- Curiosity in Bitcoin ETFs grew, with the identical indicated by hovering inflows

- Whale curiosity in BTC surged too whereas retail buyers took income

Bitcoin [BTC] has remained stagnant across the $67,000-level for fairly a while now. And but, curiosity in BTC hasn’t dipped on the charts. In actual fact, latest information means that on the contrary, curiosity in BTC ETFs has soared over the previous few days.

Bitcoin ETF inflows on the rise

Bitcoin spot ETFs continued to draw buyers on 31 Might, with whole internet inflows of $48.74 million. This marked the 14th consecutive day of internet inflows for these funds, indicating sustained investor curiosity in gaining publicity to Bitcoin via monetary merchandise accessible on the fiat markets.

Nonetheless, the inflows weren’t evenly distributed throughout all Bitcoin spot ETFs. Grayscale’s GBTC registered internet outflows of $124 million, whereas BlackRock’s IBIT and Constancy’s FBTC noticed inflows of $169 million and $5.9047 million, respectively. This recommended that buyers are shifting their preferences in favor of newer entrants within the Bitcoin spot ETF market.

Rising curiosity in BTC ETFs signifies that customers who should not primarily from the crypto house per se have additionally proven curiosity within the cryptocurrency. If this development continues, it might result in BTC turning into much more mainstream, fueling higher adoption too.

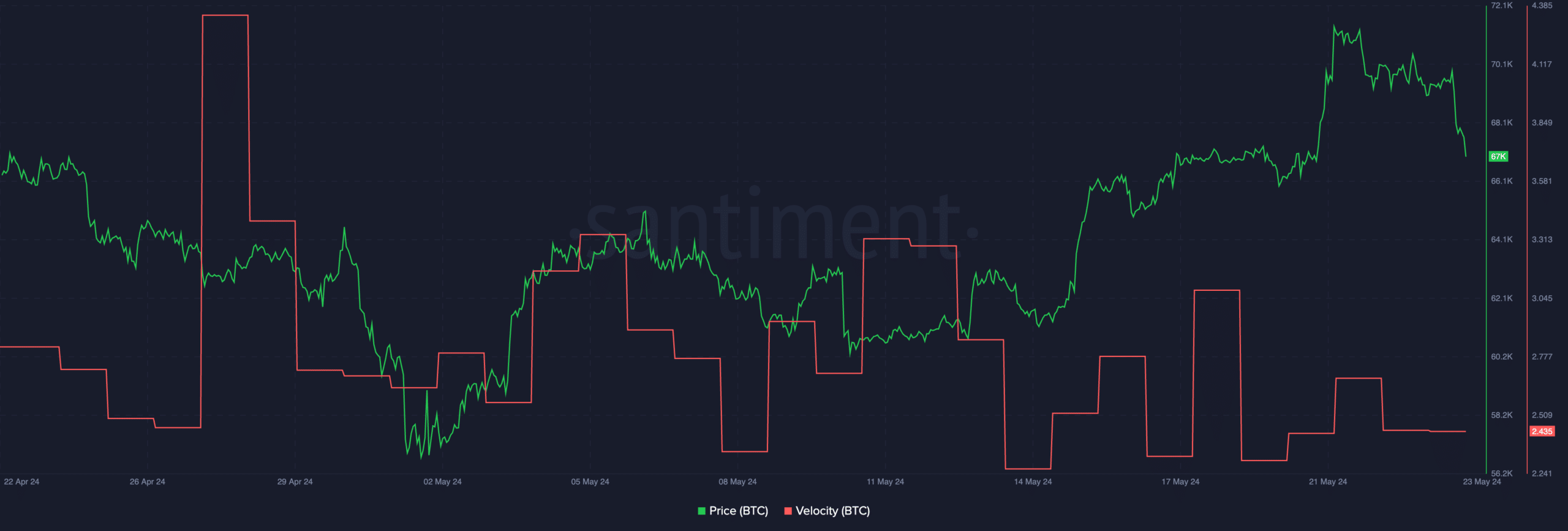

At press time, Bitcoin was buying and selling at $67,732.76, with its value up by 1.43% within the final 24 hours. The rate of BTC dipped materially over this era, indicating a slowdown of BTC transfers. This additionally implied that the majority addresses have been keen to carry their BTC.

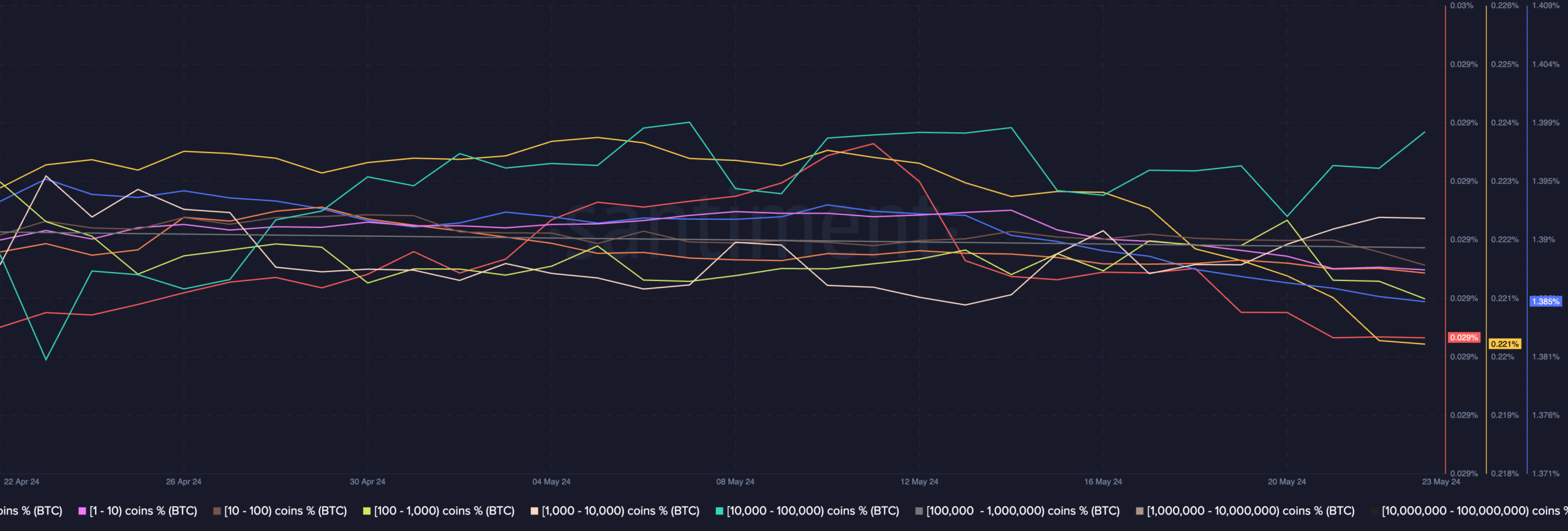

AMBCrypto’s evaluation of Santiment’s information additionally revealed that whale curiosity in BTC has grown considerably over the previous couple of days. A excessive quantity of whale curiosity can drive BTC’s value additional up sooner or later. Nonetheless, retail curiosity in BTC declined considerably throughout the identical interval, indicating that not all holders have been equally optimistic.

Learn Bitcoin (BTC) Worth prediction 2024-25

If retail buyers proceed to promote their holdings, it might spur downward strain on BTC’s value charts.

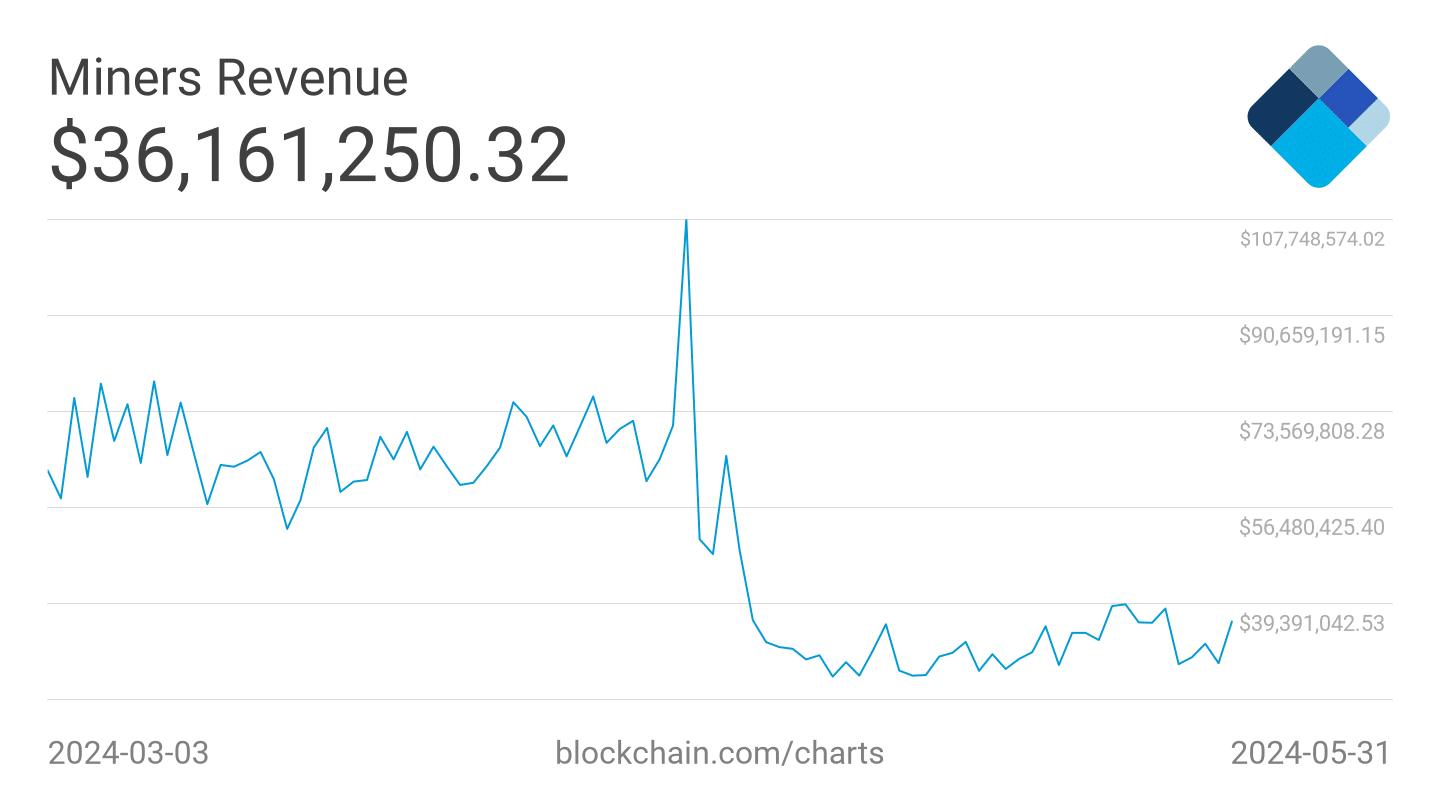

One other issue that would influence promoting strain on BTC could be the state of miners.

Based on latest information, miner income has plummeted over the previous couple of weeks. Miners must promote their holdings to stay worthwhile – Contributing to a surge in promoting strain on BTC.