- Regardless of BTC’s decline, SOL, NEAR, and KCS present shopping for potential.

- Execs are bullish on BTC post-halving and see this era as the right shopping for alternative.

Bitcoin [BTC] halving has been the discuss of the city for fairly a while, and now, with the latest risky value trajectory, conversations about its future have resurfaced.

Curiously, in response to CoinMarketCap, BTC, together with different cryptocurrencies, appears to be on a downward development.

Nonetheless, there have been exceptions like Solana [SOL], Close to protocol [NEAR], KuCoin [KCS], which had been flashing greens on the day by day charts.

Good time to purchase Bitcoin?

Thomas Lee, Co-founder and Head of Analysis at Fundstrat, was optimistic about Bitcoin’s rise. He mentioned,

“I think that we’re kind of being fooled by the April turmoil and I think that’s why it’s a buying opportunity for both Bitcoin and stocks now.”

Additionally, only a few weeks again, Arthur Hayes additionally got here up along with his essay titled- ‘Left Curve’, and provided insights right into a strengthening development that might drive BTC’s continued rise.

This underlined Hayes’s confidence in Bitcoin and the general crypto market, regardless of regulatory issues and the present risky value situation.

“So end of the year, I think we’re going to be between $70k to $100k on the price of Bitcoin end of 2024.”

Not out of hazard, although

However regardless of such optimistic sentiment, Josh Olszewicz, a seasoned dealer, believes that the cryptocurrency will not be fairly out of hazard.

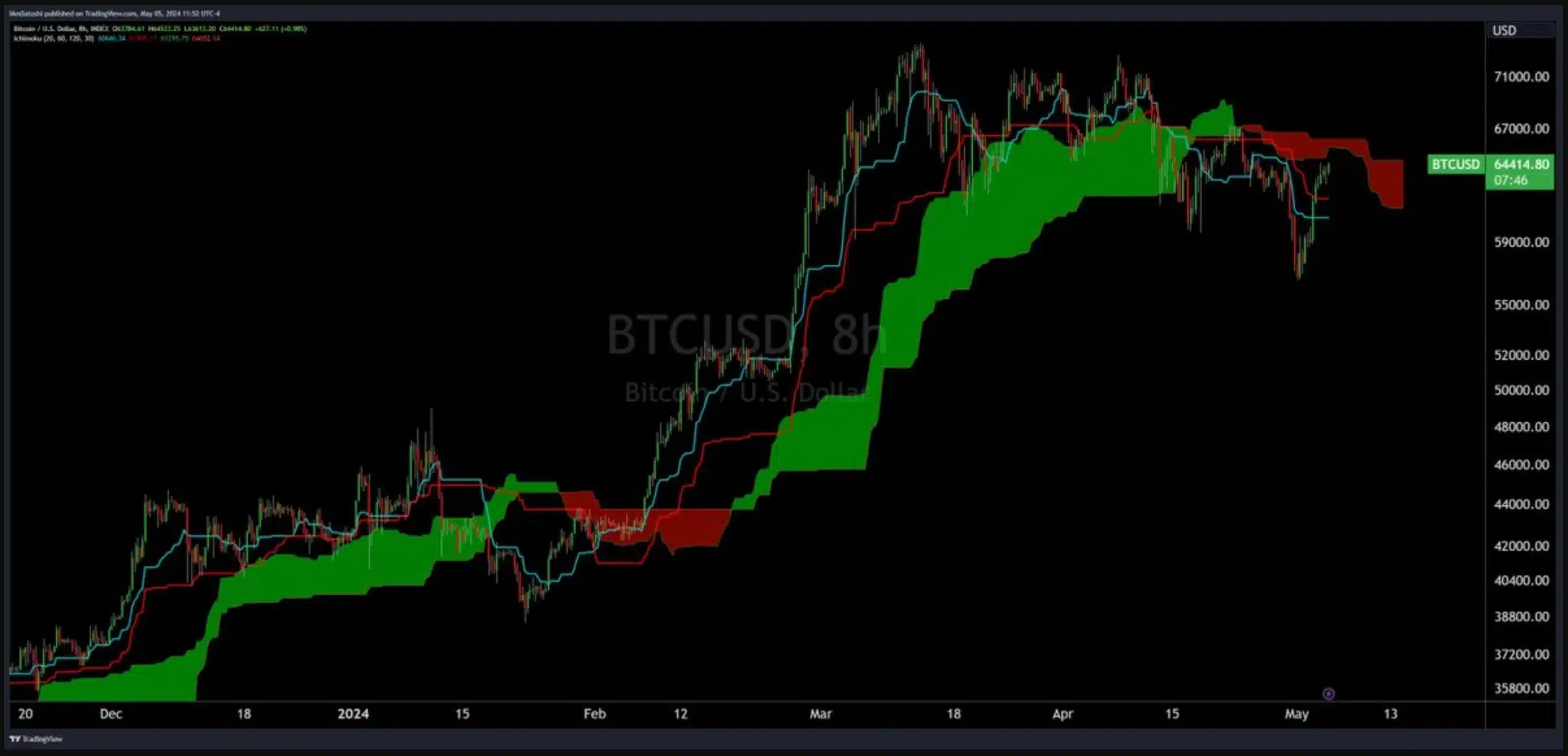

Olszewicz makes use of the Ichimoku Cloud indicator to investigate Bitcoin’s development, which is presently bearish, with Bitcoin under the cloud appearing as a barrier.

To reverse this development, Bitcoin wants to interrupt above the cloud. He added,

“Watch for iHS + cloud breakout this week if momo continues.”

This was additional confirmed by AMBCrypto’s evaluation of Santiment knowledge.

The declining MVRV ratio confirmed that the majority holders had been in losses at press time.