- Analyst have downplayed the long-term constructive affect of the U.S. BTC ETF.

- As an alternative, the analyst considered the BTC ETFs as benefiting TradFi and a risk to DeFi.

Bitcoin [BTC] went from round $40K to a brand new all-time of $73.7K on the again of the approval of U.S. spot BTC ETFs.

The large flows from establishments by way of the ETFs have been lengthy considered as a bullish catalyst for BTC value motion.

Nevertheless, Jim Bianco, a macro funding analysis analyst, downplayed the ETFs’ ‘bullish’ catalyst narrative.

As an alternative, Bianco termed the BTC ETFs as ‘pulling the money off-chain’ into TradFi, particularly in Q1.

“My other concern was that these instruments (ETFs) would not lead to on-chain adoption but instead drag money back into the TradFi world. $COIN Q1 earnings offered hints this might be the case. Coinbase revenue surges to $1.64 billion – But retail volume just 50% of 2021 levels”

Based on Bianco, the Q1 BTC ETF pattern was ‘pulling money off-chain into the Tradfi world’ and will undermine a brand new DeFi system.

Bianco’s bearish tackle U.S. Bitcoin ETFs

Bianco’s bearish stance on U.S. BTC ETF contradicted Michael Saylor and Bitwise CIO Matt Hougan’s positions.

For his half, Michael Saylor considered U.S. BTC ETFs as a method to maneuver capital from TradFi into digital belongings, fueling BTC’s competitiveness.

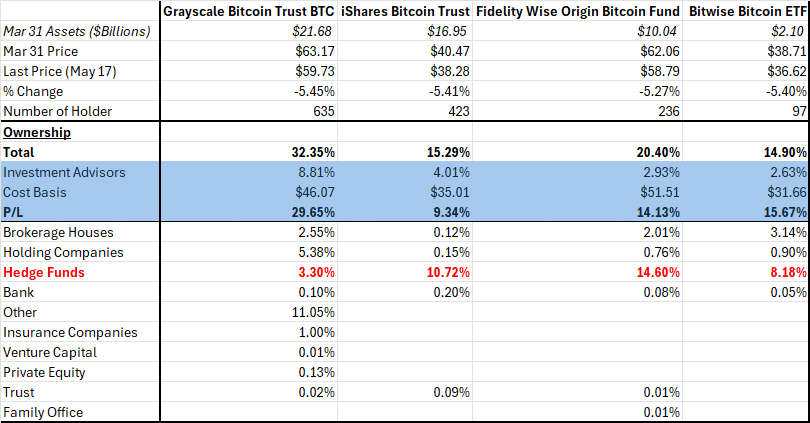

Equally, Hougan, based mostly on the 13F filings, famous that giant companies purchased $10.7 billion of the U.S. BTC ETFs in Q1. To Hougan, the quantity was a ‘down payment,’ and he anticipated extra to return.

Nevertheless, Bianco took a contrarian place and cited two different elements for his argument. Notably, funding advisors’ holdings of BTC ETF in Q1 had been beneath common to encourage the bullish catalyst narrative.

“They (Investment advisors) are very small, between 2.5% and 4% (and 8.81% for $GBTC). A recent Citi report says the AVERAGE ETF is about 35% owned by investment advisors.”

He additionally claimed that BTC ETFs aren’t recording huge demand as anticipated, and the long-term affect of BTC ETFs might have been far-fetched.

“If anything, it is concerning that the headlong rush into Spot BTC ETFs “only” drove this value again to the previous excessive (of November 2021) and never $100k.”

Within the meantime, BTC’s short-term restoration eased close to the availability space beneath $68K. Ought to bulls clear the hurdle, an prolonged restoration to the range-high of $71K might be possible.