- Bernstein projected a possible market growth for Bitcoin and Ethereum ETFs.

- Technical analyses assist bullish Bitcoin developments, regardless of latest consolidation phases.

Regardless of latest fluctuations, Bitcoin’s [BTC] market trajectory stays a focus for buyers and analysts alike.

Over the previous week, Bitcoin has struggled to keep up its momentum above the $70,000 mark, though it touched $71,000 earlier final week.

Nevertheless, that value mark was short-lived because it retreated afterward, buying and selling at $68,122 at press time. This was a decline of two.4% over the previous seven days, although there was a modest restoration of 0.6% within the final 24 hours.

Bitcoin: Market Sentiments

Amidst these value shifts, Bernstein, a distinguished wealth administration agency, has issued a bullish outlook on the potential progress of Bitcoin and Ethereum [ETH] exchange-traded funds (ETFs).

In keeping with a latest analysis report by Bernstein analysts Gautam Chhugani and Mahika Sapra, the marketplace for crypto ETFs may broaden to a considerable $450 billion primarily based on projected cryptocurrency costs.

They forecasted an inflow of over $100 billion into crypto ETFs within the subsequent 18 to 24 months, with a major year-end value goal of $90,000 for Bitcoin, and an bold cycle excessive of $150,000 by 2025.

Additional evaluation from The Birb Nest buying and selling agency supplied a technical perspective, underscoring bullish indicators within the Bitcoin market.

Their research famous that the 50-week and 200-week easy shifting averages (SMAs) stand at $43,950 and $35,358, respectively, offering sturdy market assist ranges that gas investor optimism.

Moreover, the correlation coefficient with the S&P 500 index is reasonably optimistic at 0.36, suggesting a good outlook for Bitcoin in correlation with broader monetary markets.

Furthermore, the Bitcoin Manufacturing Value (BPRO) and the 200-day SMA present vital pattern assist at $62,580 and $53,516, respectively.

The Relative Energy Index (RSI), at 59 at press time, pointed to rising shopping for curiosity, though the Momentum index is comparatively stagnant at 49.

Whereas the market’s Worry & Greed Index signifies a sentiment of “greed” at 74, The Birb Nest advises warning to mitigate dangers related to potential market overextensions.

Strategic insights and future prospects

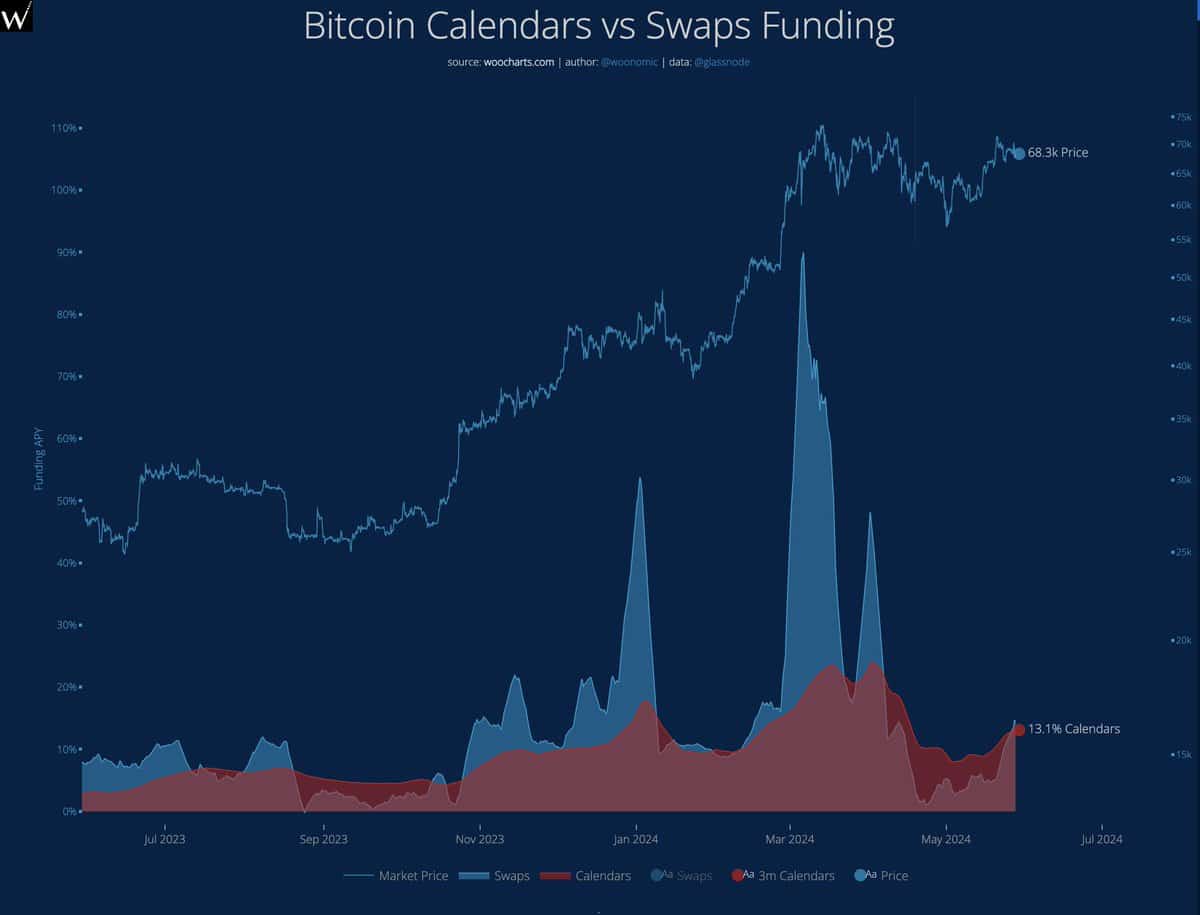

Famend crypto analyst Willy Woo contributed further insights into Bitcoin’s latest market habits.

He highlighted the demand from spot Bitcoin ETFs, notably with latest shifts in market dominance from Grayscale to BlackRock, has considerably outpaced the provision of newly mined Bitcoins.

Woo additionally noticed elevated demand within the futures market, particularly from retail merchants, which has not but reached ranges that may point out extreme speculative curiosity or concern of lacking out (FOMO).

Concurrently, there was notable Bitcoin accumulation by whales, suggesting a possible provide shock that would exert upward stress on costs within the close to future.

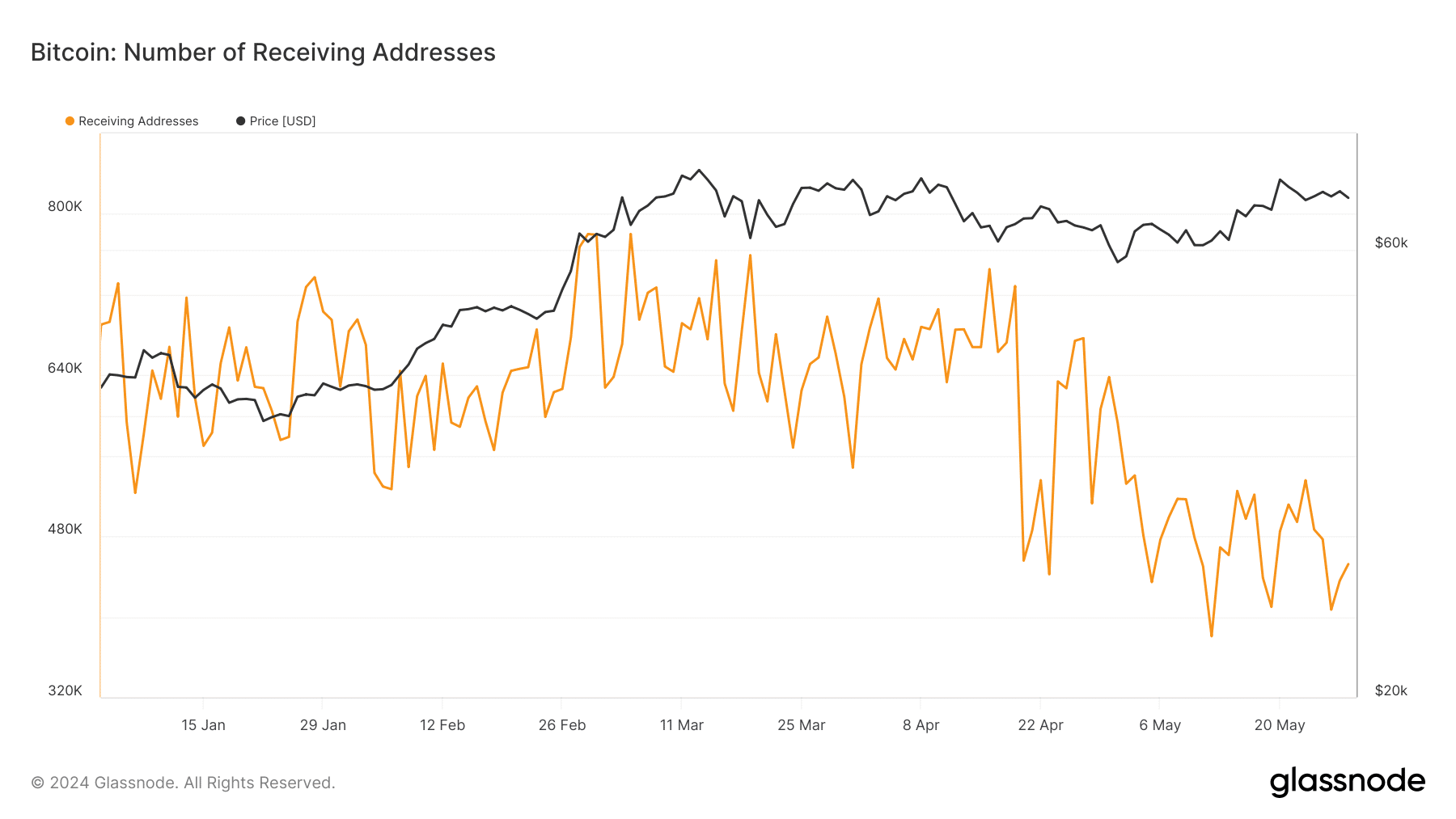

Nevertheless, not all Bitcoin metrics current an optimistic image.

Knowledge from Glassnode revealed a major decline within the variety of receiving addresses, suggesting both a discount in transaction exercise or a consolidation of funds into fewer addresses.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Regardless of these issues, AMBCrypto not too long ago reported that the $66.200 to $66.700 vary comprises a cluster of liquidation ranges, suggesting that Bitcoin might briefly dip into this area.

Conversely, liquidity at $67.800—which has already been examined—may present the required momentum to push Bitcoin’s value again in the direction of the $71.200 resistance degree.