- Although earlier inflows have been value billions, the ETF registered a web outflow on the tenth of June.

- Lengthy-term holders have been cashing out, suggesting an extra decline for BTC.

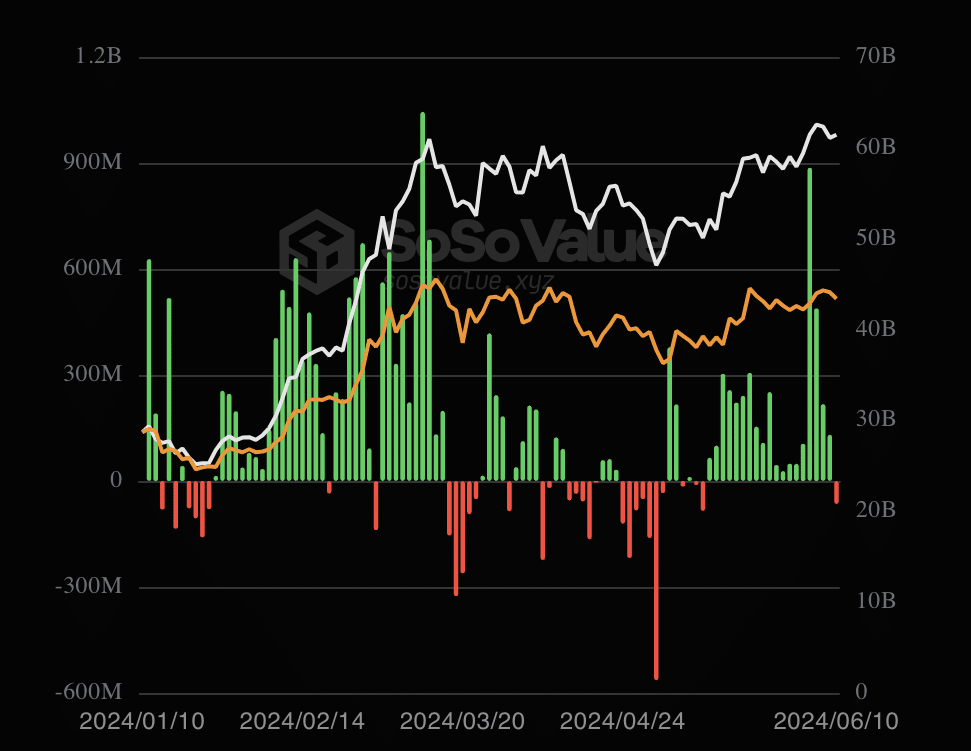

Bitcoin [BTC] ETFs have registered 19 consecutive days of inflows after enduring outflows for an extended interval. Led by BlackRock Bitcoin ETF, the inflows have been value nearly $3 billion in the previous couple of weeks.

For instance, on the tenth of June, BlackRock recorded an influx of $6.34 million. Bitwise’s IBIT had $7.59 million. Nevertheless, the tides appear to have modified as Grayscale’s GBTC had the next outflow at$39.53 million.

Because of GBTC’s file, the overall outflow was larger than the influx. For the unaccustomed, a Bitcoin ETF is just not the identical as BTC, the cryptocurrency.

The outflows are taking the highest spot

For Bitcoin ETFs, you don’t have to personal Bitcoin. As an alternative, you solely have to have publicity to the cryptocurrency as the worth influence the Web Asset Worth of the ETF.

Within the first quarter (Q1) of 2024, the property, led by BlackRock Bitcoin ETF, recorded billions of {dollars} in inflows on a number of days. Due to this, the worth of the coin rallied to a brand new all-time excessive in March.

In a while, the cash stopped coming in, thereby, main Bitcoin to slide under $60,000 at one level. However the resurgence in the previous couple of weeks ensured that BTC’s correction slowed down.

Additionally, it was throughout the identical interval that BlackRock Bitcoin ETF hit $20 billion in AUM. AUM stands for Property Below Administration. The AUM displays the influx and outflow of a fund, and the worth efficiency of the property.

Nevertheless, with the current enhance in outflows, Bitcoin’s worth is likely to be heading for a decline. At press time, BTC modified fingers at $67,539. This represents a 2.63% lower within the final 24 hours.

Will BTC slip under $67,000?

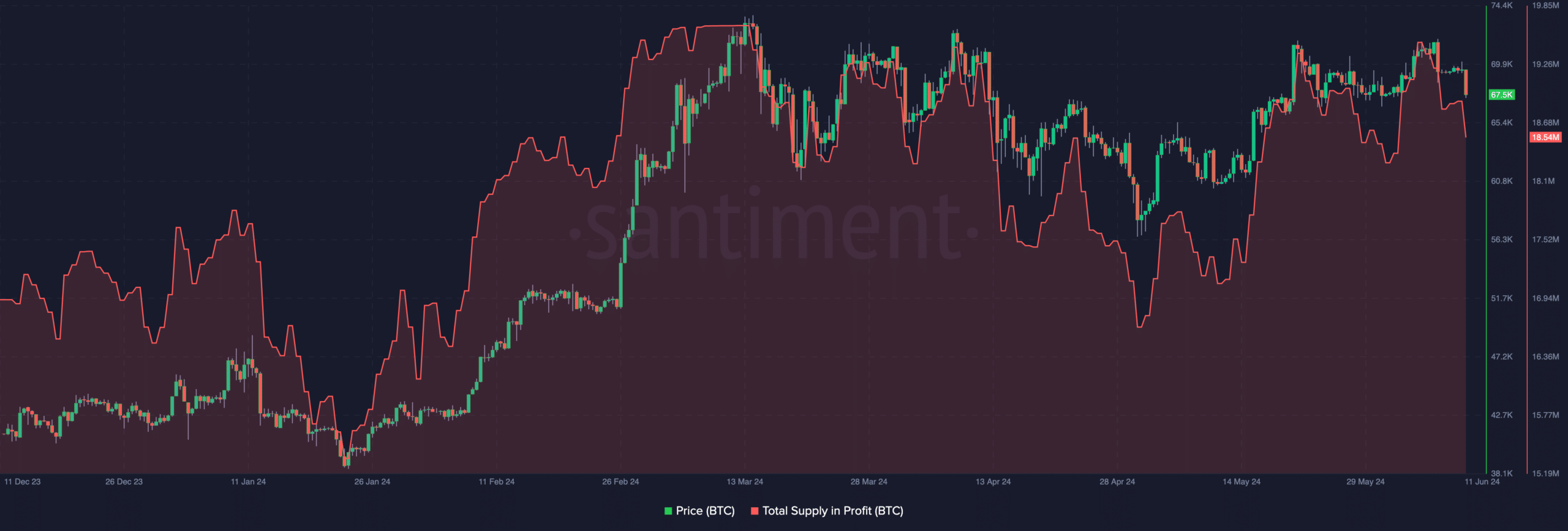

Because of this, the overall provide in revenue dropped. In accordance with Santiment, Bitcoin’s whole provide in revenue has declined to 18.54 million from a ceiling of 19.64 million.

Ought to Bitcoin worth proceed to drop, the provision in revenue will even head downwards. Nevertheless, a decrease revenue provide may very well be an opportunity for market members to purchase the coin at a reduction.

If this purchase sign seems, Bitcoin may rebound towards $70,000 within the brief time period. Nevertheless, if promoting stress continues, the worth of BTC may lower to $65,000.

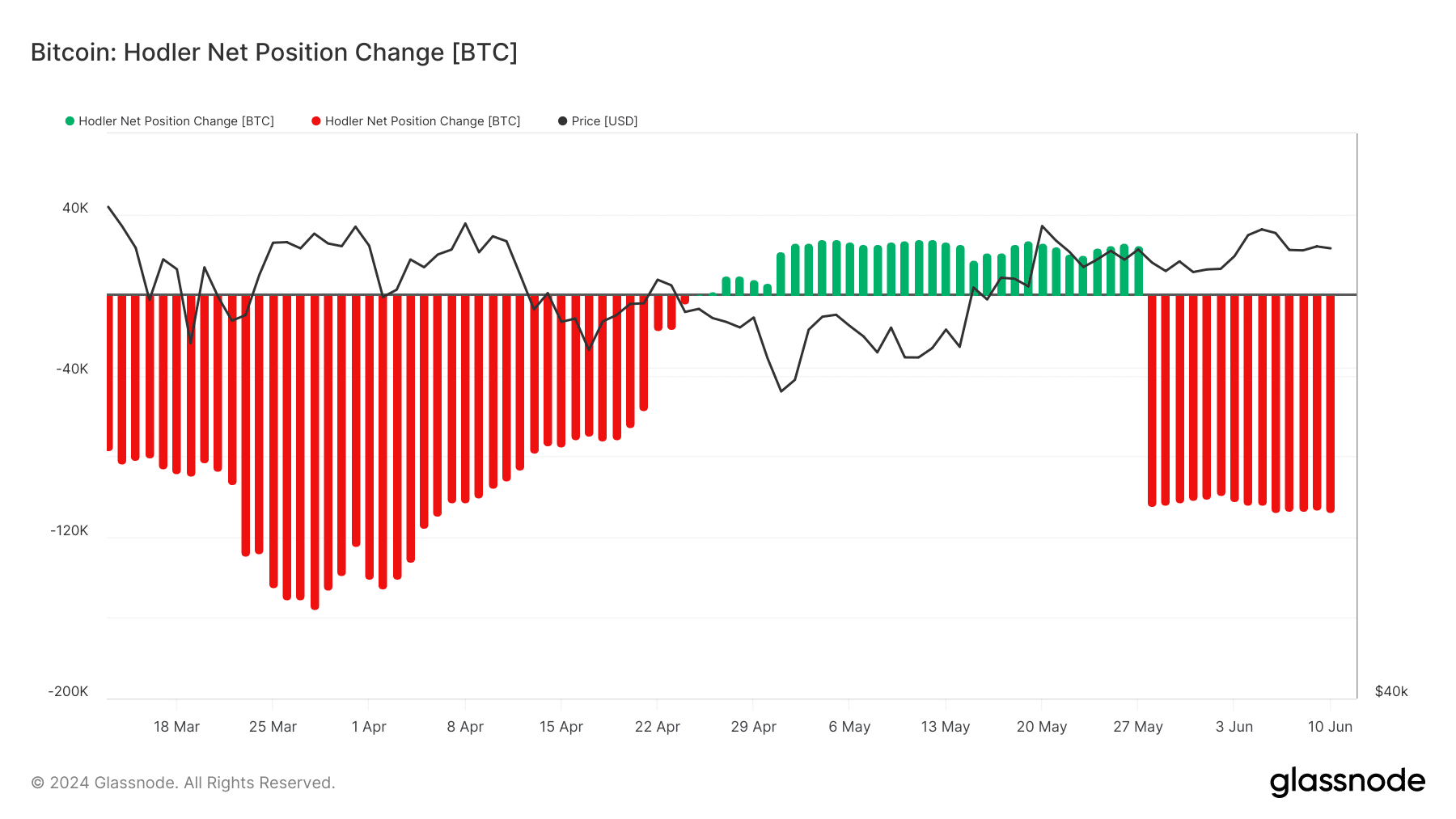

Aside from BlackRock Bitcoin ETF and the metric above, AMBCrypto checked out an important indicator. The metric thought of was the Hodler Web Place Change.

A optimistic studying of this indicator counsel that long-term holders are accumulating. Alternatively, a adverse worth implies a rise in Bitcoin cashed out.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

In accordance with Glassnode, Bitcoin’s Hodler Web Place Change was -107.211 BTC. This suggests that HODLers have been reserving income.

As such, Bitcoin’s worth may lower slightly than rebound. Nevertheless, the bearish bias may very well be invalidated if accumulation begins to return in massive numbers.