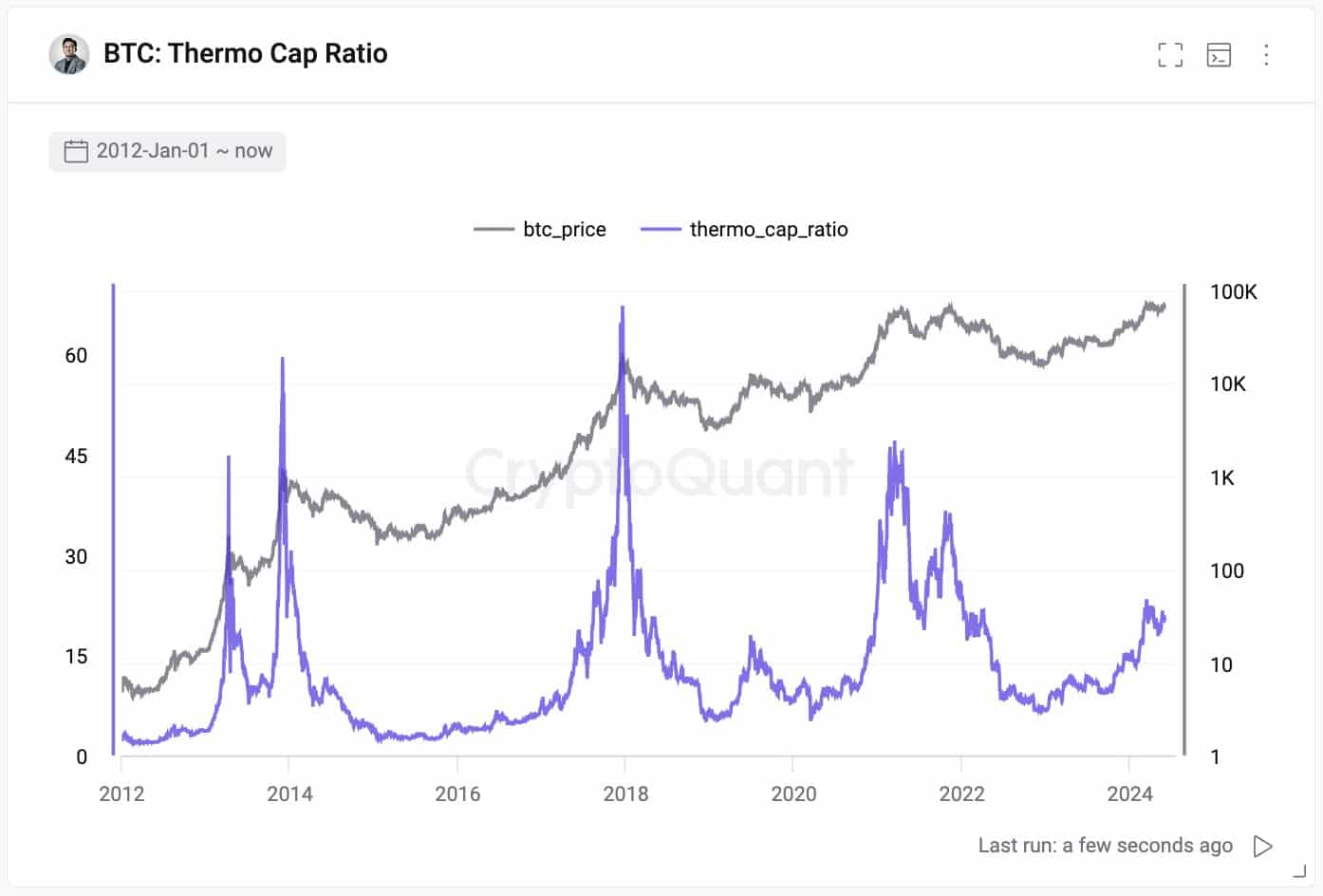

- Bitcoin has a powerful thermo cap ratio that underlined sturdy investments into the community.

- The transaction quantity and unrealized income metrics steered Bitcoin’s overvaluation and potential correction, respectively.

Bitcoin [BTC] posted sturdy features within the hours earlier than press time, gaining 3% within the final 24 hours. It was buying and selling at $71.1k at press time however faces resistance on the $71.4k zone. The dearth of buying and selling quantity not too long ago meant there’s an opportunity of one other vary formation.

Whereas the decrease timeframe worth motion lacked a bullish spark, the upper timeframes had been very a lot bullish nonetheless. A set of metrics confirmed that Bitcoin has sturdy community fundamentals, however there’s additionally a query about whether or not BTC could be overvalued.

Funding within the Bitcoin community has remained sturdy

In a submit on X (previously Twitter), CEO of CryptoQuant Ki Younger Ju acknowledged that Bitcoin was not overvalued based mostly on community fundamentals. The Thermo Cap metric was excessive, displaying sturdy community fundamentals.

Supply: Ki Younger Ju on X

The Thermo Cap metric is the cumulative worth of all of the Bitcoin mined up to now. Therefore, it represents the entire funding price into the community. The Thermo Cap ratio divides the market capitalization of Bitcoin by the Thermo Cap.

It has steadily trended greater previously eight months however was nowhere near the earlier cycle highs. Consequently, it’s probably that the present Bitcoin costs may not be the top of the bull run.

Is it time so that you can e-book income in your holdings?

Supply: CryptoQuant

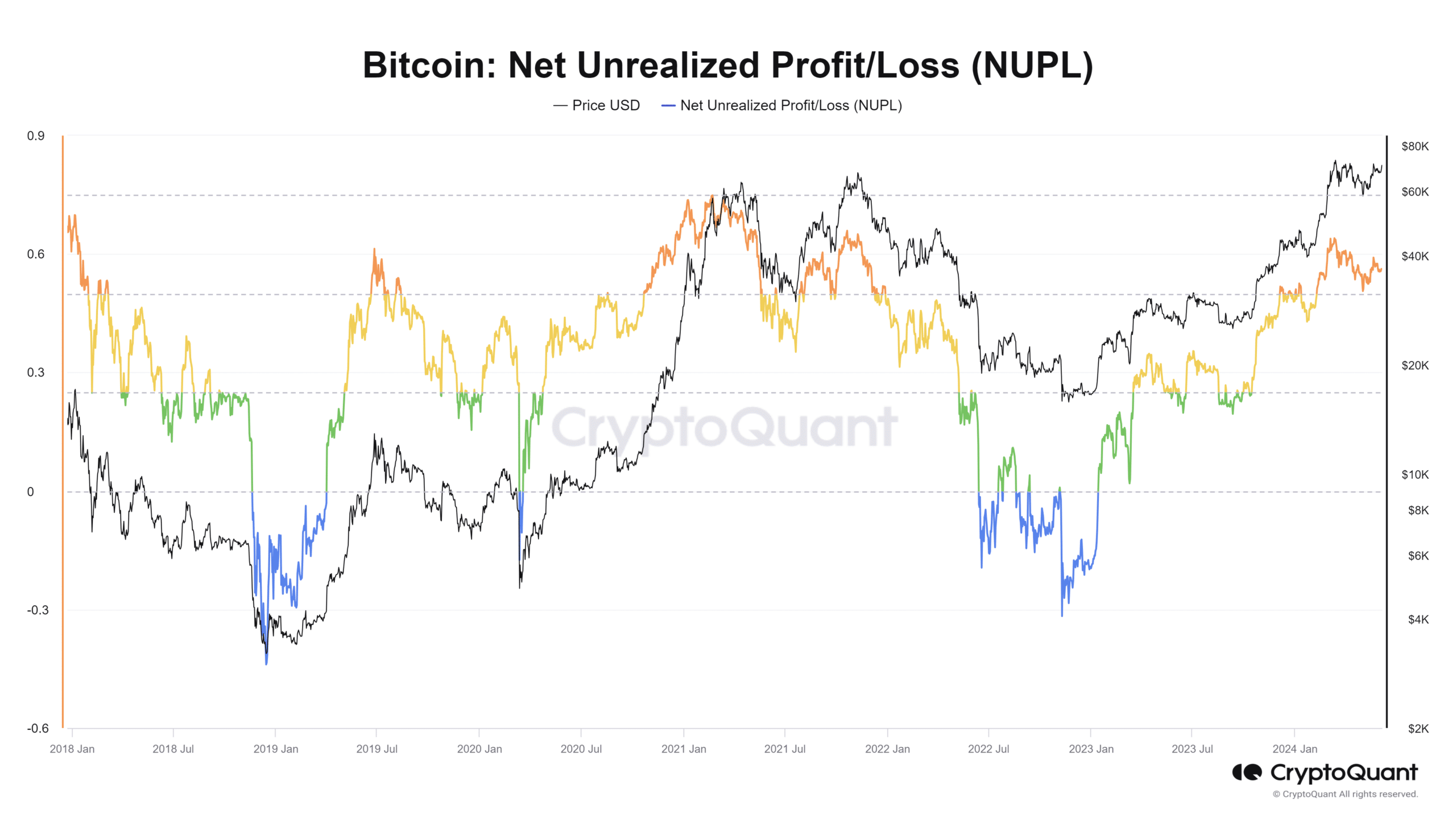

The Internet Unrealized Revenue/Loss metric was above 0.5 which typically happens throughout a bull run. It’s the ratio of traders in revenue, and with so many holders within the cash, it confirmed that holders have good purpose to e-book income.

A worth above +0.7 often comes across the cycle prime. Whereas Bitcoin will not be there but, there’s a likelihood of a pointy correction. Each bull run previously has had sharp retracements of 20% or extra adopted by a fast restoration.

Supply: CryptoQuant

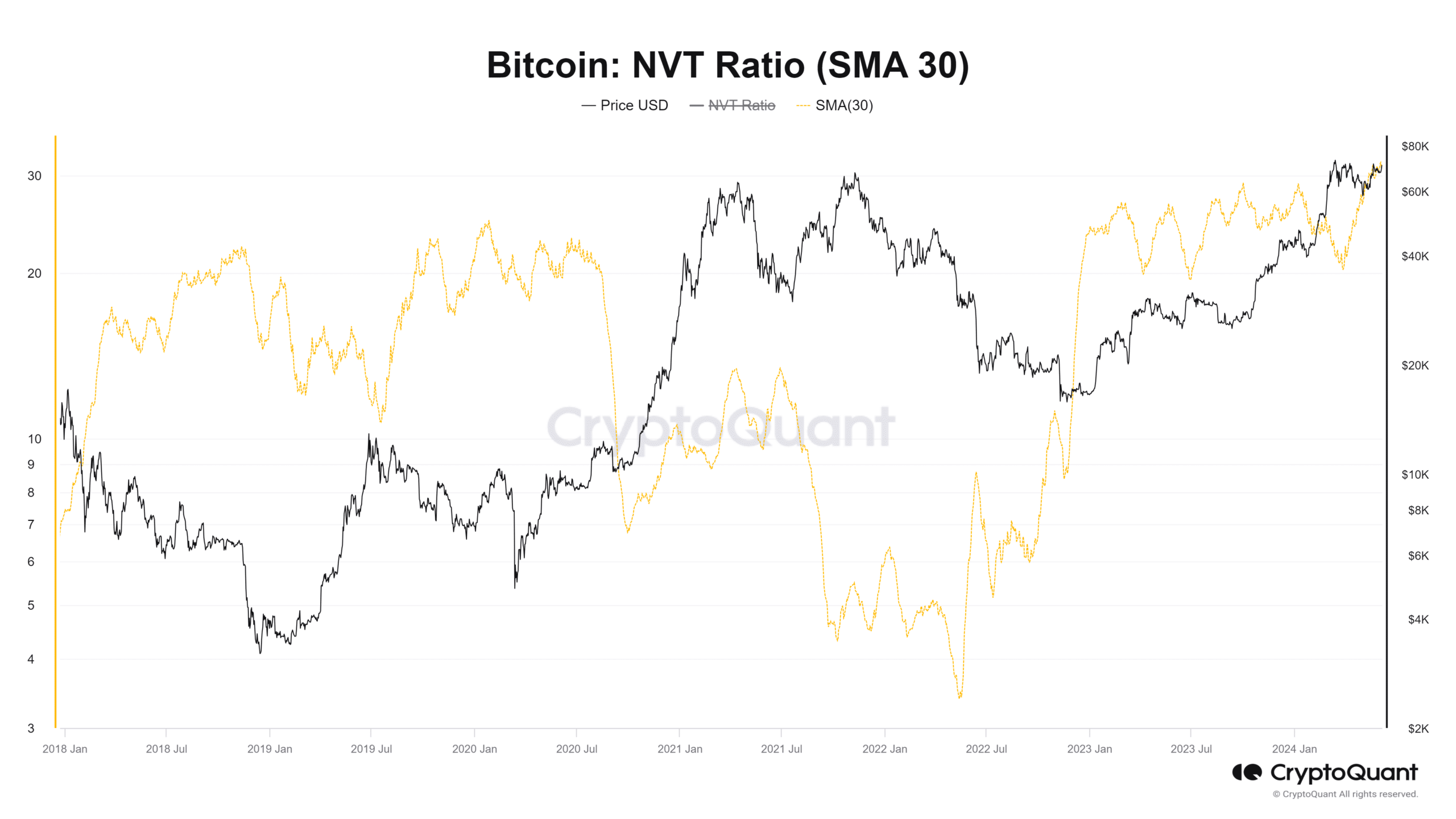

The Community Worth to Transactions is the market capitalization divided by the transacted quantity. The 30-day easy transferring common has trended greater in latest months.

It was a sign that, in comparison with the community’s means to transact BTC, it’s overvalued. This doesn’t essentially imply we’ll see a correction.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In recent times, with the outstanding instance being Michael Saylor and MicroStrategy, Bitcoin is seen as an inflation hedge in addition to a transaction community.

The rising NVT ratio could be reinforcing this concept, as an alternative of demonstrating that BTC is overvalued.