Trading Replace: Friday Could 10, 2024

S&P Emini pre-open market evaluation

Emini day by day chart

- The Emini shaped a robust entry bar following Wednesday’s Excessive 1 purchase sign bar. That is good follow-through and will increase the chances of upper costs even when there’s a pullback fist.

- Excessive 1 purchase sign bars usually result in a pullback, adopted by pattern resumption. Which means that yesterday trapped into a foul brief above Wednesday’s excessive, and bull’s out of a superb lengthy place.

- This will increase the chance that the market will check Wednesday’s excessive within the subsequent day or two.

- The bull is hopeful that in the present day will kind one other bull pattern bar, which might additional enhance the chances of upper costs.

- The market is getting close to the measured transfer goal (5,317) based mostly on the bull breakout of the bear flag (April 19th low to April 29th excessive).

- The bears don’t thoughts the rally as much as 5,300 so long as the market goes sideways and will increase promoting stress.

- The bears will see any rally as a possible main pattern reversal setup. Subsequent, the bear will need a sturdy draw back breakout beneath the April 19th neckline and a measured transfer all the way down to the January low.

- Most main pattern reversals are minor reversals that transition the market right into a buying and selling vary. This implies the chances favor a buying and selling vary and never a significant reversal in a bear pattern.

- The bulls hope the market will kind one other small pullback rally, resulting in a breakout above the all-time excessive.

- The Bulls need to hold the April 29th breakout level excessive open as an indication of bullish energy. The percentages favor the market retesting the April 29th breakout level and shutting it.

- Breakout factors are shut in buying and selling ranges, and merchants imagine that the present rally is a bull leg in a buying and selling vary. This implies the chances favor the April twentieth excessive getting examined, even when the market first reaches the 5,300 spherical quantity.

Emini 5-minute chart and what to anticipate in the present day

- Emini is up 15 factors within the in a single day Globex session.

- The Globex market shaped a good buying and selling vary for a number of hours on the 15-minute chart and shaped an upside breakout through the early morning hours.

- The 15-minute Globex chart has been above the shifting common a number of bars and not too long ago shaped a bear bar fully beneath the shifting common, closing on its low. This can be a signal that the market is transitioning right into a buying and selling vary.

- For the time being, the Globex vary is barely 18 factors, and the vary will seemingly double through the U.S. Session.

- There have solely been 2 days out of twenty-two days with a Globex vary (Together with U.S. Session) of lower than 40 factors.

- Merchants ought to take note of Wednesday’s excessive as it’s going to seemingly be a magnet, and the market might attempt to attain it over the subsequent few days.

- As at all times, merchants ought to anticipate a variety of buying and selling vary value motion on the open. Which means that merchants ought to take into account ready for 6-12 bars earlier than putting a commerce until they’ll use broad stops and make fast choices.

- Most merchants ought to attempt to catch the opening swing that usually begins earlier than the tip of the second hour after the formation of a double prime/backside or a wedge prime/backside.

- The rationale merchants ought to attempt to catch the opening swing is as a result of the market usually kinds yet one more than 80% of the time, and it usually lasts for 2 hours and two legs. There may be additionally no less than a 40% likelihood that the opening vary will greater than double through the opening swing.

- Immediately is Friday, so weekly assist and resistance are necessary. Merchants ought to be prepared for a shock breakout late within the day as merchants resolve on the shut of the weekly chart.

- A very powerful factor on the open is to be affected person and never in a rush. The longer one waits to position a commerce on the open, the extra readability one will acquire in regard to the construction of the day.

- There may be an 80% likelihood of a buying and selling vary open and solely a 20% likelihood of a pattern from the open.

Emini Intra-Day Replace

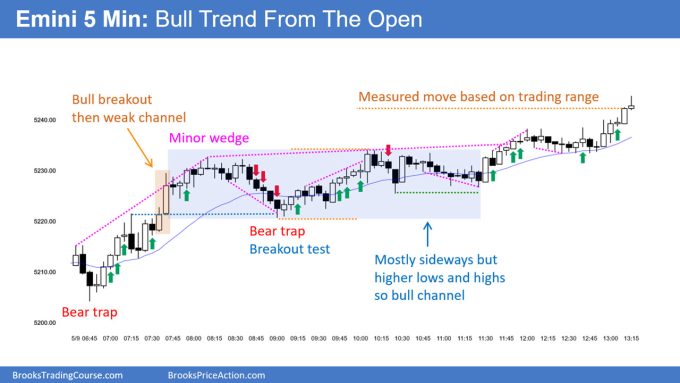

- The Emini gapped up on the open and shaped a pattern from the open.

- The bulls have 4 consecutive bull bars. Nonetheless, 3 out of the 4 have tails above the bars. This will increase the chances of a buying and selling vary open and the market falling beneath the bar 1 low.

- The bulls are hopeful that in the present day is a pattern from the open that can result in a robust bull pattern day; the overlapping bars through the first 4 bars of the day are a warning {that a} buying and selling vary will transition quickly. The bears need to check all the way down to yesterday’s excessive and shut the hole.

- The percentages favor a buying and selling vary open. If in the present day goes to develop into a robust pattern, day up or down, there can be loads of time to enter as soon as the pattern is clearly underway.

- The Bears acquired a shock breakout on bar 7, which was sturdy sufficient for a 2nd leg down.

- The market offered off to bar 12, forming a parabolic wedge backside at yesterday’s excessive.

- The bulls are hopeful that bar 14 is the beginning of a profitable bull reversal and low of the day.

- The issue that the bulls have is that the selloff all the way down to the 14 low is in a microchannel. This will increase the chances that the primary reversal up can be minor and result in a buying and selling vary, and never the beginning of a bull pattern.

- The 60-minute chart closed as a robust bear reversal bar. This will increase the chances that there can be a second leg down.

- Bar 13 triggered the promote beneath the 60-minute reversal bar and located patrons. Nonetheless, there are most likely sellers close to the midpoint of the 60-minute bar (5,253.5). Merchants ought to anticipate a check of the bar 13 low sooner or later in the present day. The bulls will strive their greatest to forestall the market from relieving the trapped bears; nonetheless, the chances are in opposition to it.

- Due to the selloff through the first 12 bars, in the present day will seemingly be a bear pattern or a buying and selling vary day and never a bull pattern day.

- Bar 17 is the retest of the Bar 13 low and it went far beneath it. The bears are attempting to get a robust entry bar on the 60-minute chart after the primary hours shut on low.

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Listed here are cheap cease entry setups from yesterday. I present every purchase entry bar with a inexperienced arrow and every promote entry bar with a crimson arrow. Consumers of each the Brooks Trading Course and Encyclopedia of Chart Patterns have entry to a close to 4-year library of extra detailed explanations of swing commerce setups (see On-line Course/BTC Day by day Setups). Encyclopedia members get present day by day charts added to Encyclopedia.

My objective with these charts is to current an All the time In perspective. If a dealer was attempting to be All the time In or almost All the time Able all day, and he was not at present available in the market, these entries can be logical instances for him to enter. These due to this fact are swing entries.

It is very important perceive that the majority swing setups don’t result in swing trades. As quickly as merchants are disenchanted, many exit. Those that exit choose to get out with a small revenue (scalp), however usually must exit with a small loss.

If the chance is simply too massive in your account, it’s best to await trades with much less danger or commerce an alternate market just like the Micro Emini.

EURUSD Foreign exchange market buying and selling methods

EURUSD Foreign exchange day by day chart

Abstract of in the present day’s S&P Emini value motion

Al created the SP500 Emini charts.

Finish of day video evaluate

Stay stream movies to comply with Monday, Wednesday and Friday (topic to vary).

See the weekly replace for a dialogue of the value motion on the weekly chart and for what to anticipate going into subsequent week.

Trading Room

Al Brooks and different presenters discuss concerning the detailed Emini value motion real-time every day within the BrooksPriceAction.com buying and selling room days. We provide a 2 day free trial.

Charts use Pacific Time

When instances are talked about, it’s USA Pacific Time. The Emini day session charts start at 6:30 am PT and finish at 1:15 pm PT which is quarter-hour after the NYSE closes. You may learn background data in the marketplace studies on the Market Replace web page.