- Binance founder faces a 36-month jail time period, spotlighting illicit actions within the crypto house.

- Authorized actions in opposition to Binance and earlier FTX elevate questions on crypto adoption.

Amidst ongoing authorized battles, Changpeng Zhao, the founding father of Binance [BNB], finds himself at a important juncture.

Scheduled for sentencing on the thirtieth of April in a Seattle courtroom, Zhao faces a pivotal second as U.S. prosecutors pursue a 36-month jail time period.

What’s the problem?

The allegations revolve round his alleged failure to stop in depth cash laundering on the Binance platform, marking a major growth within the dialogue surrounding him.

Based on the Justice Division in a sentencing memorandum filed final week, the prosecutors mentioned,

“Zhao’s willful violation of U.S. law was no accident or oversight.”

They added,

“He made a business decision that violating U.S. law was the best way to attract users, build his company, and line his pockets.”

This highlighted Zhao’s wilful neglect to ascertain an efficient anti-money laundering program mandated by the Financial institution Secrecy Act.

In truth, the choice for a three-year jail time period, exceeding the advisable 18 months, underscores the gravity of Zhao’s purported offenses and the crucial for strict adherence to the legislation.

Grounds of allegations

Zhao allegedly facilitated Binance in processing transactions tied to illicit actions, together with these involving Individuals and sanctioned people.

Prosecutors attribute unreported suspicious transactions and poor controls to Zhao’s management. They’ve additionally underlined the involvement of some designated terrorist teams like Hamas and al-Qaida.

In response to the allegations, final 12 months in November, Zhao stepped down as CEO of Binance, and only in the near past, he admitted his breach of the Financial institution Secrecy Act.

In a letter to the overseeing decide, he expressed regret for failing to implement satisfactory compliance controls at Binance, acknowledging that there was “no excuse” for his actions.

“I apologise for my poor decisions and accept full responsibility for my actions. In hindsight, I should have focused on implementing compliance changes at Binance from the get-go, and I did not. There is no excuse for my failure to establish the necessary compliance controls at Binance.”

Apparently, Binance’s founder had as soon as instructed his crew, that it’s “better to ask for forgiveness than permission” in issues of authorized compliance.

This assertion provides intrigue as observers await Zhao’s response, whereas prosecutors stay agency of their stance.

Different cases of money-laundering

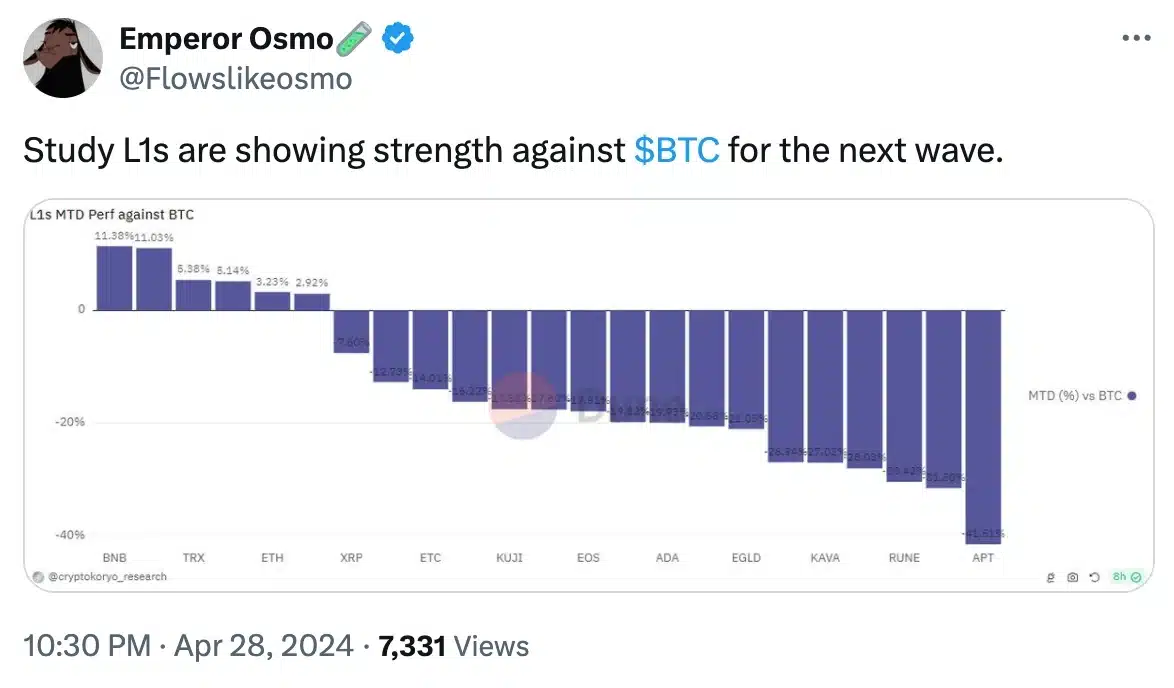

Regardless of Binance’s latest challenges, the efficiency of its BNB token and different L1s in opposition to BTC remained robust, as famous by a crypto researcher, Emperor Osmo,

Properly, Binance is just not the primary one to endure such allegations. Just lately, Nigeria has made headlines by searching for to prosecute Binance and two of its executives on expenses of cash laundering and tax evasion.

Moreover, FTX too confronted a downfall in 2022, resulting in Bankman-Fried’s conviction for fraud and a 25-year jail sentence.

This underscores the regulatory hurdles confronting main gamers in crypto.