising?

For the reason that aforementioned information revealed that there was a chance to build up ETH at a cheaper price, AMBCrypto checked CryptoQuant’s information to seek out out whether or not traders have already began to stockpile.

We discovered that ETH’s change reserve was dropping, that means that purchasing strain was on the rise. Moreover, Ethereum’s Coinbase Premium identified that purchasing sentiment was comparatively sturdy amongst U.S. traders.

CoinMarketCap’s information revealed that the bulls have already buckled up, because the token’s worth had surged by greater than 7% within the final week. On the time of writing, ETH was buying and selling at $2,727.75 with a market capitalization of over $328 billion.

Nevertheless, at press time, ETH’s worry and greed index was in a “greed” place. Each time the metric hits that stage, it signifies that there are probabilities of a worth drop.

Due to this fact, AMBCrypto checked ETH’s each day chart to seek out out whether or not this newly gained bullish momentum would final.

Learn Ethereum (ETH) Value Prediction 2024-25

The technical indicator MACD displayed a bullish crossover. ETH’s Chaikin Cash Move (CMF) registered an uptick. The Relative Power Index (RSI) additionally adopted the same path.

These market indicators advised that ETH bulls may proceed to dominate this week.