- World attain of BTC ETFs develop with the Australian Inventory Alternate set for a brand new itemizing on twentieth June.

- It stays to be seen whether or not the US spot ETH ETF approvals will enhance demand for BTC ETFs.

Australian Inventory Alternate (ASX), the most important change in Australia, has joined the Bitcoin [BTC] ETF occasion by approving its first BTC ETF product from asset supervisor VanEck.

The product, VanEck Bitcoin ETF (VBTC), might be listed on June twentieth, marking the historic debut of an ETF involving the most important digital asset on ASX.

Andrew Campion, ASX’s normal supervisor of funding merchandise, advised the Australian Monetary Assessment (AFR) that the delay in approving BTC ETFs on the change was as a result of 2022 crypto winter. Campion added,

“However with the restoration of cryptocurrency costs, we’ve had a good bit of curiosity over the past 12 months, and that’s culminated within the approval.’

ASX signaled renewed curiosity after US and Hong Kong spot BTC ETFs went stay.

Demand for Bitcoin ETF Australia

On his half, Arian Neiron, Asia Pacific managing director at VanEck, emphasised the rising investor demand for BTC.

‘Bitcoin has remained an rising asset class that many advisers and traders need”

The ASX’s itemizing is a good sign for Australian traders searching for regulated avenues for buying and selling and investing in BTC.

Comparable merchandise have additionally lately been launched on the second largest Australian change, Cboe Australia, a key competitor to ASX.

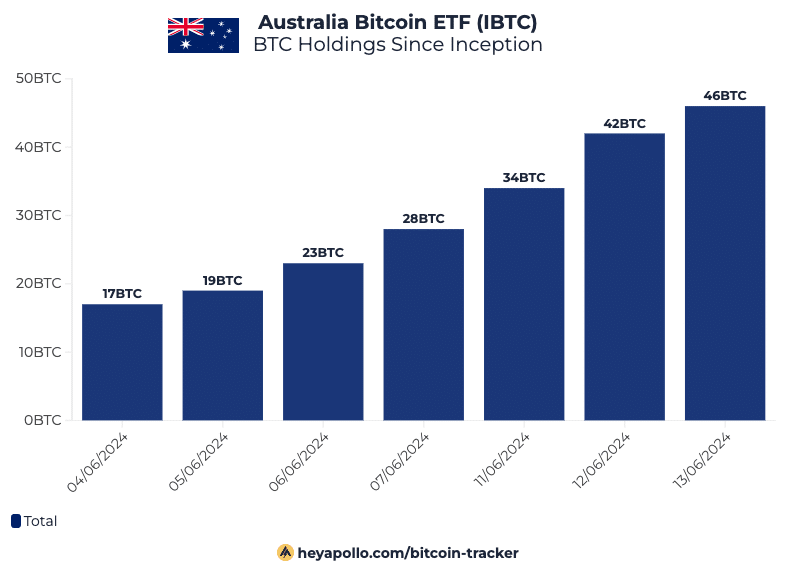

Notably, Monochrome Bitcoin ETF (IBTC) debuted and began working on Cboe Australia on June third. As of June 14th, the product had gathered 46 BTC, Julian Farher, a Bitcoin analyst and investor, revealed.

Apparently, the ASX’s itemizing will begin buying and selling only a few days earlier than US spot Ethereum [ETH] ETF approval. Many analysts view it as a catalyst for the general market. Whether or not or not it should ramp up demand for the Australian BTC ETFs stays to be seen.

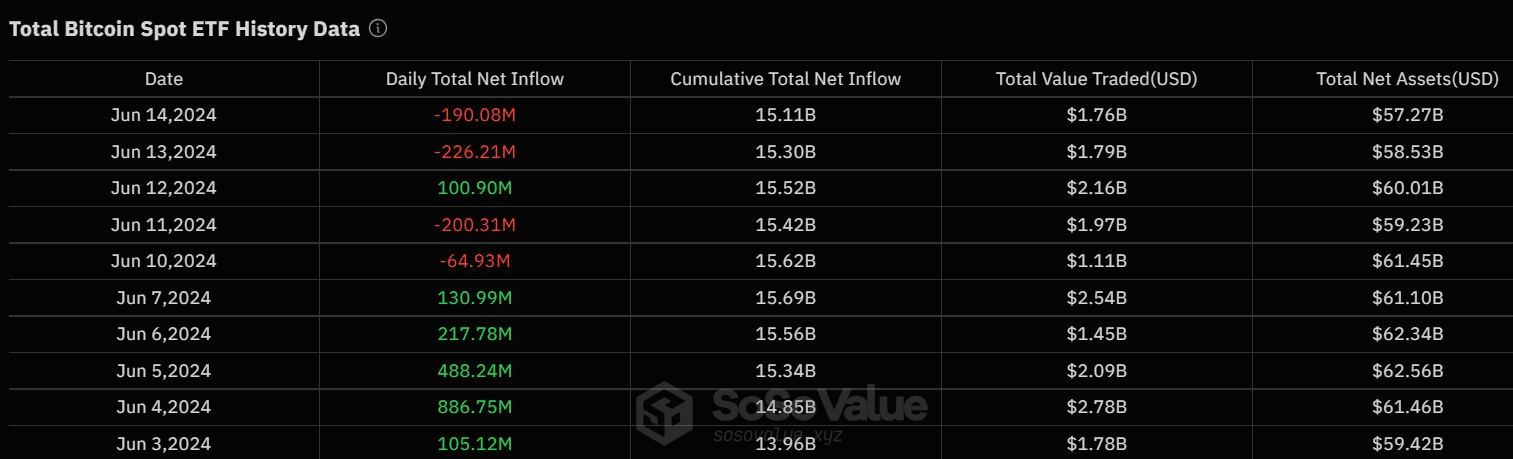

Nonetheless, the spot US BTC ETFs recorded vital outflows final week as traders de-risked earlier than and after the Fed’s resolution to maintain rates of interest unchanged for the seventh time.

Other than 12 June, the remainder of final week noticed large outflows value over $680 million, underscoring US traders’ risk-off strategy.

As of press time, the king coin slipped under $66K. It may pattern decrease to the vary low if the bearish sentiment persists.

Moreover, per Coinglass knowledge, the general market’s Open Curiosity (OI) charges have been purple as of press time, indicating low liquidity within the derivatives market and reinforcing the bearish sentiment.