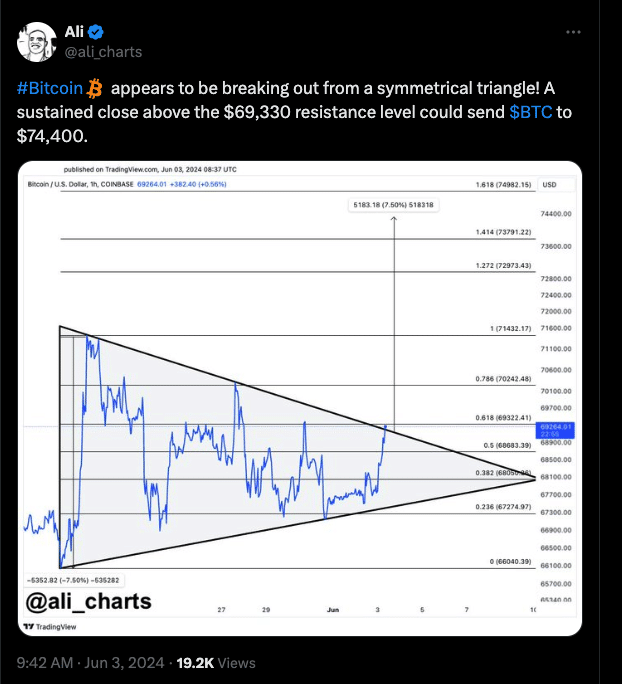

- The 1-hour chart confirmed that BTC fashioned an uneven triangle, suggesting a breakout

- If the value closes above the resistance, it might hit an all-time excessive quickly.

Bitcoin’s [BTC] worth appeared to have displayed two opposing indicators. If one goes by, it might make means for a better worth. Nevertheless, if the opposite comes first, holders of the coin must take care of a worth lower.

Analyst Ali Martinez made this identified in two totally different posts on X. In his first publish, Martinez talked about that Bitcoin had fashioned an asymmetrical triangle on the 4-hour chart, indicating that the value might leap to $74,400.

It’s a breakout or breakdown

However there was one situation connected to it. The prediction may solely come to cross if Bitcoin closes above the $69,330 resistance.

An asymmetrical triangle happens when two trendlines with opposing slopes converge. An in depth above the higher resistance on this occasion brings about breakout.

Alternatively, if the value dumps into the assist, a notable correction may very well be subsequent. At press time, Bitcoin modified fingers at $69,031, that means it was near the resistance level.

Nevertheless, the analyst’s second publish centered on the Tom DeMark (TD) Sequential. In response to him, this indicator had flashed a promote sign which might ship BTC right down to $68,050.

Once more, he talked about that the following path for the coin is determined by the resistance as talked about earlier. Past this technical knowledge, it is usually necessary to take a look at Bitcoin’s worth motion from an on-chain perspective.

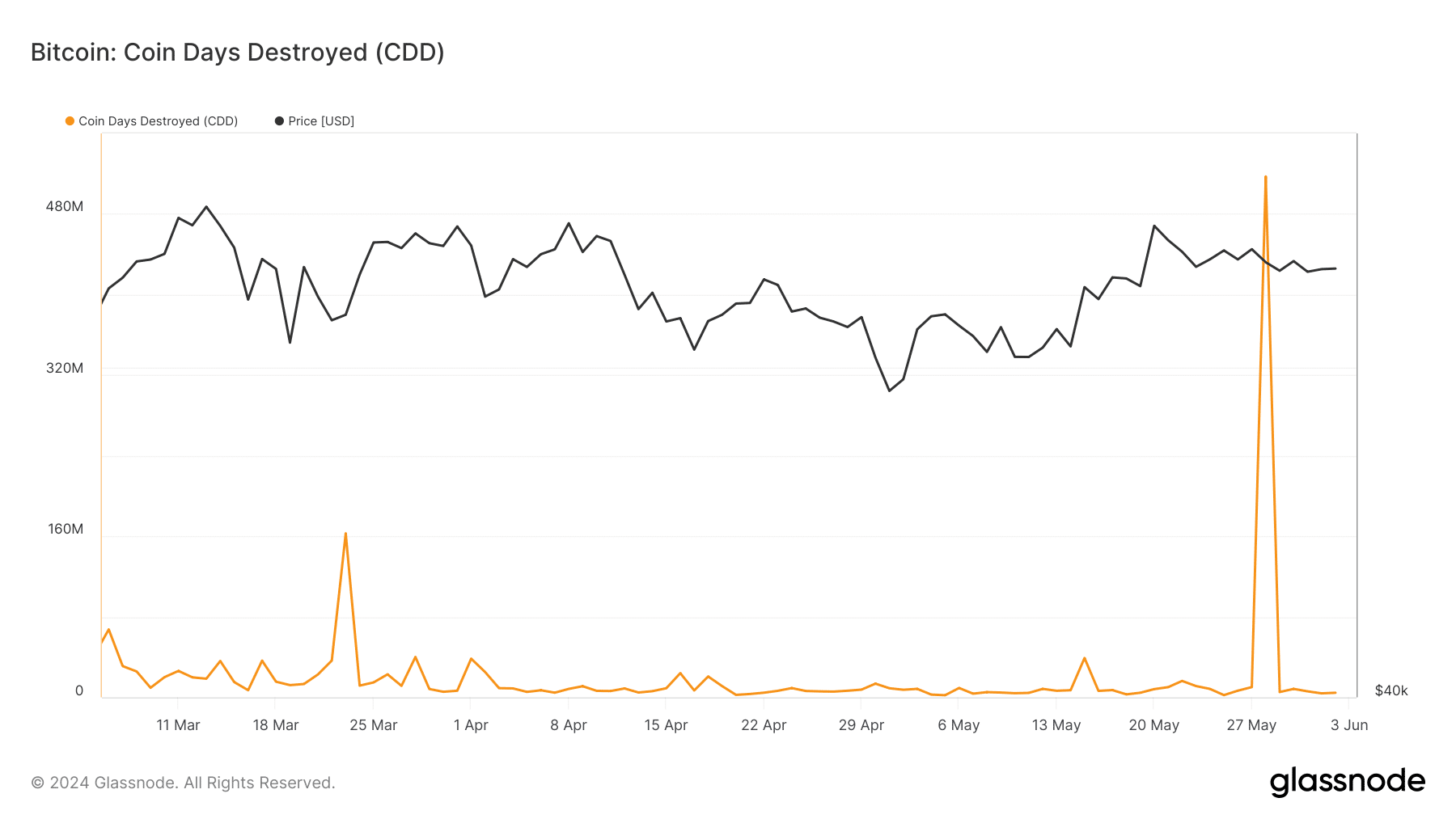

One of many metrics AMBCrypto examined was the Coin Days Destroyed (CDD). This metric how far long-term cash are shifting in massive quantities.

HODLing continues as liquidity hunt begins

If the CDD is excessive, BTC may turn out to be extraordinarily unstable, and promoting stress might trigger a worth lower. This was the state of affairs with Bitcoin on the twenty eighth of Could.

Nevertheless, press time knowledge confirmed that the CDD was right down to 4.55 million. On this occasion, long-term cash usually are not shifting round as individuals are sticking to holding.

If this continues, then the bullish prediction of $74,400 may overcome the potential decline to $68,050. To buttress this level, AMBCrypto additionally seemed on the liquidation heatmap.

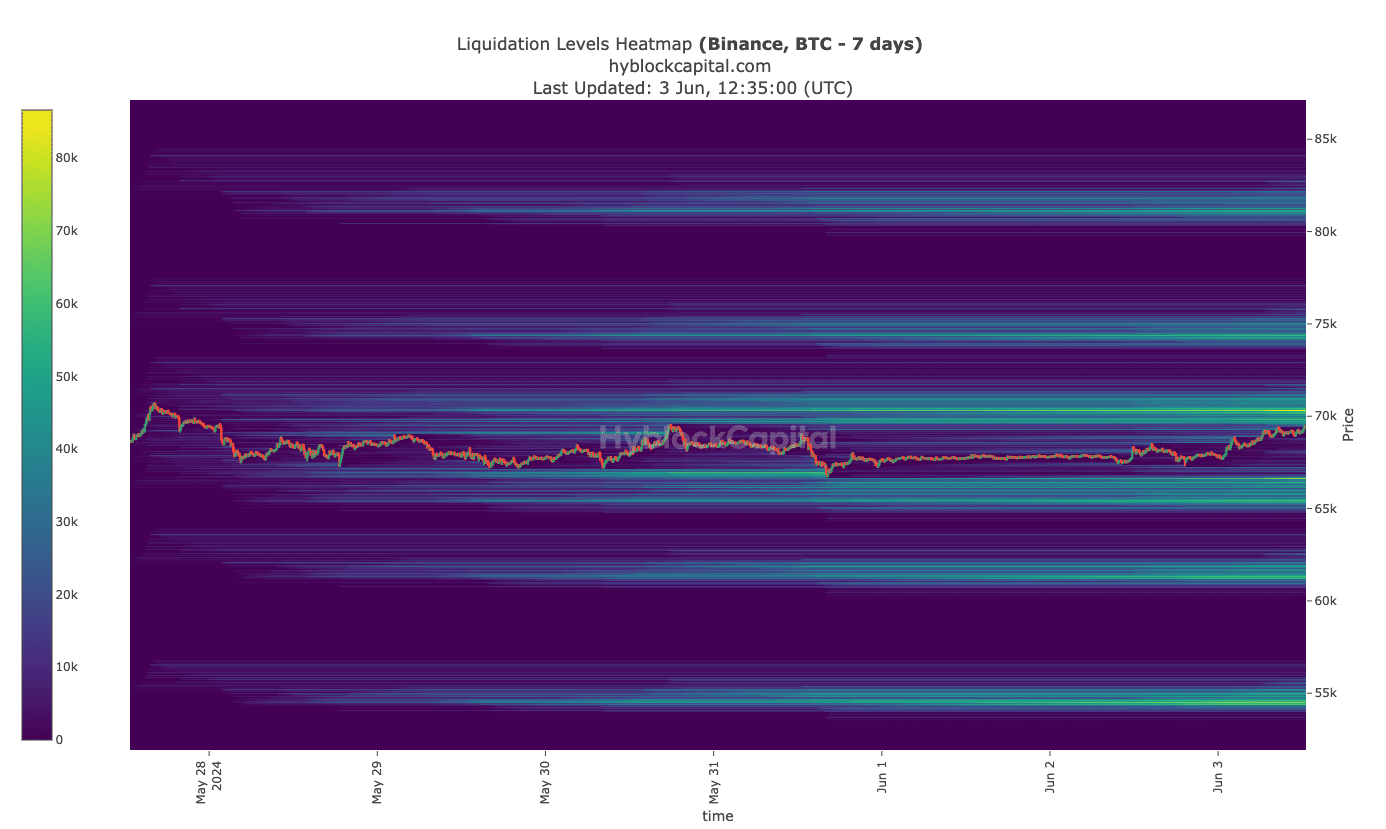

The heatmap may help merchants establish excessive areas of liquidity. And if there’s a magnetic space, the value can rise in that path. At press time, there was a excessive stage of liquidity at $70,300, suggesting that Bitcoin might hit the value.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

If attained, this might result in a breakout to $74,500 the place one other magnetic zone existed. Nevertheless, if the uptrend will get rejected, Bitcoin might stoop as little as $65,050.

However by the look of issues and metrics analyzed, BTC appears to be like set to climb above $74,000.