- US ETH ETF may entice much less capital flows in comparison with US BTC ETF merchandise

- The analyst based mostly his projection on ETH vs. BTC futures ETFs and Silver vs. Gold.

The much-awaited launch of US spot Ethereum [ETH] ETF (exchange-traded funds) could wrestle to duplicate the success of the Bitcoin [BTC] ETF. In response to Bloomberg ETF analyst Eric Balchunas, the much-hyped spot ETH ETFs may seize about ‘20%’ of the BTC ETF’s market share.

A part of Balchunas’ evaluation learn,

“I’d a minimum of divide by 5 in relation to expectations across the Ether spot ETFs re-flows/quantity/media/all the things relative to identify bitcoin ETFs. That mentioned, grabbing 20% of what they obtained could be enormous win/profitable launch by regular ETF requirements.’

Ethereum ETF vs. Silver ETF

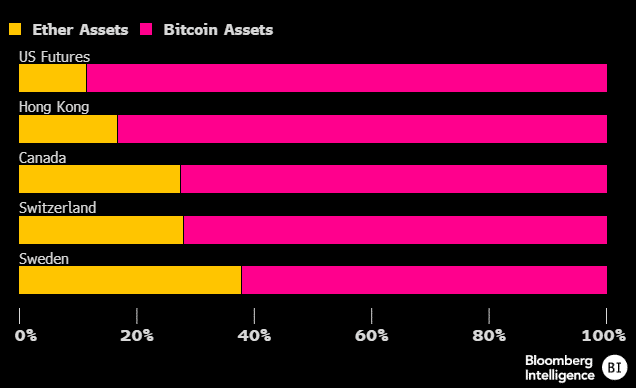

The analyst’s 20% of the BTC ETF market share was based mostly on the present market share on the futures market. ETH ETF devices are already obtainable in numerous jurisdictions as futures ETF choices.

Based mostly on the futures market share between BTC and ETH, Balchunas confirmed that ETH solely commanded about 20% on common, a possible situation that might occur to identify ETFs, too.

“The poor showing of the eth futures is a big part of my calculus. That said, the stronger showings in Europe have me splitting the difference with the final prediction of 20% share.”

Moreover, the analyst equated BTC to Gold and Ethereum to Silver and made one other evaluation and assumption Gold vs Silver ETF foundation. Per Balchunas, Silver ETF presently has solely 15% of Gold ETFs’ market share. He said,

“Many won’t feel the need to go beyond bitcoin/gold for their crypto/precious metals allocation.”

As of twenty eighth Could, the US spot BTC ETFs had $13.7 billion in complete flows. Based mostly on Balchuna’s projection, that might equate to $2.7 billion of ETH ETFs over the identical interval.

Nevertheless, from a Hong Kong perspective, particularly based mostly on the main ETF funds from Bosera, BTC flows have been twice as a lot as ETH flows for the spot merchandise.

In response to Farside knowledge, Hong Kong’s Bosera spot BTC ETF noticed complete inflows of $15.3 million, in comparison with its ETF product’s $7.5 million. That interprets to about 50% of BTC ETF flows for Bosera spot ETH ETF.

Nevertheless, in keeping with CoinMarketCap knowledge, ETH’s $454 billion spot market cap was 34% of BTC’s $1.3 trillion.

That mentioned, the US spot ETH ETF merchandise may launch in July, with some analysts anticipating the ETH worth to hit $4.5K earlier than they begin buying and selling.