- Long run Bitcoin holders refuse to promote their holdings.

- Quick time period holders showcase an analogous perspective, inflicting BTC’s worth to surge.

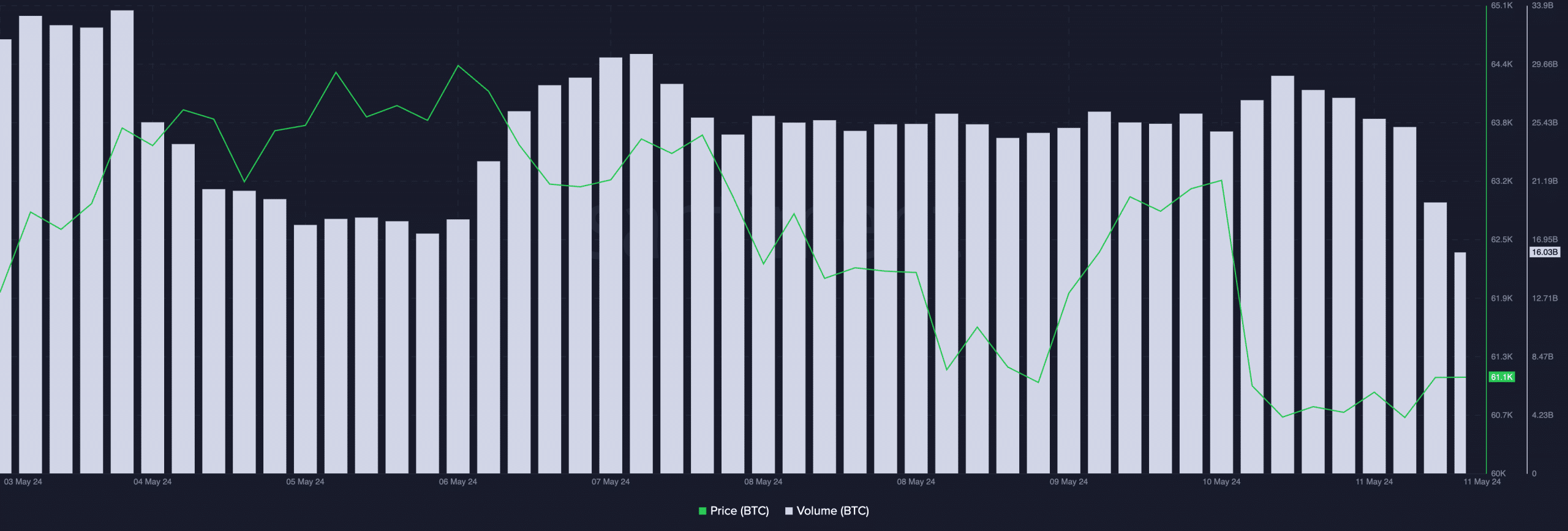

Bitcoin [BTC] has been stagnating on the $62,000 stage for fairly a while, inflicting restlessness amongst merchants hoping for a optimistic soar in worth.

Long run holders present religion

Nonetheless, it was seen that long-term holders refused to promote their holdings regardless of the stagnancy of the market.

These are buyers who’ve held onto their Bitcoins for a big interval, sometimes outlined as over 155 days (or 5 months).

They’re usually thought of believers within the long-term potential of Bitcoin and are much less more likely to be swayed by short-term worth fluctuations.

The present conduct of LTHs is just like what was noticed in 2021. Again then, LTHs additionally held onto their cash for prolonged durations, which coincided with a big bull run within the Bitcoin worth.

Traditionally, durations of LTH accumulation have been related to worth rises in Bitcoin. It’s because if fewer cash can be found on the market, it could actually drive up the worth if there’s elevated demand.

Its HODLing season

Nonetheless, it wasn’t simply short-term holders that had been displaying religion within the king coin.

Historically recognized for promoting shortly at a loss throughout worth dips, knowledge suggests they could be holding onto their cash even throughout pullbacks.

This shift, with solely a small quantity of Bitcoin being despatched to exchanges at a loss lately, might have optimistic implications for Bitcoin’s stability.

By panicking much less and holding throughout downturns, short-term buyers might contribute to a much less unstable market and probably pave the way in which for worth will increase.

The interaction between LTH and STH conduct can decide the general path of the market.

If LTHs are accumulating and STHs are holding throughout pullbacks, it could actually create a bullish surroundings with potential for worth will increase. A market with a steadiness between LTHs and STHs tends to be extra secure.

LTHs present long-term stability by holding onto their cash, whereas STHs can add liquidity by their buying and selling exercise.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, an overabundance of STHs susceptible to panic promoting can improve volatility sooner or later.

At press time, BTC was buying and selling at $63,113.08 and its worth had grown by 3.38% within the final 24 hours, the quantity at which it had traded had additionally grown by 69.49% in the previous few days.