- Distinguished figures like Vinnik, Bankman-Fried, and Zhao have confronted DOJ prices for cash laundering

- Common crypto-exchange KuCoin was additionally slapped with related prices

Cryptocurrencies have more and more change into related to cash laundering actions, with notable figures like Sam Bankman-Fried and Changpeng Zhao dealing with jail phrases. A brand new participant may be added to that record now, with Alexander Vinnik, co-founder of BTC-e, a bootleg crypto-exchange, pleading responsible to related prices.

Based on a press launch from the U.S. Division of Justice (DoJ),

“A Russian national pleaded guilty today to conspiracy to commit money laundering related to his role in operating the cryptocurrency exchange BTC-e from 2011 to 2017.”

Based on the identical, Alexander Vinnik, aged 44, performed a major function as one of many operators of BTC-e, acknowledged as one of many largest digital forex exchanges globally.

BTC-e underneath DoJ’s radar

BTC-e operated from round 2011 till its closure by legislation enforcement in July 2017. This era noticed the change facilitating transactions exceeding $9 billion, whereas catering to over a million customers worldwide. This included a notable buyer base in the USA as properly.

In its assertion, the DoJ claimed,

“BTC-e was one of the primary ways by which cyber criminals around the world transferred, laundered, and stored the criminal proceeds of their illegal activities.”

BTC-e’s operations relied closely on shell firms and affiliate entities that lacked correct registration with FinCEN. It additionally uncared for primary anti-money laundering (AML) and Know Your Buyer (KYC) insurance policies.

Alexander Vinnik executed the setup of quite a few such shell firms and monetary accounts worldwide to facilitate BTC-e’s transactions.

Now, a federal district courtroom decide will decide the sentence for Vinnik, contemplating varied elements together with U.S. Sentencing Pointers.

Right here, it’s price noting that again in 2017, FinCEN imposed important civil cash penalties totaling round $122 million towards BTC-e and Vinnik for wilfully violating U.S. AML legal guidelines.

KuCoin too?

In a latest growth, the DoJ additionally charged KuCoin, a serious cryptocurrency change, alongside its founders Chun Gan and Ke Tang. The fees introduced towards them embody conspiring to violate the Financial institution Secrecy Act and conspiring to function an unlicensed money-transmitting enterprise.

The DoJ claimed,

“Since its founding in 2017, KuCoin has received over $5 billion and sent over $4 billion, of suspicious and criminal proceeds.”

Taken collectively, these developments spotlight the continuing challenges confronted by authorities in combating monetary crimes inside the cryptocurrency ecosystem.

What do the figures say?

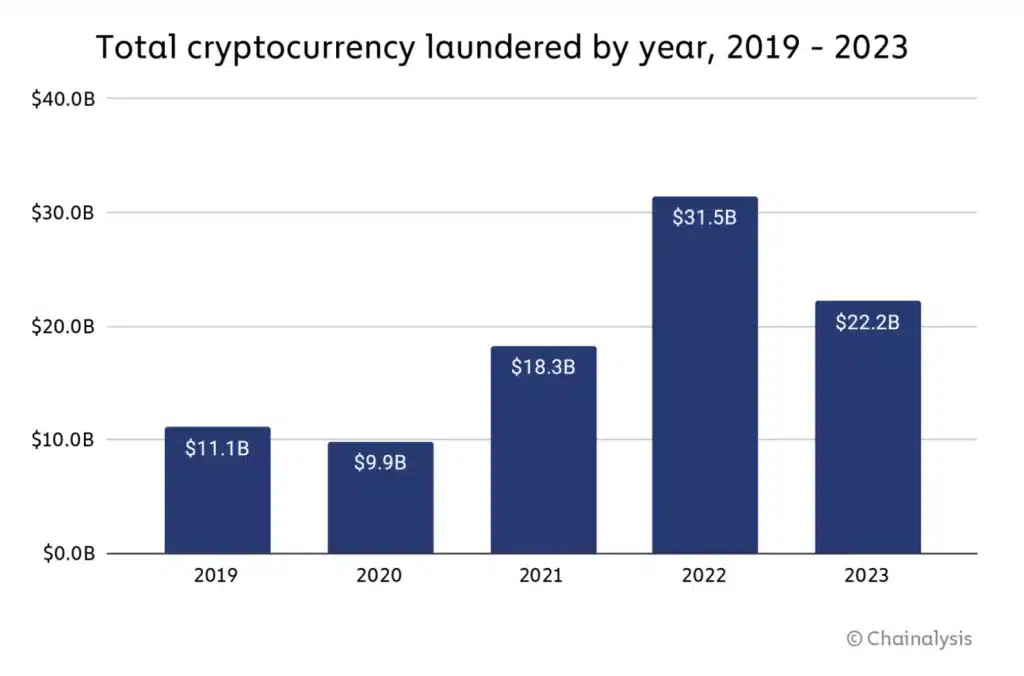

A latest report by Chainanalysis, nonetheless, paints a extra constructive image of the crypto-space. Based on the blockchain knowledge platform, there was a pointy decline in cash laundering actions in 2023, particularly when in comparison with 2022.