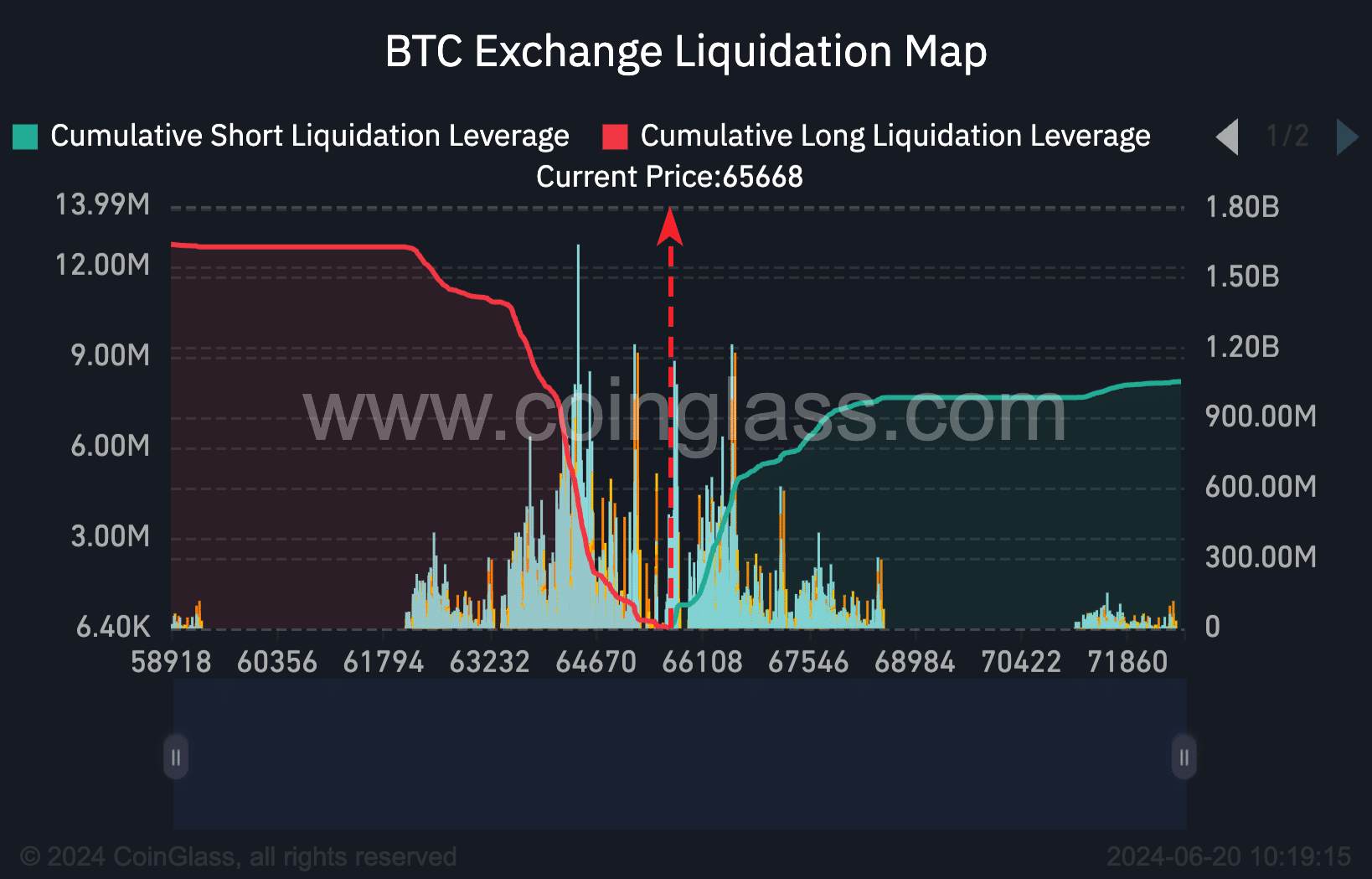

- $1.84 billion in Bitcoin quick positions in danger if it hits $70,000.

- Latest bullish indicators counsel a possible surge, regardless of ongoing market corrections.

Amid the turbulence of the crypto markets, Bitcoin’s [BTC] resilience is being examined because it battles to reclaim the $70,000 threshold, a worth level teeming with potential liquidations.

Brief sellers, laden with bearish bets, are intently monitoring each market tick, with important monetary stakes hanging within the steadiness.

Bitcoin nears key thresholds

Bitcoin was buying and selling at $65,802 at press time, reflecting a slight uptick of 0.7% during the last 24 hours, but it nonetheless information a virtually 7% drop over the previous week.

The crypto market’s present state exhibits a strong battle between hope and warning.

This sentiment is primarily fueled by the in depth quantity of quick positions totaling $1.84 billion, which faces the specter of liquidation, in response to information from Coinglass, ought to Bitcoin surge again to $70,000—a stage unseen since early June.

The potential for Bitcoin reaching this pivotal worth has been a subject of appreciable dialogue.

Joshua Jake, CEO of Uncover Crypto, shared his insights on X (previously Twitter), stating,

“Markets are incredibly bullish right now. Bitcoin and ETH Liquidations are stacked. Bounce imminent.”

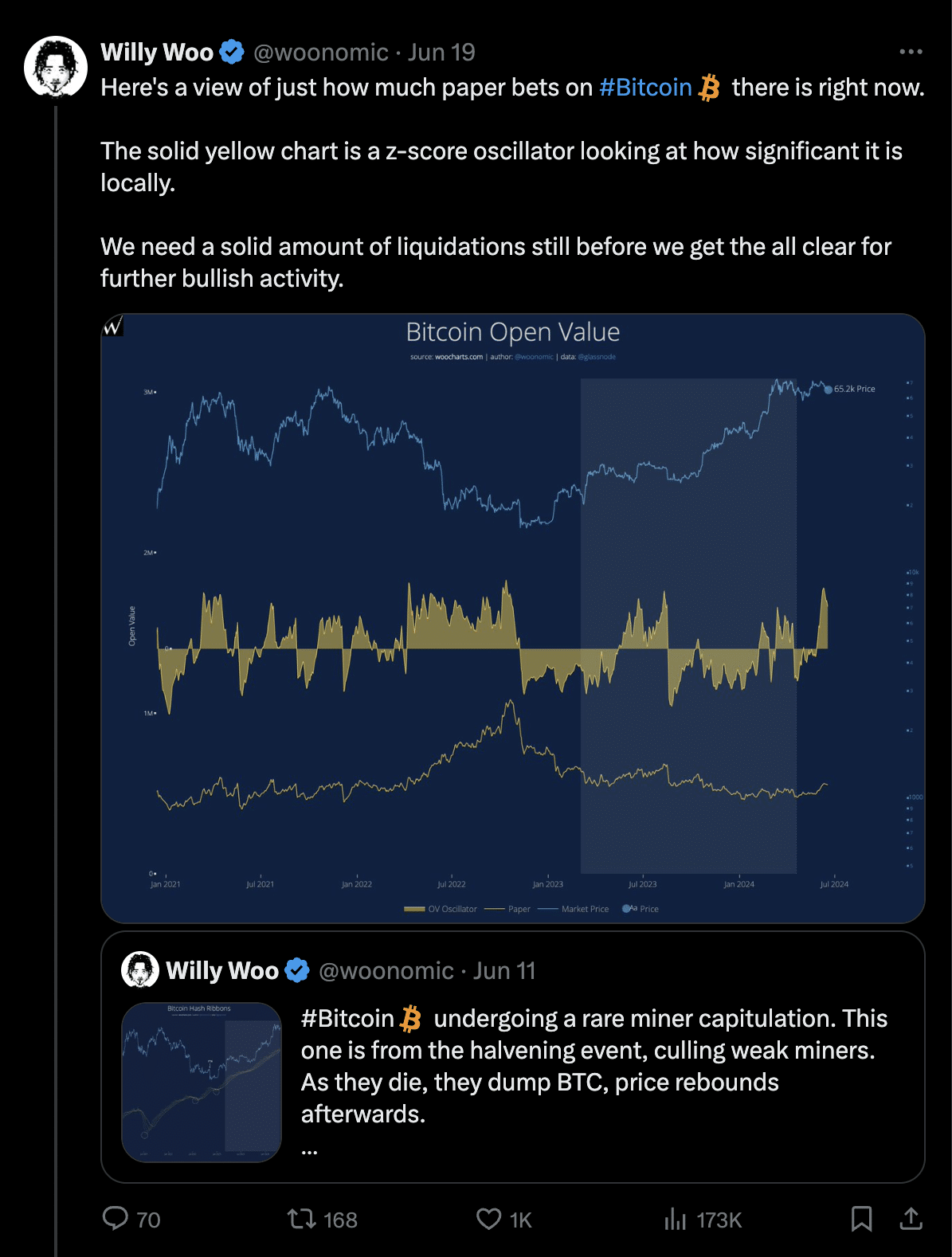

This sentiment was echoed by distinguished crypto analyst Willy Woo, who recommended on the identical platform {that a} substantial wave of liquidations may be essential to clear the trail for a bullish resurgence.

Analyzing BTC’s fundamentals

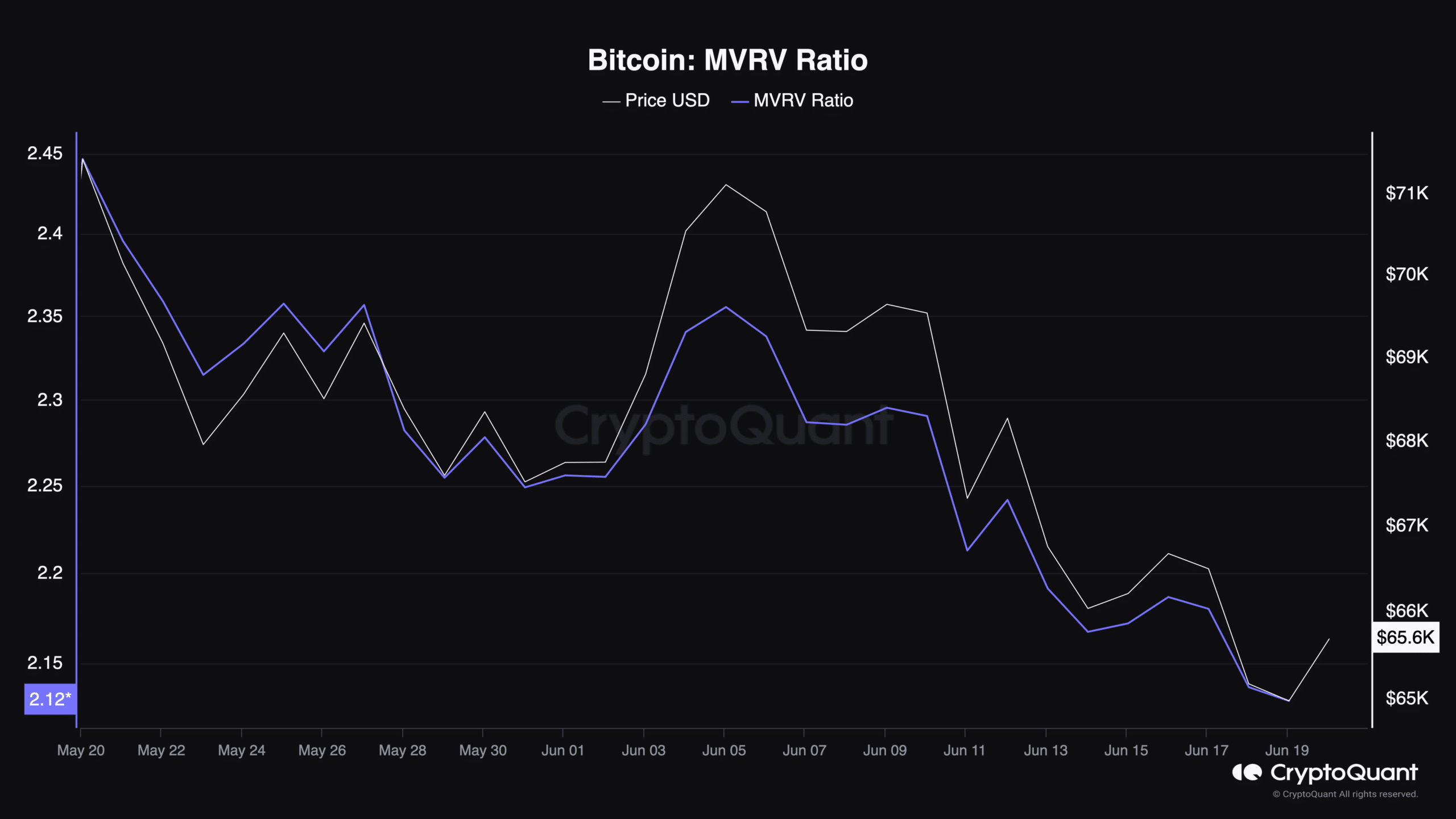

Delving into Bitcoin’s fundamentals, the MVRV ratio—a metric that compares the market worth to realized worth—has lately declined alongside the value, at the moment standing at 2.12, in response to information from CryptoQuant.

This determine means that Bitcoin may nonetheless be undervalued, providing a doubtlessly profitable entry level for buyers who consider within the forex’s long-term viability.

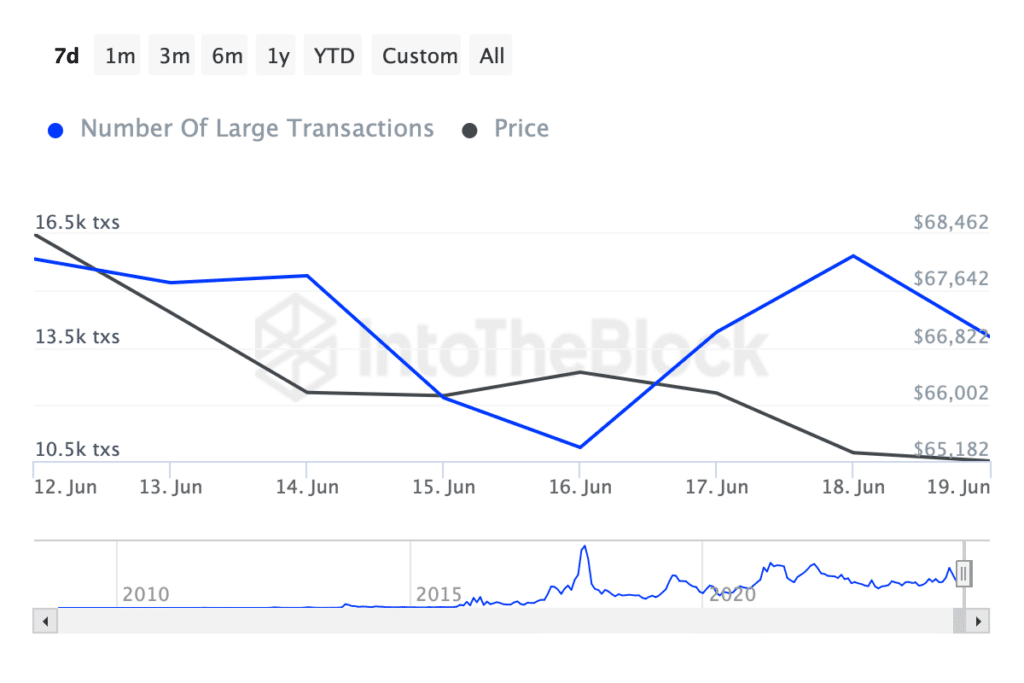

Moreover, there was a notable enhance in Bitcoin transactions exceeding $100k, which rose from beneath 10,000 to 13,000 transactions over the previous week.

This surge in massive transactions is usually seen as an indication of heightened exercise and curiosity from substantial buyers or establishments.

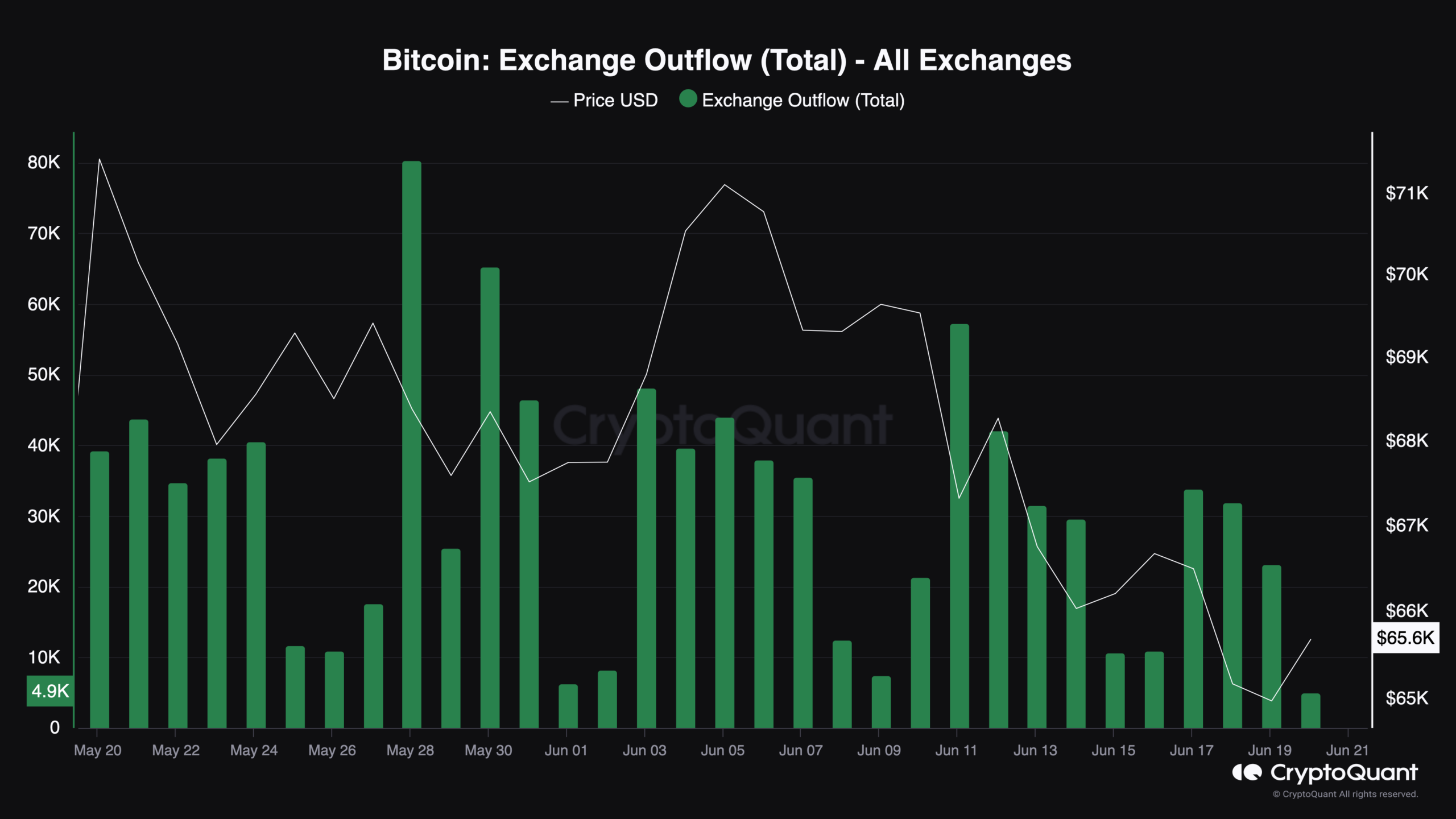

Complementing the transactional information, change outflow metrics from CryptoQuant have additionally indicated elevated exercise.

Particularly, Bitcoin outflows from exchanges spiked to over 33,000 BTC on seventeenth June, a big rise from figures recorded simply days prior.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Such outflows can typically sign accumulating conduct by buyers, suggesting a doable preparation for a worth enhance as cash transfer from exchanges to non-public wallets for long-term holding.

Regardless of these doubtlessly bullish indicators, there stays a cautionary notice from AMBCrypto, which reported a key Bitcoin metric signaling a possible additional correction that would depress costs to as little as $54,000.